- Peru: April GDP at 5.3%; it could hardly be better!; Mining investment slows but there is progress in approving mining permits

PERU: APRIL GDP AT 5.3%; IT COULD HARDLY BE BETTER!

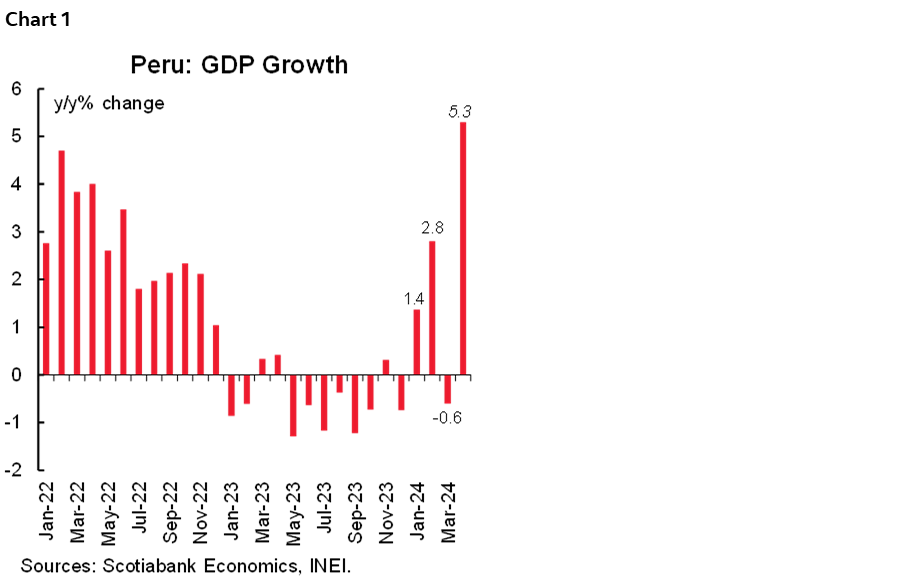

Yes, we were expecting a strong GDP figure for April, but the 5.3% YoY figure that was released this weekend soared past our expectations of 4.4% YoY growth. And we thought we were going out on a limb when we published our forecast. Note that the market consensus only reached 2.2%. Even the authorities got it wrong, as Finance Minister José Arista last week had initially stated that he expected 3.2% growth, only to offer that growth would surpass 4% a few days later (chart 1).

In any event, April GDP growth was the highest monthly figure since the economy rebounded from the COVID pandemic back in 2021. The question is, will it last? The short answer is probably not. The longer answer is that, even if growth that is consistently over 5% may not be in the cards for Peru anytime soon, growth should still remain quite robust.

One reason that April was special, is that April benefitted from two additional days due to the calendar shift in Easter holidays. This is part of the reason why April MoM growth figures are positive (versus March, which had two less days) nearly across the board, with hotels & restaurants the only exception.

The second reason, the absence of El Niño, the severe weather event that affected growth strongly during this period in 2023, will last for a bit longer in the year, but will also eventually dissipate.

The El Niño rebound effect will last at least until May, which will be another strong month. We expect around 4.0% growth as fishing and agriculture will once again rise sharply compared with May 2023.

More specifically, the April–May fishing season has been remarkable, and we expect yet another month of double-digit growth in fishing GDP. However, after May, fishing will be much closer to normal. High agricultural growth may last a bit longer, but probably not on par with April growth of nearly 24%.

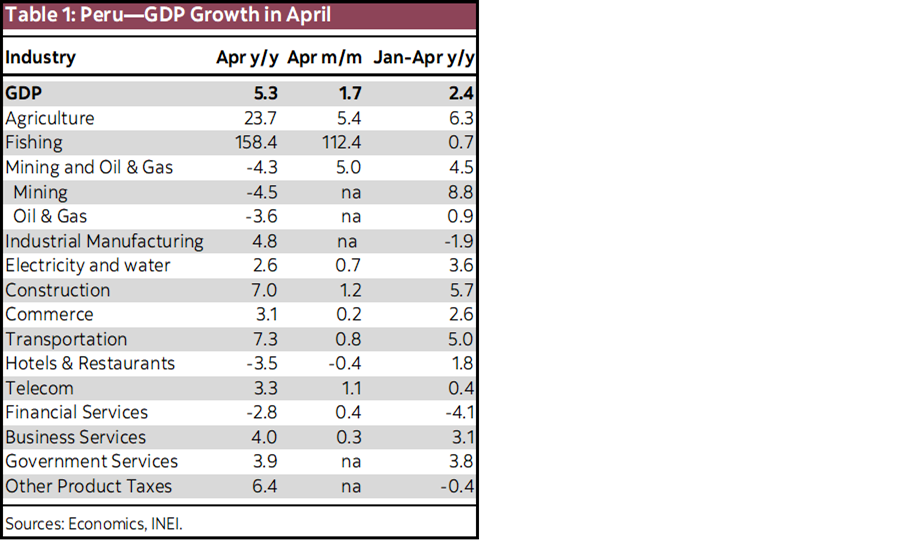

Thankfully, not all growth is due either to a calendar effect or to El Niño’s disappearance. Domestic demand sectors are picking up as well. Construction growth, 7.0% YoY in April, and 5.7% YTD, is no doubt linked to public investment, which rose nearly 40% in Q1-2024, and continued rising, up 44.5% YoY in May, according to the BCRP. Aside from public investment, we are also starting to see incipient signs of positive private investment growth (more infrastructure than residential), see table 1.

One of the more hopeful signs is the 4.8% increase in industrial manufacturing. We have been saying for a few months now that growth in Peru will lack sufficient conviction until industrial manufacturing, which is tightly linked to domestic demand, begins to perform better. The mildly positive growth in January–February was not quite enough, and was followed by an 8.2% decline in March that caught us off guard. So, while it’s a relief to see growth back in comfortably positive territory, after what happened in March, we’ll need to see a couple more months of positive growth before we feel comfortable that industrial manufacturing growth is here to stay (chart 2).

There is one more, somewhat curious, aspect to wonder about. The item officially presented as Other Product Taxes, which has not been a material contributor to growth in the recent past, rose 6.4% YoY in April, enough to appear on the radar screen. It is, however, not easy to gauge whether this component will continue to contribute or not going forward.

All in all, what current GDP growth figures are telling us is that growth is healthy and broad-ranged. Certainly, growth still represents more of a rebound from a difficult 2023 than anything else, but it’s starting to appear to be more than that, with a more organic component as well.

The labour market is also improving, albeit perhaps with a bit of a lag. Employment in Lima, the bellwether city, rose 4.7% in the three-months ending in May, with employment in the formal sector up 7.2% (informal employment only rose 1.4%). This is quite robust. Wait, there’s more. Household income rose 5.4%, YoY. This ratifies that, unlike 2023, household income is outpacing inflation, which should sustain positive consumption growth.

—Guillermo Arbe

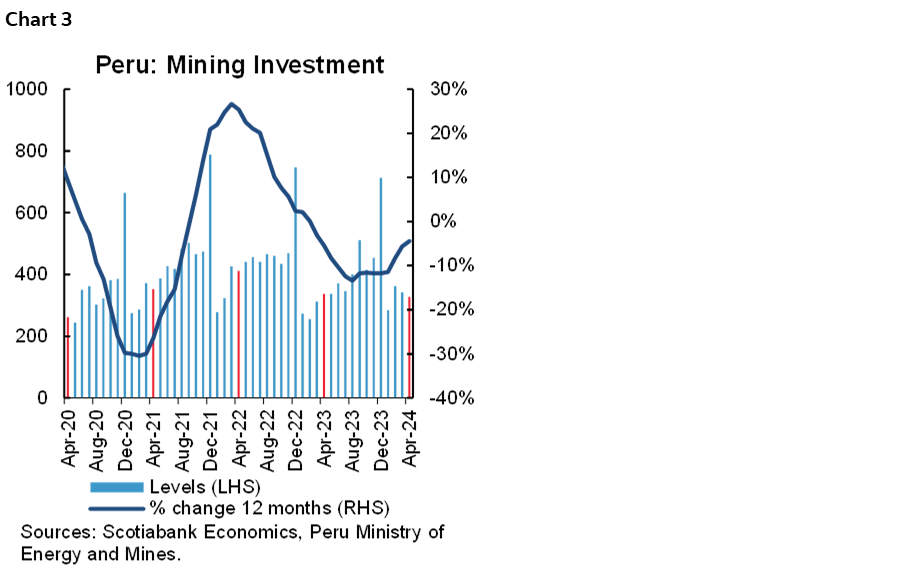

MINING INVESTMENT SLOWS BUT THERE IS PROGRESS IN APPROVING MINING PERMITS

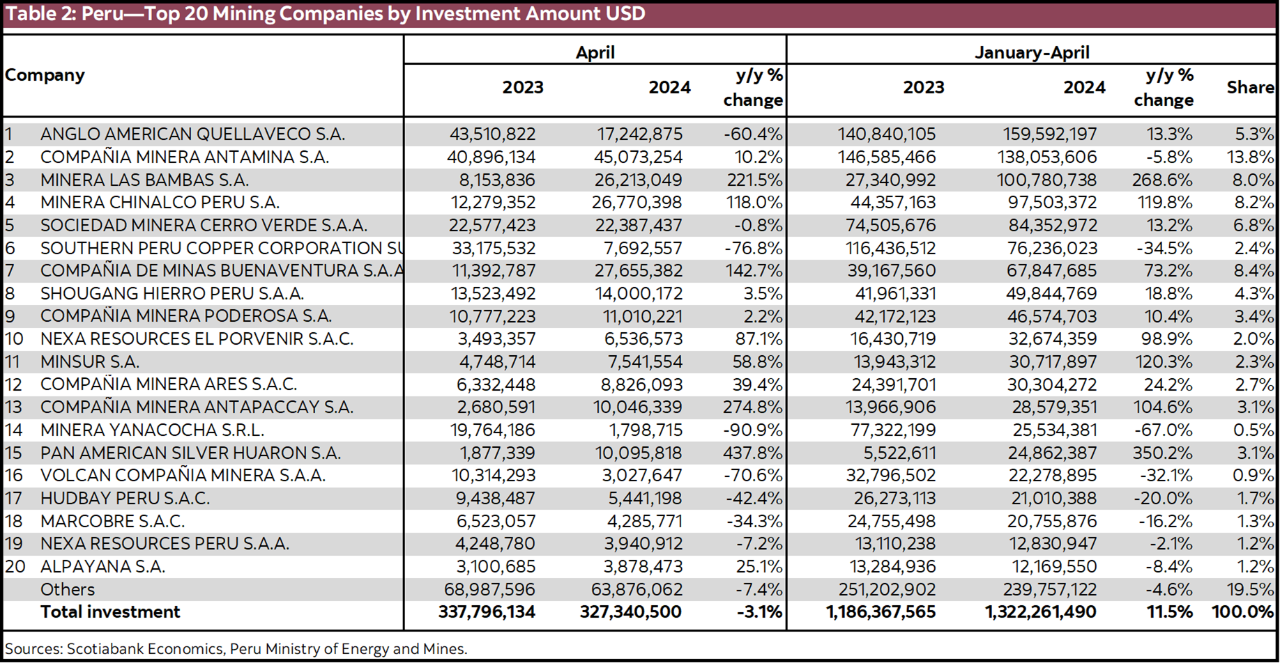

Mining investment fell 3.1% y/y in April, mildly better than the 6% drop we estimated (chart 3). The greatest deceleration came from Quellaveco (-60% y/y), as expected following the culmination of the investment stage of the new mine. This was compensated by greater investment at Antamina (+10.2%), Las Bambas (+221.5%), and Chinalco (+118%), in all cases thanks to the acceleration in the execution of brownfield projects. Investment in exploration continued to increase at a healthy annual rate (+16.6%), see table 2.

Government initiatives to reduce approval times for permits continued to advance. In early June the Ministry of Mines announced the approval of the modification of the Environmental Impact Assessment (MEIA-d) of the Tantahuatay Replacement project (Minera Coimilache), for more than US $1.5 billion, well above of US $127 million announced in the Mining Project Portfolio (March 2024 edition). This investment is expected to take place over five years. Additionally, the technical supporting report for the expansion of the Cerro Verde mining unit was also approved, for more than US $600 million, to be invested over three years, according to the company.

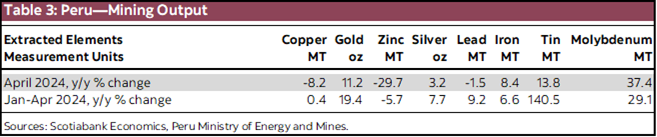

Regarding mining output, April had a mixed performance. Gold production increased 11.2%, led by higher output at Yanacocha (+33.5%), while the production of molybdenum continued to increase at a good pace due to the base effect of Quellaveco, which began to produce in May 2023, and also reflecting higher output at Southern Perú (+36.0%) due to better ore grades and recoveries. Silver production also increased for silver, up 3.2%, together with iron, up 8.4%, tin, 13.8%, and molybdenum, 37.4%.

On the other hand, copper output fell 8.2%, zinc was down 29.7%, and lead declined 1.5%. All of this was mainly due to the two-day stoppage of Antamina’s plant to carry out scheduled maintenance and due to the suspension of three Volcan mines, to update their operating permit for their tailings dam (table 3).

—Katherine Salazar

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.