- Colombia: Economic activity in July comes in slightly below our forecast

Another Asia session, again rangebound trading, with little on tap today in ex-Latam aside from Canadian CPI and US housing starts/building permits (8.30ET) while markets count down the hours to the Fed’s decision tomorrow. Treasurys held to a narrow range overnight before yield moves picked up a bit ahead of European hours, slightly cheapening, with limited spillovers in other markets. The USD began to lose ground around 2.30ET with its weakness particularly favouring high-beta FX (NOK +0.4%, CAD/MXN +0.2/3%).

US equity futures are up marginally, copper and iron ore are down bad (-1% and -1.5%), but the latter is still in solid footing around its best levels since late-March/early-April. Brent reached another new high in the cycle this morning, breaching the $95/bbl level and tracking a ~0.6% gain today to trade overbought through most of September (its longest stretch here since early-2021).

In Latam, Chilean markets are again closed for the holidays and elsewhere we have Brazilian economic activity figures for July at 8ET and Colombian imports and international trade data at 11ET.

Brazil’s data are seen showing a muted economic expansion of 1% y/y by the Bloomberg median—in a wide –0.3% to 2.6% band of estimates. Industry/sector level data released over the past few weeks showed a decline in industrial output (-1.1% y/y), strong services volumes growth (+3.5% y/y), and a decent gain in retail sales (+2.4% y/y). The print likely won’t have much influence on the BCB’s decision tomorrow where anything but a 50bps cut with mostly unchanged guidance would be a surprise.

—Juan Manuel Herrera

COLOMBIA: ECONOMIC ACTIVITY IN JULY COMES IN SLIGHTLY BELOW OUR FORECAST

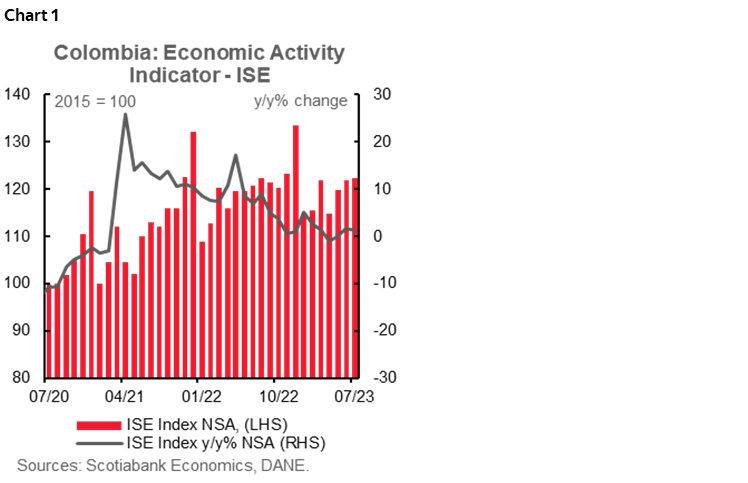

On Monday, the National Statistics Institute (DANE) published the latest data on the economic activity indicator (ISE) for July 2023. The indicator showed an expansion of 1.2% y/y (chart 1), slightly above the expectations of analysts surveyed by Bloomberg and slightly below our projections (1.1% y/y and 1.3% y/y, respectively), showing a further moderation compared to the 1.7% y/y of the previous month. In seasonally adjusted terms, the monthly decline was -0.7% m/m.

In terms of year-on-year growth, the increase in July continued to be driven by primary and tertiary (services) activities, which recorded positive annual variations of 2.2% and 2.3%, respectively. Within tertiary activities, public administration, health services and arts and entertainment expanded on a year-on-year basis. In contrast to the growth of these two sectors, secondary activities (manufacturing and construction) continued to decline, reaching -5.2% y/y in July. In seasonally adjusted terms, all three sectors contracted, with the tertiary sector showing the smallest decline at -0.3% m/m, while the primary and secondary sectors recorded monthly decreases of -1.0% m/m and -1.8% m/m, respectively.

Therefore, given the recent economic results, combined with the latest inflation data and an increase in inflation expectations, we believe that the BanRep board will keep interest rates unchanged at the September 29 meeting and will only start the cycle of cuts in December.

Key Highlights include:

- Primary activities (agriculture and mining) recorded an annual growth of 2.2% y/y in July (chart 2), while in seasonally adjusted terms, they contracted by 1.0% m/m. In the agricultural sector, producer price moderation, partly due to fertilizer price moderation, continued to alleviate food production, due to exchange rate appreciation. On the mining side, oil and coal production is also contributing to better sector performance.

- Secondary activities (manufacturing and construction) showed a contraction of 5.2% y/y in July 2023, and in seasonally adjusted terms, experienced a moderation of 1.8% m/m. According to data published by DANE on Friday, July 15th, manufacturing contracted for the fifth consecutive month in July (-7.2% y/y), indicating that this fall, along with lower construction sector performance, led to this slowdown in secondary activities. However, on the industries related to vehicle body manufacturing and trailer manufacturing along with coking, oil refining, and fuel blending the data showed positive variations in July.

- As for tertiary activities (which include trade and service-related activities), they recorded a growth of 2.3%y/y in July. Growth was driven by the public administration sector, education, and entertainment sector (+8.9% y/y), followed by financial and insurance activities (+3.3% y/y), and real estate activities (+1.9% y/y). In seasonally adjusted terms, there was a decrease of 0.3% m/m, with the commerce, transport, and hotel component having the highest growth with +1.5% m/m, the best growth recorded so far in 2023 for this subsector.

Final Remarks:

The activity data for the first month of the second half of 2023, was slightly below the market consensus (+1.4% year-on-year) and our forecast of +1.3% y/y. While today’s data is weaker than we expected, the slight rebound presented in the commerce, transport, and hotel subsectors hints at slight signs of recovery, which we expect to continue gradually in the second half of 2023.

However, we believe that this result will not significantly affect market expectations regarding monetary policy decisions at the end of this month, given that the most recent inflation data have skewed the probability towards a later start of the central bank’s easing cycle. At Scotiabank Colpatria, the official call is for a rate cut to begin in December due to the slower pace of inflation deceleration.

—Sergio Olarte, Jackeline Piraján & Santiago Moreno

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.