- Chile: February GDP of 4.5% (0.8% m/m) supports upward revision to 2024 GDP growth forecast to 2–3% range

- Peru: Inflation remains high in March, BCRP evaluates new pause; Presidential impeachment motion submitted in Congress; Metals mining output soars in February

European markets reopened to a steep US rates selloff on Monday, ahead of a packed data and events week. Following a relatively benign Easter Monday open to cautious Powell comments and mixed PCE data on Friday, thin trading combined with large IG issuance yesterday to slam USTs, with a strong ISM manufacturing print adding fuel to the fire. US JOLTS figures, factory/durable goods orders, and the Fed’s Borman, Williams, Mester, and Daly await as today’s G10 highlights.

The UST curve is mostly holding to yesterday’s closing levels, slightly twist steepening this morning with small moves of 1/2bps declines in the front-end and a 0/1bp rise in long-end yields. EGBs opened weaker but rallied strongly in the front-end after regional German CPI data (ahead of national print at 8ET). US equity futures are a touch softer.

The USD is mixed after a massive rally yesterday, with the MXN among the gainers, up 0.2% after US yield-led declines on Monday. Crude oil is driving 1%+ higher on Middle East risks and drone strikes in Russia. Also helping prices higher is a report that Pemex has decided to suspend some Maya crude exports over the next few months to US, Europe, and Asia refiners. Pemex is reportedly aiming to produce more fuels at home ahead of the June elections.

Today’s Latam morning is quiet outside of Banxico’s economists’ survey results out at 11ET and a couple of Mexican auctions, with a long wait until the 17ET BCCh rate decision where we, the Bloomberg median, and local markets expect a 75bps cut to 6.50% (see below). We’re also keeping an eye on political developments in Peru as Pres Boluarte faced six minister resignations yesterday—with their replacements already announced overnight and due to face confirmation votes tomorrow.

Regarding today’s BCCh decision, from our economists in the Latam Daily (see here): “We anticipate a 75bps cut at the next meeting, which would bring the reference rate to 6.50%. This does not leave the door closed to further cuts in the following meetings or to the convergence of the rate to its neutral level by mid-year. However, we see the BCCh justifying a somewhat smaller withdrawal of near-term monetary tightening in light of the positive GDP growth data we anticipate for February, which will lead to an upward adjustment of the GDP growth projection for 2024 in the next IPoM, along with two consecutive upside surprises in inflation.”

—Juan Manuel Herrera

CHILE: FEBRUARY GDP OF 4.5% (0.8% M/M) SUPPORTS UPWARD REVISION TO 2024 GDP GROWTH FORECAST TO 2–3% RANGE

- Room for 50–75bps cuts to the policy rate at subsequent meetings

With no differences with respect to our early projection, the February GDP of 4.5% y/y (0.8% m/m) is well above analysts’ and consensus projections. The consequences of this reading are not minor, among them, an expected upward adjustment in GDP 2024 growth expectations, a somewhat more cautious view regarding the process of reference rate cuts and, also, some impact on the government’s negotiation strength for structural reforms in Congress.

The print was a generalized surprise for market expectations which, at the beginning of the month, anticipated a GDP of 1.5% y/y (Economists Survey) and of 3.3% after INE’s sectorial indicators. However, the figure was in line with our early estimate.

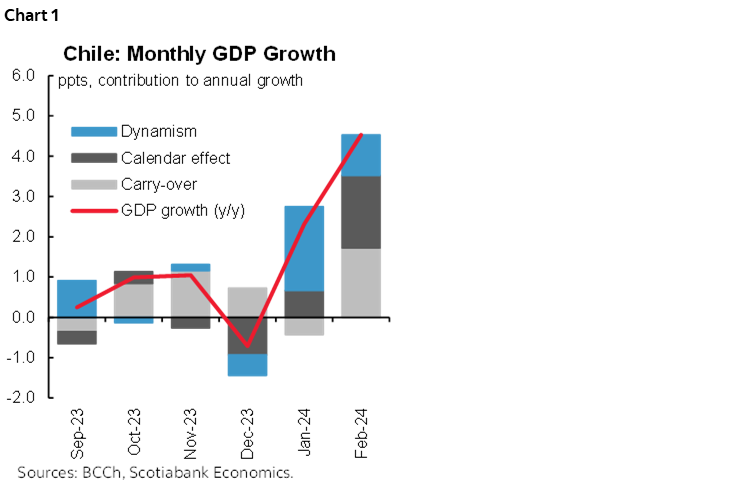

Was it a genuine recovery of economic activity? Yes. February’s GDP shows elements that go beyond the positive effects of the leap year (calendar effect) and the good starting point provided by January’s GDP (carry-over), since additionally the economy grew 0.8% with respect to the previous month thanks to services and industry (chart 1). Finally, investment seems to be regaining dynamism driven, in no small part, by the growth of public investment, which expanded significantly in February according to Ministry of Finance figures revealed last week (86.3% real y/y).

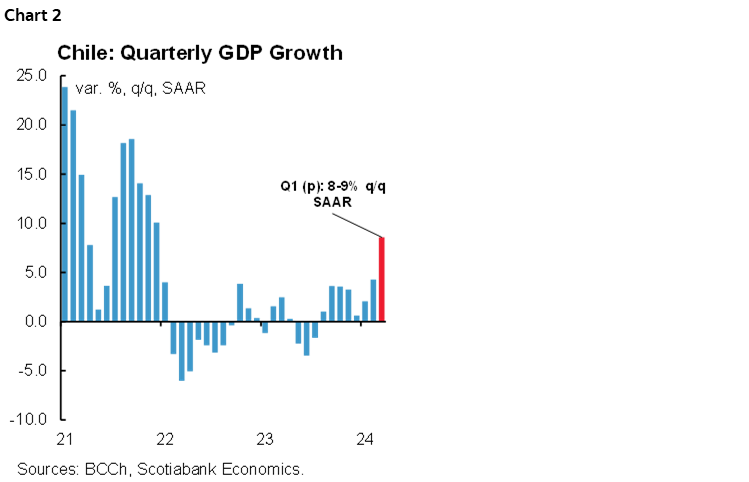

Will it have a positive effect on local asset prices? Quarterly GDP growth for March would be between 8% and 9% (annual rate, seasonally adjusted, chart 2), more than tripling (after a long time) what was expected for the US in the same period. These figures will be read positively by external investors, which could have an impact on monetary tightening expectations and, particularly, on the exchange rate. We could then see a reversal of the penalty evidenced on the peso in recent weeks, as GDP growth projections below 2% for this year become obsolete. At Scotiabank, we ratify our projection of 3% GDP growth for 2024, which we expect to be partially shared in the IPoM to be published by the Central Bank (BCCh).

Do these activity figures imply that monetary policy should take a pause? No, but it does give greater degrees of freedom to the BCCh. There seems to be a misreading that this surprise in activity means a halt in the normalization process of monetary policy. However, this ignores the current inflationary level of around 3.6% and the still contractionary nature of monetary policy. Moreover, although the activity figures show an economy with a smaller output gap, the implications for inflation are not direct, since at the margin this recovery is driven by a rebound in investment and a stabilization of consumption. This, added to the adequate level of inventories in commerce should give the BCCh peace of mind to continue with the process of cutting the reference rate since we are still at a highly contractionary level of real reference rate, even in international comparison. This keeps us expecting a 75bps cut in the April meeting and similar (or somewhat lower) cuts in subsequent meetings. Certainly 100bps cuts have fallen off the radar, while 50bps to 75bps cuts are still very much in the cards for subsequent meetings.

The economy grew in a synchronized manner at the beginning of this year, driven by mining investment and the return of public investment. For the second consecutive month, the GDP expanded with respect to the previous month, this time in all sectors for which we have visibility. The return of mining investment after the approval of the royalty in the middle of last year seems to be permeating the sector’s activity, and its positive effects are beginning to be seen in sectors highly leveraged to mining, such as services, industry and even construction. Likewise, the return of public investment (especially in public works) would be providing a floor to the growth of total investment this year.

What do we expect for March? March’s GDP could be the worst of the year, heavily impacted by a negative calendar effect due to three fewer working days, an effect that would be reversed during April. However, the month has a positive carry-over that would allow us to avoid a negative growth figure for the month (we preliminarily project GDP between 0% and 1.5% y/y for March).

—Aníbal Alarcón

PERU: INFLATION REMAINS HIGH IN MARCH, BCRP EVALUATES NEW PAUSE

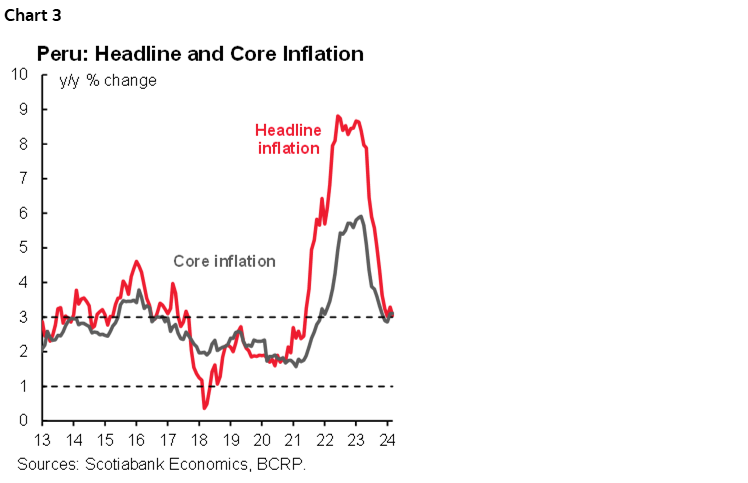

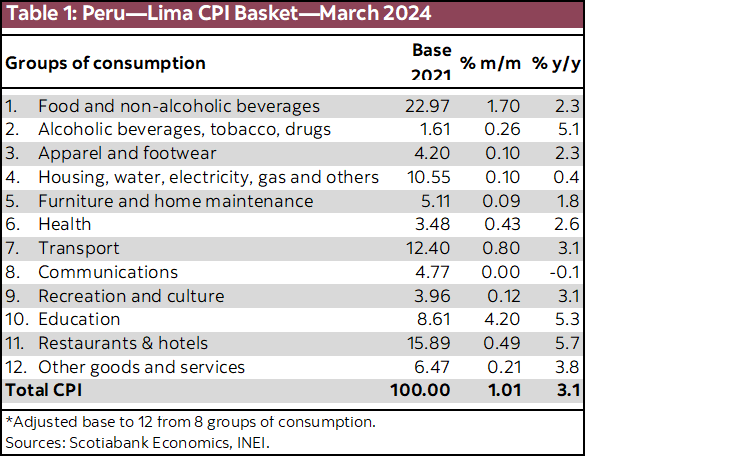

Lima’s CPI rose +1.01% m/m in March, above what was expected by market consensus (+0.76% according to a Bloomberg survey) and the historical average of the last twenty years (+0.75%). At Scotiabank, the figure was very close to our expectations (+1.12%). With this, interannual inflation declined from 3.3% to 3.0% (chart 3). As of March, there are thirty four months in which inflation remains above the upper limit of 3% of the inflation target (table 1).

In March, the main price increases were linked to the seasonal increase in prices in the education sector—that react in a indexed way to 2023 inflation—and the impact of avian flu on poultry prices. Together, both factors explained 52% of March’s inflation. The prices of foods sensitive to El Niño, such as fruits and vegetables, registered a low variation (1.5%), contributing only 0.1 p.p. to this month’s inflation, reflecting that El Niño is dissipating.

Core inflation increased by 0.88%, like that of March 2023 and higher than the historical average (+0.68% in the last twenty years), so in year-on-year terms it remained at 3.1%, exceeding the target range (between 1% and 3%) for the second consecutive month. Inflationary pressures on costs remained low. The PEN appreciated 3% in March, after unusual volatility at the beginning of the year, accumulating an appreciation of 1.8% during the last twelve months. During 2024 Q1, the PEN was the fifth strongest emerging currency, with a depreciation of only 0.5%, below the average of emerging currencies (0.9%). Inflation at the national level (not only in Lima) went from 2.9% to 2.7%, placing it within the inflation target range for the third month.

Looking ahead, we see it likely that inflation will return to the target range starting in April, when it will fall to a range between 2.7% y/y and 2.8% y/y, partly due to a comparison base effect, since April 2023 inflation was relatively high (0.56% m/m vs 0.22% m/m historical average). Cost pressures have remained low so far, but we see an upward trend in the international oil price and unusual currency volatility. Risks on food prices should decrease, after El Niño is already visibly in decline, as well as the impact of bird flu.

Our inflation forecast of 2.4% for 2024 is under review, since the performance of inflation during 2024 Q1 reflects that the return to the target range has been taking longer than initially expected. Higher than expected inflation will give a sense of caution to the central bank’s decisions and could support new pauses in the pace of interest rate cuts in the future. The inflation results for March, both headline and core, are in line with this vision, which is why we consider a new pause at the meeting on Thursday, April 11th is likely. The BCRP reviewed monetary conditions in its March report, reflecting moderate flexibility, but also caution, so we see 50bps cuts unlikely in the future. For now, we see no rush to change its policy, permeated today by a sense of caution.

—Mario Guerrero

PRESIDENTIAL IMPEACHMENT MOTION SUBMITTED IN CONGRESS

Perú Libre submitted a motion to impeach (sp. “vacancia”) President Dina Boluarte in Congress. The motion invokes “moral incapacity” as the reason for the impeachment, but this is simply to comply with the Constitution. The issue that actually triggered the motion is the “scandal” that opposition political leaders and the press are vociferating about to exhaustion concerning a Rolex watch that President Boluarte was photographed using, and which would purportedly be indicative of enrichment through corruption, even though, outside of her jewelry, there is little to hang a charge of corruption on. The true motivation for Perú Libre’s motion likely lies in the political antipathy it’s members feel towards the person who replaced former President Pedro Castillo, after his failed coup in December 2022. Castillo won the presidency on the Perú Libre ticket.

Perú Libre has attempted, and failed, to impeach President Boluarte in the past. This time the chances of the impeachment motion being successful is somewhat higher due to the Rolex scandal, which has weakened the already fragile Boluarte government even more. The Rolex caper has triggered to such high profile events as the Attorney General’s office opening an investigation on President Boluarte, and the police, with a search warrant in hand, breaking down the door to President Boluarte’s house to conduct their search for evidence (of what, nobody is quite sure).

It is true that the likely reason that impeachment attempts failed in the past subsist, namely that congressional elections would also need to be called, which is something most members of Congress oppose. However, the decibels of the noise surrounding President Boluarte’s troubles are strident enough to conceivably sway enough votes for an impeachment to at least be debated in Congress, if not approved.

The impeachment motion obtained the twenty six signatures it needs to be submitted for consideration. The motion will require fifty two votes to be put on the Congressional agenda for debate. This number of votes is a tall order, but doable. The date for this vote could be as soon as this Wednesday. Once the debate takes place, two more weeks from now, an eventual approval of the impeachment would require eighty seven votes, out of one hundred and thirty total. Given past votes, it seems difficult to obtain this magnitude of votes, but it is not impossible. A lot will hinge on how the investigation into President Boluarte’s finances evolve in the meantime, and to how much attention the press pays to the issue.

This is the backdrop for the upcoming presentation that the new cabinet, headed by Gustavo Adrianzén, must prepare to address before Congress on Wednesday, April 3rd. How the Adrianzén cabinet is dealt with will be telling in terms of how the government is currently viewed by the members of Congress. In principle, one would think that the cabinet should receive the vote of confidence that it is seeking, as Congress holds no grudges against Adrianzén as such. However, a number of members of Congress are not happy about some of the cabinet members, in particular the Minister of the Interior Victor Torres, who resigned on April 1st in order to remove himself as an issue of contention.

—Guillermo Arbe

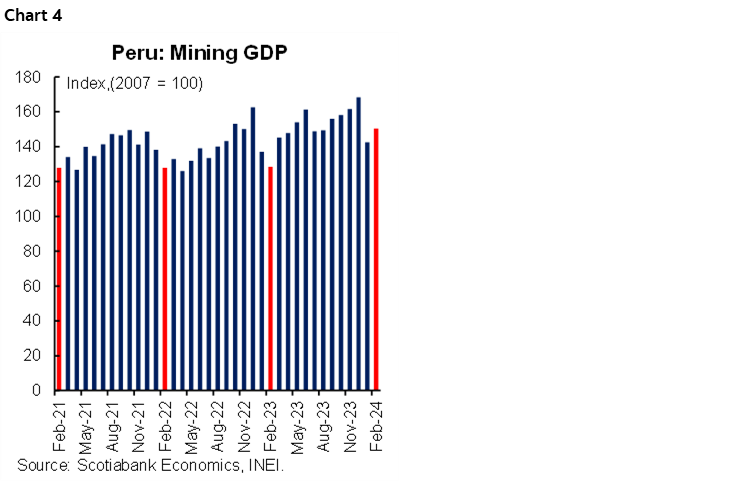

METALS MINING OUTPUT SOARS IN FEBRUARY

Metals mining GDP rose 17.1% YoY, in February (chart 4). We were expecting a hefty increase in February, mainly due to a low YoY base, and also, to a lesser extent, due to an extra day this leap-year February. However, the increase was greater than expected, which may simply reflect that weather (seasonal rains) did not interfere with mining operations as much this year compared to previous years.

Looking at the results by metal, some of the figures were a bit surprising. Molybdenum soared 59% and gold rose 29%. We need to see the breakdown by company to get a better sense of what was driving growth. This breakdown will be released in the final week of April. Meanwhile, copper output was up nearly 14%.

Oil and Gas GDP rose a robust 8.9%, led by oil, up 29%, perhaps linked to the newly refurbished Talara oil refinery which came on stream in late 2023.

These mining and oil growth figures suggest that aggregate GDP could grow over 2.0% YoY in February.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.