- Colombia: October exports fell again, but to a lesser extent; current account deficit narrowed to 1.7% of GDP, lowest since 2009

- Mexico: GFI slowed in construction, with good progress in M&E; private consumption continued increase in September

- Peru: Mining under attack

Late-Asia and early-Europe hours saw sharp moves in markets, after mostly range-bound trading earlier in the overnight session, triggered by Moody’s change to China’s debt outlook (from stable to negative) and ECB hawk Schnabel doing away with rate hike expectations in the Eurozone; stronger than expected private Chinese PMIs came and went. The USD’s swing higher on the headlines was quickly unwound and rates markets have also weakened after a strong open in Europe, while the overarching mood remains somewhat risk averse. The G10 day ahead has two key US data releases, the very volatile JOLTS and the very important ISM services, both out at 10ET and bound to shake up trading.

The UST curve is marginally lower across the board (sub-1bp yield declines) while EGBs and gilts outperform, on 4–5bps declines with a slight steepening in Germany; markets are now pricing in an 80%+ chance of an ECB cut in March. US equity futures are off 0.3–0.6%, continuing corrective losses after a strong rally, while European indices are mixed; ESX up 0.3%, FTSE down 0.5% (some issues in LSE trading this morning).

In commodities, oil is up 0.6% on some jawboning by Saudi’s Energy Min on Bloomberg yesterday that combines with news that Putin will meet with UAE and SA officials tomorrow, which should at least firm up the OPEC+ alliance. Copper is down 1% with the China Moody’s news, which also dragged on iron ore (but only temporarily) that is trading 0.3% higher.

The USD’s jump this morning was seemingly counteracted by large selling of dollars by Chinese state-owned banks that stepped in to counteract yuan weakness on Moody’s announcement. At writing, the USD is sitting stronger against most major FX, with the MXN in the middle of the pack on a small 0.1% loss. The AUD is a clear laggard, down 0.7% after a less hawkish than expected RBA hold.

It’s all about Brazil today in Latam data. The country releases Q3-23 GDP data at 7ET, followed by S&P’s PMIs at 8ET—which tend to not be market movers. The median economist polled by Bloomberg forecasts that the Brazilian economy contracted by 0.3% q/q (1.8% y/y median), which would mark its first quarterly decline since Q2-21 (-0.2%) and its weakest quarter since Q2-20. This comes after a strong start to the year on the back of agricultural output that will be paid back in today’s data against slight gains in services. The BCB is in self-driving mode with 50bps cuts due at the December and February decisions, and markets think 50bps will also be delivered in March and possibly April (~40bps priced in). Yesterday, the BCB’s survey showed the median economist lowering its end-2025 rate forecast by 25bps to 8.50%.

It’s all relatively quiet in Latam outside of Brazil. The bi-weekly Citibanamex survey of Mexican analysts may be worth a look, but would predate tomorrow’s more relevant CPI data. In Chile, the Treasury holds an exchange/buyback of nominal and inflation-linked debt today. We’re also keeping an eye on announcements by Peru’s government on tackling illegal mining after a deadly raid of a mine over the weekend which continued the President’s long streak of negative headlines.

—Juan Manuel Herrera

COLOMBIA: OCTOBER EXPORTS FELL AGAIN, BUT TO A LESSER EXTENT

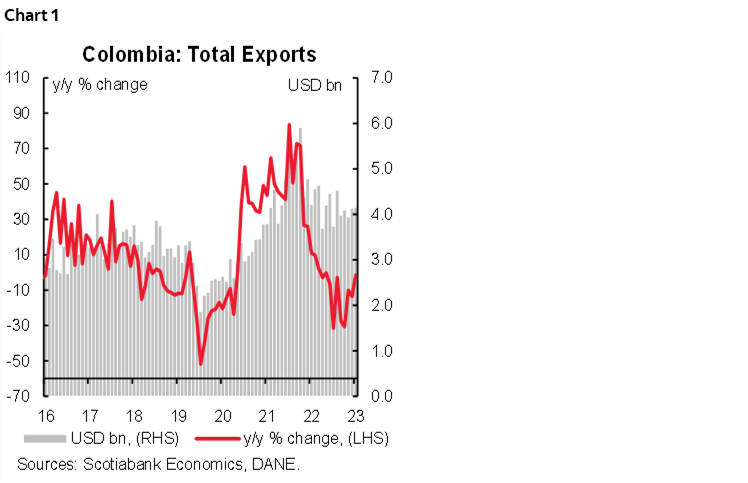

The National Administrative Department of Statistics (DANE) released export data on Monday, December 4th. October exports were USD 4.1 billion FOB, showing a 1.5% y/y decrease (chart 1). The result was mainly due to a -14.3% drop in the agricultural, food and beverages group, which contributed -2.9 p.p. to the total variation.

The comparison with the previous month shows an increase in exports of 0.56%. This behaviour is partly explained by a growth in exports of oil and its derivatives, which on a monthly basis increased by USD 66 million FOB, added to an increase in non-traditional exports of 6.2% y/y.

In annual terms, traditional exports totaled USD 2.37 billion FOB, which represents a drop of 6.58% YoY. In the breakdown, coffee exports decreased by -43.16% YoY, which could be explained by a lower international price. Coal exports also decreased, reaching USD 617.1 million FOB, with a variation of -36.8% YoY, a behaviour that is also influenced by the price at which it is exported. On the other hand, the export of oil and its derivatives reached USD 1.5 billion FOB, which represents an increase of 28.34% (chart 2).

YTD exports amounted to USD 40.9 billion FOB, showing a variation of -14.2% YoY, mainly explained by a decrease of -19.8% YoY in the export of fuels and extractive industry products, subtracting -11.1 p.p to the total. In second place, agriculture, food, and beverages contributed -3.1 p.p. by registering a fall of -15.2% YoY.

Key highlights:

- The group of agricultural goods, food and beverages, reached USD 743 million FOB, registering a variation of -14.3% YoY and contributing negatively with -2.9 p.p to the total variation. Within the group, the component to register the largest drop was the export of coffee, with a variation of -42.6% YoY, contributing -15.4 p.p, while the most added to the group were other sugars with a variation (+2.4 p.p), and the export of palm oil (+1.6 p.p).

- The fuels group added USD 2.2 billion FOB, registering an annual variation of 1.2% and contributing 0.7 p.p. to the total variation. It is worth noting that this behaviour was contrary to the previous month’s record (-16.1% YoY). This performance was mainly due to a 28.1% YoY increase in exports of oil and its derivatives, which contributed 15.1 p.p. to the group’s variation and 8.0 p.p. to the overall variation. Counteracting is the component of hard coal, coke and briquettes with a variation of -36.9% YoY, and a contribution of -16.1 p.p. to the fuel group.

- The manufacturing group reached USD 875.7 million FOB, which represents a variation of 5.4% YoY and a contribution of 1.1 p.p to the total. The export of machinery and equipment was the component that contributed most to the variation of the group, rebounding with 38.2% YoY and adding 6.2 p.p. On the contrary, the export of ferronickel counterbalanced with -1.4 p.p to the manufacturing group.

—Sergio Olarte & Daniela Silva

CURRENT ACCOUNT DEFICIT NARROWED TO 1.7% OF GDP, LOWEST SINCE 2009

On Friday, December 1st, the central bank (BanRep) released the Q3-2023 Balance of Payments (BoP). The current account deficit stood at USD 1.68 billion, representing 1.7% of GDP (chart 3), the lowest level since the third quarter of 2009. The current account deficit reduction mirrors the economic activity deceleration; trade deficit shrinks by 67.4% y/y and 33% q/q, which is the lowest level since 2017 (USD 1,47 bn). Total imports (of goods and services) contracted 22% y/y (+0.2% y/y) and are at levels like those observed in 2021, reflecting a lower domestic demand. On the other hand, exports have deteriorated at a more moderate pace (-11.3% y/y and +4.6% q/q), explained mainly by fluctuations in international commodity prices. Income account outflows diminished, reflecting lower business earnings. At the same time, transfers remained pointing north (+8.1% y/y and +10.7% q/q) due to a still positive remittances trend.

On the financing side, the current account deficit was financed by FDI, especially in the mining, financial, and manufacturing sectors. FDI inflows represent two times the current account deficit in Q3-2023. The still strong FDI performance offsets the weaker balance from Portfolio Investments, which shows net outflows of USD 1.55 bn (USD 981 million in the YTD), the most significant quarterly outflow since 2019.

Twin deficit traditionally has been the weakest fundamental for Colombia. However, in 2023, the country showed again that the current account deficit is procyclical; when economic activity grows significantly, we have a high but sustainable current account deficit, while if the economy decelerates, the current account deficit narrows. That said, Colombia is closing 2023, delivering a decent picture in which the monetary policy tightening is working to reduce the positive output gap, and in turn, it is contributing to reducing the external deficit. On the fiscal side, the deficit is expected to fall from 5.3% of GDP in 2022 to 4.3% in 2024, which is also a positive outcome.

All in all, BoP results confirm that recent USDCOP appreciation have a robust macroeconomic background. The Colombian peso has appreciated by 21.8% since its weakest level in November 2022. It has been a combination of a reduction in risk premium attributed to the political uncertainty, but it also reflects a lower dollar demand due to lower imports. On the other side, financing is healthy via FDI, which reflects investment in the real sector but also the effect of the fiscal reform obligating offshore companies with FDI in Colombia to bring money to pay taxes (which in turn is also contributing to moderate the fiscal deficit).

We don’t expect further fiscal deficit reduction in forthcoming periods. Instead, we have to monitor how the economy evolves to the current environment of lower FX and new regional government. That said, FX could consolidate a more stable range between 3950 pesos in the base case and 4300 pesos in the upside, which reflects that macro adjustment is almost done.

Regarding monetary policy, BoP results are positive since the lower current account deficit affirms that Colombia is reducing macro vulnerabilities and is also a signal of a positive output gap reduction. Our base case scenario points to a possibility of a 25 bps rate cut in the December 19th monetary policy meeting, however, it will be relevant to monitor what happens with the CPI inflation result on December 7th and what is the result of the minimum wage negotiation since it defines most of the indexation effect in prices for 2024.

Further details about the Balance of Payments results:

Current account:

- In Q3-2023, the current account deficit stood at USD 1.68 bn (1.7% of GDP, chart 4), while in the YTD up to September, the current account deficit was COP 7.09 bn (57.3% lower compared with the same period of 2022), representing 2.7% of GDP. In 2023, the main contribution to the current account reduction was a lower trade deficit that in the YTD basis stood at USD 6.02 bn (53% lower than one year ago). The second main contributor was the income account, which reflects better inflows, while transfers are now increasing more moderately.

- Trade balance: The deficit in Q3-2023 was USD 1.47 bn, a 67.4% y/y contraction. Narrowing in the trade deficit reflects a significant reduction in imports, especially goods-related imports (-21.9% y/y).

- Imports totaled USD 18.6 bn in Q3-2023, the lowest level since 2021. In the YTD, imports have decreased by 17% y/y, mainly explained by a 19% y/y reduction in good imports. According to DANE, the main imports contraction is concentrated in raw materials (-24.5% y/y) and capital goods (-22.5% y/y).

- On the exports side, the contraction was 11.3% y/y in the YTD figure, primarily reflecting the deterioration of international commodity prices. In the third quarter, exports totaled USD 17.2 bn (-11% y/y).

- Income account: Net outflows stood at USD 3.57bn and USD 10.56 bn in the YTD until September. Compared with the previous year, in the YTD up to September, net outflows have decreased by USD 2.35 bn (-18% y/y). Inflows are improving, while outflows contract by 4.7% y/y amid lower earnings from FDI investments in Colombia.

- Transfers: Continued contributing to a lower current account deficit. Transfers stood at USD 3.36 bn in Q3-2023, while the YTD figure stood at USD 9.48 bn (+4.1% y/y). Remittances posted a 7.7% y/y expansion, cumulating to USD 7.4 billion in the YTD. Remittances represent 2.8% of GDP and account for 11% of total current inflows.

Financing side:

- The financial account registered net inflows of USD 6.8 bn in the YTD up to September (2.6% of GDP), a 57% y/y contraction. FDI increased by 19% to USD 12.2 bn (4.8% of GDP), while portfolio investments posted net outflows of USD 7.15 bn in the YTD, a combination of outflows from domestic investments in international markets and outflows from offshore investors. That said, the FDI is consolidating as the main source of financing for the current account deficit (chart 5).

- Foreign Direct Investment: In Q3-2023, FDI inflows stood at USD 3.37 bn (3.4% of GDP). In the YTD, the FDI was USD 12.8 bn (4.8% of GDP). Mining and oil-related sectors accounted for 39% of FDI inflows, while financial services represented (16%) and manufacturing represented 15%.

- Capital Investment: In the YTD, Colombia registered capital outflows of USD 981 million (0.5% of GDP). Offshore investors reduced their portfolio in local assets by USD 4.27 bn, which was partially compensated by debt payments in international markets by USD 1.41 bn.

—Sergio Olarte & Jackeline Piraján

MEXICO: GFI SLOWED IN CONSTRUCTION, WITH GOOD PROGRESS IN M&E

During September, gross fixed investment slowed on an annual basis, going from 29.2% to 21.9%. Machinery and equipment rose 18.8% (16.6% previously), the domestic subcomponent increased to 21.5% (14.2% previously), and the imported one 17.1% (18.1% previously). Construction slowed to 24.8% (41.5% previously), non-residential construction stood at 39.8% y/y (85.5% previously) and residential construction rose 8.5% (-1.4% previously). In the seasonally adjusted monthly comparison, the GFI observed a significant drop of -1.5% (2.2% previously), machinery and equipment rose 2.7% (0.7% previously), and construction fell -5.0% (3.8% previously). In the cumulative comparison from January to September, the index has increased 19.8% YTD.

On the construction side, there was a significant slowdown in the private component as it went from 43.9% to 23.9% annually, and the public component from 36.7% to 28.5%, although the data suggest that this will maintain its trend, hoping that private construction will be less than public construction. Private machinery and equipment have maintained double-digit increases for 14 months, this time at 19.6% y/y (17.3% previously), signaling a certain stability, while the public component remained at 0.9% annually, placing the index well below that of the private.

We highlight that the indicator has already exceeded the levels observed before the pandemic, and we expect the upward trend to moderate in the following months, with lower levels in construction (chart 6) and stability in machinery and equipment (chart 7).

MEXICO: PRIVATE CONSUMPTION CONTINUED INCREASE IN SEPTEMBER, DRIVEN BY IMPORTED GOODS, WITH A POSITIVE OUTLOOK

Private consumption kept its real annual growth at 4.5% y/y in September. The advance continues to be driven by imported goods (20.8% y/y, vs. 23.9% previously), in line with a stronger peso (chart 8). In the domestic component (chart 8 again), services rose from 2.7% to 2.8% y/y, while goods remained unchanged (0.0%, vs. -0.8% previously), as non-durable goods added 7 months of declines (-1.9%), semi-durable goods rebounded to 0.7%, and durable goods accelerated to 15.6%. In a seasonally adjusted monthly comparison, consumption accelerated, from 0.6% to 0.8% m/m, in line with the perspective of a stronger dynamism as the year ends. Services rose 0.5% m/m, followed by domestic goods (1.2% m/m) and imported goods (1.5% m/m). Year-to-date, consumption has grown 4.0% with respect to the same period a year earlier. During 2023, private consumption has surprised on the upside thanks to a solid labour market, with unemployment rates at record lows, and also supported by remittances and the appreciation of the exchange rate. Going forward, we think that private consumption will maintain a vigorous pace thanks to real wage growth (a 20% increase for minimum wage for 2024 was just announced this Friday) and low unemployment levels, along with a pro-cyclical fiscal policy, which will encourage greater economic activity especially in the first half of next year.

—Miguel Saldaña & Brian Pérez

PERU: MINING UNDER ATTACK

Mining came under attack this week. Not through over-regulation or by environmental groups this time. This was a real, bona fide, attack, with violence, explosives and everything. On Saturday, December 2nd, the Poderosa gold mine was assaulted and, as a result, nine workers were killed and 15 were wounded.

Minera Poderosa is located in the Pataz mining region in Peru’s northern Andes. The region is not well-attended by the State, and groups known to be involved in illegal activities, from illegal mining to extortion, human trafficking and theft, have been increasingly active in the region, especially over the last five years.

The first thing to note is that the events this weekend were not linked to social protests. They were not linked to environmental groups. Pataz has a long history as a mining district, and the activity is well established. Minera Poderosa has been the main target for criminal groups for some time. In July 2023, Poderosa publicly alerted the government to the activities of what they termed “delinquents… allied with illegal miners which aim to control mining operations in the region”.

Prior to Saturday’s events, the company had seen seven of its workers killed in recent years. In addition, the electricity grid that Poderosa uses has been attacked on a number of occasions, with well-placed bombs taking down a number of high-tension towers. Given these acts, Poderosa’s claim that the people involved were seeking to control mining operations in the region seems to be a valid one.

Until now, and despite Poderosa’s pleas for help, the government had done little outside of imposing an ineffectual State of Emergency in the region. However, illegal miners may have exceeded their reach this time, prompting the government to react more forcefully. On Monday the Minister of the Interior, Víctor Torres, together with the Minister of Mining, Oscar Vera, travelled to Pataz together with a contingent of 60 policemen specializing in organized crime. Seven people, presumably linked to the bombs that killed the workers, have been apprehended.

What the government does next will have much more significance. Illegal mining has become a many-headed monster in Peru. According to figures by the Ministry of Mining for 2019, some 200,000 people work directly in illegal/informal mining. Gold exports from illegal mining purportedly represent USD4bn. Illegal mining is present to some degree in all regions of Peru. The activity is no longer marginal, but, rather, is encroaching increasingly on the concessions of formal miners. As an example, part of the concession that belongs to the Las Bambas copper mine has been taken over by illegal miners.

Illegal mining is not an issue that will be easy for the government to solve. Having said this, it would make a world of a difference if the government would at least confront the issue decisively. This is something that no government has done since at least 2018. As a result, over the last five or six years, illegal mining has soared in the country. Currently, over 40% of Peru’s gold exports is not reported as output by gold companies (see chart 9). This excess presumably represents illegally mined gold.

Given its growth, it is legitimate to wonder whether illegal mining may pose a threat to other formal mining operations in the country, aside from Las Bambas and Poderosa. We believe that the threat is real, albeit measured. To be sure, we know of no other formal mining operation in which this threat is imminent. However, over time, either the situation of illegal mining is brought under control, or it will simply continue expanding and threatening to encroach more and more on formal mining operations. Over time. But one gets the feeling that time is running short.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.