- Mexico: Headline inflation beats on non-core price gains

It was another quiet one overnight, where we only had a marginally lower than expected Australian and Norwegian inflation, supporting bets for no more hikes from the RBA nor Norges—the two central banks in the G10 that still look at a small risk of tightening policy further. That’s excluding the BoJ, of course, where we await spring wage negotiation outcomes; on that note, Japanese wage growth hugely missed in November. The G10 data schedule is uneventful while the global market focus remains on issuance— which has started out strongly with a good gilts auction to give rates markets another push in recent trading—while waiting for the release of US CPI tomorrow as the main data this week. The Fed’s Williams at 15.15ET after the US10y auction at 13ET are the other main things to watch in the G10.

The global risk mood looks positive, with USTs bid evenly 3/4bps across the curve while gilts and EGBs bull flatten, especially periphery European debt which had a bit of a rough day yesterday. Most major currencies are strengthening against the USD, where the JPY is again an outlier, this time losing ground vs the USD to reach the 145 zone on a 0.3% drop. The MXN is flat after testing the 17 level overnight, continuing its losses that started around the release of local inflation data yesterday (see below). Crude oil is 0.5% weaker, shunned in European hours after range-trading in Asia, while iron ore gets slammed 3.5% on soft demand and copper rises 0.7%. SPX futures are up 0.2%.

After a busy two days of inflation data from Chile, Colombia, and Mexico, we have today a relatively quiet day in Latam (tomorrow, Brazil and the US publish their own CPI data). Colombia December prices data published yesterday was mixed as the headline miss of 0.45% m/m—vs 0.62% median but in line with our 0.46% forecast—and 9.28% y/y—vs 9.45% median and 9.40% at Scotiabank—contrasted with a slightly stronger core inflation reading. The single-digit reading, its first since mid-2022 is welcome news for BanRep however, who will consider a 25 or 50bps rate cut at its late-January meeting.

Today’s 6.30ET release of the BCCh’s economists survey may show some analysts changing their expectations for the size of the bank’s next rate cut, following the significant miss in data published on Monday (see here).

Mexican fixed investment data out at 7ET should come and go, and it’s worth highlighting that these figures seem inconsistent with trends in hours worked data (see here) so take them with a grain of salt. What may be of greater interest is that the Movimiento Ciudadano party has chosen Jorge Alvarez as the replacement candidate for Samuel Garcia (who returned to the Nuevo Leon governorship) in the 2024 presidential race. Alvarez was Garcia’s campaign coordinator before the latter went back on his resignation as governor. We’ll see whether the naming of an MC candidate influences polls to see voters pull away from Morena’s Sheinbaum or PRI/PAN/PRD’s Galvez, but it is a very high bar for the latter to close the distance to AMLO’s protégée before the June contest.

—Juan Manuel Herrera

MEXICO: HEADLINE INFLATION BEATS ON NON-CORE PRICE GAINS

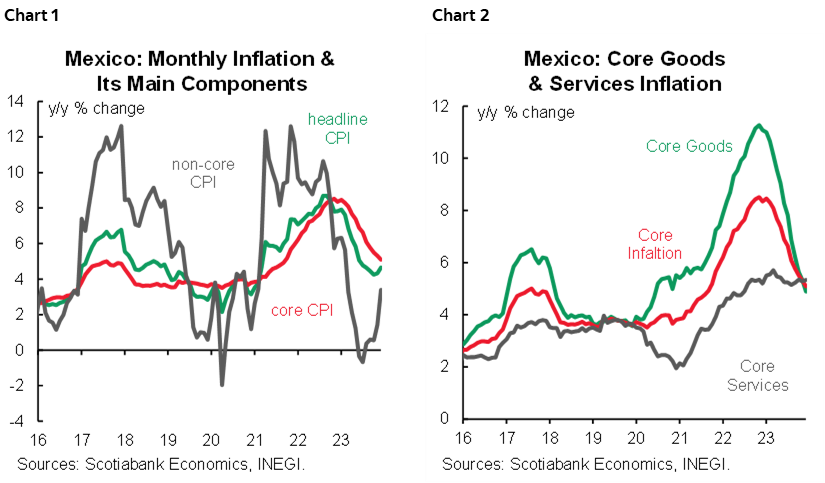

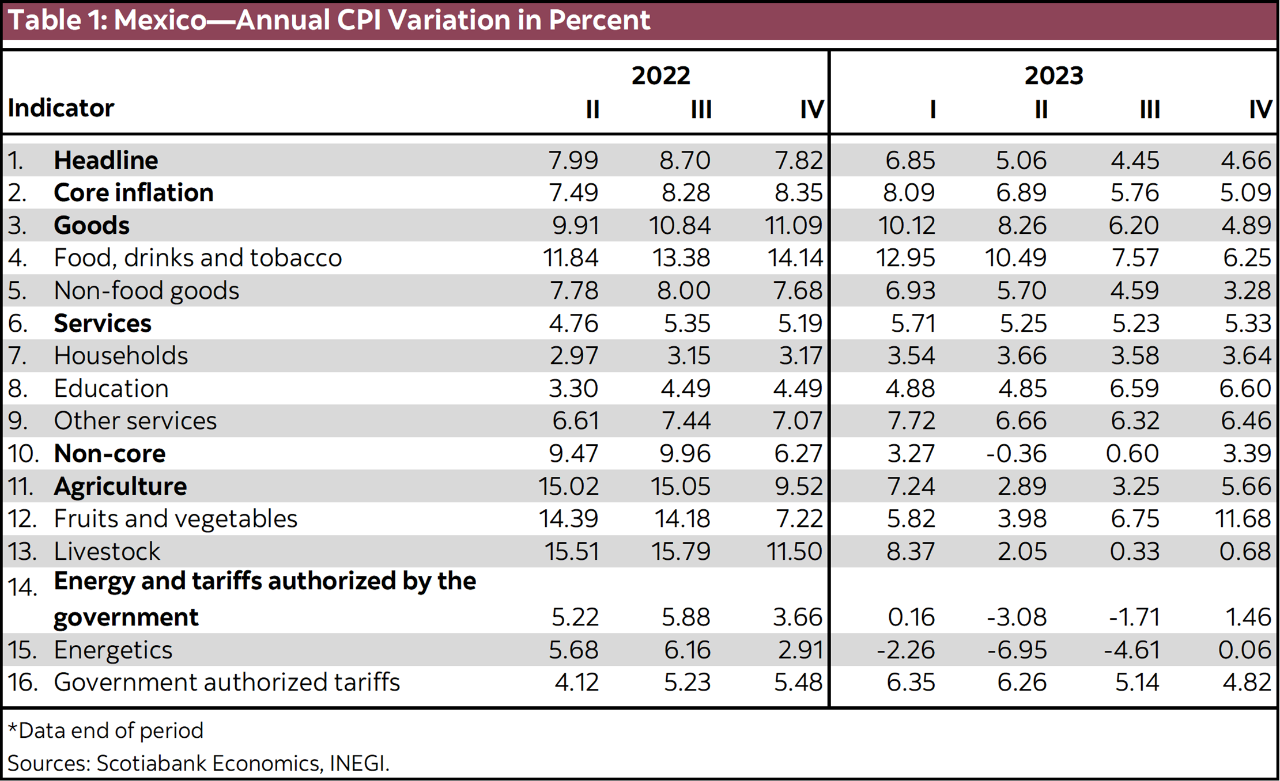

In December, inflation accelerated to 4.66% y/y from 4.32% previously (4.54% consensus). Core inflation moderated to 5.09% y/y from 5.30% previously (5.15% consensus), derived from a slowdown in merchandise at 4.89% (5.33% previously), and services 5.28% (5.34% previously). The non-core component rose 3.39% y/y from 1.43%, with energy and government tariffs rising 1.46% (0.24% previously), and agriculture 5.66% (2.85% previously). In its monthly comparison, general inflation rose to 0.71% m/m (0.64% previously, 0.59% consensus), core inflation had a greater increase of 0.44% m/m (0.26% previously, 0.50% consensus), with a greater pace in both goods and services. Finally, the non-core decelerated to 1.53% m/m (1.81% previously). Headline Inflation averaged 5.55% during 2023.

Given this print, we expect that in the following months headline inflation will continue to exceed 4.0%, mainly owing to the rebound in non-core items, which have already rebounded from negative prints and has resumed its upward trend, while the core component continues with a slow deceleration, mainly affected by pressures in services, which increased compared to Q3 2023 levels (5.33% vs 5.23%). Analysts expect year-end inflation at 4.02%, and lower levels in 2025, at 3.76%, although with several possible scenarios, in a range of 3.44%–4.69% for 2024. For now, we have maintained the forecast of 4.60% for 2024 partly owing to the expectation that economic activity will remain strong during the present year, although possibly to a lesser extent than in 2023, for which we expect a y/y growth of 3.4%, pending the publication of Q4 data. Climatic events, such as droughts and floods, could lead to a significant increase in the non-core component in coming months, as well as the persistence observed in the core items.

—Brian Pérez & Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.