- Colombia: August Citi Survey—majority expects an acceleration of the easing cycle

- Peru: GDP growth in Q2—waiting for the private sector

Monday’s drift higher in yields continues today, with gilts catching up to weakened UST and EGBs (that are a touch cheaper today) after yesterday’s bank holiday, while G10 markets have little to trade on today ahead of a busier second half of the week—when we’ll get Euro CPIs and US PCE data. Banxico’s quarterly report, Chilean, Colombian, and Brazilian unemployment figures, and a flood of Chilean macro data await over the balance of the Latam week; Peruvian markets are closed on Friday.

Risk sentiment looks in ok shape this morning as currencies trade mixed against the dollar, where the MXN’s 0.3% rise is among the best, European bourses and US equity futures trade decently stronger, and commodities sit mixed, with oil falling about 0.5% off its best levels in two weeks, copper trades flat, and iron ore climbs 1.5% on reduced China pessimism. The MXN, which yesterday erased its Friday gains on Powell’s dovish address, remains at risk of political anxiety after Mexico’s lower house’s constitution committee voted the main components of AMLO’s judicial reform plan through to its next steps (debate to start as soon as next week).

Today’s Latam highlight is the release of Brazilian IPCA-15 inflation for August at 8ET. After three months of acceleration from May to July, economists now expect headline prices growth to slow slightly, from 4.45% to 4.33% (with a halving of m/m gains, at 0.17% from 0.30%). In yesterday’s results to the latest BCB weekly economists survey, respondents lifted their longer-term Selic rate estimates to 9.50% from 9.00% at end-2026, while holding their end-2024 projection at the current policy rate of 10.50%—in contrast to markets that are eyeing a rate increase at the early-September meeting. Today’s IPCA figures, if lower than expected, may ease pressure on the BCB to hike.

—Juan Manuel Herrera

COLOMBIA: AUGUST CITI SURVEY—MAJORITY EXPECTS AN ACCELERATION OF THE EASING CYCLE

August’s Citi survey results were released on Monday. BanRep uses this survey as one of its indicators for inflation expectations, the monetary policy rate, GDP, and COP.

Highlights:

- Economic growth forecast improved. For 2024, growth is expected at 1.64%, while for 2025, it is at 2.60%, 12bps and 1bp above the previous survey, respectively. For 2026, the expectation is at 2.94% (+4bps). The Q2-24 GDP growth stood at 2.1% y/y, fueled by temporary positive shocks on agriculture and public services, however the rest of the sectors are still showing weak performance; in H2-2024, our expectation is for a modest recovery that will take the 2024 GDP growth to 1.5% and 2.9% in 2025.

- Inflation expectations were stable on average. Inflation for the end of 2024 is expected at 5.66%, 4bps lower than in the previous survey, while for Dec-2025, the expectation increased by 5bps to 3.84%, but still within BanRep’s target range. For August, headline inflation is expected at 0.23% m/m, which could take the annual figure from 6.86% to 6.38%, affirming the downward trend of inflation. At Scotiabank Colpatria, expectations are 0.24% m/m and 6.38% y/y, while for Dec-2024, we expect inflation to close at 5.69% and 3.35% for Dec-2025.

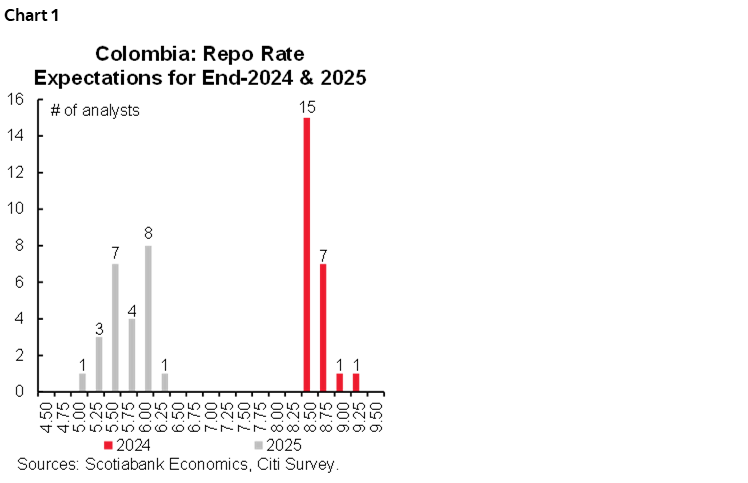

- Monetary policy: The majority of those surveyed expect an acceleration in the easing cycle in September. Out of the twenty-four respondents, fifteen expect a 75bps cut at September’s meeting, while nine expect a 50bps cut. For Dec-2024, the monetary policy rate is expected at 8.50%, and for Dec-2025 it is expected at 5.88% on average. Scotiabank Colpatria is aligned with consensus as we expect an acceleration to a 75bps cut in September to close the year at 8.50% and reach a terminal rate of 5.5% by mid-2025 (chart 1).

- At Scotiabank Colpatria we consider the central bank has arguments to accelerate the easing cycle because: 1) the economic activity performance remains weak, and the impact in the employment market has been more material, 2) headline and core inflation resumed the downward trend, and inflation expectations remain converging towards the target, and 3) the confidence for the kick-off of a consistent easing cycle in the US has increased significantly.

- Finally, economist consensus expects the exchange rate to average 4,062 in Dec-2024, while for 2025, it is expected to be 4,043 pesos. Scotiabank Economics’ projections for the exchange rate are 4,116 pesos in December 2024 and 4,150 pesos in 2025.

—Sergio Olarte & Jackeline Piraján

PERU: GDP GROWTH IN Q2—WAITING FOR THE PRIVATE SECTOR

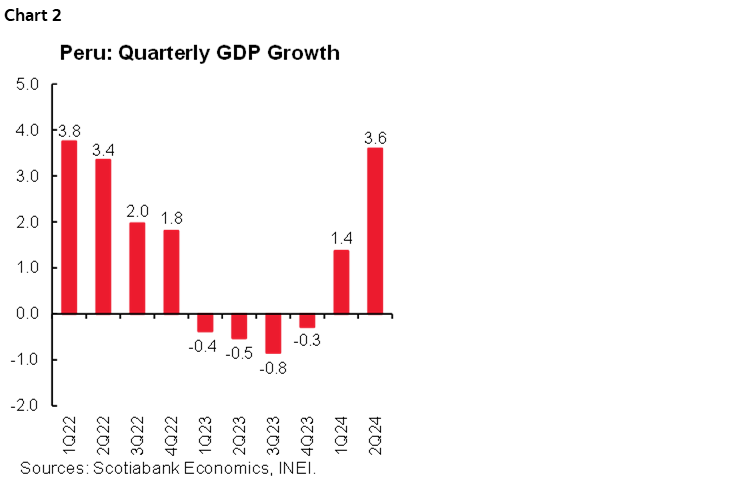

Second quarter results were released on Friday. GDP growth was 3.6%, YoY, in Q2 (chart 2). This was over double the 1.4% YoY GDP growth of Q1. Together, the two quarters represented 2.5% GDP growth for the first half of 2024, in line with our forecast of 3.0% growth for full-year 2024.

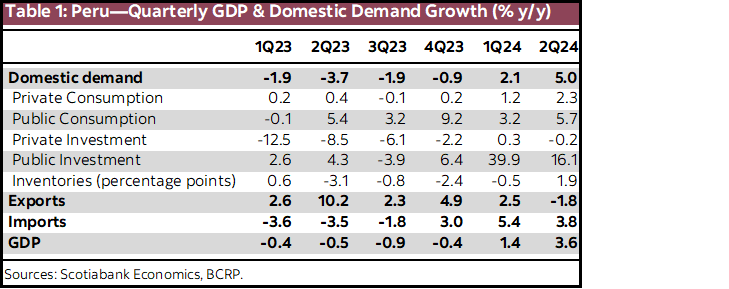

Diving into the details is revealing. The first thing of note is that the two demand components that outperformed aggregate GDP growth in both quarters were public investment and public (current) expenditure. It is clear, then, that government spending is what is driving growth, while the private sector lags.

What was particularly jarring in Q2 was the 0.2% YoY decline in private investment. We expected low private investment. However, after low but positive private investment in Q1, we had been looking for a mildly upward trend thenceforth. For private investment to have been negative is very discouraging

Private consumption did better, accelerating for a third consecutive quarter to 2.3%, YoY, in Q2. The trend is constructive, especially considering that the pension fund withdrawals had still not kicked in during this period. Private consumption growth promises to be even stronger once it does in Q3.

At first glance, 5.0% domestic demand is very upbeat. But, look again. Domestic demand includes inventories, which added a huge 1.9 percentage points in Q2. Without this, domestic demand growth would have been 3.1%, which makes more sense. Note that one cannot do the same exercise, exclude inventories, with regard to aggregate GDP growth, because inventories was actual production on the way to the market. It so happens that, in Q2 the increase in inventories consisted largely of fishmeal production that had yet to be exported simply due to timing. This is also part of the reason why exports fell 1.8% YoY despite the strong fishmeal season in Q2. In Q3, this impact should reverse, with fishmeal adding to exports growth, and inventories being depleted (table 1).

The main message of the Q2 figures is that Peru is living through a typical Keynesian fiscal stimulus situation, with public spending driving growth, but at a fiscal cost that has taken the fiscal deficit up to 4.0% of GDP. Now, it’s time to put the Keynesian multiplier impact on private demand to the test. There are signs that there is at least a mild impact on private consumption. There are, however, no clear signs that there is any impact at all on private investment. Of course, one of the eternal misgivings concerning the Keynesian proposal has been that it gives little consideration to the political environment in which it takes place. And that, of course, is the what of the question for private investment in Peru.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.