- Chile: Unemployment rate falls to 8.7% due to drop in the labour force

Risk aversion permeated overnight markets following weak Chinese PMIs, with little help from the US debt ceiling extension bill clearing procedural hurdles in the House ahead of a vote today. China’s manufacturing sector fell further into contractionary territory in May and the non-manufacturing gauge also disappointed. Iron ore fell steeply on the print but eventually recovered to a small gain on the day (maybe hoping for some fiscal or monetary support?), but copper did not manage to erase losses and is off 0.7% on the day. Crude oil is trading choppy, and 0.3% weaker at writing.

US stock futures are tracking a 0.2% loss and the USD is higher against all major currencies and on pace for its best gain in two weeks on a Bloomberg dollar index basis (+0.4%). The MXN is flat, paring losses from the overnight lows as it traded in a relatively narrow range compared to the steeper weakening of its high-beta/FX peers.

Closer to home, the MXN’s regional peer, the COP, closed below the 4,500 pesos level for the first time since September yesterday, ending around the 4,400 zone with USD selling by offshore investors and/or tax-related flows reportedly behind the move. The ~1% gain was in striking contrast to the caution in markets, and continued weakness in crude oil prices.

Colombia’s DANE publishes unemployment data for April today at 11ET in what should be a mostly uneventful print for markets that will likely remain driven by flows rather than macro-fundamentals—and would probably prefer to keep their powder dry for Monday’s May CPI release. We also get BanRep’s financial stability report for H1-23 today, accompanied by a presentation by officials.

Brazil releases jobless rate data at 8ET, where the median economist expects an unchanged rate of 8.8%. The BRL has been on the backfoot of late as rate cut bets build with about an 80% chance of a 25bps reduction reflected in markets. Yesterday, Deputy FinMin Galipolo (on track to join the BCB’s board) said that the government is thinking of updates to inflation targets. Planning and Budget Minister Tebet also said that the central bank will have room to cut rates in August.

Chile’s big data day is here, with the releases of manufacturing/industrial/coper production and retail sales data at 9ET, an hour after the publication of the results to the latest BCCh traders’ survey. This follows the publication of a lower-than-expected April unemployment rate print out yesterday morning that our economists detail below; in a nutshell, it reflected a labour force decline and a poor jobs mix that would still support their expectation for a first rate cut in June.

Finally, Banxico will today publish updated projections in its quarterly inflation report at 14.30ET which are expected to show higher GDP growth projections with little surprise in the inflation forecasts when compared to those published alongside the latest decision. We’re looking for the bank’s judgment on the GDP and inflation outlook to guide for how long they may leave the overnight rate at its current level.

—Juan Manuel Herrera

CHILE: UNEMPLOYMENT RATE FALLS TO 8.7% DUE TO DROP IN THE LABOUR FORCE

- The destruction of salaried employment continues (35k), offset by self-employment, a symptom of a weak labour market

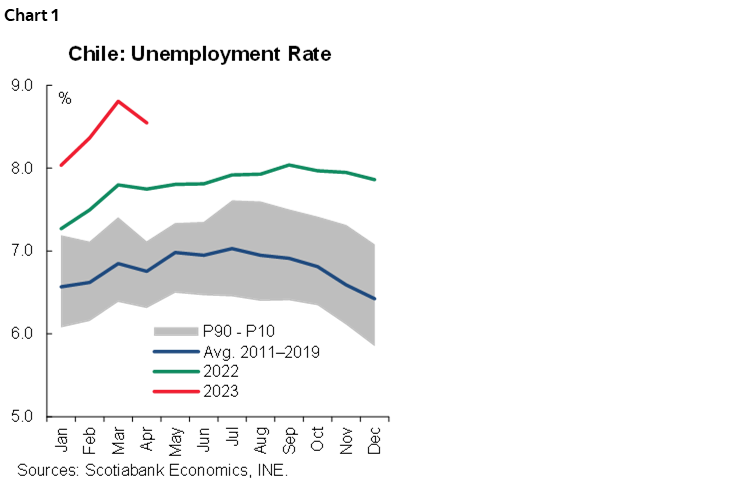

On Tuesday, May 30, the statistical agency (INE) published the unemployment rate for the quarter ending in April, which dropped to 8.7% (chart 1), surprising market expectations (consensus: 8.9%). Overall, the fall in the unemployment rate is explained by a contraction in the labour force (-0.2% m/m; -15k), while total employment remained stable (+1k). As for the composition of total employment, the economy lost 35k salaried jobs, while 35k self-employed jobs were created, mainly in the manufacturing and construction sectors. In our view, the decline in the labour force is transitory and has seasonal characteristics, so a further recovery is expected in the coming months, which coupled with low total job creation may quickly bring the unemployment rate to 2 digits.

The drop in the labour force was due to transitory and seasonal reasons, so we expect it to recover in the next print. In fact, the labour force decreased by 15k people, registering the largest drop in the last 10 months. This drop is almost entirely explained by an increase in inactivity for usual study reasons, an eminently seasonal and transitory factor. On the other hand, the number of people outside the labour force—who do not wish to work—decreased by 21k.

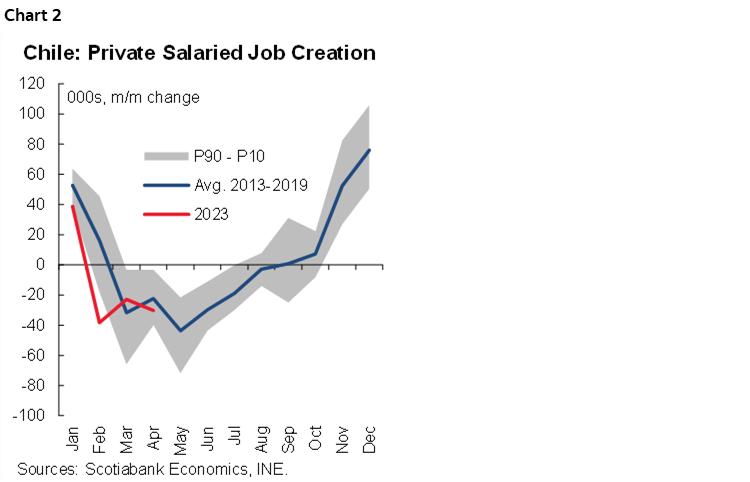

The composition of employment continues to deteriorate, with the destruction of salaried employees and the creation of the self-employed. Salaried employment fell by 35k, contrary to the usual seasonal pattern and at the lower end of the historical trend. As for the composition of the fall, it is explained by a decrease of 5k public salaried and 30k private (chart 2). In fact, unemployment insurance contributors decreased by 27k, a figure similar to that reported by the INE for private employees in the quarter ending in February. On the contrary, self-employment expanded by 35k people—in line with the usual seasonality for April—and was concentrated in the construction and manufacturing sectors.

By economic sector, the weakness shown by commerce and professional activities, the latter closely linked to the materialization and engineering of investment projects, stands out. On the other hand, there was an increase in the number of private employees in the (private) education sector and in public salaried employment in the health sector.

—Aníbal Alarcón

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.