- Peru: BCRP keeps its reference rate unchanged

- Mexico: Banxico minutes point to a possible cut in August

PERU: BCRP KEEPS ITS REFERENCE RATE UNCHANGED

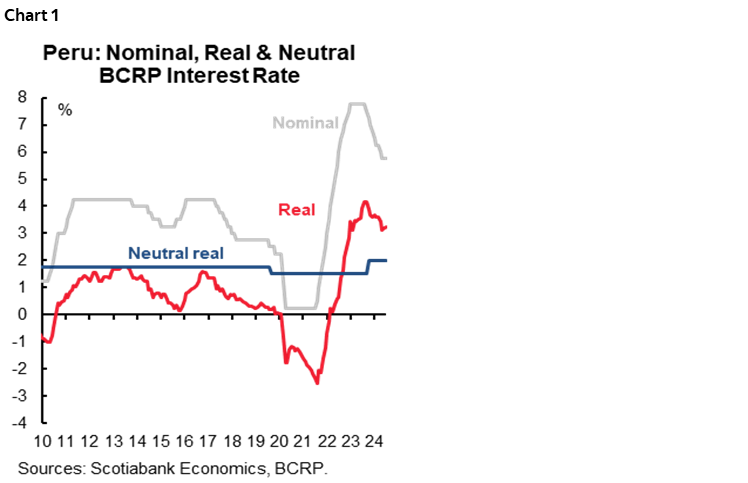

The board of the Central Bank of Peru (BCRP) kept the local rate unchanged at 5.75%, in line with what was expected by market consensus, the Bloomberg median, and our forecast at Scotiabank.

The BCRP board highlighted in its statement that it maintained the rate for two main reasons: 1) core inflation remained at 3.1% in June, above the target range (1%–3%), once again showing persistence associated with some service sectors and 2) the macroeconomic expectations survey for June (published on July 4th) indicated favourable current economic conditions and optimistic expectations for most indicators, for the second consecutive month.

By maintaining the reference rate at 5.75%, the spread with the Fed rate remains at 25bps and the real interest rate remains at 3.2%, still far from the 2.0% considered a neutral level, reflecting a still contractionary stance.

Our base case sees three cuts of 25bps over the next five meetings until the end of the year. That means that the reference rate would be 5% at the end of 2024. The BCRP survey for June showed that the market increased its key rate expectation for the end of the year from 4.75% to 5.00%. We expect that the BCRP will cut its policy rate at its meeting on August 8th by 25bps, to 5.50%.

—Ricardo Avila

MEXICO: BANXICO MINUTES POINT TO A POSSIBLE CUT IN AUGUST

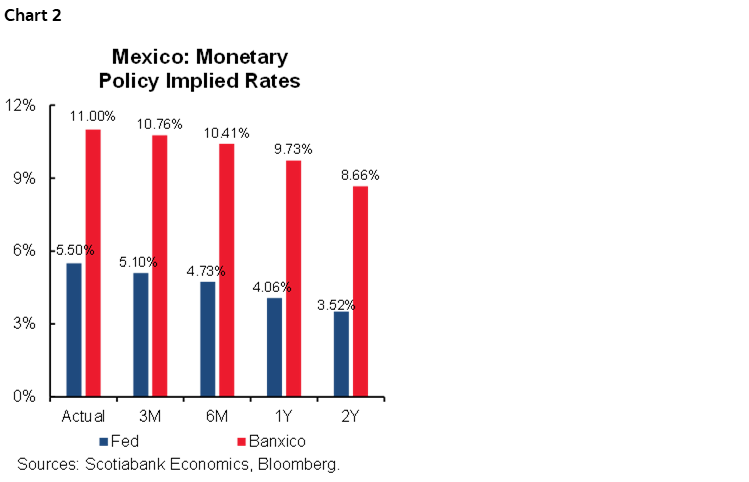

In the minutes to Banxico’s June 27 rate hold decision, members noted that the disinflationary process has continued globally, although still exceeding the inflation target of central banks. The case of the Federal Reserve stands out, which, according to the statements of its members, does not have enough confidence to cut the rate.

Regarding growth, the majority agree that it has continued with its weakness that began since the end of last year, pointing to the low pace of manufacturing. Additionally, although construction has led growth, a slowdown is already observed. Consumption, for its part, has remained strong, mainly due to imported goods.

They also mentioned the strength of the labour market, highlighting that the unemployment rate remains at historically low levels, although with mixed signs going forward.

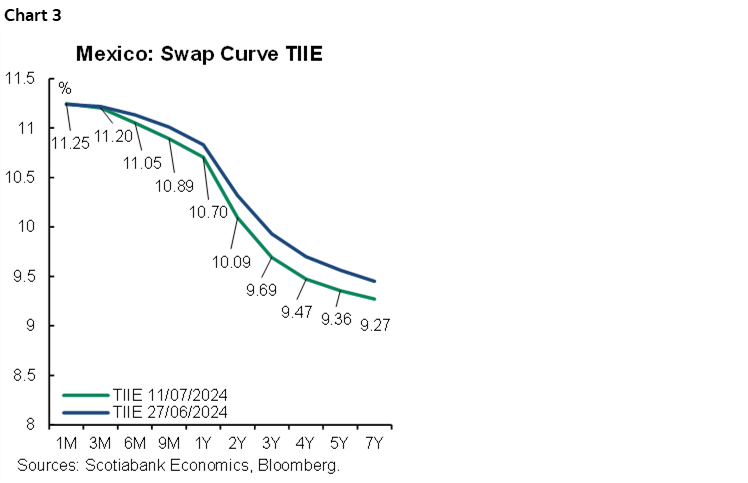

This monetary policy meeting considered the inflation print for the first half of June, which increased to 4.65%, mainly for the non-core component. In this sense, “some emphasized that non-core inflation is very volatile and usually experiences short-term shocks,” so they expect this strong increase to be transitory. On the other hand, they highlighted that the underlying component decreased due to the slower pace of merchandise, while risks persist in services, due to cost pressures and delays in the transfer to consumers. Banxico increased its short-term inflation forecasts, while its medium and long-term forecasts have remained stable, partly due to lower economic activity, since they expect to converge to the inflation goal in Q4-2025, although the balance of risks is biased upwards.

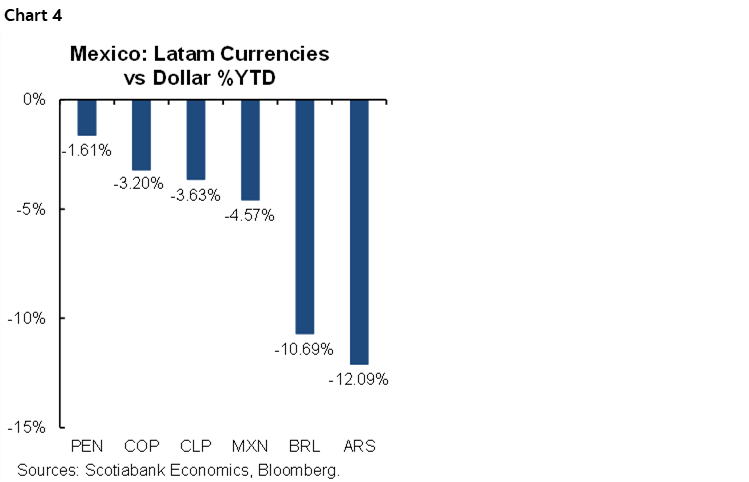

Regarding monetary policy, the board highlighted the recent volatility of Mexican financial markets as the main reason for maintaining caution in the latest decision. However, the majority mentioned that economic slack will support the disinflationary process in the coming months. In our view, given the loose bias of the minutes, with three members favouring a less restrictive stance going forward, there is a strong chance that the central bank will resume its easing cycle in August if there are no major surprises in the inflation data and if we see more signs of weakening economic activity.

- Member 1) Dovish: this participant considered that an adjustment was consistent with the risk outlook, given the highly restrictive policy stance and disinflationary progress. He also mentioned that if the central bank fails to adapt to changes in the outlook, it will need to increase its pace of easing.

- Member 2) Hawk: considers that financial volatility would affect convergence to inflation and expects that economic activity will be supported by consumption, investment and public spending, so it remains cautious.

- Member 3) Dovish: uncertainty about the determinants of inflation considered it necessary to pause this time, but if macroeconomic conditions favour favourable price dynamics it would be appropriate to resume the flexibility cycle.

- Member 4) Hawk: greater certainty about the downward trend in inflation is necessary before resuming rate cuts. He believes the central bank should continue to rely on data and maintain only occasional and gradual rate calibrations.

- Member 5) Dovish: keeping the rate on hold this time doesn’t mean they won’t discuss rate cuts in the future. The progress in both general and underlying inflation stands out. It believes that inflationary pressures will continue to dissipate, supported by weaker economic activity.

—Brian Pérez & Luisa Valle

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.