- Mexico: Negative revisions to Q2 GDP; Headline inflation slowed in the first half of August; Banxico August meeting minutes detailed a discussion on inflation and rate cuts

- Peru: Looking ahead to Peru’s 2025 fiscal budget and debt financing plan; First impact of pension fund withdrawals on bank loans

MEXICO: NEGATIVE REVISIONS TO Q2 GDP

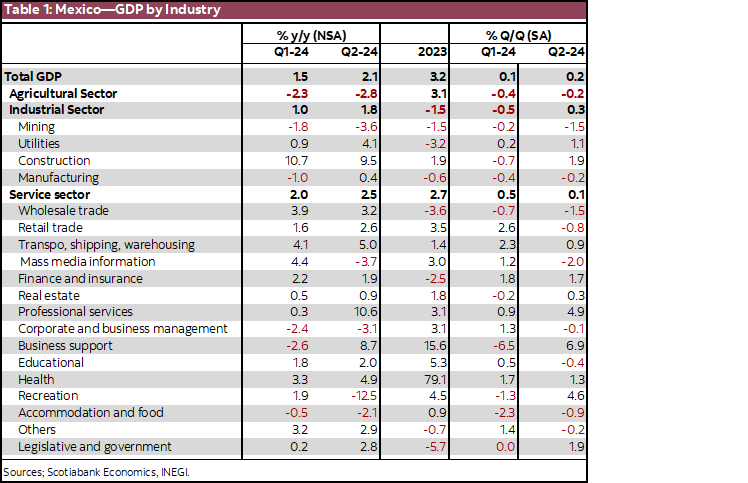

The revised GDP estimate for Q2-24 resulted in a lower annual growth of 2.1% y/y in comparison to the flash estimate of 2.2% and the previous estimate of 1.5%. Industry advanced 1.8% y/y (1.9% in the flash estimate), maintaining a strong pace in construction, although lower than in the previous quarter, at 9.5%, while manufacturing rose only 0.4% showing a stagnant trend. On the services side, these rose 2.5% y/y (2.7% in its flash estimate) led by professional services (10.6%), and transportation services (5.0%), on the other hand, leisure services dropped -12.5%, and hospitality services fell by -2.5%. Primary activities fell for the sixth consecutive time, now by -2.8% (table 1).

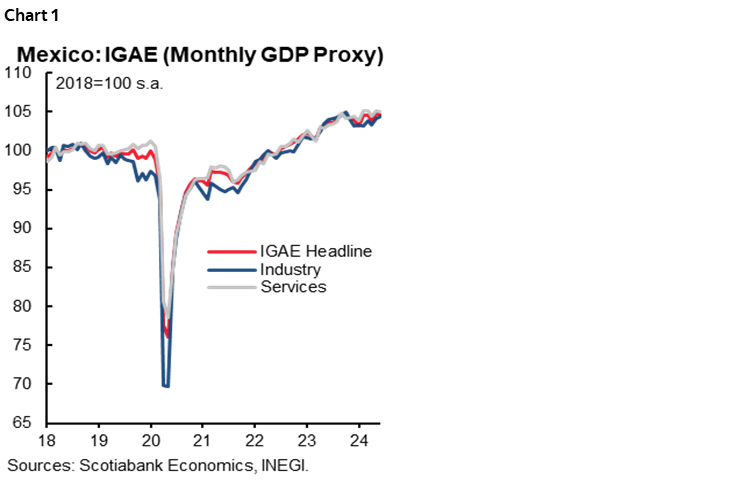

In its seasonally adjusted quarterly comparison, economic activity rose only 0.2%, with an increase of 0.1% in services and 0.3% in industry, while primary activities fell 0.2%. In June alone, the GDP monthly proxy (IGAE) observed further weakness, with a drop in economic activity of -0.6% y/y, due to declines of -0.4% in services, -0.7% in industry, and -2.9% in primary activities (chart 1). Economic activity numbers show a slower than expected pace in the economy in the first half of the year, even though analysts initially expected that the increase in public spending would translate into a higher pace of activity, which was not reflected in the data. Looking ahead, we believe that activity will see a slower pace for the remainder of the year, due to weak formal job creation and increased uncertainty, which will have a negative impact on investment. In the same sense, the consensus now anticipates growth at 1.7% for 2024, followed by a slower pace of 1.4% for the following year.

MEXICO: HEADLINE INFLATION SLOWED IN THE FIRST HALF OF AUGUST

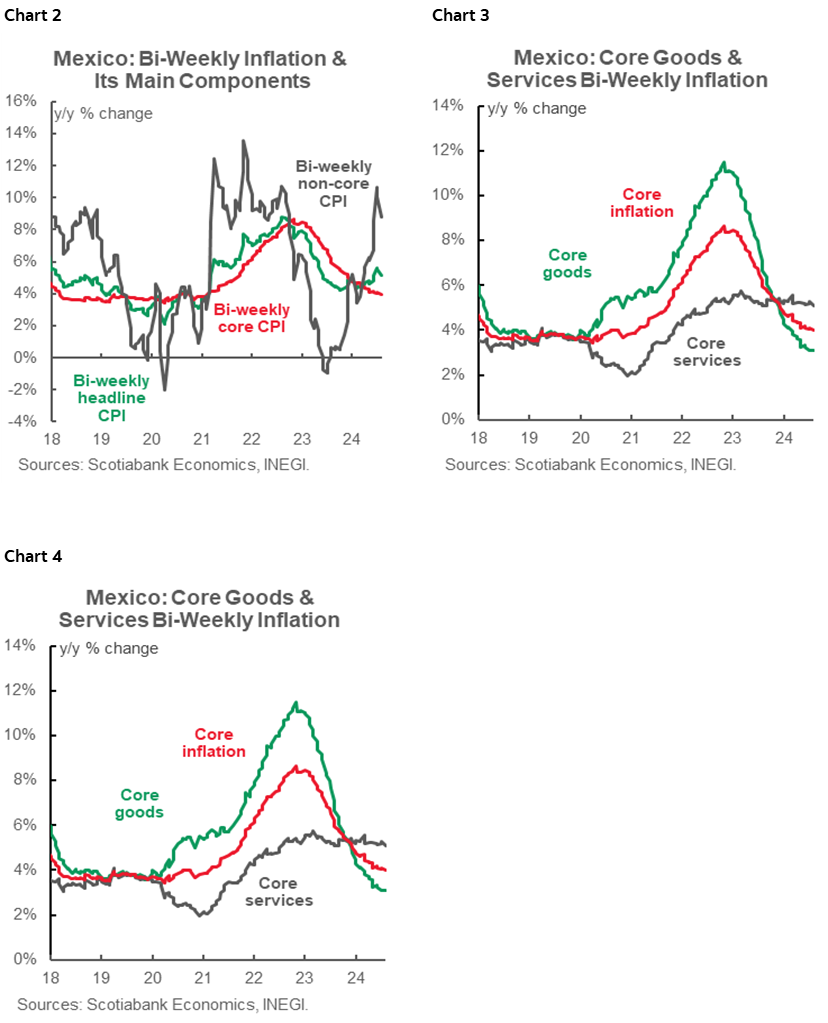

In the first fortnight of August, headline inflation surprised downward with an annual pace of 5.16% y/y versus the previous 5.61% and the 5.31% consensus (chart 2). The core component also moderated, to 3.98% y/y from 4.02%, contrary to 4.06% expected (chart 3). Merchandise moderated to 3.07%, while services stood at 5.11%. On the other hand, the non-core component decelerated to 8.80% from 10.09% previously (chart 4). Agriculture and livestock slowed to 10.95%, fruits and vegetables decelerated to 15.9%, remaining as the sub-component with the highest inflation rate. Looking ahead, August inflation could decelerate, in line with the results from the first fortnight; however, upside risks persist, so we do not rule out further revisions to the year-end inflation expectation, whose current consensus is 4.70%.

MEXICO: BANXICO AUGUST MEETING MINUTES DETAILED A DISCUSSION ON INFLATION AND RATE CUTS

Banco de Mexico minutes for the August 7th meeting provided details of the discussion on inflation and monetary policy within the governing board, where a 3–2 split vote revealed divided positions. We highlight the arguments of the dovish board members who voted in favour of the cut, which revolved around the expectation that the upsurge in non-core inflation will be transitory and will not contaminate other components; that core inflation will continue on a downward trend; and that the slowdown in economic activity will result in lower price pressures. On the other hand, dissenting members focused their positions mainly on the possibility that cutting the interest rate amid rising inflation and higher short-term expectations could undermine the credibility of the central bank’s commitment to ensure price stability. Looking ahead, analysts anticipates that Banxico will repeat another cut in September. The inflation reading for the first half of August, along with the dovish comments of the members voting for the last cut reinforce this expectation.

The governing board agree that rebound in inflation in recent months is due to the increase in non-core components; however, they also had varying degrees of concern about its behaviour. The dovish members considered that there are no signs of a generalized rise in prices. In addition, one member noted that non-core components are subject to shocks that could cause significant changes, thus reiterating a transitory outlook for inflation. On the contrary, one board member considered that there is a risk that the rise in these components could lead to a contagion effect in core inflation components. On the other hand, some members pointed to the resilience of the services component, and the risk that this resistance could go forward.

Regarding the USDMXN depreciation that started in June, and particularly at the beginning of the August decision week, some members pointed out that it will be necessary to assess possible implications for inflation. In this regard, some members considered that the exchange rate pass-through is low. On the other hand, one member recalled that, although the pass-through effect is low, this does not mean that the exchange rate dynamics are not relevant for inflation. As for the volatility observed, while most of them considered that it has decreased since June, one member mentioned that additional episodes cannot be ruled out in the future, while another member considered that markets have overreacted to economic news in an uncertain environment.

Regarding monetary policy, the board highlighted the economic slack and the transitory nature of the rebound in inflation to opt for a rate cut, despite the volatility in financial markets. We agree with Deputy Governor Espinosa’s dissenting opinion that “foreign exchange volatility could intensify due to domestic and external factors. This would jeopardize the disinflationary process, even considering the anticipated slowdown in economic activity”. Moreover, as Deputy Governor Heath also commented, “voting in favour of easing the monetary policy stance at this time, given a high fiscal deficit and a yet-to-be confirmed weakness of economic activity, while inflation is still far from target, may be interpreted as premature”. In this sense, we believe that higher uncertainty in the coming weeks could lead to greater financial volatility, a higher perception of risk and a depreciation of the exchange rate, so a cautious tone at the September meeting may be appropriate. Despite this, we believe that, if inflation slows in the following prints, there is a high possibility that the central bank will repeat another cut in a split vote at the next meeting.

—Miguel Saldaña

PERU: LOOKING AHEAD TO PERU’S 2025 FISCAL BUDGET AND DEBT FINANCING PLAN

Next week will reveal how the government plans to manage its 2025 budget, debt levels and financing. The government should present the following by August 31st at latest:

- The Marco Macroeconómico Multianual (MMM, the Multiannual Macroeconomic Framework) for 2024–2028

- The fiscal budget law

- The debt management law

- The fiscal balance law

The MMM is a yearly framework, planning and guideline document for government economic policy. The document has already been approved by the cabinet and is likely to be published shortly. The Minister of Finance, José Arista, has already anticipated a few details, advising that the document forecasts 3.2% GDP growth in 2024, and 3.1% in 2025. Arista stated that he considers the forecasts appropriately conservative, and that there is an upside, especially for 2024 GDP.

The MMM provides not only macroeconomic forecast, but is also the framework document that supports the fiscal budget, debt management and fiscal balance laws. These three laws have been presented to the cabinet and are under discussion. They must then be submitted to Congress by August 31st for discussion and approval. Congress habitually takes some time for its go ahead, which may occur as late as December.

Meanwhile, the documents will be available for public scrutiny. These are the things to look for:

- What new spending initiatives appear, and what priority is given to the different initiatives.

- How the government intends to reduce the fiscal deficit to its fiscal rule levels of 2.8% of GDP in 2024 and 2.2% of GDP in 2025. The first figure looks nearly impossible, as the fiscal deficit was 4.0% of GDP in July, and the second figure, while not impossible, seems quite challenging.

- How the government intends to finance the fiscal deficit, and spending in general.

FIRST IMPACT OF PENSION FUND WITHDRAWALS ON BANK LOANS

The impact of the pension fund withdrawals, which began in June and were in full force in July, are beginning to show. The main impact was as expected, namely, that many households used the additional resources to draw down their bank debt and improve household balances. Outstanding household loans fell 0.8% MoM in July. The trend for household loans, which was already weakening, up a soft 1.5% in the twelve months to June, rose only 0.4% in the twelve months to July.

The impact of pension fund withdrawals on outstanding household loans was pretty much as expected. Many households view their withdrawals as a sort of windfall, to be used for special or one-off issues, such as improving balances or as a down payment on a mortgage loan. This latter use has been evident since June, when the net increase in mortgage loans was double the monthly average levels from January to May. Mortgage loans in July repeated June’s lofty figure.

June–July is just the beginning of the pension fund disbursement period, which extends into September, with a bit filtering into October. By the end of October, we estimate that household loans may be down over 2%, YoY, with consumer loans down over 6%, as a result of the pension fund withdrawals. There is a silver lining, however. The current pension fund withdrawal is the seventh since 2020. In the past, large withdrawals like the current one led to a decline in outstanding consumer loans similar to the one we are seeing now. However, this was only an initial reaction. Once the health in household balances had improved, consumer debt levels gradually reestablished themselves over time, with the consequent greater consumption growth. Based on precedent, one can expect this latter effect to kick in in 2025, bolstering consumption.

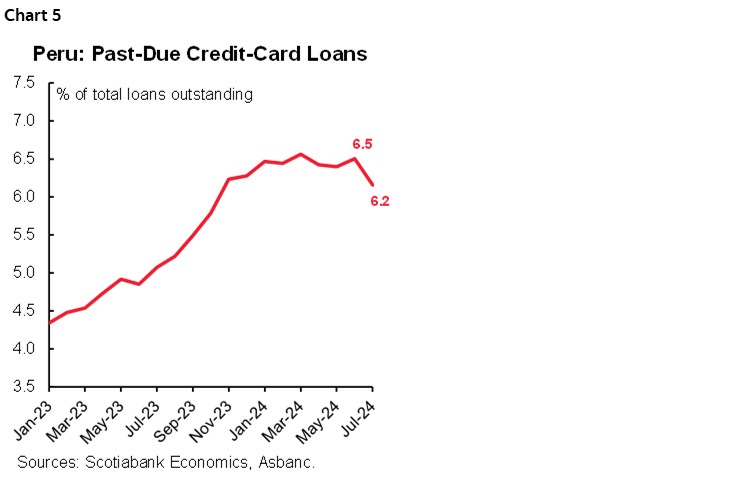

As households improve their balance sheets, past-due loan (PDL) levels should also decline. The information for July is just coming out, but so far we know that credit card PDLs fell to 6.2% of total credit card loans in July, after having fluctuated around 6.5% during most of 2024 (chart 5). This decline should continue.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.