- Chile: Government reduces maximum public debt issuance for next year to USD 16.5 bn

- Colombia: Manufacturing and retail sales showed mixed results in September, reaching seven months in negative territory

Post-US CPI risk-on trading continued overnight, though soured in early European dealing as currencies trade mixed, and global rates, commodities, and US equity futures come off their best levels. The PBoC did not lower its MLF rate, nor did it lower the reserve requirement ratio, but it injected a net CNY600bn (~USD80bn) via the MLF, helping massive gains in regional indices on top of their catch-up to the rally in the US. Yesterday, the US House passed a short-term funding extension bill days ahead of a Friday deadline that at least temporarily delays shutdown risks until Jan 19 or Feb 2 (as the end of funding varies by department).

Data-wise, Chinese retail sales and industrial production grew more than expected in October, but fixed investment fell short of estimates. The main release this morning was UK October CPI figures which came in lower across the board in y/y and m/m, and headline and core terms, with surprisingly limited impact on UK rates. Today’s G10 highlight is US retail sales and PPI data at 8.30ET with economists expecting a strong deceleration in core retail sales (0.2% from 0.6%) and a roughly unchanged core PPI m/m. The risk going into today’s print is that we get another surprisingly strong retail print that slams yesterday’s rates rally.

In currency markets, the GBP is underperforming among the majors, but its 0.3% drop is not too far off the EUR’s 0.2% amid a mixed USD that is flat on a BBDXY basis after losing 1.2% yesterday—its biggest one-day decline since November 2022. The MXN is on track for a 0.2% gain that at 17.30 pesos has it around its best levels in early-November. USTs are roughly trading in the US afternoon range with a slight drift higher in yields in recent hours for 1/2bps increases across the curve. US equity futures are adding 0.3/4% in SPX after the index’s 1.9% jump on Tuesday. Crude oil is off about 0.5%, lagging a nice 1.5% rise in iron ore and a 0.6% gain in copper (re: China).

We have two key releases in Latam today, Colombian and Peruvian GDP for Q3/September and September, respectively. Yesterday, we got Colombian retail sales and industrial sector data that showed a larger than expected contraction in retail volumes of 9.3% y/y (see below) that adds downside risks to the GDP data out at 11ET. Our team in Colombia projects a 0.4% q/q increase in output (short of the median’s 0.7% forecast) that would undo less than half of the 1% drop in Q2, reflecting a sluggish economy impacted by declines in construction and manufacturing against relatively stagnant, but better, activity in services.

As for Peru, the country’s is certainly not in good shape as various factors from social unrest to adverse weather to high interest rates have taken a toll on the economy, contracting in year-on-year terms for seven out of nine months this year. Our Peru economists project a 0.8% y/y GDP contraction, worse than the –0.6% y/y median, dragged by sharp losses in agricultural output offset by mining gains associated with the Quellaveco mine. To tackle economic weakness, Peru’s government announced a new stimulus plan, that maybe falls short of filling the economy’s gaps (see Latam Daily).

Note that we got the BCC’h’s October meeting minutes yesterday. In my view, the minutes had a dovish feel as nothing suggests that 75bps cuts are no longer a possibility while the minutes also highlight the stronger than expected decline in ex volatiles inflation—which was even more noticeable in the post-meeting inflation print. As expected, the minutes showed a concern about the CLP’s weakness as an inflationary risk which could still see them opt in favour of a repeat 50bps instead of going back to a 75bps hike as may be warranted by the most recent inflation and economic data. With that in mind, the CLP rallied 3.6% yesterday thanks to the US CPI miss and the 900 pesos support level in the cross getting easily taken out, which means the CLP is now 4.7% stronger vs the USD since the BCCh’s decision.

—Juan Manuel Herrera

CHILE: GOVERNMENT REDUCES MAXIMUM PUBLIC DEBT ISSUANCE FOR NEXT YEAR TO USD 16.5 BN

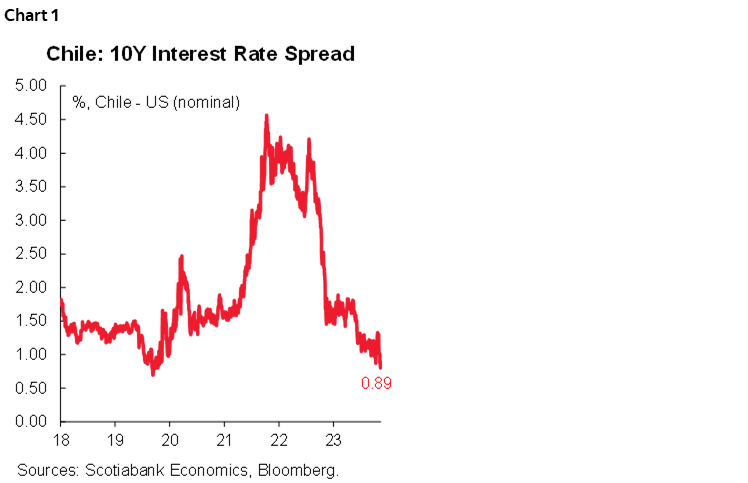

On Monday, November 13th, the Lower House of Congress approved (in general sense) the 2024 budget bill delivered by the government at the end of September. One of the main changes in the process was the reduction of the maximum amount of public debt authorized for 2024 to USD16.5 bn, a reduction of USD3 bn with respect to the government proposal of USD19.5 bn (see our Latam Daily). According to the Minister of Finance, this does not imply a reduction in terms of fiscal spending for next year. After the vote (particular sense) in the Lower House this week, the budget bill will be delivered to the Senate, where the final date for approval of the initiative will be November 28th. As a result, 10-year interest rates on government bonds fell and the spread vis-à-vis US rates decreased to its lowest level in four years (chart 1).

—Aníbal Alarcón

COLOMBIA: MANUFACTURING AND RETAIL SALES SHOWED MIXED RESULTS IN SEPTEMBER, REACHING SEVEN MONTHS IN NEGATIVE TERRITORY

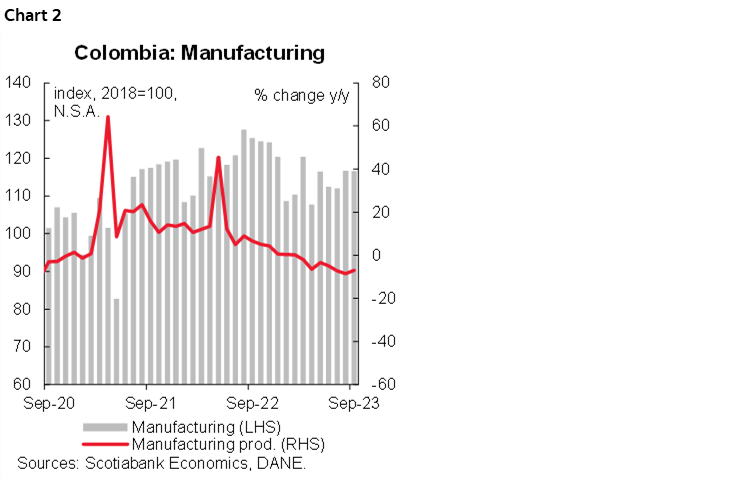

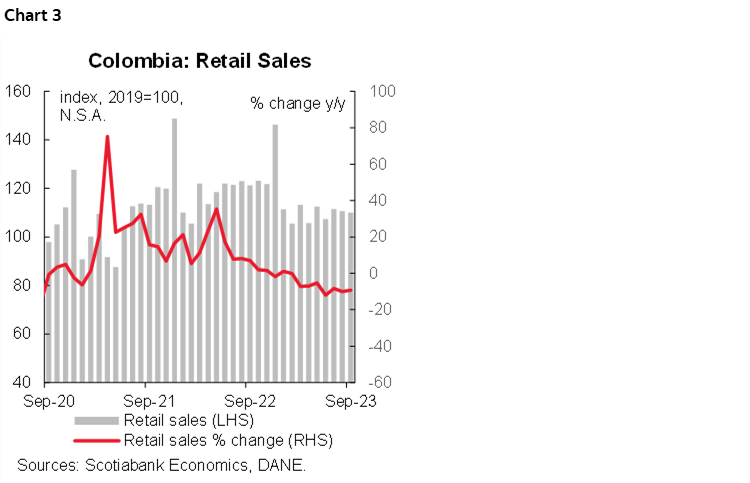

On Tuesday, November 14th, the National Administrative Department of Statistics (DANE) released manufacturing and retail sales data for September 2023. Real manufacturing production posted a year-on-year contraction of 6.9% in September 2023, while real retail sales decreased by 9.3% y/y in September, which represents a smaller drop compared to the data recorded the previous month (-8.5% y/y and -10% y/y in August respectively). However, results were mixed, on the manufacturing side. Analysts expected a decrease of 7.5% y/y, while on the retail sales side, a smaller drop of 8.5% was estimated. That being said, both indicators posted seven months in a row of annual contractions. However at the margin both improved, showing a 1.6% m/m s.a. expansion in the case of manufacturing and 0.9% m/m s.a. in the case of retail sales

While today’s results continue to show a substantial slowdown compared to the previous two years, economic activity at levels remains above its long-term path, which is still supportive for the labour market. That said, the economic performance has been heterogeneous across sectors, showing setbacks and even stagnation in activities such as industry, commerce, and construction, offset by activities associated with services and entertainment. On the other hand, in investment contraction and lower demand of durable and semi-durable goods has contributed to lower imports and in turn a lower current account deficit. In contrast, services demand remains resilient and defensive sectors such as personal hygiene products, food, and beverages.

Thus, the impact of the tightening of monetary policy continues to be evident, especially in the demand for durable and semi-durable goods. For BanRep, the balance of risk points to a still-high inflation and inflation expectations well above the 3% target, and with levels of economic activity close to the installed capacity (neutral output gap).

Considering these macroeconomic variables, at Scotiabank Colpatria, we estimate that the growth of economic activity for the 3Q-2023 will be located at 0.4% y/y, which will be published on November 15th by the DANE. These results added to the inflation data from last week, along with the measurement that will be published in December, make us maintain hopes of a possible rate cut between 25 bp and 50 bp at BanRep’s meeting on December 19th. However, the definition of minimum wage will also be essential data, as it defines a large part of the indexing effects of 2024.

Key highlights

Manufacturing production:

- Manufacturing production contracted by 6.9% y/y in September 2023 (chart 2), better versus our expectation of a -7.8% y/y, however posting the seven consecutive month of decline. In seasonally adjusted terms, the manufacturing industry grew by 1.6% m/m on the margin, the first positive figure after three months of decline.

- Of the 39 industrial activities accounted for in the survey, a total of 31 recorded negative year-on-year variations in real production, subtracting 8.4 pp from the total annual variation, while 8 subsectors with positive variations contributed a total of 1.5 pp to the total variation.

- In annual terms, the sectors that recorded the most significant contractions were the manufacturing of motor vehicles (-69.9% y/y and a contribution of -1.1 pp), the manufacturing of clothing (-16.4% y/y and a contribution of -0.7 pp), Manufacturing of non-metallic mineral products (-10.1% y/y and -0.6 pp contribution), the category of other food products (-12.5% y/y and -0.6 pp contribution) and the manufacturing of chemical substances (-14.2% y/y and -0.4 pp contribution). These industries represented -3.4 pp of the total annual variation in manufacturing production.

- On the other hand, other significant industries experienced annual contractions, particularly those related to durable and semi-durable goods, such as the manufacturing of paper and cardboard (-9.2% y/y and a contribution of -0.4 pp), spinning, weaving, and finishing of textiles (-18% y/y and a contribution of -0.4 pp), the manufacturing of furniture, mattresses and beds (-13.1% y/y and a contribution of -0.2 pp), along with the manufacturing of footwear (-12.8% y/y and a contribution of -0.1 pp).

- On the other hand, the sectors that showed the best performance were the manufacturing of beverages (+10% y/y and a contribution of 1.2 pp), coking, refining of petroleum, and mixing of fuels (+2.3% y/y), the manufacturing of machinery and equipment (3.8% y/y and a contribution of 0.04 pp) and iron and steel industries (+1.6% y/y and 0.04 pp).

Retail Sales:

- Retail sales contracted by 9.3% y/y in September 2023 (chart 3), below market expectations and our own projections for August (-8.5% y/y and -8% y/y respectively) and posting seven months in the negative as occurred with the manufacturing industry. In seasonally adjusted terms, retail sales, excluding freight vehicles, public transport, and others, showed a growth of 0.9% m/m, the first positive data after three months of recording contractions.

- Of the 19 product lines, 14 reported negative annual variations in real sales, while 5 merchandise lines reported growth in their sales.

- In annual terms, the performance of retail sales in September 2023 was influenced by a decrease in sales of other motor vehicles and motorcycles (-35.2% y/y and -3.7 pp), mainly domestic use motor vehicles and motorcycles (-25.8% y/y and -2.7 pp), as well as automotive fuels (-3.9% y/y and -0.8 pp). In total, these three merchandise lines contributed to a drop of -7.2 pp in general retail sales.

- On the contrary, the most significant positive contribution was observed in non-alcoholic beverages, with a contribution of 0.2 pp (+14.3% y/y), followed by personal care products, cosmetics, and perfumes with 0.2 pp (6.7% y/y). It is worth noting that in September, the growth of durable goods such as televisions continued for the third consecutive month with 5.3% y/y and a positive contribution of 0.1 pp.

Services & Hotels:

- In September 2023, most activities related to services moderated in real terms. The subsectors with the worst results were storage and complementary transport activities (-19.6% y/y), call centers (-13.9% y/y), publishing activities (-17.1% y/y), mail and courier services (-11.5% y/y), other entertainment services (-11.5% y/y) and administrative activities (-11.4% y/y). On the other hand, the services that showed a positive dynamic were restaurants, catering and bars (+4% y/y), human health (+3.9% y/y), and real estate services (+2.6% y/y).

- In the hotel sector, revenues showed a decrease of 11.6% y/y in real terms in September. In addition, hotel occupancy remained at 51.5% in September, still above the pre-pandemic average of around 49%.

—Jackeline Piraján & Santiago Moreno

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.