- Chile: Unemployment rate remained at 8.9% for the quarter ending in October; Congress approves fiscal budget for 2024

- Peru: More stable prices lead us to review inflation forecast

Eurozone CPI misses continued overnight with France and the Netherlands, leading up to the bloc’s aggregate undershooting forecasts. The Asia session had weaker than expected Chinese official PMIs, where the miss was centred in the non-manufacturing sector (services and construction) that is just above the 50 expansion/contraction level, and a terrible JGB2s auction. Moves related to these developments are most evident in the EUR’s weakness and lower European yields, while the broad market holds a dollar-positive, US bear-steepening mood alongside steady to slightly-positive US equity futures and gains in crude oil prices ahead of the OPEC+ decision. Canadian Q3 GDP and US PCE inflation are the main things to watch in the G10.

The rally in global rates, outside of EGBs, seems to have hit a wall today in Asia hours that saw a slight rise in US long-end yields while holding the front-end little changed. The UST curve is bear steepening 3bps in 2s10s versus a nice 4bps bull steepening in Germany. US equity futures are a touch firmer, up 0.2% which compares with gains in European bourses. WTI has been chopping around, but sits higher 2.0%, on a collection of OPEC headlines that generally point an increase in supply cuts—with no real sign that African members are rebelling all that much. Iron ore is up 0.9% while copper is 0.3% lower.

In the FX space, the USD is stronger against all major currencies as the rates rally stalls, seeing a 0.5% appreciation versus the EUR, half the decline of the day’s worst performer, the MXN which is shedding over 1% to the mid-17s. Today’s steep losses leave the MXN trading at its worst level since mid-November, weakening easily through the ~17.35 100-day MA but facing solid resistance in the cross at the mid figure zone that is followed by the 200-day MA at 17.58.

Banxico Gov Rodriguez spoke her dovish mind yesterday (again) saying that she sees “a possibility that at the start of the meetings next year we put on the table the start of discussions on a rate cut”. Her comments weakened the MXN by about 10pips. It’s certainly a case of whether it will be February or March when the first rate reduction will come, so maybe we have to begin thinking about whether some Banxico doves may even push for larger cuts down the line. For now, markets are just roughly seeing 25bps cuts at each of the bank’s 2024 meetings. Rodriguez’ comments came after the publication of Banxico’s quarterly report that revised higher its growth forecasts and was generally overlooked by market participants. They also were considerably more dovish than Dep Gov Heath’s shortly before, who said that they need to maintain restrictive policy for some time (i.e. the statement language).

We have a flood of Chile data to look forward to today, including unemployment, manufacturing/ industrial production, retail sales, and economic activity data during the second half of the week. The industry-level data out today will be a strong guide for the Imacec print on Friday; we project an 8.5% y/y drop in retail sales. Mexican, Brazilian, and Colombian unemployment data should come and go with little impact on markets. We also await the approval of Peru’s 2024 budget by today’s deadline, after lawmakers postponed pension withdrawal debate to allow the passage of the fiscal package. BanRep has a non-mon-pol meeting so no changes to the 13.25% overnight rate are due, but the discussion may build a consensus for cuts to begin in December (25 or 50bps).

—Juan Manuel Herrera

CHILE: UNEMPLOYMENT RATE REMAINED AT 8.9% FOR THE QUARTER ENDING IN OCTOBER

- Job creation with heterogeneity among sectors: manufacturing stands out positively, but construction sinks

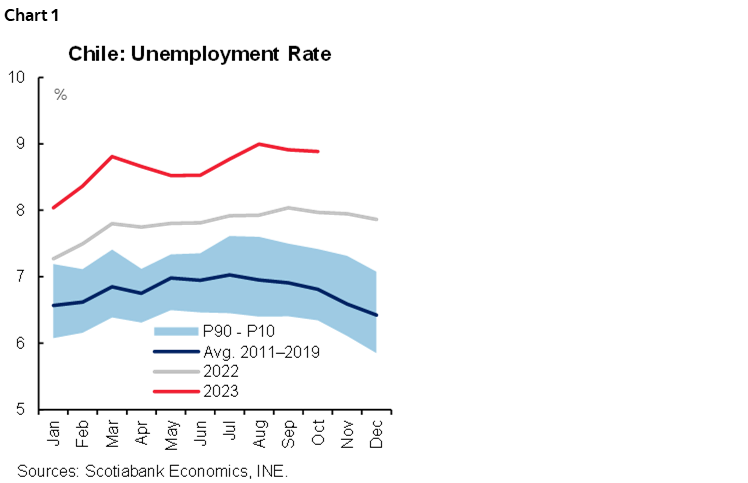

On Wednesday, November 29th, the statistical agency (INE) released the unemployment rate for the quarter ending in October, which remained at 8.9% (chart 1). Compared to the previous quarter, 30k jobs were created—the second largest creation of the year—while the labour force grew by the same amount. Some considerations:

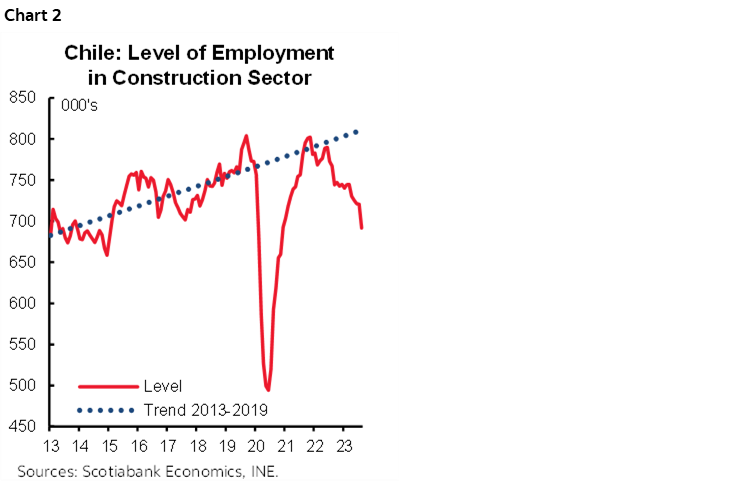

- The 30k new jobs were not a surprise in seasonal terms. Moreover, job creation was eminently informal. Forty-one thousand informal jobs were created, while 11k formal jobs were lost, half of them in the construction sector.

- When looking at the seasonally adjusted unemployment rate, it increased from 8.8% to 8.9%. This is because, although employment grew due to seasonal factors, the labour force also expanded above its historical average for the quarter, which continues to reflect a weak labour market.

- Construction lost 29k jobs, its worst record since the pandemic. With mortgage interest rates reaching record highs in November and investments remaining stagnant, the outlook for this sector remains negative. With this, the employment stock in the sector declined to its lowest level since 2015, excluding the pandemic (chart 2).

- In this scenario, in which some key sectors of the economy are in recession—such as construction—the unemployment rate could remain high during the summer months.

The labour market continues to look weak when looking at a broad set of indicators (see our Latam Weekly). The unemployment rate remains near its highest levels since 2010, as do initial and continuing jobless claims, which are at the upper end of their historical range. At the same time, job ads are at historic lows, while employment prospects for major sectors remain pessimistic.

CONGRESS APPROVES FISCAL BUDGET FOR 2024

Late on Tuesday, November 28th, the Senate approved the Budget bill sent by the Government in September. With this, fiscal spending would increase 3.5% in 2024 while public investment would reach 4.1% of GDP. In addition, as mentioned in our Latam Daily, Congress reduced the maximum public debt issuance for next year to USD 16.5 bn (from the USD 19.5 bn proposed by the government), which implied a drop in the interest rates of 10-year government bonds.

—Aníbal Alarcón

PERU: MORE STABLE PRICES LEAD US TO REVIEW INFLATION FORECAST

We expect November inflation to be close to 0.15% m/m in our most updated estimate, recovering from the October drop (-0.32% m/m). Despite this, the inflation trend would continue to decline, from 4.3% to 4.0%. Our forecast of 4.6% for the year-end assumed a strong El Niño scenario, as well as a higher oil price due to the potential impacts of the Middle East conflict. However, although a moderate/strong El Niño scenario continues to be dominant, the sea temperature anomaly is less intense than expected for this time of year and therefore less impact on food prices. On the other hand, the probability that the conflict in the Middle East will escalate shows now lower. These developments lead us to reduce our inflation forecast for this year from 4.6% to 3.6%. The lower level of inflation with which we would begin 2024 leads us to revise our inflation forecast for next year from 4.0% to 3.5%. That is, in general terms we expect an inflation rate like this year’s for next year, slightly higher than the central bank’s target range (between 1% and 3%), since we maintain a moderate/strong El Niño scenario.

—Mario Guerrero

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.