- Chile: The government will issue USD 19.5 bn in sovereign bonds next year

- Colombia: Exports continue to decline in August

- Mexico: Private consumption stagnates in July; imported goods lead the annual advance; Investment soared in July owing to construction

- Peru: Between cut or maintain

CHILE: THE GOVERNMENT WILL ISSUE USD 19.5 BN IN SOVEREIGN BONDS NEXT YEAR

On Tuesday, October 3rd, the Ministry of Finance released the Public Finance Report (IFP) corresponding to Q3-23, which reveals the main fiscal and macroeconomic projections considered for the 2024 Budget Bill.

Next year, public spending will grow 3.5% with respect to this year (2.5% projected for the GDP growth, optimistic compared to market expectations), which is compatible with the fiscal commitment to reduce the structural deficit to 0.5% of GDP in 2026. It will be possible thanks to export revenues (copper and lithium), new resources from the mining royalty and expectations of an increase in copper production in 2024. With this, the government projects an effective fiscal deficit of 1.9% of GDP in 2024. To finance the deficit (around USD 8 bn), among other needs such as bond maturities (around USD 7.5 bn), the Ministry of Finance will issue public debt for USD 19.5 bn in 2024, even though the Budget Bill authorizes a maximum level of USD21 bn. This would raise public debt as a percentage of GDP from 38.2% projected for 2023 to 41.1% expected for 2024.

All of the above is based on an expansion of public spending of 2.2% in 2023, higher than expected in the Q2-23 IFP (0.7%) and which would imply both a fall in total spending of 2% on average during the second half of 2023 and a higher effective fiscal deficit, from 1.9% to 2.3% of GDP. For its part, the Ministry of Finance projects 0% GDP growth in 2023, lower than expected in the last IFP (+0.2%) but optimistic compared to market expectations, the central bank (-0.3%) and our own (-0.5%).

—Aníbal Alarcón

COLOMBIA: EXPORTS CONTINUE TO DECLINE IN AUGUST

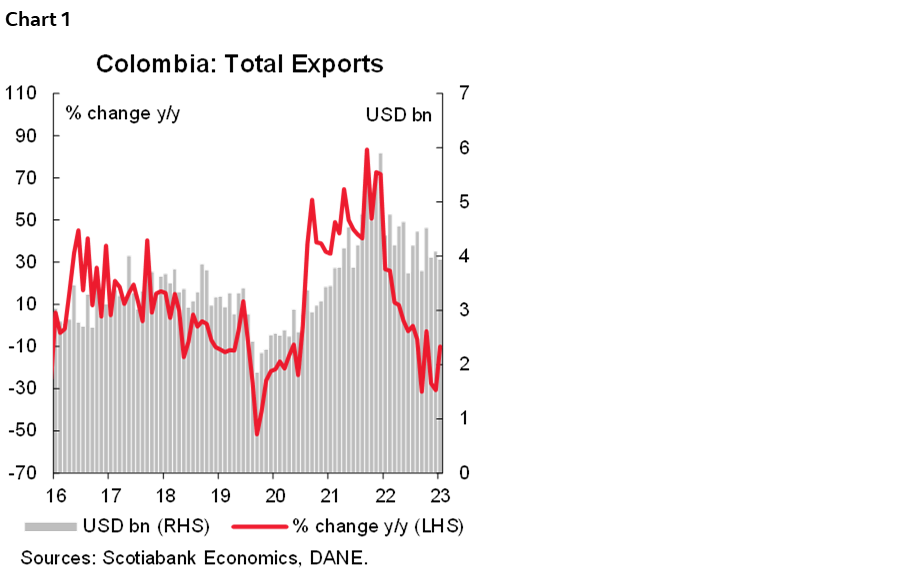

The National Administrative Department of Statistics (DANE) released export data on Tuesday, October 3rd. Monthly exports in August 2023 totaled USD 3.9 billion FOB, down 10.1% year-on-year (YoY) from August 2022. While this represents a smaller decline than the declines in the past two months, the value of exports is still the third lowest of the year, only above January and April’s exports, which did not exceed USD 3.7 billion in each of those months (chart 1).

This result was again due to a YoY decline of 11.5% in exports of the group of fuels and extractive industries, which totaled USD 2.0 billion FOB, primarily due to a fall in coal exports, coke, and briquettes (-31.8% YoY) with a negative contribution of 9.9 pp to the group’s variation. Similarly, exports of agricultural products, food, and beverages showed a decline of 12.5% YoY, totaling USD 764 million FOB (explained by a decline in exports of unroasted coffee of -30.3% YoY and a contribution of -10.8 pp to the group’s variation).

As for exports of the group of manufactures, they totaled USD 889 million FOB and registered a decline of 9.7% YoY (due to lower exports of the sub-group of chemicals and related products, which recorded a contraction of 20.7% YoY and a negative contribution of -8.7 pp). On the other hand, during August 2023, the group “other sectors” registered a growth of 9.6% YoY, explained basically by the increase in sales of non-monetary gold with a contribution of 9.7 pp.

In August 2023, exports of fuels and extractive industries participated with 51.1% of the total FOB value of exports, while the manufacturing share was 22.5%, agricultural products, food, and beverages 19.4%, and other sectors with 7.0%.

Thus, on a YTD basis, total exports were USD 32.7 billion FOB and registered a decline of 15.6% compared to the same period in 2022, driven mainly by the decline in external sales of petroleum, petroleum products, and related products (-25.6% vs January–August 2022), and a contribution of -15.8 pp to the group’s variation. The results of exports up to August maintain the hypothesis of moderation in prices and volumes of export of basic products so far this year compared to 2022, especially in exports related to oil and coal, generating pressure to reduce the trade deficit.

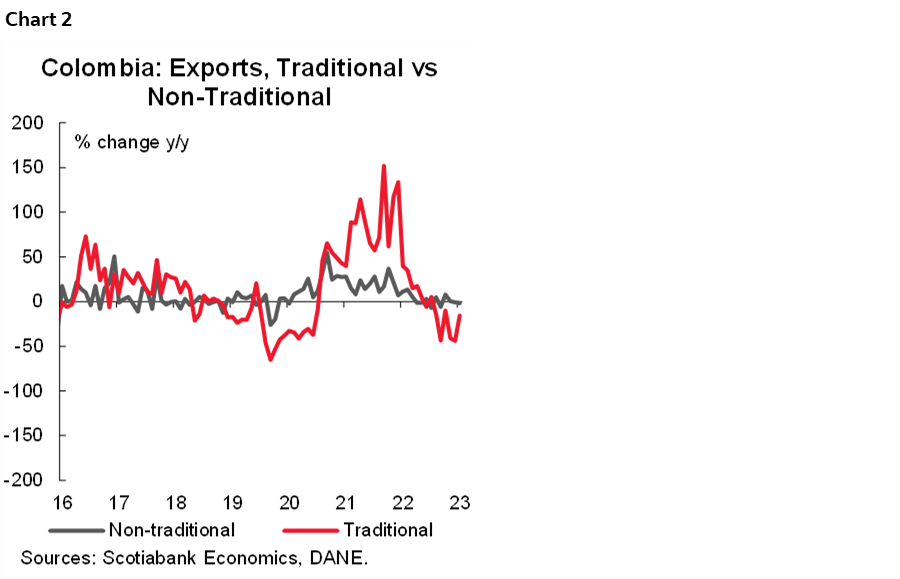

Traditional exports (related to coffee, oil, and mining, chart 2) contracted both in value and volume. YTD, traditional exports totaled USD 18.6 billion FOB, which represents a decrease of -24.6% YoY, due mainly to lower international prices. Only during August, external sales were worth USD 2.2 billion (a decrease of -15.6% YoY vs. August 2022, see chart 2 again).

Among the components of traditional exports, coal exports decreased by 31.8% YoY in August (USD 484 million), followed by coffee exports, which contracted by 30.4% YoY (USD 214 million). Oil and its derivatives decreased by 5% YoY in August ($1.4 billion FOB). In terms of volume, external sales of oil and its derivatives showed an annual growth of 5.6% YoY in August (2.7 million metric tons), followed by coal exports, which grew by 4.2% (3.6 million metric tons). As for coffee exports, they registered an annual decline of 3.3% YoY (45 thousand metric tons).

Finally, ferronickel exports showed the highest growth in volume by 19.7% year-on-year compared to August 2022, reaching 15,000 metric tons. However, in value terms, ferronickel foreign sales reached around USD 65 million, a decrease of 16.9% year-on-year compared to August 2022.

On the other hand, non-traditional exports reached USD 1.7 billion in August 2023, registering a decline of 1.9% compared to the same period in 2022. However, during the period of January–August 2023, non-traditional exports reached USD 14 billion (+0% vs. 2022).

Concluding remarks

Finally, the fear of lower global demand (especially due to slower growth in China) and the reduction in commodity prices compared to the previous year continue to weigh on lower export earnings from traditional exports such as oil, coal, and coffee, placing them at their lowest levels since mid-2021. As a result, the pace of reduction in the current account deficit could lose momentum in the coming months, despite recent import data, which already show a decrease of close to 30% for the month of July.

—Sergio Olarte, Jackeline Piraján & Santiago Moreno

MEXICO: PRIVATE CONSUMPTION STAGNATES IN JULY; IMPORTED GOODS LEAD THE ANNUAL ADVANCE

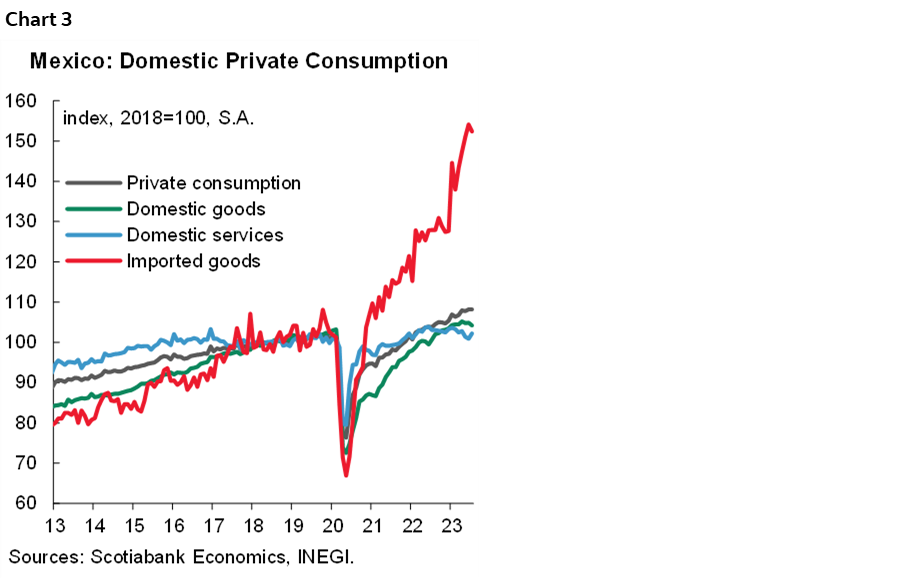

In July, private consumption moderated its pace in real annual terms, from 4.3% to 4.0%. National goods fell -1.0% (-2.8% previously), due to a slower pace of semi-durable and non-durable goods, although durable goods presented a strong increase of 19.6% (14.4% previously), in addition, services moderated to 3.0% (previous 5.5%). Imported goods slowed down 19.4% (22.3% previously) but maintain important positive variations in their three components. In its seasonally adjusted monthly comparison, private consumption stagnated at 0.0% (0.4% previously), derived from the fact that services fell -0.6% and imported goods -1.1%, despite a rebound in domestic goods (1.4%, see chart 3).

The evolution of household spending on consumer goods and services has maintained significant increases for 29 consecutive months, with consumption of imported goods far exceeding the other components, while national goods have shown some weakness in recent months, due to five months of negative annual readings. On the other hand, national services, which experienced a deeper decline during the pandemic, are barely surpassing pre-crisis levels. We expect private consumption to continue showing positive annual variations, as it has done in previous months, because the outlook for economic growth continues to increase, although the indicator is expected to be pressured by the effect of restrictive monetary policy by the end of 2025.

INVESTMENT SOARED IN JULY OWING TO CONSTRUCTION

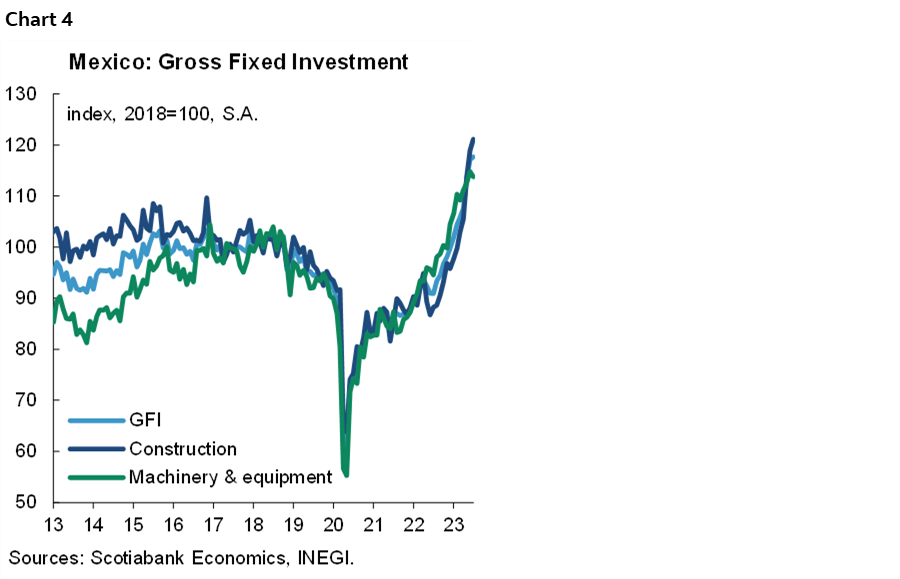

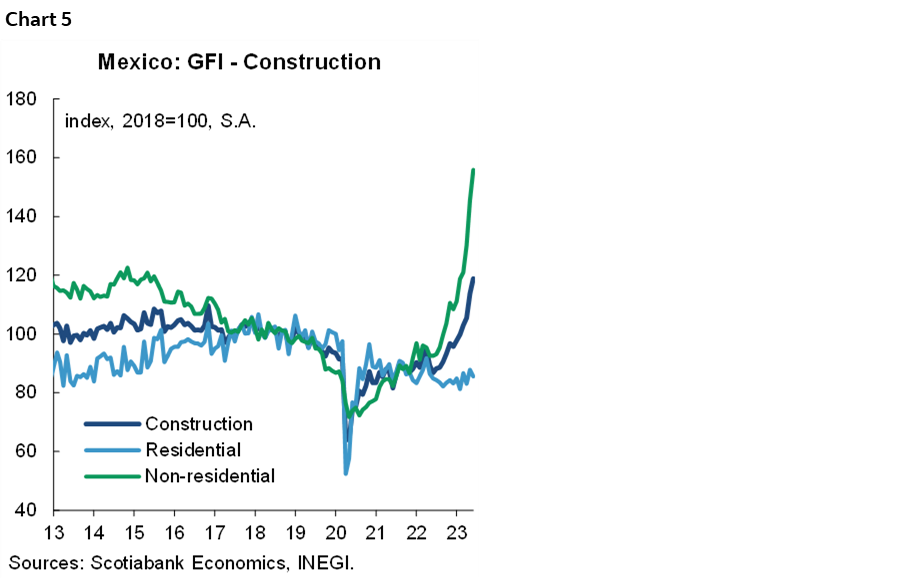

Also in July, gross fixed investment accelerated on an annual basis, from 28.8% y/y to 29.1% y/y. Machinery and equipment moderated 19.8% y/y (20.5% previously); in particular, the imported subcomponent fell to 21.3% y/y (31.1% previously), while the domestic subcomponent rose 17.5% y/y (6.4% previously). Construction soared to 37.4% y/y (37.1% previously), non-residential construction stood at 71.1% (71.5% previously) and residential construction at 3.5% (0.5% previously). In the seasonally adjusted monthly comparison, GFI moderated to 0.5% m/m (3.3% previously), machinery and equipment fell -0.9% m/m (2.0% previously), and construction moderated 1.9% m/m (4.5% previously, chart 4). Despite the year-over-year gains, these strong increases have been supported also by the change in base year to 2018. Additionally, we highlight that investment has already surpassed pre-pandemic levels, and that the upward trend will continue in the following months.

In recent months, the GFI has shown a pronounced upward trend, adding twelve consecutive monthly increases, and twenty-nine months of annual gains. This strong acceleration has been led during the year by soaring construction, especially by non-residential construction. In addition, public construction continues to show greater progress than the private component of the indicator. Thus, we believe that gross fixed investment could hold a vigorous pace during the year, as the flagship public investment projects of the current administration continue, although also supported by the more favourable outlook for nearshoring (chart 5).

—Miguel Saldaña & Brian Pérez

PERU: BETWEEN CUT OR MAINTAIN

The BCRP began its interest rate reduction cycle in September. Yes, it was the beginning, but in its statement, it also highlighted that this did not necessarily imply continuous cuts in interest rates. Based on this, our base scenario contemplates the possibility that the BCRP maintains its reference rate unchanged at 7.50% this Thursday. Added to this are the signs of caution recently expressed by Governor Julio Velarde, regarding the impact on prices due to the proximity of a more intense-than-expected El Niño event, delaying reaching the inflation goal, initially planned by the BCRP for the first months of 2024, for a few more months. In the past, Governor Velarde has indicated that the worst mistake would be to lower the interest rate and then raise it. He has also pointed out that Peru maintains the lowest real rate in the Pacific Alliance and Brazil and that he would be in no rush to lower it. However, these statements have not been conclusive since the cycle of interest rate cuts began in September. Perhaps the weakness of the economy tipped the balance.

The statistical factor also plays in its favour. We foresee stable interannual inflation for October—around 5%—since of the last three months of the year, the one with the least comparison base effect is October. If any month is preferred to pause—and thereby consolidate the signal that it is not a recurring cycle of rate cuts—it would be October. Although inflation in September was close to 0% m/m, the result was explained by the fall in prices of two highly weighted products. Without them, inflation would have been 0.27% m/m. In the past, the BCRP has executed a strategy of staggered cuts (events 2017 and 2019), so it would not attract attention if it used it again.

However, there are also counterarguments that make a new 25bps cut likely, so we would not be surprised to see the key rate at 7.25%, as expected by the market consensus, according to a Bloomberg survey. Inflation came in below expectations in September and reached the 5% we expected for the entire year. Core inflation also continues to slow, and it is very likely that inflation expectations, which are mainly adaptive, will also reflect that direction.

In its September forecast report, the BCRP changed its El Niño scenario from weak to moderate, although the probability of a strong El Niño scenario continues to rise. The uncertainty due to the impacts of El Niño makes us remain cautious, although we have been evaluating the revision of our inflation and interest rate forecast for the 2023–2024 horizon.

—Mario Guerrero

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.