- Chile: Moving slowly but in the right direction

On Monday, August 19th, the central bank (BCCh) released the Q2-24 National Accounts, which showed a slight recovery of domestic demand, in a context where no relevant changes were observed with respect to the preliminary GDP figures revealed monthly by the BCCh. The convergence of the current account deficit towards sustainable levels stands out, at 3.1% of GDP, where financing is maintained—and even accentuated—by FDI. From this point of view, the new evolution seems positive and supports the view that a further real depreciation of the CLP is not necessary to ensure a further decrease in the deficit.

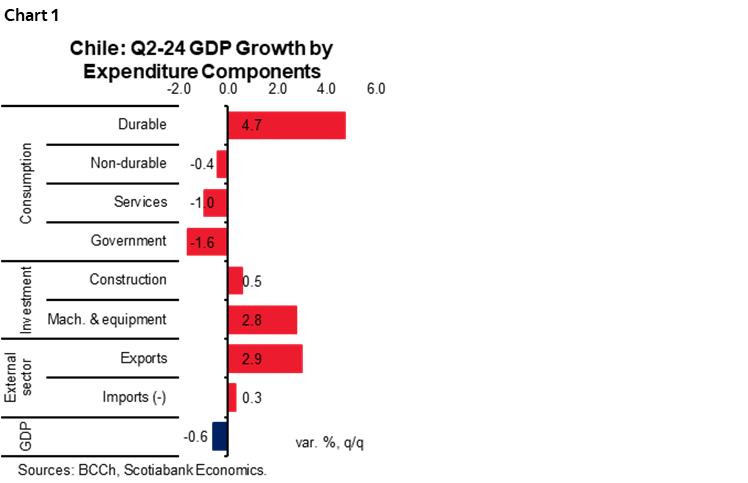

Total consumption experienced a seasonally adjusted decline of 0.6%, while investment expanded by a surprising 1.4%, both with respect to the previous quarter, the highest growth since Q3-22. This recovery has the same major culprit for its significant decline, machinery and equipment (M&E). As a result of a relevant fall in this component of investment, Chile broke away from the rather flat trend of total investment that we saw for the world average. Indeed, the seasonally adjusted fall in investment observed in Chile since mid-2023 was completely orthogonal to that observed in the rest of the world, although certainly some economies showed huge expansions (Mexico), while others, consecutive falls (Canada). Casuistic information regarding m&e dynamics refers to the already known difficulties to materialize investment to restrictions in credit lines in a context of significant increase in m&e prices as well as regulatory issues in vehicles.

Construction within investment, a substantive and always worrying component from several real and financial dimensions, would confirm that the worst is behind us after showing a slight increase after two flat quarters. It will take time to see a substantial recovery of this component on the private side, but it seems that we are facing symptoms of stabilization.

It seems relevant to reflect on the decline in private consumption driven by non-durable goods and services. In some dimension, climatic factors could have played a relevant (transitory) role, which was not shown on the durable goods side, which showed a strong growth of 4.7% q/q (chart 1). This remarkable recovery allows the level of durable goods consumption to be very close to the one seen by the end of 2022 and 5% above the level of Q3-19. This is good news, as durable goods end up largely reflecting the perception of household wealth that was in continuous decline until the middle of last year. The perception of political and economic uncertainty “made in Chile” has receded and that certainly reassures households.

These National Accounts leave a marginally positive taste. Things seem to be moving in the right direction. Probably not as strongly as many would like, but finally towards the desired shore. Also, this slight reconfiguration of domestic demand tends to provide some room for frontline counter-cyclical policies to move in the direction already outlined, perhaps with somewhat greater intensity than thought a few weeks ago.

—Aníbal Alarcón

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.