- Peru: BCRP surprises with a hold; April GDP Flowers

PERU: BCRP SURPRISES WITH A HOLD

The board of the Central Bank of Peru (BCRP) was not ready to put the PEN reference rate on par with the FED rate, and kept the local rate unchanged at 5.75%, surprising the market consensus.

Although headline inflation decreased from 2.4% in April to the mid-point of the target range (2.0%) in May, and prices that we track suggest that there could be negative monthly inflation once again in June, the BCRP emphasized in its statement that core inflation increased from 3.0% in April to 3.1% in May, mainly due to a certain persistence associated with some service sectors.

Another significant factor influencing the BCRP’s decision was the outcome of its macroeconomic survey for May, which indicated a recovery in current economic conditions and mostly optimistic expectations for future indicators.

Finally, the statement highlights the persistent risk regarding the reduction of monetary policy interest rates in advanced economies. The forecasts of the Federal Reserve Board members would have influenced the BCRP’s decision, especially considering that at their June meeting, they anticipated only a 25bps cut for 2024, contrasting with their earlier projection of three cuts three months ago.

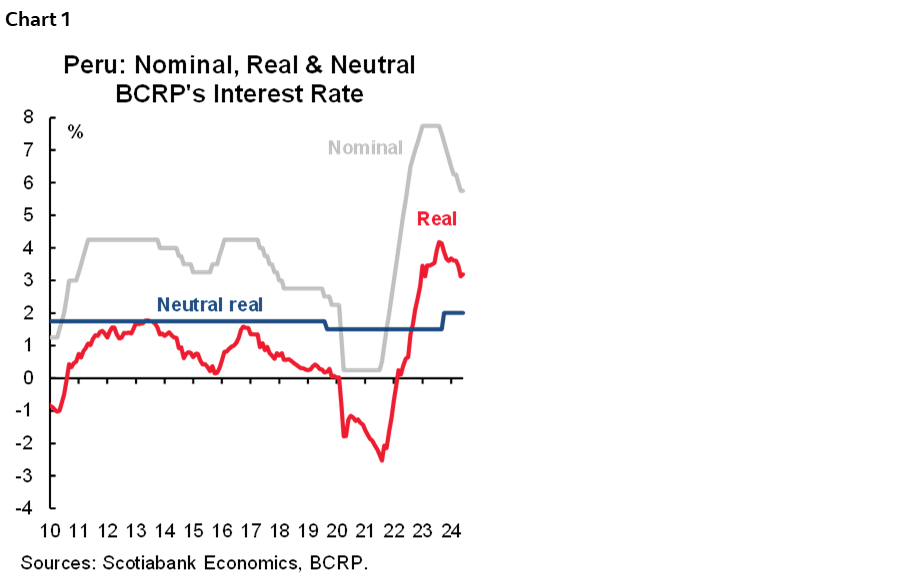

By maintaining the reference rate at 5.75%, the spread with the Fed rate remains at 25bps and the real interest rate increases from 3.1% to 3.2%, still far from the 2.0% considered a neutral level, reflecting a still contractionary stance (chart 1).

—Ricardo Avila

APRIL GDP FLOWERS

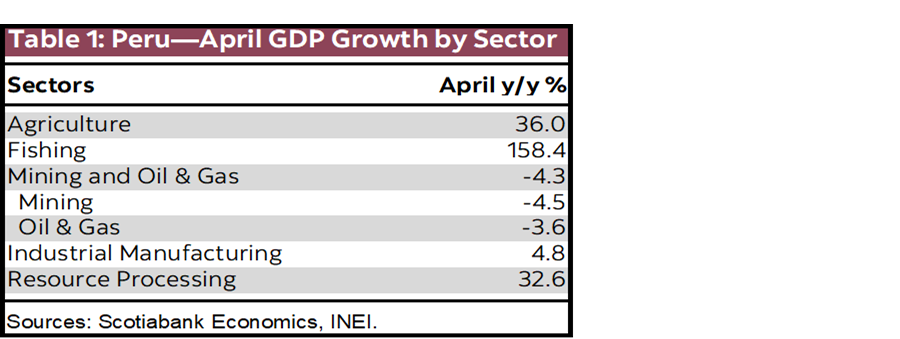

Newly released, early figures suggest that April GDP growth will surpass our previous estimate of 3.4% YoY, and could very well break through the 4% YoY mark. These recently released figures include agriculture GDP growth, which was reported up a whopping 36%, YoY. We were expecting a double-digit figure, but the actual figure was over twice our forecast.

Industrial manufacturing rose 4.8%, YoY. This was a nearly two-year high, and also exceeded our expectations. Resource processing, namely the industrialization of fishing, mining and agricultural production, rose 32.6%, also ripping through our, already high, forecast. Add to this the already known 158% YoY increase in fishing GDP (table 1).

On the other hand, and quite surprisingly, mining GDP fell 4.3%, YoY. Thankfully, this was mostly one-off, reflecting a two-day plant closure for maintenance purposes at Antamina, and a partial interruption at Volcan due to permit issues at its tailings dam.

This is the actual official GDP sector data released so far. In addition, cement consumption suggests construction could have risen 7.0% (our estimate).

When you put all these figures into the model mix, the aggregate GDP growth number that emerges for April is 4.4%. We shall know for sure once the figure is released over the weekend.

Note that such high monthly growth is not representative, as April saw the benefit of two additional work days due to an Easter calendar shift. Luckily, weather is now playing a supporting role for growth, with those sectors that were affected by El Niño in 2023, most notably agriculture and fishing, now rebounding with conviction. At the same time, April does not say much about how much of the growth is organic and not related to weather-related rebounds or special events. For that we will need to wait for May.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.