- Mexico: Banxico’s minutes add some additional colour on Board’s bias; inflation is slowing slightly, but there is no downward trend

MEXICO: BANXICO’S MINUTES ADD SOME ADDITIONAL COLOUR ON BOARD’S BIAS; INFLATION IS SLOWING SLIGHTLY, BUT THERE IS NO DOWNWARD TREND

Banxico’s minutes add some additional colour on Board’s bias

Following its surprise 50bps hike a couple of weeks ago, Banxico’s Board published the minutes from its February 8th decision. The most relevant sentence in the minutes for monetary policy watchers was likely that “The Board considers that given the monetary policy stance already reached, and the recent evolution of data, the adjustment in the monetary policy rate in the coming meeting will likely be of a smaller magnitude”. A slowdown in the magnitude of hikes was already anticipated by markets, who look for a moderation in the pace of tightening, with the TIIE curve currently pricing in a terminal rate of 11.70% (essentially pricing in 3X 25bps hikes in the coming meetings). This is at the top of the range of the expectations provided by Deputy Governor Heath in his comments on February 16th, where he said he anticipates a terminal rate in the range of 11.25%– 11.75%.

The latest economist consensus survey by Banamex (February 21) shows that economists see CPI inflation ending the year at 5.2%, and that it will remain at 4.0% by the end of 2024. This essentially shows that expectations remain above target for the duration of the monetary policy horizon (two years), which supports the view of further tightening ahead. In somewhat of a dissenting voice, Deputy Governor Espinosa said that “it’s dangerous to provide guidance of a smaller hike in March” stating her view that she believes it’s better to be cautions with regards to forward guidance. This statement reminds us of comments former Governor Carstens made at the IMF meetings in Peru, where he stated that for price taking central banks (i.e., not the Fed), it was arguably better to provide conditional guidance rather than forward guidance—as forward guidance as a price taker can risk credibility loss. We tend to agree with both of their assessments.

In terms of the decision to hike 50bps in the previous meeting, some key elements from the minutes include:

- The key driver for the 50bps hike surprise was that the Board remains concerned over the persistence in high core inflation.

- In addition, although Banxico sees 2-way risks to inflation, the balance of risks remains tilted to the upside.

- It is worth noting that the minutes show that the guidance on the next move likely being of a smaller magnitude is shared by a majority, not all the Board. We know that at least Deputy Governor Espinosa seems to believe this guidance is risky.

- Besides Espinosa, the other more hawkish member of the Board (Heath) in his comments on his expectations on the terminal rate being in the 11.25%–11.75% range seems to be open to moving 25bps in the next move.

- It’s also worth noting that some members of the Board suggested that MXN’s strength could be driven by high rates, which we wrote about last week. However, Banxico (and the FinMin, who jointly run the FX Commission) has so far refrained from making changes to its FX policy. Our view is that if Banxico were to start accumulating FX reserves, it could stop rolling its maturing FX swaps first. This could be combined or followed by the implementation of reserve accumulation through the options mechanism.

—Eduardo Suárez

Inflation is slowing slightly, but there is no downward trend

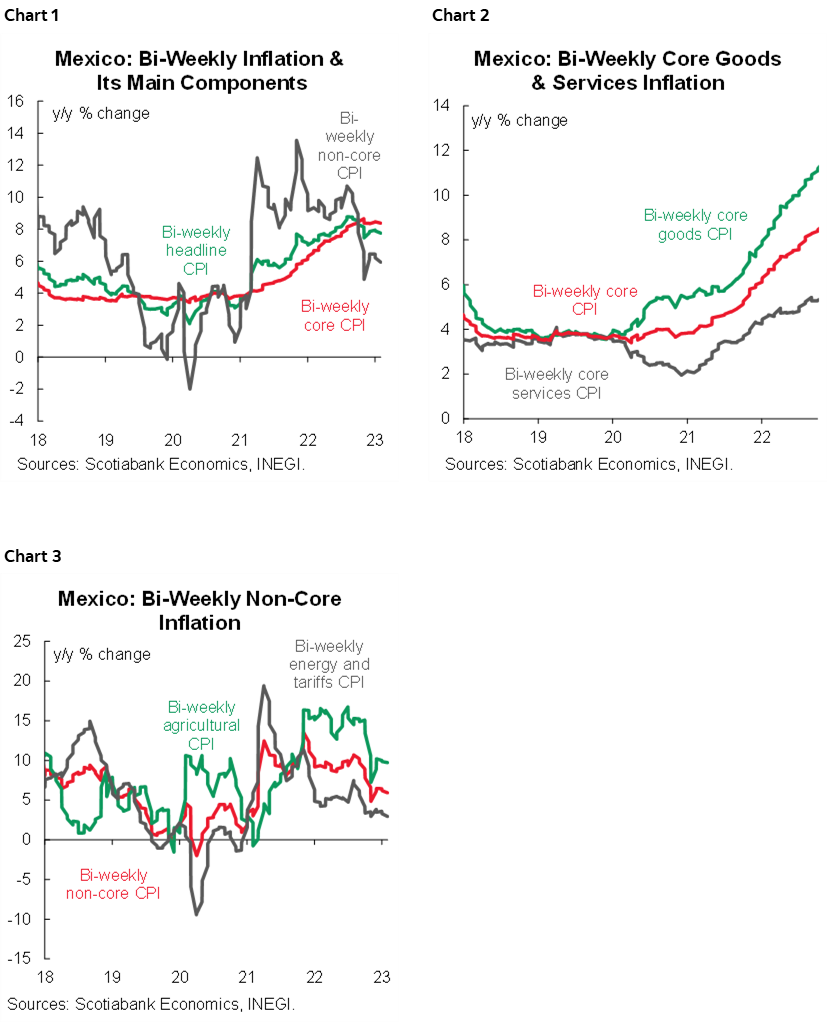

In the first fortnight of February, headline annual inflation was lower than expected, going from 7.88% to 7.76% y/y (vs 7.81% consensus) (chart1), as core inflation decelerated less than expected, from 8.46% to 8.38% y/y (vs 8.42% consensus), owing to an increase in services by 5.58% (5.54% previously), while merchandise decelerated to 10.79% (10.97% previously) (chart 2). On the other hand, non-core inflation moderated from 6.20% to 5.93%, with agriculture slightly slowing to 9.71% (9.87% previous), energy and government fees at 1.81% (2.26% previously) (chart 3). In its sequential biweekly comparison, headline inflation moderated from 0.35% to 0.30% 2w/2w (vs 0.35% consensus), and the core component marginally moderated from 0.36% to 0.35% 2w/2w (vs 0.39% consensus). In particular, merchandise accelerated to 0.40% 2w/2w (vs 0.34% previously), but services moderated their pace to 0.30% (0.37% previously). The non-core component slowed to 0.15% from 0.31%, derived from a drop in agriculture at -0.24% (0.06% previously), while energy and government fees remained at 0.52% as previously. Consumption has remained strong since last year, even with the rate hikes, therefore we maintain our stance that inflation will remain high during the first half of 2023, with pressures in merchandise and services, having already touched its peak in September 2022 (8.70% y/y), as well as their impact on households. For now, it seems that inflation will remain high without a clear downward trend, therefore analysts increased their forecast in Citibanamex Survey for the end of 2023 (5.2%) and 2024 (4.0%), also the terminal rate was revised in a range of 9.25%–12.0%, without a clear consensus.

—Miguel Saldaña & Brian Pérez

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.