- Chile: Non-mining GDP contracted by 0.7% m/m, mainly due to trade and services; Government will insist on the Tax Reform bill in the Senate at the end of July

- Colombia: The current account deficit in Q1-2023 shrunk significantly, reflecting the economic slowdown

- Mexico: Banxico minutes with a more hawkish tone than expected

- Peru: June inflation could be close to 7%, BCRP will continue pause

Overnight markets traded on reduced volumes (with Singapore on holiday) and on limited developments, with little to carry them through European trading until the release of US nonfarm payrolls data at 8.30ET. The passage of the US debt ceiling suspension through the Senate was only delayed by eleven failed proposed amendments and the bill now heads to Biden’s desk for a final inking.

US equity futures are taking the progress well, adding 0.3/4% to SPX contracts that are aiming for 4,250 and setting up the highest close in cash markets since last August. Crude oil is adding another ~1.5% to its steep rally since the North American morning, but still looking at risk of OPEC+ not doing enough at its meeting this weekend. Iron ore and copper are also gaining ground, up 2%, supported by reports that China is thinking of a classic property-market support package. Rates markets are on the backfoot, however, bear steepening in the US and bear flattening in Europe.

The USD is broadly weaker, with high-beta/commodity FX leading the pack, but here the MXN is somewhat missing out and is only gaining 0.2%—though nearing the key 17.50 mark. Mexico’s INEGI publishes April unemployment rate data at 8ET, which is seen higher owing to seasonal factors (from 2.39% to 2.75%), while remaining low under 3%. Out at the same time is Brazilian industrial production for April on the heels of a massive beat in quarterly GDP growth yesterday of 1.9% vs 1.2% q/q expected, though with less than encouraging details as the beat was driven by a sharp drop in imports and household consumption was relatively soft.

Mexican and Brazilian markets are better off waiting until next week’s May inflation prints to guide expectations on the timing of the first cut by their respective central banks. There’s also important political developments to watch in in Mexico. the Edomex and Coahuila elections on Sunday will help shape the outlook for the 2024 elections, and it was also announced a few minutes ago that a private company has been granted a Mexican export permit for the shipment of LNG starting in August 2023 (a change in tone relative to the recent rail line dispute).

Also in the political sphere, Chile’s president Boric said yesterday he will present a new tax reform next month. We shall see how this proceeds, but Chilean institutions have been successful on various occasions in curbing or diluting more ‘extreme’ proposals put forward by the administration.

Global markets are eagerly awaiting the release of US employment data at 8.30ET.

—Juan Manuel Herrera

CHILE: NON-MINING GDP CONTRACTED BY 0.7% M/M, MAINLY DUE TO TRADE AND SERVICES

- The economy would face an excessive downward adjustment in the absence of an early countercyclical monetary policy

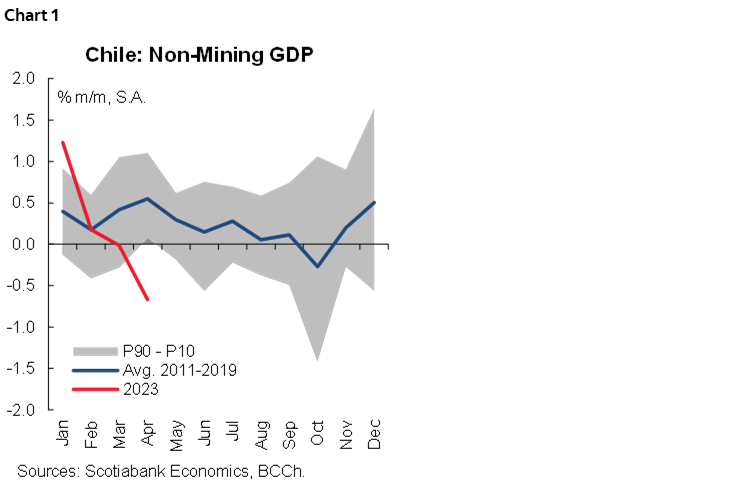

On Thursday, June 1, the Central Bank (BCCh) released April GDP data, showing a contraction of 1.1% y/y, negatively surprising market expectations (consensus: -0.5%; Economic Expectations Survey: -1%). This contraction was higher than expected by the market despite a favourable impact of the mining sector. Compared to the previous month, the total GDP did not experience any variation, while the non-mining Imacec contracted 0.7% due to the negative contribution of commerce, services and construction. It is worth noting that, within services, the BCCh points out the negative impact of Business Services, which are those more linked to investment.

The BCCh has in its base scenario a y/y contraction of 0.5% in Q2-23, which is far from this negative record at the non-mining GDP level (chart 1). Indeed, in order to achieve a contraction like the BCCh's base scenario, the economy would have to see consecutive seasonally adjusted expansions of 0.3% m/m in May and June, which would be far from happening after knowing the figures at the margin at the sector level where all non-mining sectors show seasonally adjusted declines with the exception of Industry. At Scotiabank we reaffirm our 2023 GDP contraction projection of 0.8%, higher than that contemplated by consensus and BCCh.

Trade continues to make the adjustment and this becomes consecutive and aggressive at the margin. Services decelerates slower due to its Personal Services component (Health and Education), while Business Services seems to have completely reversed its March increase (chart 2). Trade GDP contracted 2.4% m/m, falling back to levels of two years ago (April 2021). While the adjustment process accelerated in April, it does not represent a surprise for our scenario given the current moment of weakness in the labour market and our short-term indicators of transactions with debit cards. This sharp slowdown in trade and private consumption is occurring despite the contribution being made by the payment of the Universal Guaranteed Pension (PGU). In effect, this injection of liquidity has allowed consumption and trade not to plummet more aggressively and has partially offset the weakness of the labour market.

Government Will Insist on the Tax Reform Bill in the Senate at the End of July

On Thursday, June 1, in the annual speech to Congress of the State of the Nation, President Boric announced that the government will insist with the Tax Reform bill in the Senate at the end of July, after negotiating with all economic agents, which will be the key to finance the social agenda. It should be recalled that the bill was rejected in the Lower House in March (see our Latam Weekly). Subsequently, the Minister of Finance identified some points of agreement that should be approved without problems in the Senate, such as the reduction of evasion and avoidance and the increase of the basic pension (PGU).

In our view, the main concern in the last bill was the high level of collection that the Tax Reform was intended to achieve. As with the mining royalty, we consider that the government should concede much more on structural reforms in order to reach agreements with political parties. All in all, the tax reform will require important modifications to be approved in Congress and should be approved with relevant adjustments that will very likely lower the long-term collection objective.

—Aníbal Alarcón

COLOMBIA: THE CURRENT ACCOUNT DEFICIT IN Q1-2023 SHRUNK SIGNIFICANTLY, REFLECTING THE ECONOMIC SLOWDOWN

On Thursday, June 1, the central bank (BanRep) released the Q1-2023 balance of payments. The current account deficit stood at USD 3.42 billion (4.2% of GDP), the lowest since Q1-2021, reflecting a sudden reduction in the trade deficit. Imports contracted by 7.83% q/q and 4.8% y/y, which reflects the economic activity slowdown, especially on the investment front. The previous is compatible with the projection from the central bank of a current account deficit of 4% of GDP (equivalent to USD 14.69 bn) in 2023.

External accounts demonstrate again that in Colombia the deficit reacts to the economic activity and it has a kind of endogenous financing. Financing, came mainly from FDI, increasing by 7%. FDI inflows represented 75% of the total inflows of the financial account, and investments were concentrated in the mining sector, financial services, and manufacturing. All in all, the previous result affirms our call for rate stability in BanRep’s June 30 meeting. On the FX side, a significantly lower external deficit will also contribute to a lower exchange rate in the medium term.

Twin deficits, especially the structurally high current account deficit, are the weakest fundamental for the Colombian economy. However, 2023 is proving that the external deficit responds to the economic activity dynamic. In fact, the narrowing of the deficit was stronger than expected by market consensus, while the financing is healthy since is concentrated in FDI.

The COP has appreciated more than 8% during the year, and the lower external deficit contributes to reducing the possibility of a strong depreciation. Imports are decreasing significantly, while services exports remain close to historical highs.

Information by lines in the balance of payments.

Current account:

- In Q1-2023, the current account deficit stood at USD 3.42 bn (4.2% of GDP, chart 3). The deficit was 30.6% lower than the Q4-2022 current account deficit. In absolute terms, the main source of the current account deficit was net outflows in the income account (USD 4.14 bn) due to payments to companies with FDI (chart 4). The trade deficit was the second main contributor, however, it fell by 37% y/y and 30.62% q/q. Net transfers remain at a high level amid still strong remittances inflows.

- Trade balance:

° In 1Q-2023, total exports contracted by 2.97% q/q showing a reduction in goods, which reflects weaker price terms and lower exported volume. It is important to say that services exports remain close to their historical high, especially related to the IT sector such as call centers, and consultancy services, among others. On the other side, FX depreciation and the total reopening are reflected in higher touristic activity.

° Imports reflected the main response to the economic slowdown. It contracted by 9.3% q/q and 10.3% y/y. Reaching the weakest level since Q3-2021. According to DANE’s statistics. Imports are weakening especially on capital goods and raw materials.

° The trade deficit in Q1-2023 stood at USD 3.42 bn, the lowest level since early 2021, shrinking by USD 1.51 bn vs the previous quarter (-30.6% q/q), representing a contraction of 36.3% y/y.

- Income account: Net outflows stood at USD 4.14bn. Compared with the previous year, it is showing higher outflows due to earnings payments to foreign companies with FDI in Colombia, especially in industries related to mining ( USD 632.8 m), which were partially offset by lower earnings in the oil sector (USD 282.2 m), and Financial Services (USD 132 million). The other big component that takes higher income account net outflows was interest payment, which is due to higher interest paid to the Government amid the increase in interest rates.

- Net current transfer inflows stood at USD 3.1 bn in Q1-2022, remaining at historically high levels but moderating around 3% versus the previous quarter. Remittances stood at USD 2.48 bn (+21.0% y/y), which represents 2.7% of GDP and 11.4% of total current inflows in the BoP.

Financing side:

The financial account registered total inflows of USD 5.75 bn, 75% came from the FDI, 17% from capital inflows, and the rest from other liabilities of the private sector. That said, the current account deficit financing came mainly from the FDI (chart 5), which totaled net inflows of USD 4.31 bn, decreasing moderately from the previous year. Net portfolio investment improved versus the previous quarter, however, capital inflows remain at a low level compared with what was observed in 2021, showing a more cautious approach from the offshore investors. Either way, it is good news to see that the majority of financing comes from FDI.

- Foreign Direct Investments: In Q1-2023, FDI inflows stood at USD 4.31 bn (5.3% of GDP). FDI was allocated 31% in the oil and mining sector, 17% in financial services, 14% in manufacturing, 10% in transport, 10% in commerce and hotels, 9% in the electricity-related sector, and 9% in other sectors.

- Capital Investments: Net capital investments registered inflows of 999 million (1.2% of GDP). The issuance of external debt of USD 1.23 bn was partially offset by a reduction in the positioning of offshore investors of local assets.

- Other liabilities: in Q1-2023, foreign currency liabilities contracted by 91% q/q and 80.5% y/y. Private sector indebtedness was USD 796m, which is USD 2.47 bn lower than the previous year. Meanwhile, in the public sector, debt payments were lower compared with Q1-2022.

—Sergio Olarte, Santiago Moreno, & Jackeline Piraján

MEXICO: BANXICO MINUTES WITH A MORE HAWKISH TONE THAN EXPECTED

Yesterday, Banxico published the minutes to its latest monetary policy meeting that took place on May 18, 2023, where the Board decided to keep the rate at 11.25%, since they consider that the current monetary stance is adequate to reach the central bank target at 3.0% (chart 6 and chart 7). In the statement, they indicate that they have been monitoring different economic indicators, both national and international. An important factor to consider was the higher-than-expected growth in 1Q 2023, with a high pace in services and industrial activity, although manufacturing has begun to moderate. Regarding inflation, they highlight that, although a downward trend has already been observed, it is still well above the central bank's target. This deceleration has been attributed mainly to non-core inflation (which was 2.12% y/y in April), although the core component has barely begun to moderate (7.67% y/y), with the persistence of merchandise, both food (12.14% y/y) and non-food (6.59% y/y). Regarding the services, a decrease in its rate (5.46% y/y) is already observed, where a member pointed out that it reflects the recovery of the sector after the pandemic and that various components have been affected by global shocks.

- One member mentioned that it is premature to think about possible rate cuts.

- Another said that the rate level is restrictive enough to combat inflation, and in the absence of unforeseen events, it would continue with the downward trajectory, although he considered that there could be some additional increase in the rate, if necessary.

- Another member declared that given the increase of 725 bps it is necessary to pause and evaluate the effects of monetary policy, pending any internal shock.

- Another board member highlight that the following decisions will continue to be data driven. In this sense, derived from the degree of uncertainty, he stressed that further monetary tightening cannot be ruled out, if inflation suffers unexpected shocks in the current perspectives.

- Several highlighted external factors such as uncertainty regarding the decline in inflation and its trend. Two members said they are not considering cuts this year.

- Several also highlighted that the USDMXN has appreciated and is at levels not seen since 2016, some attributed it to the rate differential with the Fed, since it has appreciated since the restrictive cycle began.

In general, the Board agrees that the inflation outlook is uncertain, and that for this reason it will be necessary to maintain the rate at its current level for a prolonged period to reach the inflation target.

They mentioned that they expect the Federal Reserve to reach a terminal rate in the next few meetings. They also highlighted that the financial markets have relaxed after the turmoil in the US banking sector in recent months, pending its evolution and adverse effects.

We consider the statement to be more somewhat hawkish derived from the fact that several members do not rule out future increases in the rate as in the case that inflation does not behave as expected. In addition, the forward guidance diverges with the market sentiment since analysts expect a decrease by the end of the year, according to the Private Sector Expectations Survey in 2023 the rate would see a reduction of 25 bps. to 11.0% and reaching 8.50% in 2024.

—Miguel Saldaña & Brian Pérez

PERU: JUNE INFLATION COULD BE CLOSE TO 7%, BCRP WILL CONTINUE PAUSE

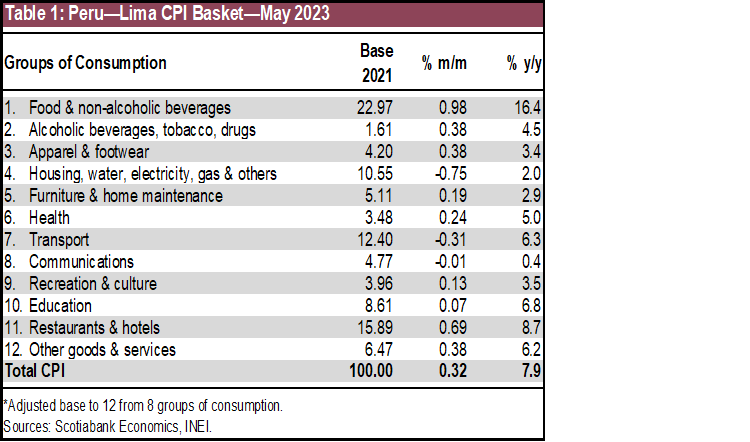

Inflation in Lima reached 0.32% m/m in May data released on Thursday, June 1, in line with our forecast (0.30%) and the Bloomberg consensus (0.30%). Year-on-year inflation fell for the fourth consecutive month, going from 7.97% y/y to 7.89% y/y (chart 8), remaining below 8% for the second consecutive month after 11 months. With inflation data for May, 24 months have been accumulated in which inflation remained above the upper limit of 3% of the inflation target, a record since the target band of 1-3% was established in 2007.

Factors such as abnormal waves on the Peruvian coast and seasonal factors influenced the rise in fish prices, which contributed to almost 40% of inflation in May. The lagged effects of Cyclone Yaku affected the increase in prices of some perishable products, such as vegetables and legumes, explaining 14% of inflation for the month. The number of roads interrupted by weather factors decreased on average from 13 in April to 5 in May. These impacts were offset by the drop in poultry prices, which would be reflecting that the effects of bird flu are dissipating, lower electricity rates, home rentals and local fuel prices.

In May, of the 586 products that make up the consumer basket (base 2021), 402 increased (69%), 96 decreased (16%) and 88 remained unchanged (15%) (table 1). Core inflation went from 5.7% y/y to 5.1% y/y, falling for the second consecutive month, although it accumulates 18 months outside the target range. Several cost indicators kept a downward trend, such as wholesale prices that slowed from 5.2% y/y to 1.7% y/y, as well as machinery and equipment prices that went from 4.5% to a/a to 0.9% a/a, and the construction materials prices that went from 1.6% a/a to 0.3% a/a (again, chart 8). The prices of imported inputs fell in line with the appreciation of the PEN (Peruvian New Sol), whose annual rate went from a depreciation of 0.6% to an appreciation of 1.8%. Inflation of a national level (not only in Lima) went from 8.04% y/y to 7.99% y/y, surpassing Lima for 21 consecutive months. Year-on-year inflation slowed in 14 of the country's 26 largest cities. Only one city posted annual inflation above 10%, less than the two cities that posted in April.

Looking ahead, we expect a more visible decline in inflation in June, possibly moving closer to 7%, mainly due to a high base of comparison (June 2022 inflation was unusually high: 1.19% m/m, well above the 0.17% m/m average of the last 20 years for the same month), to which would be added lower poultry prices posted since the end-May. We keep our inflation forecast of 5.0% at the end-2023. The resistance of inflation increases the probability that the BCRP will continue with its monetary pause for a long time. Our baseline scenario considers that the current rate of 7.75% is the terminal level and that it will remain at that level until 3Q-2023.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.