- Colombia: BanRep Survey—Economist consensus lowers inflation expectations, and foresees a larger rate cut in September

It’s a very quiet Monday devoid of major data or news while we wait for a busier second half of the week punctuated with global PMIs and the Jackson Hole symposium. Markets are trading with a neutral mood as Asia FX post strong gains (JPY up 1%, CNH up 0.3%) while other majors grind marginally higher—except for the MXN, losing 0.2%. US equity futures are only a touch lower, as European indices trade mixed and so do commodities with oil about 1% lower (though with no real movement in ceasefire talks) and iron ore surging ~3% despite a weak demand backdrop and gluts while copper follows with a decent 1% rise.

After opening weaker in Asia by a couple of bps in the front-end, USTs have been steadily bid to show a small bull flattening, while EGBs and gilts are more evenly bid 2/3bps across the curve to align with post-London gains in rates on Friday that unwound the selloff on the US U Michigan beat. The Fed’s Daly, in an FT interview on Sunday, said that the economy is “not in an urgent place”, pouring more cold water on thinning expectations of a 50bps cut in September; her comments broadly point to two or three 25bps cuts this year.

The Latam day ahead has only the release of Chilean Q2 GDP at 8.30ET on tap with the BCCh’s September 3 meeting rising on the horizon. The median economist is expecting a 0.6% q/q contraction in output, but with the decline following a strong 1.9% q/q rise in Q1 that owed greatly to a 6.9% increase in mining output. Monthly economic activity figures show a ~1% drop in mining but also weakness in manufacturing, commercial activity, and services. Overall, recent data and the BCCh’s July meeting minutes point to the bank resuming rate cuts at its September decision after a somewhat unexpected rate hold in July; figures in coming months will determine which meetings the BCCh decides to skip.

—Juan Manuel Herrera

COLOMBIA: BANREP SURVEY—ECONOMIST CONSENSUS LOWERS INFLATION EXPECTATIONS AND FORESEES A LARGER RATE CUT IN SEPTEMBER

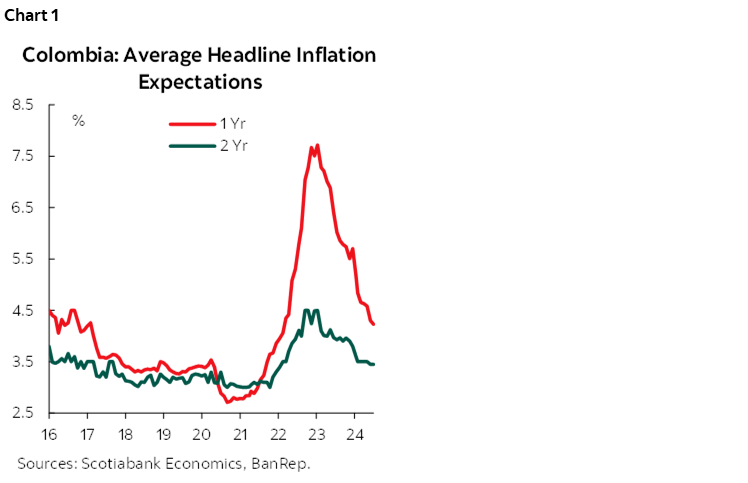

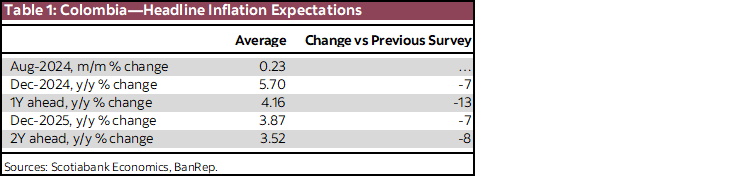

The central bank (BanRep) released results to its survey of economists for August (chart 1). Inflation expectations decreased, which is good news for the central bank and vanishes fears about lack of credibility on the monetary policy front. For December 2024 and December 2025, expectations stand at 5.70% and 3.87%, respectively. The one-year inflation expectation is at 4.16%, down 13bps, while the two-year horizon (August 2026) decreased by 8bps to 3.52%. As for short-term inflation expectations for August, the expectation is at 0.23% m/m, which could lead to inflation falling to 6.36% from the current 6.86%. Scotiabank Colpatria’s projection is 0.24% m/m and 6.37% y/y. Inflation in August would continue to be pressured by the indexation of rental rates, while the other components would have moderate pressure on prices. Tolls increased at the beginning of August, however, the impact of the adjustment would not imply greater pressures.

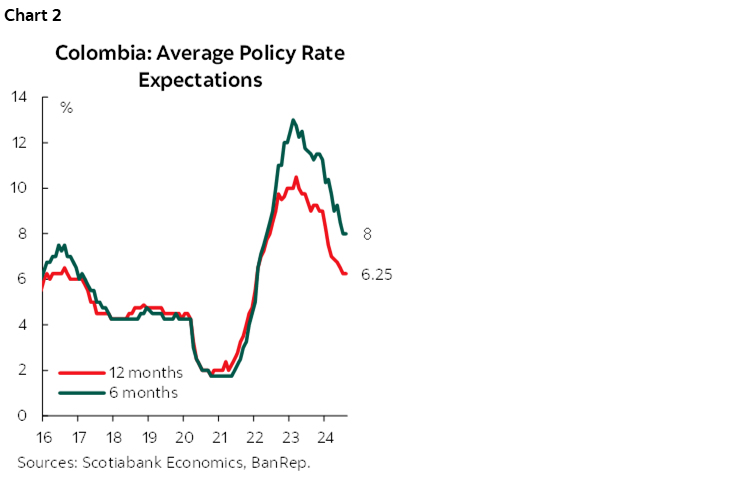

Regarding the monetary policy rate, the market consensus projects a cut of 75bps at the meeting on September 30th, which is the same expectation that Scotiabank Colpatria has. For the end of the year, the consensus expectation of economists remained at 8.50%, the same expectation as Scotiabank Colpatria. For 2025, the consensus of analysts expects the monetary policy rate to fall to 6%, while Scotiabank Colpatria maintains the expectation that it will reach 5.5%.

BanRep has maintained its cautious stance in the easing cycle, however, the most recent inflation data reinforces our expectation that the pace of cuts will accelerate in September. However, we still need to observe inflation in August, which will be key to the materialization of our base scenario. Additionally, BanRep will have the advantage of deciding after the Federal Reserve. If the Fed cuts interest rates, BanRep could have greater confidence to accelerate the pace of cuts.

Key points from the survey :

- Short-term inflation expectations. For August, the consensus is 0.23% m/m, which implies an annual inflation rate of 6.36% y/y (compared to 6.86% in July). The maximum expectation is 0.44% and the minimum is 0.10%. Scotiabank Economics’ projection is 0.24% m/m and 6.37% y/y. Core inflation excluding food projected by analysts is 0.24% m/m, lower than the 0.26% m/m estimated by Scotiabank Economics, and higher than the variation for July (0.20% m/m).

- Medium-term inflation expectations improved. Inflation expectations for December fell by 7bps to 5.70% y/y (table 1). Similarly, expectations for the one-year horizon were 4.16% y/y (-13bps). The two-year inflation expectation fell by 8bps to 3.52%.

- Monetary policy rate. The median expectation points to a rate cut of 75bps at the September meeting, a pace of cuts that would be maintained at the October and December meetings until reaching 8.50% at the end of the year (chart 2). Scotiabank Colpatria’s projection is the same as the analysts’ consensus, with three cuts of 75bps for the remainder of the year. While for 2025, Scotiabank Colpatria’s expectation is 5.50%, 50bps higher than the market estimate.

- FX. Projections for the US dollar exchange rate for the end of 2024 averaged 4,044 pesos (5 pesos below the previous survey). For December 2025, respondents, on average, expect an exchange rate of 4,053 pesos (three pesos below the previous survey).

—Sergio Olarte & Daniela Silva

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.