- Chile: BCCh cuts benchmark rate by 75 bps to 9.50%

- Colombia: Exports fell again in July

Risk-off sentiment continued into the overnight session but with a more mixed feeling to it amid no major catalysts for market action. The Asia and European data runs were mixed as Australian GDP beat slightly with positive revisions in contrast to a steep drop in German factory orders followed by very weak Eurozone construction PMIs. The G10 day ahead has the BoC’s decision (no change expected) and US ISM services data as the highlights.

US equity futures are 0.2/3% lower, while oil down 0.7/8% is fading a good share of yesterday’s jump on Saudi/Russian production/export cuts; Brent is now ‘only’ up 75c versus pre-announcement and sub USD90/bbl, after rising to as high as $91/bbl+ yesterday. Iron ore up ~1% stands in contrast to a 1% drop in copper.

The USD is mixed in +/-0.2% ranges against most majors with the main exception being the MXN that is down 0.7% to the mid-17s (USDMXN reached as high as 17.67 overnight) as negative pressure from Banxico’s hedging program reduction builds a near 3% drop in the currency in the month-to-date. Broad dollar strength and higher US yields are also a clear headwind.

The CLP, which as of yesterday was tracking a 2.5% drop in September, will likely open stronger this morning after yesterday’s unanimous 75bps cut by the BCCh that also raised the bar for the BCCh to repeat with a 100bps cut this year (see below). Today, at 8ET, the BCCh will publish its latest forecasts and outlook in the IPoM (Monetary Policy Report) which may provide some insights on the rates outlook, though most signs point to a year-end rate of 8% (75bps cuts at each the remaining two meetings).

Mexico’s ruling party Morena will tally today the results of polls carried out to determine who will represent them in next year’s presidential elections. According to the head of the party, Mario Delgado, they will meet with the candidates at 18ET to present the results in private before announcing these to the public at 19ET. The counting of votes will begin at 15ET, so we may get ‘leaks’ on who won the joust ahead of the official announcement.

Mexican paper El Financiero published yesterday the results to an early-September survey that showed former Mexico City mayor Sheinbaum with 40% support versus 28% for former foreign affairs secretary Ebrard. This heavily suggests that Sheinbaum won in the private polls organized by Morena, and will lead the incumbent’s candidacy next year with her main opposition being Xochitl Galvez, the PRI/PAN/PRD coalition representative.

In other news, also reported by EF, Pres AMLO has cancelled renovation work planned for Mexico City’s main international airport since he reportedly did not want to leave unfinished work before the end of his term. Just a few hours after this report (seemingly unrelatedly, though timely), Fitch revised its outlook for the airport’s trust from negative to stable, with its BBB– rating affirmed, due to maintenance gaps and a faster “deterioration of the facilities” as well as the latest decision by the government to reduce flights at the airport.

—Juan Manuel Herrera

CHILE: BCCH CUTS BENCHMARK RATE BY 75BPS TO 9.50%

- BCCh would target a benchmark rate of 8% in December, among the five highest real policy rates in the world

On Tuesday, September 5th, the central bank (BCCh) cut its benchmark rate by 75bps, in line with our expectation, surveys, and market rates. According to the statement, the domestic scenario shows slight improvements in confidence indicators and private investment in its machinery and equipment component but recognizes that activity has not yet recovered dynamism.

In fact, GDP showed a relevant transitory positive impact in July that should not be extrapolated to the medium term. As we pointed out in Scotiabank Economics, and what the BCCh agrees with is the influence of transitory factors of personal services and electricity generation as the main reasons for the acceleration of economic activity in July. For now, we see few GDP tailwinds for the rest of the year in a challenging external context, real contraction of public spending, and a monetary policy rate at twice its neutral level.

Exchange rate concerns and/or supply shocks due to weather events? We believe that the BCCh incorporates these elements in the IPoM scenario, but they are not major concerns for monetary policy to the extent that their impacts are transitory. In particular for the exchange rate, the recent real and nominal depreciation of the CLP is framed in a more complex external scenario and places the real effective exchange rate at values consistent with its long-term equilibrium. It is not possible for now to point to a misalignment due to idiosyncratic causes that condition monetary policy.

It is worth remembering that Chile’s real reference rate is among the highest in the world, so continuing to cut the policy rate is the base scenario. The BCCh’s target real reference rate for December would continue to be between 3.6–3.8%, which would keep Chile among the five economies with the highest real (inflation-adjusted) rate in the world, only surpassed by Brazil, Mexico, Russia and Ukraine. At Scotiabank, we expect another 75bps cut at the next two meetings of the year, leaving the monetary policy rate at 8% in December. Only the materialization of risk scenarios could lead to acceleration of the process of cuts again.

—Aníbal Alarcón

COLOMBIA: EXPORTS FELL AGAIN IN JULY

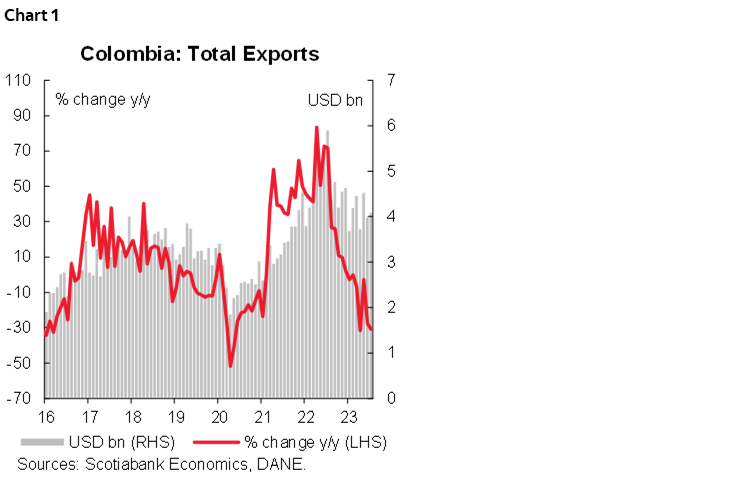

The National Statistics Administration (DANE) published exports data on Tuesday, September 5th. Monthly exports in July 2023 amounted to USD 4.1 billion FOB and decreased by 30.8% Y/y compared to July 2022, making this month, along with exports in April 2023 (-31.5% Y/y), the strongest decline since May 2020 (chart 1).

The decline in July was again due to a 43.3% Y/y drop in exports of the group of fuels and products of extractive industries, which amounted to USD 2.1 billion FOB, mainly due to a drop in sales of coal, coke, and briquettes. Similarly, exports of agricultural products, food, and beverages showed an annual decline of 13.2% Y/y, amounting to USD 832.6 million FOB (explained by a decrease in exports of unroasted coffee). As for the exports of the group of manufacturers, they amounted to USD 821.0 million FOB and registered a decrease of 10.6% Y/y, compared to June 2022 (due to lower exports of the subgroup of external sales of chemical products and related products). On the other hand, during July 2023, the group “other sectors” registered a growth of 6.9% Y/y, basically explained by the increase in sales of non-monetary gold.

In July 2023, exports of fuels and products of extractive industries accounted for 51.7% of the total FOB value of exports, as well as manufactured goods with 20.0%, agricultural products, food and beverages with 20.3%, and other sectors with 7.9%.

Thus, between January–July 2023, exports amounted to US$28.7 billion FOB and registered a decrease of 16.4% compared to the same period in 2022.

The results of exports in July keep alive the hypothesis of moderation in prices and volumes of export of basic products so far this year compared to 2022, especially in exports related to oil and coal, generating pressure to reduce the trade deficit.

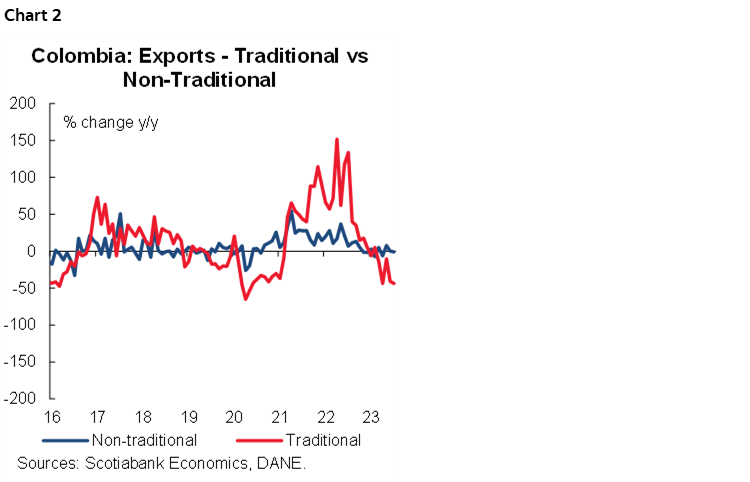

Traditional exports (related to coffee, oil, and mining—chart 2) contracted both in value and volume. In July, exports amounted to USD 2.3 billion FOB, representing a decline of -43.9% Y/y, mainly due to lower international prices. Likewise, the volume showed a decline of 20.9% compared to July 2022 (7.8 million tons).

Among the components of traditional exports, external sales of coal decreased by 62.5% Y/y in July ($679 million), while oil and its derivatives decreased by 26.2% Y/y in July ($1.4 billion FOB), followed by coffee. Coffee exports declined by 43.0% Y/y (USD 216 million FOB). In terms of volume, external sales of oil and its derivatives showed an annual growth of 3.8% Y/y in July (2.8 million tons), while coal and coffee exports registered negative annual variations of -30.2% Y/y (5.0 million tons) and -25.8% Y/y (44 thousand tons), respectively.

Lastly, ferronickel exports showed the highest growth in volume by 50.4% Y/y compared to July 2022, amounting to 14 thousand metric tons. However, in terms of value, foreign sales of ferronickel reached about $53 million, a decrease of 35.2% Y/y vs. July 2022.

On the other hand, non-traditional exports in July registered an annual growth of 2.8% Y/y in volume (+755 metric tons) but showed a slight decline of -0.8% Y/y in value, reaching USD 1.8 million FOB.

Closing remarks

Finally, given the transition year of the Colombian economy and the weakness of imports, especially capital goods and raw materials, the export outlook is expected to continue to face difficulties in the coming months, as evidenced by the results of the first month of the second half of 2023.

The fear of lower global demand (especially due to slower growth in China) and the reduction in commodity prices compared to the previous year continue to be alarms that generate lower income from traditional exports such as oil, coal, and coffee. As a result, the pace of reduction in the current account deficit may lose momentum in the coming months, despite the latest import data, which already show a decline of more than 20% for the month of June.

—Sergio Olarte, Jackeline Piraján & Santiago Moreno

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.