- Colombia: Headline and core inflation were lower than expected, showing diverging trends between services and goods inflation

- Peru: BCRP will continue rate cuts cycle

Rates and currency markets traded in relatively narrow ranges overnight while Japanese bourses clawed back some of the early-week losses versus mixed to weaker HK and China indices. Slightly more negative Chinese inflation was the overnight data highlight with little else of note until markets were shaken up in the early-European session on comments from the BoJ’s Ueda—talking about hopes to eventually exit YCC—and the BoE’s Pill—who walked back some of his dovishness on Monday.

Central bank musical chairs continue today with speakers from the ECB, BoE, SNB, and the Fed. Powell speaks again at 14ET and he may have something more interesting to say after yesterday’s remarks did not include comments on the economic or policy outlook; today’s is an IMF panel on monetary policy challenges. Weekly jobless claims at 8.30ET are the only US/G10 data worth watching today.

US and European curves are bear steepening in a correction of the strong rally in US10s yesterday with some additional pressure coming from a small rise in oil prices and maybe some preparation for a USD24bn auction of 30s at 13ET. Gilts were leading the selloff after Pill’s comments but are rallying strongly ahead of the open from their worst overnight levels. The USD is mixed in narrow ranges against the bulk of the majors; the MXN is flat as a pancake. Euro Stoxx gains of 0.8% are well ahead of the FTSE’s 0.1% rise and outpace SPX futures being up 0.2%. WTI crude oil is in a minor reversal day, up 1% after a 2.6% drop on Wednesday, iron ore is up 0.3% and copper is down 0.3%.

At 7ET, Mexico’s INEGI will publish the only Latam data of note today. October CPI figures that are expected to show about a 0.2/3ppts deceleration in y/y headline and core inflation, from 4.45% to 4.26% and from 5.76% to 5.49%, respectively, according to the Bloomberg median. The 0.4% m/m increase in core prices that economist project is still above seasonal norms for October, reflecting inflation persistence (especially in services) that is justifying Banxico’s hawkishness.

Banxico’s rate announcement at 14ET should again be a mostly uneventful placeholder. Not enough has changed since the bank’s latest meeting in late-September to change their guidance. On the inflation front, data have been mixed or in-line. Meanwhile, economic activity remains strong with no signs of slowing rapidly—and remittances growing in September at their fastest pace since early-year (11.4% y/y) point to consumption strength continuing. So, Banxico’s announcement may be a bit of a dud, but depending on the bank’s hawkishness there may be more who push out their forecast for the first rate cut to Q2-24 instead of late-Q1.

The team in Peru go over their expectation of a 25bps cut by the BCRP this evening (18ET) which is the view shared by virtually all economists and markets. Ahead of the decision, Peru’s government will unveil a package of 33 stimulus measures at 12ET to kickstart the economy. Foreign Trade and Tourism Sec Mathews (sic) said yesterday that these are to aid a near-term bounce (“which is what is urgent”), but also support the medium-term outlook. Recall that we forecast a 0.2% GDP contraction in 2023.

We also refer our readers to our Chile team’s Latam Flash on yesterday’s lower than expected inflation print (see here). After the data release, BCCh chief Costa highlighted that the central bank will continue to act with flexibility in policy setting, which would mean in our Santiago team’s view that the BCCh will consider a larger rate cut at its December meeting, of “no less than 75bps” after it chose to hike by a smaller 50bps in late-October.

—Juan Manuel Herrera

COLOMBIA: HEADLINE AND CORE INFLATION WERE LOWER THAN EXPECTED, SHOWING DIVERGING TRENDS BETWEEN SERVICES AND GOODS INFLATION

Monthly CPI inflation in Colombia stood at 0.25% m/m in October, according to DANE data released on Wednesday, November 8th. The result was well below the economist’s expectations of 0.36% m/m, according to BanRep’s survey and Scotiabank Colpatria’s expectation of 0.32 % m/m.

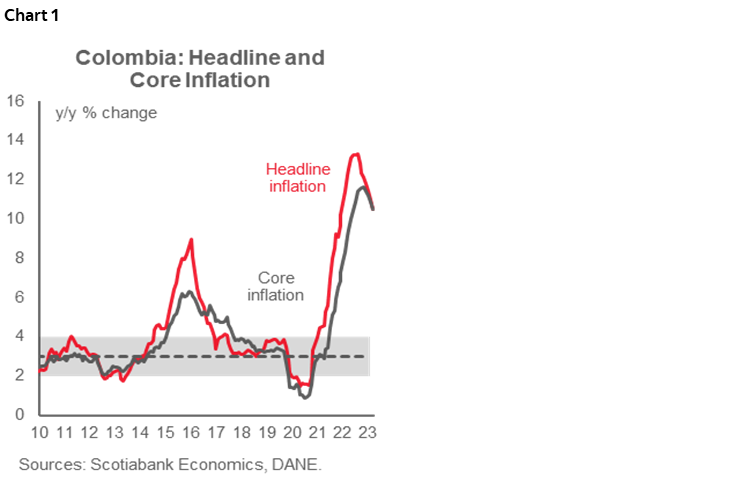

Annual headline inflation declined for the seventh month, from 10.99% in September to 10.48% in October (chart 1), the lowest since July 2022 (10.21% y/y). According to our projections, the headline inflation could reach a single digit in the following report (November to be released on December 7th).

Core inflation fell for the fourth consecutive month; non-food inflation is now at 10.51% y/y, 1.11 percentage points lower versus the peak observed in June 2023; inflation ex-food and regulated was at 9.20% y/y, down by 1.31 percentage points from the peak of June of 10.51% y/y. It is worth noting that despite headline and core inflation affirming a downward trend, the reduction has been very gradual, and in absolute terms, previous numbers are still more than three times above BanRep’s target of 3%, something that has been highlighted by the central bank in previous meetings.

October’s inflation showed moderate increases in food inflation and housing-related expenses; it is worth noting that during this month, the government interrupted the increments in gasoline prices. However, it was also notable the reduction in tradable goods prices, especially vehicles, which posted a contraction of more than 1% m/m for the second month in a row. The dynamic in tradable goods reflects the FX appreciation fast transmission to final prices in a context of fragile demand; this is something that could be very welcome by BanRep, and it makes us maintain hopes of a potential rate cut between 25 bps and 50 bps at the December 19th meeting. However services inflation remained very sticky, showing that indexation effects matters but also that the demand for services such as touristic plans is still booming.

It is worth noting that before this meeting, the board will have one more inflation reading, the Q3-2023 GDP figure, and some economic indicators for Q4-2023. The minimum wage is also an essential piece of information since it defines a huge part of indexation effects. However, we are not sure the final decision will be taken before BanRep’s meeting.

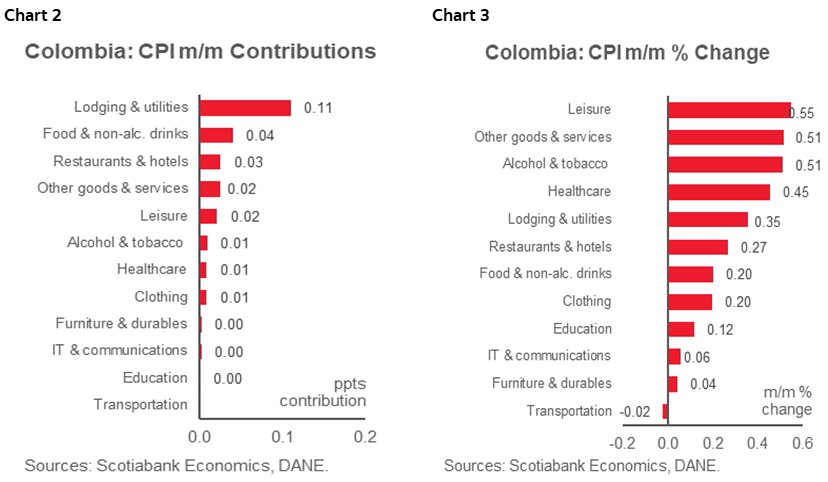

Looking at October’s figures in detail, food inflation is the group that generated the greatest upside pressure on inflation during the month (charts 2 and 3).

Other highlights:

- The lodging and utilities group was the main contributor to the monthly inflation. The group recorded +0.35% m/m inflation and +11 bps contribution. The previous result is moderate since it reflected a more modest increment in rent fees: 0.39% m/m, the lowest monthly increase in the year, and low compared to the average 0.69% m/m inflation recorded in 2023. Either way, indexation effects continue to be a concern for 2024; in that regard, minimum wage negotiations will be critical for BanRep in the assessment of inflation risk. Utility fees increased by 0.24% m/m due to significant increases in gas prices (+1.19% m/m).

- Food inflation was lower than expected, recording 0.20% m/m inflation and contributing to the headline only 4 bps. In October, there were moderate changes in most of the food basket; the most significant contractions were in onions (-10.9% m/m) and oranges (-11.44% m/m), while the main increases were in potatoes (+19.14% m/m) and fresh fruits (+2.41% m/m), however it seems food prices are not reflecting a huge atypical impact from weather phenomenon or logistic interruptions this time.

- In the forthcoming months, the main challenge remains the El Niño weather phenomenon. However, we only expect a material impact on prices if the El Niño phenomenon lasts longer than current projections.

- The transport group recorded a 0.02% monthly contraction; however, it was a result of offsetting effects between lower vehicle prices (-1.03% m/m) but still increasing fees for services around transportation, such as airfares (+2.70% m/m), vehicle repair services, among others (+0.28% m/m). That said, transport reflects the paradox between goods and services inflation trends. People are not buying cars but are still pushing up flight ticket prices. That is a good point for BanRep’s debate.

- It is worth noting that during October, we didn’t have gasoline price increases, which in previous months represented a direct 6 bps contribution to the number. Gasoline increases resumed in November and are expected to extend until January; after that, diesel price moves will be in the spotlight, given their potential second-round effects. According to a BanRep study, if diesel prices increase by 10%, the full indirect impact on inflation is 0.25 percentage points, which looks low; it probably does not account for potential social disruption and protests that an increase in those prices could trigger.

- Inflation by major groups: goods inflation continued decreasing, going down from 10.44% y/y to 9.51% y/y, while services prices decreased in a lower magnitude from 9.07% vs. the previous 9.14% y/y, reflecting still some robust demand in that sector, but also the effect of indexation.

- Tradable goods, excluding food, posted a 9.17% y/y inflation, lower than the previous month’s 9.47 % figure. It is worth noting that home appliances and vehicles are the items that contribute the most to the inflation reduction of tradable goods.

—Sergio Olarte & Jackeline Piraján

PERU: BCRP WILL CONTINUE RATE CUTS CYCLE

We expect the BCRP to continue its interest rate cutting cycle today’s meeting. It would be the third consecutive cut of 25bps, taking its key rate to 7.00%. The first readings for November inflation suggest that it could fall from 4.3% to below 4%. The weakness of the economy also tilts the bias towards continuing to relax monetary policy.

We recently revised our key rates forecast, considering now that the BCRP would have room to continue cutting its interest rate even in December by 25bps more, to 6.75%, since on the one hand we see a delay in the impact of the El Niño event, which seems to be moderating, and an unexpected drop in the price of oil despite the conflict in the Middle East. Both factors could contribute to further reducing inflationary pressures.

We postpone the pause until the first months of 2024, when we expect the BCRP to execute a strategy of staggered cuts (2017 and 2019 events), as has happened in the past. Governor Velarde pointed out that the El Niño represents a risk that will likely hit food production and affect prices in a temporary supply shock. He said that “perhaps a reaction from the bank could be avoided. But it will depend on how it evolves.”

—Mario Guerrero

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.