- Peru: July vehicle sales fall more than expected

Global yields are higher on the day, chopping around the release of Eurozone and UK PMIs to eventually rise more clearly with 2/3bps increases across US and European curves. Combined with the modest UST selloff on Wednesday afternoon despite surprisingly dovish Fed meeting minutes—several saw recent data building a plausible case for a 25bps cut at the July meeting—US long-end yields are now practically at their same levels as 24hrs ago prior to the release of payroll numbers revisions.

Although PMI data shook up global rates markets, they had practically no impact on stocks with US equity futures steadily rising from their worst overnight levels to sit marginally higher, while European indices register decent 0.3/4% gains. Moves vis-à-vis the USD are fairly small with no clear risk narrative to drive currency markets (MXN flat), while crude oil and copper trade unchanged on the day and iron ore drops ~1.5%. G10 markets now await the release of the ECB’s July meeting minutes at 7.30ET, followed by US jobless claims at 8.30ET and US PMIs at 10ET.

A flood of Mexican data at 8ET awaits, with final Q2 GDP figures, H1-Aug CPI, and June economic activity figures all on tap. The median economist polled by Bloomberg expects bi-weekly headline inflation to drift away from the mid-5s zone, with a 5.31% reading seen from the 5.52% print in H2-Jul on a standard 2w/2w 0.12% rise in prices. Core inflation is projected to have held unchanged at 4.08%, however. Economic activity is estimated to have slowed down considerably on a m/m basis to 0.1% (after 0.75% in May) with a marginal year-on-year contraction in output expected.

With still very high headline inflation (and its implications for inflation expectations), alongside the MXN just not having a good time (15-20% weaker than its best levels in April) one may think there’s decent odds of Banxico sitting out its September decision. But, weakening growth and recent comments by officials (namely [former?] hawk Heath saying an easing cycle is around the corner) have raised the bar for a rate hold; markets have about 20bps priced in for the September gathering.

Banxico’s meeting minutes out at 11ET will give us a bit more colour on the view of officials on the cadence of rate cuts, with their comments on how much possible/realized losses in the MXN may influence their decisions. Note that yesterday’s results to the latest Citibanamex economists survey showed the median expecting a 25bps cut in September, lowering their year-end Banxico rate forecast to 10.25% from 10.50%—i.e. anticipating two more cuts while markets are favouring three more.

—Juan Manuel Herrera

PERU: JULY VEHICLE SALES FALL MORE THAN EXPECTED

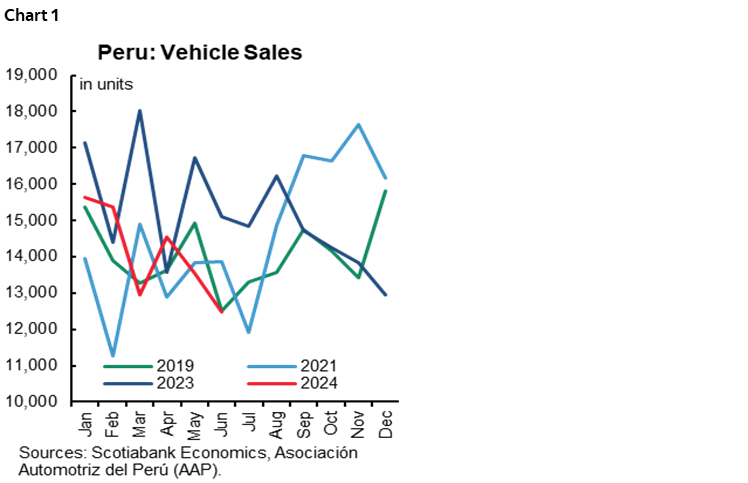

New vehicle sales fell 15% y/y in July, the third consecutive month of decline, after growing in April. Although we estimated a year-over-year decline for July, the magnitude was larger than we expected. With this result, although we expected new vehicle sales in 2024 to be lower than in 2023, the magnitude is greater, as we are now projecting a drop of around 6% y/y, mainly explained by a lower level of light vehicle sales, not offset by the increase we expect in heavy vehicle sales.

In July, vehicle sales reached 12,608 units, dropping 15% y/y (chart 1). Although we expected a drop in sales, we expected a single-digit decline. By segment, the drop was mainly due to lower sales of light vehicles, which in July reached 11,063 units—the second lowest number between January and July—dropping 17% y/y, a figure that was below what we were expecting, due to lower demand for city cars, light trucks and, to a lesser extent, SUVs. The drop in sales could have been associated to low job creation, mainly in the private sector, affecting the improvement in the population’s income, and therefore the purchase of new cars. Although the withdrawal of pension funds—such as AFPs and CTS—could have boosted the demand for light vehicles, it could be that a low proportion of the withdrawals would be used for the purchase of new cars.

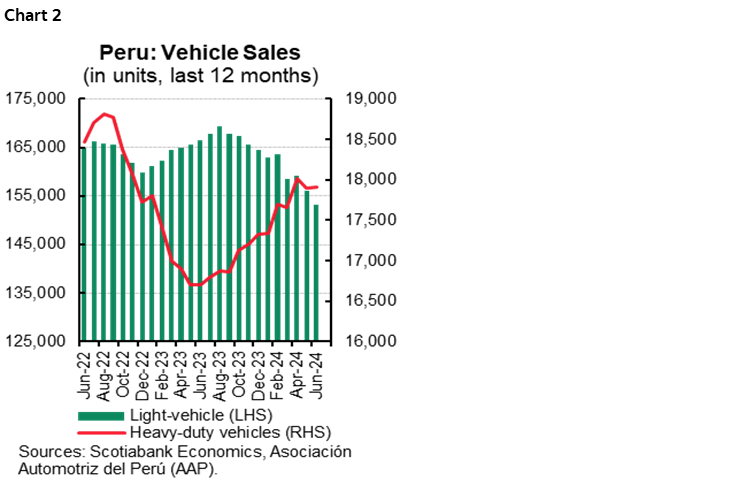

On the other hand, heavy vehicle sales grew 2.1% y/y, the second consecutive month of growth. The higher demand for tractor-heavy duty vehicles and buses drove the result, being limited by the lower demand for trucks—which represent 70% of the segment’s sales. Higher demand from the mining and construction sector explained the higher level of heavy-duty vehicle sales.

From January through July, new vehicle sales reached 97,159 units, 11.5% lower than in the same period of 2023. The negative result was explained by the lower placement of new light vehicles, falling 13.5% between January and July, partly due to the low level of demand in the last three months, accentuating the downward trend in sales of the last twelve months ending in July (chart 2). This result could not be offset by the higher demand for heavy vehicles, whose accumulated sales grew 6.3% as of July compared to the same period in 2023. The slight increase in sales between June and July had an impact on the progressive recovery of the average sales of this segment for the last twelve months ending in July.

The decline in new car sales in the local market during H1-24 was similar to the performance in H1-24 sales in countries such as Argentina (-23.2%), Chile (-10.8%), Colombia (-6.1%), and Ecuador (-18.7%). On the other hand, there was an increase in sales in countries like Brazil (+14.6%) and Mexico (+11.8%), which are also countries that manufacture new vehicles, according to the Latin American Association of Automotive Distributors (ALADDA).

Finally, we expect year-end new vehicle sales to be near 171 thousand units, lower than 2023’s result (181,812 units), although as mentioned above, the magnitude of the decline, of just over 6%, would be greater than what we projected at the beginning of this year. However, while we expect the weakness in sales to continue during Q3-24, we expect a better performance during Q4-24, partly due to a base effect, given that Q4-23 sales were, on a quarterly basis, the lowest since Q2-21, and the lowest quarterly sales in 2023.

—Carlos Asmat

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.