- Mexico: H1-Jan inflation complicates outlook for next Banxico meeting; Economic Activity slowed in November, as both industry and services decelerated on an annual basis

Global markets are waiting for the ECB’s decision and US GDP/PCE after a relatively quiet overnight session where Chinese equities euphoria on support measures continued. The ECB’s statement may have few, and no major, changes compared to December, so markets will focus on Gov Lagarde’s presser at 8.45ET, fifteen minutes after the US data releases (that also include jobless claims and durable goods orders).

US equity futures are little changed, resisting Tesla earnings-related weakness, while European bourses trade with slight losses. The USD is weaker against most currencies but ranges are small outside of the NOK’s 0.5% gain on a marginally hawkish Norges Bank decision, while the MXN is a laggard on account of a minimal decline. Crude oil’s grind higher is continuing today with a 1.5% gain on the now-usual run of Red Sea developments, while iron ore and copper marginally build on the now-usual run of China support news.

Chile’s lower house passed the government's pension reform bill yesterday on a line-by-line vote that saw a key article rejected. The 3% ‘solidarity’ fund/3% individual accounts split of the 6% of wages increase in employer mandatory contributions was rejected. Discussion of the bill will now be taken up in the Senate, where the government faces even more opposition and changes to its proposal, once lawmakers return from recess in March.

After yesterday’s Mexico data day (see below), today’s Latam calendar brings only Mexican unemployment rate figures that rarely influence local markets.

—Juan Manuel Herrera

MEXICO: H1-JAN INFLATION COMPLICATES OUTLOOK FOR NEXT BANXICO MEETING

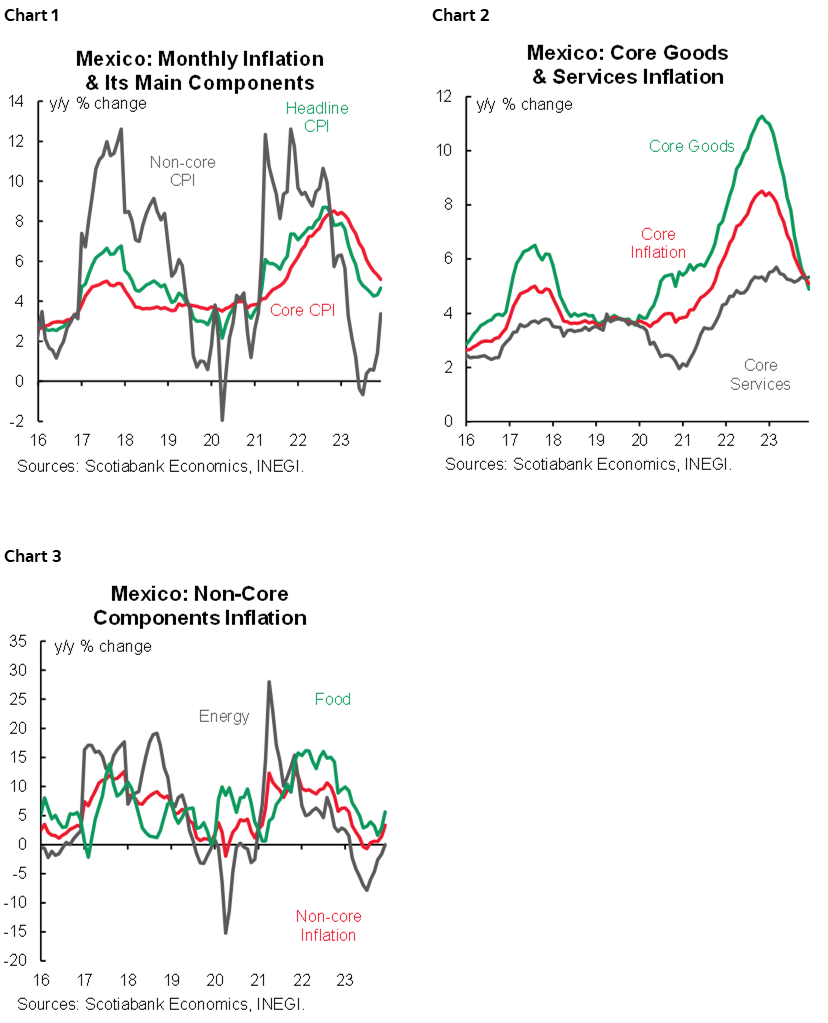

In the first half of January, inflation edged up to 4.90% y/y from 4.86% (vs. 4.78% consensus), while core inflation moderated as expected from 4.98% to 4.78% (vs. 4.78% consensus). Merchandise decelerated 4.45% (4.76% previously), and services decelerated 5.19% (5.26% previously). On the other hand, non-core inflation increased 5.24% (4.49% previously), with agricultural products rising 9.73% (7.52% previously). In its sequential biweekly comparison, headline inflation slightly increased 0.49% (0.48% previously, 0.38% consensus), while the core component rose 0.25% (-0.01% previously, 0.26% consensus) and the non-core component rose 1.22% from 1.97% (charts 1–3).

Inflation has been on the upside for the last five fortnights since the 4.25% y/y in the second half of October, mainly affected by the non-core component, which came out of negative territory in the second half of August to resume an upward trend, in contrast with core items, which has been decelerating since March, although still facing stickiness and upward biased risks. This print reinforces the outlook we have been presenting for some time about a rebound in inflation during 2024, mainly on the non-core side, but also from some core subitems, as higher demand in merchandise and services could pressure the core components.

This data brings uncertainty to the markets as it contrasts with what Banxico’s Board of Governors have said in recent statements about rate cuts in 2024, showing a dovish stance. We believe that Board members will change their stance if the recent rise in inflation continues. For the time being, in the baseline scenario, rate cuts at the end of Q1 2024 remain on the table as the latest Citibanamex survey has shown, with almost all participants expecting the first cut in March.

ECONOMIC ACTIVITY SLOWED IN NOVEMBER, AS BOTH INDUSTRY AND SERVICES DECELERATED ON AN ANNUAL BASIS

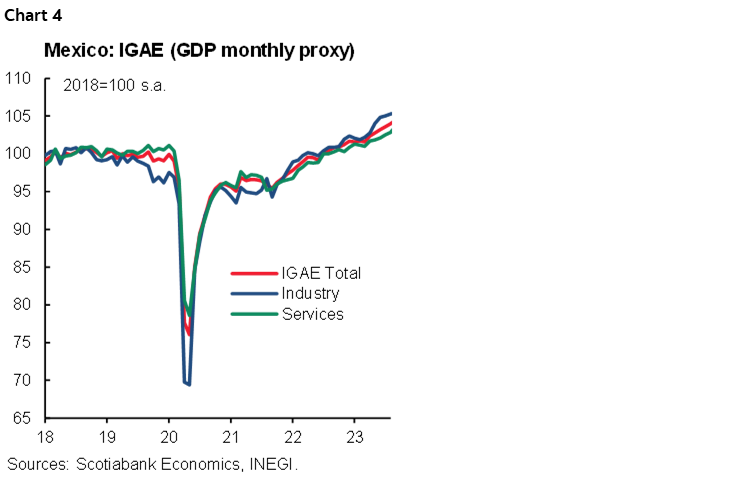

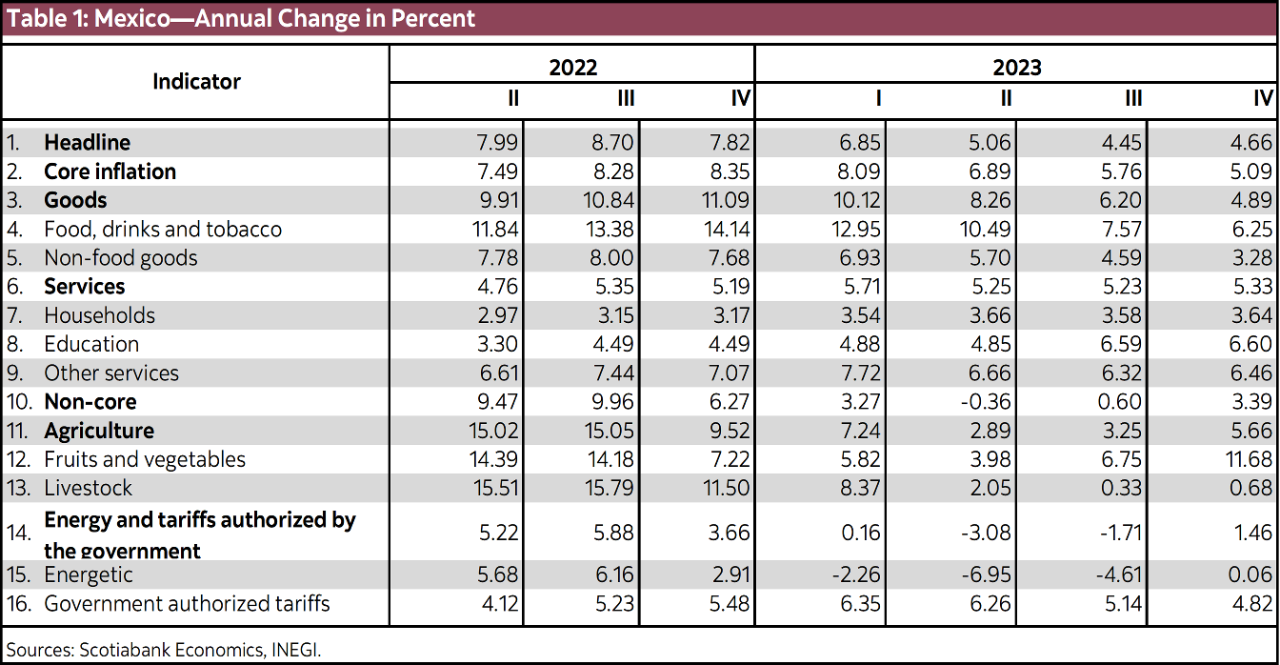

In November, the GDP monthly proxy (IGAE), registered a monthly decline of -0.5% m/m from -0.1% previously with seasonally adjusted monthly numbers, the consensus expected a drop of -0.2%. Industry presented a slower pace of -1.0% (0.6% previously), services rebounded 0.2% (-0.4% previously), and primary activities decreased -6.2% (1.8% previously). In its annual comparison nsa, the index moderated to 2.3% y/y from 4.4% previously, lower than the consensus of 3.2%. By sectors, industry slowed to 2.8% (5.6% previously), with manufacturing dropping -0.3% (1.1% previously), and construction decelerating to 18.0% (28.1% previously). Services slowed to 2.6% (3.6% prior), with wholesale rising 7.5% (8.0% prior), as retail trade slowed to 0.8% (2.9% prior), while primary activities declined to -6.5% (5.8% prior), see chart 4.

Over the last seven months, construction has shown double-digit growth, which has boosted the industry, although this vigorous growth could cool down as public sector infrastructure projects are completed. In contrast, manufactures has shown an advance of less than 2% during the year owing to a slowdown in most subsectors, with the exception of automotive and transport manufactures, affected by the restrictive level of interest rates.

On the other hand, services have maintained a pace above the historical average, led by wholesale and retail trade, with also strong rates in most of its subsectors, such as financial services, transportation, and hospitality (see table 1). In the next print, we believe that we could see some moderation on a y/y basis, although for the following months we believe that activities will continue to advance at a solid pace, in line with the strength of household incomes.

Despite the moderation observed in November, we maintain the outlook for an accelerated increase in the first half of 2024, driven by the increase in public spending, and by the strength of the labour market, which maintains annual increases in real wages.

—Brian Pérez & Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.