- Mexico: Industrial Production: construction increased again by double-digits

Thursday’s post-US CPI moves are being partially unwound his morning to show bull flattening USTs and EGBs and a weaker USD against practically all majors (but dollar weakness is fading in recent trading). In both cases, and especially in currencies, today’s reversals are well shy of erasing yesterday’s sell-off on the strong US services ex shelter CPI reading.

The MXN is closing what was a strong week with a somewhat disappointing Thursday and Friday performance; today that peso is flat, but around the 18 pesos level for a 1% gain since last Friday. Unfortunately for the MXN, hawkish Banxico minutes were but a secondary consideration for trading yesterday as the external backdrop and the broad global tone dominated moves in the currency.

Developments in Israel have markets trading with a risk-averse feel, and risk-off selling may accelerate in the next few hours as participants lighten risk ahead of along weekend that could see an escalation of the conflict. US equity futures are about 0.7% weaker while Eurozone cash indices trade roughly 1% lower. US 2s are down 4bps and 10s are down 8bps.

Israel called for an evacuation of civilians in Gaza City, as it seemingly readies a ground offensive, was a relatively minor immediate influence on global markets. Comments that followed from Iran foreign minister noting that if Israel continues its assaults on Gaza then “it is possible to open new fronts against Israel” prompted a steep rally in oil in the last few hours while weighing on other assets. Crude oil is up 4%+, well better than copper’s 0.2% gain and iron ore’s slight 0.3% decline.

After the ECB’s Lagarde speaks at 9ET, US U Michigan survey data at 10UK is the day’s highlight, with inflation expectations the component in focus and a likely (albeit unreliable) indicator that could either further the rates selloff or pare another good share of yesterday’s weakness.

In Latam, we have the release of Colombian retail sales and industrial/manufacturing production at 11ET as the main thing to watch, teeing up next Wednesday’s economic activity data. Marginal improvements are expected across the board for each of the three series on a y/y basis, but they are still seen in contractionary territory. Most notably, the median economist polled by Bloomberg projects retail sales down 8.0% y/y according to the Bloomberg median, reflecting weakness in household spending.

—Juan Manuel Herrera

MEXICO: INDUSTRIAL PRODUCTION: CONSTRUCTION INCREASED AGAIN BY DOUBLE-DIGITS

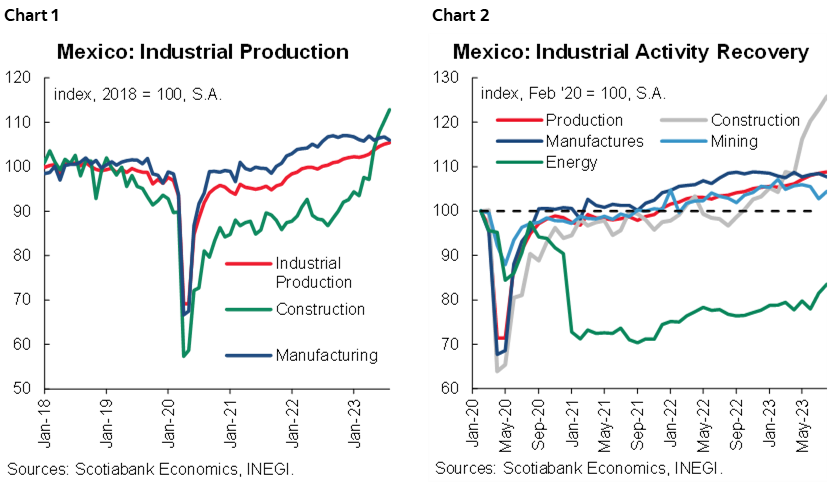

In August, industrial activity increased 5.2% y/y from 4.8% previously, within it, construction increased 30.8% (25.6% previously), generation, transmission, and distribution of electrical energy by 8.9% (4.8% previously), manufacturing fell -0.6% (0.8% previously) and mining rose 1.4% (-0.7% previously). In the monthly comparison, it moderated slightly to 0.3% m/m from 0.5% previously, with seasonally adjusted monthly data. Construction rose 2.4% (2.2% previously), manufacturing fell -0.7% (0.2% previously), while electric power generation, transmission and distribution moderated 2.6% (4.5% previously), and mining rose 1.6% (-2.6% previously). On the other hand, in the cumulative from January to August there is a real annual increase of 4.0%.

This increase in industrial production is led by construction (chart 1), which continues to accelerate at double-digits, and has had 11 months of positive percentage change, supported by the change of base year to 2018 by INEGI. While the component that experienced the most difficulties was manufacturing (chart 1 again), since it broke with the 21-month streak of increases, in addition to the fact that 13 of its 21 components fell in the annual comparison. On the side of the generation, transmission and distribution of electrical energy (chart 2), a slower recovery is observed than the other components, even less than that of mining, which is usually more volatile.

We expect the index to maintain its pace in the following readings, mainly due to construction, and the upward trend that energy may take, and with a slight slowdown in manufacturing (chart 2 again). This indicator may be a factor for revisions in growth forecasts that could increase for the following year, along with the strength of gross fixed investment and private consumption, remembering that in surveys the average growth is around 2.0% by 2024.

—Brian Pérez

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.