- Mexico: 2024 budget shows sharp increase in planned indebtedness

- Peru: Lowering our GDP growth forecasts on a poorly behaving Niño

Currency strength is the market highlight to start the week, driven by strong gains in the JPY and CNY/H on comments from BoJ chief Ueda talking about rate increase being (eventually, and under certain conditions) an option and the PBoC warning regulators will move against one-sided moves when needed. Reuters also reported that the PBoC will tighten its scrutiny of USD50mn+ dollar purchases.

Global rate curves are bear steepening, with APac debt leading losses, while the risk tone is overall positive—US equity futures are 0.3/4% higher—but with no obvious catalyst outside of FX; the MXN is up 0.4% around the mid-17s. Iron ore and copper are recording strong gains of ~3.5% and ~1.5%, respectively, helped by stronger-than-expected Chinese lending data. On the flip side, crude oil is about 0.5% lower as it battles for further gains versus trading in overbought territory.

The G10 day ahead is quiet with no major data of note and the ECB and Fed in blackout mode ahead of their respective meetings, with the ECB first up on Thursday when the slim majority see a rate hold (us included). We have a collection of key data this week to monitor, too, namely US CPI (see Global Week Ahead).

In Latam, Mexican July industrial/manufacturing production figures at 8ET (IP seen decelerating to 0.3% from 0.6% m/m) are today’s data main event but should mostly come and go for regional markets that have more important releases to look forward to, like Brazilian inflation tomorrow, the BCRP’s decision on Thursday, and Peruvian GDP on Friday (see Latam Weekly)

Today’s highlight will be an expected announcement by former Foreign Affairs Sec and Morena internal candidacy runner-up Marcelo Ebrard on today his plans for next year's presidential election. He may choose to run for the Movimiento Ciudadano party for a three-horse race that will include Sheinbaum (Morena) and Galvez (PRI/PAN/PRD). Most likely, Ebrard running under the MC would actually take more votes away from Galvez than it would from Sheinbaum, thus raising the odds that the presidency stays in the hands of Morena. We’ll also watch the reaction in local debt to the large deficit increase forecast in the 2024 Economic Package (see below).

—Juan Manuel Herrera

MEXICO: 2024 BUDGET SHOWS SHARP INCREASE IN PLANNED INDEBTEDNESS

The Mexican Government submitted its 2024 Economic Package last Friday, which includes the Economic Policy Guidelines (the macro assumptions), the Income Law (the funding of the budget which includes taxes and debt), and the Expenditures Decree (what the money will be spent on). The Income Law and the Economic Policy Guidelines must be approved by a simple majority in both houses in Congress, while the Expenditures Decree must only be approved by the lower house (also simple majority).

Given Morena’s strong position in the legislature, we don’t anticipate any problems in the approval process, unless we see a split of the party—which some commentators have speculated could happen, after the reported anger of some of those who participated in the recent internal selection process for the party’s standard bearer for the 2024 Presidential election. It’s worth noting that former Foreign Affairs Secretary Marcelo Ebrard said he would announce his plans for the 2024 election on September 11th (today). This should provide some clarity over how turbulent—or not—the process will be.

The budget is largely in line with private sector consensus in most macro assumptions, but there is a sharp increase in the deficit / indebtedness metrics, which could test local markets. In particular, the planned budgetary deficit increases from 3.3% of GDP in 2023, to 4.9% of GDP in 2024, to subsequently decline to 2.1% – 2.2% of GDP in the coming 5 years. The broader definition of the public deficit, the Public Sector Borrowing Requirements (PSBR) increases from 3.9% of GDP to 5.4% of GDP in 2024.

Not helping how this change in the fiscal stance is received by markets is the fact that 2024 is an election year, and this could be seen as consistent with the traditional political cycle / fiscal discipline slippage views. It could also be problematic for monetary policy, which is already struggling with sticky inflation and tight labour markets, and hence it could lead to markets pushing back the anticipated start of Banxico’s easing cycle. LATAM watchers will be wary of the slippage on the fiscal front and potential contamination of monetary policy, especially given struggles on this front in Brazil (where fiscal risks delayed the start of the BCB’s cutting cycle).

The rest of the key 2024 assumptions are largely in line with consensus:

- 2024 GDP growth is anticipated at 2.5 – 3.5% of GDP, significantly above our forecast of 1.8% and the Banxico survey average of 1.7%.

- End-of-year inflation is expected at 3.8%, which we see as slightly optimistic.

- USD/MXN is seen at 17.60, which we see as slightly on the stronger side for the peso.

- End of year 28-day cetes are expected to be at 9.5%, which is not terribly out of line with market expectations.

We would argue this is the least prudent budget the government has produced so far in the past 6 years, primarily due to the large increase in the planned deficits.

—Eduardo Suárez

PERU: LOWERING OUR GDP GROWTH FORECASTS ON A POORLY BEHAVING NIÑO

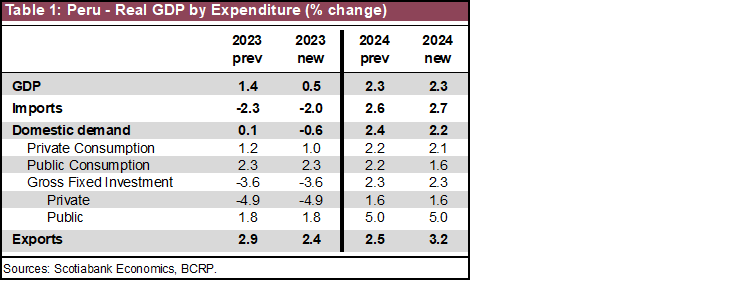

We are lowering our GDP growth forecasts for 2023 to 0.5% from 1.4% (table 1). This takes into account the evolution of economic activity in 1H23, and the increased impact of a more intense El Niño. Our new forecast includes a lower increase in exports due to the fall in fishing production as well as slower private consumption growth, considering its virtual stagnation in 1H23 and the slowdown in job creation.

Additionally, domestic demand has had a worse-than-expected evolution during the first half of the year (1H23), affected by the social protests at the beginning of the year and, more recently, by the fall in private investment—which has had an impact on a slowdown in the employment—and the increase in inflation—which has reduced the purchasing power of the population.

For 2024 we maintain our growth forecast at 2.3%. Although the lower growth projected for 2023 should favour a rebound in GDP in 2024, we prefer to be cautious, because the effects of El Niño on fisheries and agriculture are likely to continue even during 1H24. Furthermore, the strong growth of mining—which would contribute around 0.7 p.p. to the GDP of 2023—thanks to Quellaveco—will no longer be present in 2024.

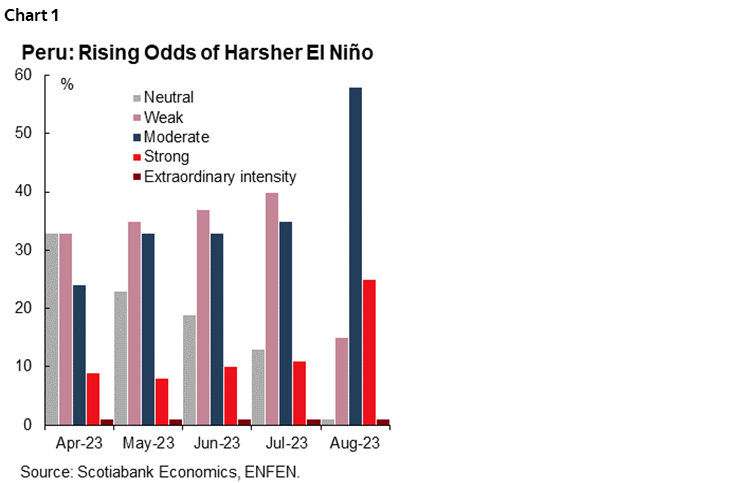

El Niño is occurring in two stages during 2023–2024. The current presence of El Niño, which has been recorded since March 2023, has had a greater-than-expected impact on economic activity, especially in fishing and agriculture. In fact, it caused the first anchovy fishing season to be suspended, which usually takes place between May and July, and a significant drop in agricultural production was recorded during 2Q23, which is seasonally the period of greatest harvests.

At the end of August, ENFEN, a public institution that monitors the evolution of El Niño, reported that the probabilities have increased that the second-round of El Niño, which will extend until the first quarter of 2024 (1Q24), will have a greater intensity than initially expected. Indeed, until July there was a 75% probability of a “weak” to “moderate” El Niño in the sea off the Peruvian coast. However, there is currently an 83% chance of a “moderate” to “strong” El Niño in that period (see chart 1).

—Pablo Nano

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.