- Chile: Strong July GDP growth partly reverses negative weather impact in May and June

- Peru: Headline inflation is slowing, but could rise again in Q4-24

Markets are trading somewhat erratically through overnight hours, as a positive risk swing at the Asia/Europe crossover is now turning into a more risk-averse tone but with conflicting market signals. It should not surprise that the JPY, a haven, is leading the charge against the dollar with a 0.7% rise on the day. But, it is one of only two major currencies higher on the day, with the other being the MXN, up 0.5%, a currency that has tended to trade in the opposite direction of the JPY in recent weeks; at least AUD and NZD lagging makes more sense with the slightly risk-negative mood.

US equity futures are off 0.3% while European indices sit little changed to slightly negative. It’s a rough day for commodities as crude oil falls near 1%, while iron ore sheds 3.5% and copper drops 2% on the combination of Chinese demand weakness for the former and negative price forecast revisions from a key US bank for the latter. USTs are reopening little changed after yesterday’s Labor Day market holiday. The G10 day ahead has US ISM manufacturing figures at 8.30ET as the highlight, with the July edition of these figures showing very weak labour market metrics that contributed to the strong rally in rates in early-August.

At 8ET, Mexican June investment and consumption data is on tap, but the local highlight in Mexico will be the start of judicial reform debate in the lower house at 13ET—with no signs of delays in the face of protests and Supreme Court workers going on strike. The process in the Chamber of Deputies may conclude as early as tomorrow, with the governing coalition clearly having the supermajority needed to approve constitutional amendments. We’ll see whether some modifications to the proposal presented over the next few days help assuage investor worries.

At 18ET, Chile’s central bank is due to deliver a 25bps rate cut to 5.50%, after it chose to leave rates unchanged at its late-July decision. Despite a beat in monthly economic activity data for July released yesterday (see below), the BCCh is on track to resume cuts today (to then maybe skip a cut in October) as labour markets show signs of slowing, while CLP resilience and the start of Fed cuts in two weeks allows the BCCh to reduce the degree of policy restriction. After yesterday’s GDP beat, markets are assigning about a 70% chance of a cut today, while roughly three-quarters of economists polled by Bloomberg expect a cut.

We also get Brazilian Q2 GDP figures at 8ET and at 9ET Colombia’s finance minister addresses congress on the government’s budget for 2025. The Brazilian economy is forecast to have roughly held a steady pace of growth last quarter, with the median economist seeing a 0.9% q/q expansion from the 0.8% recorded in Q1 (2.7% y/y from 2.5% y/y) thanks to solid consumption and investment spending.

—Juan Manuel Herrera

CHILE: STRONG JULY GDP PARTLY GROWTH REVERSES NEGATIVE WEATHER IMPACT IN MAY AND JUNE

- GDP growth in 2024 remains between 2.5 and 3.0%

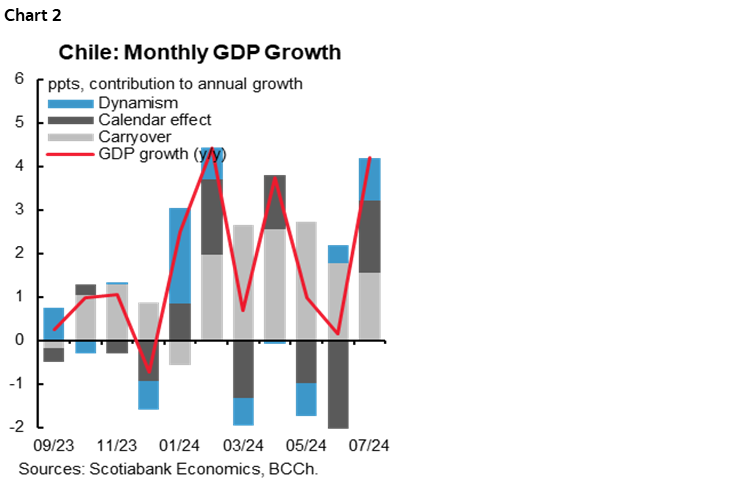

On Monday, September 2nd, the central bank (BCCh) released July GDP, which expanded 4.2% y/y, showing a significant and surprising reversal of the negative weather effects observed in May and June. The calendar effect has been particularly anomalous during the last three months due to weather factors that affected services and productive sectors, which explains an important part of the strong reversal observed in July. Without additional supply side surprises, the economy should expand around 5% q/q (SAAR) in Q3-24 consistent with 2.4% y/y GDP growth in the same quarter.

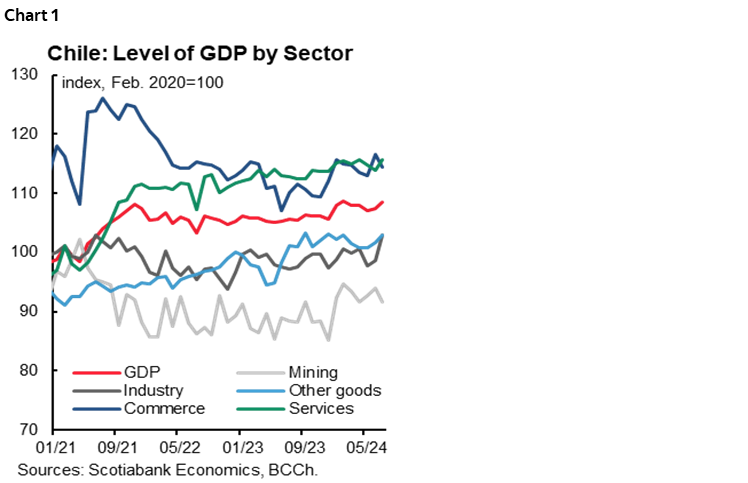

Non-mining activity recovers speed across the board (chart 1). Beyond the positive calendar effect, the dynamism of activity shows an important recovery, with a growth of 1.5% m/m in non-mining activity (1% m/m in total GDP), the highest since January of this year.

Services recover dynamism and commerce leaves behind the positive impact of CyberDay. The growth of services (1.6% m/m) would have been largely explained by the normalization of activities in some sectors, especially in education, business services and transportation, in the absence of weather events similar to those observed in May and June that had a negative impact on these sectors. In contrast, commerce fell 1.8% m/m, leaving behind the positive (and transitory) impact of CyberDay on activity during June.

Industry registered its fastest monthly growth rate in more than four years (+4.4% m/m). INE’s manufacturing production figures anticipated a positive industry performance for the month, led by increased fishing activity after a negative June due to the lower availability of the natural resource. However, after some years of zero growth in the sector, the level of GDP is still below the trend of recent years.

The calendar effect far exceeds what was expected: climatic factors in recent months with statistical impacts not very different from those of a leap year. In chart 2 we can see the greater magnitude of the calendar effect (negative) in the months of May and June, where the estimate was probably affected by the climatic events and the distortion in the production of goods and provision of services recorded in those months. On the other hand, we see that in the month of July there is a significantly higher-than-expected (positive) calendar effect, partially offsetting the declines of the previous months. Finally, the same figure show the positive effect of the leap year in the month of February.

For the BCCh, the overall reading of the latest activity records would be read as a scenario of volatile activity given weather impacts, but which in trend reading would be in line with the baseline scenario of GDP growth 2024 of the last IPoM. In that context, we expect the September IPoM to revise the GDP growth range for the year to 2.5–3.0% (from 2.25–3.0%). Consequently, in terms of the output gap, we would not have relevant adjustments. However, it will be somewhat more complex to explain the GDP growth recovery that has not been accompanied by cyclical job creation.

—Aníbal Alarcón

PERU: HEADLINE INFLATION IS SLOWING, BUT COULD RISE AGAIN IN Q4-24

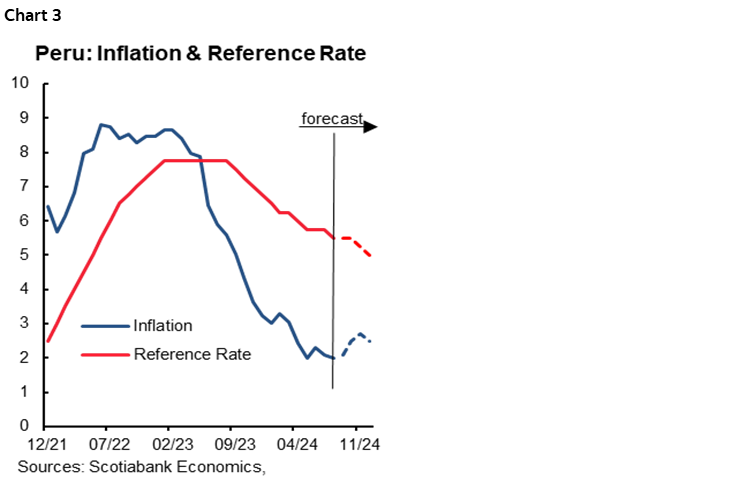

Headline inflation rose 0.28% m/m in August, above what was expected by the market consensus (0.22%) and similar to the historical average of the last twenty years (+0.29%). That means that yearly inflation decreased from 2.1% in July to 2.0% in August, at the mid-point of the target range (chart 3). As of August, there are five months in which inflation remains under the upper limit of 3% of the inflation target.

Core inflation, trend component that excludes food and energy, rose slightly by +0.01%, well below the historical average of the last twenty years (+0.25%). In year-on-year terms, it fell from 3.0% in July to 2.8% in August, returning to the target range (1%–3%) after six months. Although the decline was greater than we expected (2.9%), in the short term it would not continue to fall to the extent that headline inflation did.

The increase in headline inflation during the month is mainly explained by the impact on the prices of tubers, mainly white potatoes (+19.4%) and yellow potatoes (+9.2%), the price of chicken (+4.9%) despite its seasonal increase from the previous month and the increase in the price of garlic (+56.8%) due to lower harvests. These increases were offset by the decline in corn (-22.9%), strawberries (-14.9%), mango (-12.14%) and onions (-8.19%). Inflation at the national level (not only in Lima) went from 1.8% in July to 1.7% in August, placing it within the inflation target range for past eight months.

For the end of the year, we slightly increase our estimate of headline inflation from 2.4% to 2.5%. Due to the base effect, inflation will rise at the beginning of Q4-24, before moderating to 2.5% at the end of the year.

—Ricardo Avila

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.