- Mexico: Inflation decline continues; Services inflation exceeds 5.0% for 15th consecutive month

- Peru: BCRP cuts rate for the third consecutive time due to faster slowdown of inflation

Overnight markets felt the pain of Thursday’s sharp selloff in Treasurys on a one-two punch of a disastrous 30y auction and hawkishly-interpreted Powell comments. But, at least a quiet overnight session is not adding too much fuel to the fire and instead the relative data/events calm is helping steady US equity futures and the USD. On the data front, Norwegian CPI came in much stronger than expected and UK Q3 GDP ‘beat’ but the details were soft and the economy is still stagnant.

The G10 data highlight today is US U Mich inflation expectations at 10ET, which tends to deliver off-consensus 1- and 5-10-yr inflation expectations readings that trigger choppy trading. More central bank speakers, including Lagarde are also on tap.

The US yield curve is roughly unchanged from yesterday’s close, as a drift lower in yields (especially in the long-end) has reversed in European hours; 30s had even traded below their pre-auction (5bps tail) yield before swinging higher this morning. EGB and gilt yields gapped higher at the open in line with the post-Europe rise in US yields on Thursday.

US equity futures are swinging between small gains and small losses coming off a 0.8% drop in the SPX yesterday which is reflected in 0.8–1.0% declines in the main European and UK indices. Crude oil is up ~1%, to simply build a buffer above $75/bbl in WTI and $80/bbl in Brent, behind iron ore’s 1.4% rise, thanks to slowly rebuilding China property optimism, standing opposite to copper’s 0.7% drop. The USD is mixed though outside of more niche major FX posting large losses (KRW, ZAR) and the NOK outperforming up 0.7%, the rest of the majors are relatively flat in +/-0.2% ranges.

The MXN is trading around the 17.80 level, not too far off its worst levels yesterday after Banxico’s surprisingly less hawkish policy decision (see our recap here). The change in wording on how long the policy rate will remain at the current 11.25% from “an extended period” to “for some time” was perhaps rolled out too early and much too unexpectedly for markets that punished the peso and strongly bid Mexican rates on the decision. “Banxico’s rate announcement […] should again be a mostly uneventful placeholder”—me, yesterday (see Latam Daily).

There’s Mexican industrial/manufacturing production data scheduled for release at 7ET, but it’s not going to do anything for the peso while we keep an eye out for impromptu comments from Banxico officials. Chile’s BCCh will publish the results to its latest economists survey which should have forecasts that incorporate Wednesday’s inflation miss that could have some projecting a 75bps cut in December. The BCRP’s press conference at 12.30ET on yesterday’s decision to cut 25bps, as expected, is also worth a look as are comments by BanRep Gov Villar at 8.30ET and board memder/Fin Min Bonilla at 12.30ET.

The top release in Latam will be Brazilian CPI at the same time as Mexico’s data, which is expected to show a decent drop in headline inflation from 5.2% to 4.9% y/y but still hold a ~0.3% m/m pace of increases. The focus for the print will be on the services basket that the BCB is most closely paying attention to. However, unless today’s reading is a huge surprise the BCB will cut 50bps in December and likely in February.

—Juan Manuel Herrera

MEXICO: INFLATION DECLINE CONTINUES; SERVICES INFLATION EXCEEDS 5.0% FOR 15TH CONSECUTIVE MONTH

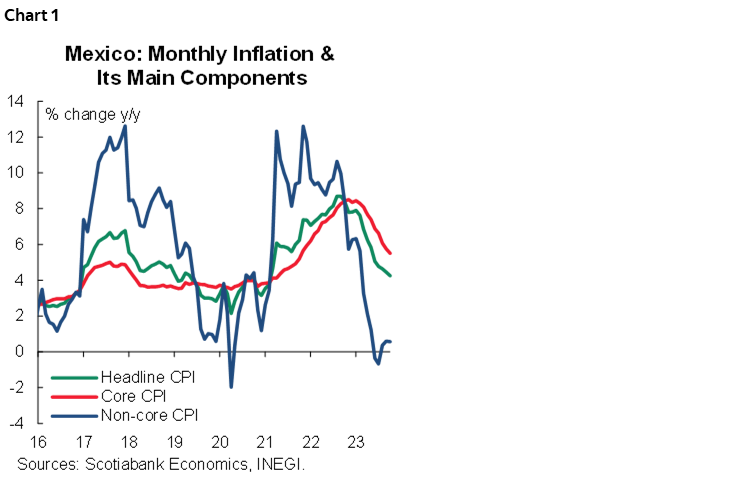

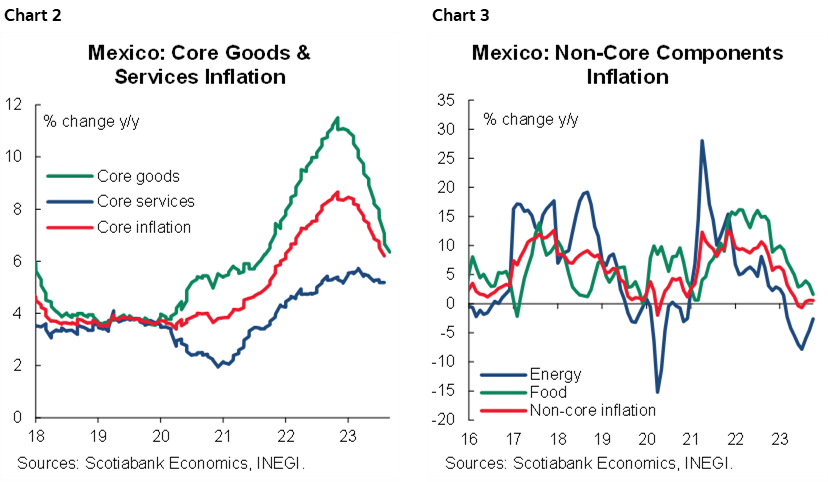

In August, inflation slowed down to 4.26% y/y from 4.45% previously (4.28% consensus, chart 1), core inflation also moderated to 5.50% y/y from 5.76% previously (5.50% consensus), derived from a slowdown in merchandise to 5.64% (6.20% previously), and increase in services to 5.34% (5.23% previously). The non-core moderated to 0.56% y/y from 0.60%, with energy and government fees falling -0.35% (-1.71% previously), although agricultural prices moderated to 1.62% (3.25% previously). In its monthly comparison, headline inflation slowed down 0.38% m/m (0.44% previously, 0.40% consensus), core inflation increased 0.39% m/m (0.36% previously, 0.37% consensus), with a higher pace in merchandise and services. Finally, the non-core moderated to 0.34% m/m (0.70% previously).

In this print, the deceleration in merchandise stood out, as it dropped 56 bps y/y, summing 11 consecutive declines (chart 2), and services trend remain flatter derived from the fact that they have been exceeding annual increases of +5.0% for 15 months (chart 2 again), in line with solid activity of services during the year. On the non-core side, it remains particularly low after the annual negative change, but it is important to consider any risk that could cause problems in agriculture, such as the recent hurricane in Guerrero, or other external factors. On the other hand, energy prices and government fees have been negative for 8 months, although the trend has already begun to change (chart 3).

The price index continues to surprise downwards, contrary to what analysts are estimating, it is most likely that a trajectory very similar to US inflation in previous months will occur, when headline inflation reached 3.0% y/y and ended up rebounding to 3.7% in August and September. We anticipate that inflation will continue to decelerate to a lesser extent, since merchandise is decelerating at a slower pace, and the non-core component is increasing.

—Miguel Saldaña & Brian Pérez

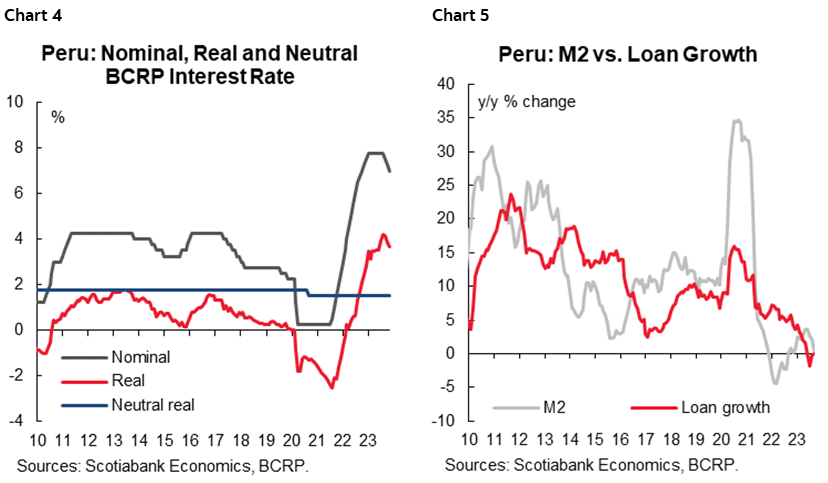

PERU: BCRP CUTS RATE FOR THE THIRD CONSECUTIVE TIME DUE TO FASTER SLOWDOWN OF INFLATION

The board of Peru’s Central Bank (BCRP) cut its key interest rate again on Thursday, November 9th by 25bp, to 7.00%, in line with what was expected by the market consensus, according to a Bloomberg survey, in a context of further slowdown in inflation and weak economic performance. In its statement, the BCRP once again emphasized that the rate cut “would not necessarily imply a cycle of successive cuts in the key rate,” which keeps open the possibility of a pause on the horizon. In the past, El Niño recorded significant impacts on food inflation, so we consider that during Q1-2024 it would be a favourable time for some pause.

Governor Velarde noted that El Niño represents a risk that is likely to hit food production and affect prices in a temporary shock. He maintained that “perhaps a reaction from the bank could be avoided. But it will depend on how it evolves.” This concern would appear to be reflected in 12-month inflation expectations, which fell only slightly, from 3.4% to 3.3% in their latest reading. Although inflation is slowing, it has already accumulated 29 months outside the target range (between 1% and 3%). In its September report, the BCRP raised its inflation forecast from 3.3% to 3.8% for this year. The BCRP statement confirms the forecast that a downward trend in inflation will continue and that the target range would be reached at the beginning of next year. It also emphasizes that a more marked downward trend has been observed since June, as some of the transitory effects due to supply restrictions dissipate.

Weak economic results also influenced the decision. The BCRP warned that the leading indicators and expectations about the economy continued to show a deterioration in October, remaining in the pessimistic range, and reiterated that "the shocks derived from social unrest and the El Niño event have had a greater-than-expected impact on economic activity and domestic demand". The macroeconomic expectations survey reflects a new drop in GDP growth forecast for this year from 0.9% to 0.5% on average, still above our GDP forecast of -0.2%, also beginning to contaminate the GDP growth of 2024 (which went from 2.4% to 2.3% in the survey).

The first readings for November inflation suggest that it could fall from 4.3% to below 4%. The weakness of the economy also tilts the bias towards continuing to relax monetary policy. In the case of core inflation, we expect it to remain around 3.3% in November. Recently, we reduced our inflation forecast from 5.0% to 4.6% for this year, with the assumptions of a strong Niño and rising oil prices. To the extent that both factors are weaker than expected, the bias of our forecast is still downward.

By cutting its policy rate to 7.00%, the real interest rate fell from 3.9% to 3.7% (chart 4), maintaining the restrictive stance of monetary policy, and still well above the neutral level (which was revised by the BCRP from 1.50% to 2.00%), accumulating 15 months in contractionary territory. The monetary policy stance was maintained by reaffirming that, “if necessary, it will consider additional modifications to monetary policy.” We recently revised our forecast, considering now that the BCRP would have room to continue cutting its interest rate even in December by 25bps more, to 6.75%, since on the one hand we see a delay in the impact of the El Niño event, which seems to be moderating, and an unexpected drop in the price of oil despite the conflict in the Middle East. Both factors could contribute to further reducing inflationary pressures. For 2024 we maintain our forecast of 5.00%, to be reviewed based on the magnitude of the impact of El Niño on inflation and its expectations. Despite the interest rate cut cycle, monetary conditions continued to tighten until September, with a greater contraction of currency (-6.5% y/y) and liquidity (-1.6% y/y, in negative territory for the third consecutive month). Loans posted a zero variation, after three months of decline, in line with the weakness of the economy and the still contractionary stance of monetary policy (chart 5).

—Mario Guerrero

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.