- Chile: Labour market supports good GDP figures in April

- Peru: Eventful start to June, from low inflation to greater growth to pension fund developments

Overnight trading has a clear rates-averse stance with global curves bear flattening, first with a slight reversal of Thursday’s USTs rally in Asia and early-Europe and then a jump in yields on a stronger-than-expected Eurozone HICP release (with hot services). Unfortunately for markets, there’s not much in terms of details for what drove the surprise but airfares and accentuated base effects may account for the bulk of it. In any case, we still expect the ECB to cut 25bps next week, and skip its July decision.

The risk mood is so-so, as European cash equities are mixed while US futures trade 0.2/3% lower, with tech underperforming (see Dell taking a near-15% hit on earnings yesterday). The USD is mixed. High-beta FX like SEK, NOK, and CAD are stronger, which is an odd development considering disappointing Chinese PMIs data, higher US yields, and the soft mood in stocks; on top of that copper and oil are off about 0.5% while iron ore is flat. It’s the yields move that is dragging on the JPY and CHF that lag the majors and are perhaps preventing MXN gains today as the peso sits little changed just above 17 per USD.

Today’s main G10 event is the release of US PCE at 8.30ET, a print that is unlikely to bring markets on board with a first full Fed cut priced in before September as officials will need a good deal more of inflation data to build the confidence needed to begin easing. At the same time, Canada releases Q1 GDP data. The Fed’s communications blackout period begins tomorrow so we may have some post-PCE headlines on comments made by officials this afternoon to shake up markets.

In Latam, we have a flood of Chilean macro data for April at 9ET that should show a very strong turnaround from disappointing March figures. The March data were impacted by the timing of Easter that meant fewer working days when compared to March 2023. Now, April readings out today will reflect this same effect but in the opposite direction and thus show a strong performance across the board.

In the words of our Chile team in Wednesday’s Latam Daily “All in all, we anticipate a GDP expansion between 4 and 5% y/y in April owing to the positive contribution of the three additional working days compared to the previous year, which would have mainly benefited industry and mining. The above is compatible with our GDP growth projection of 3% for this year.“ It’s unlikely that today’s figures will see markets price in much more for a 50bps move by the BCCh in June (currently ~35bps priced in), but they may impact year-end expectations a bit more.

In Colombia, unemployment rate data out at 11ET is worth a look but these figures are usually not market movers. BanRep also meets today for a non-rate-setting meeting. There won’t be a statement or anything of the sort but board members may have a heated argument over the pace of further rate cuts and we may hear from them in coming days to present their case to the public.

Finally, we remind our readers that Peru will release May inflation data tomorrow, which BCRP Pres Velarde said yesterday could be closer to 0% (m/m). Our team in Peru outlines their projections for tomorrow’s print below, as well as their expectations for April GDP and an update on pension funds developments in the country. Of course, this weekend we also have elections in Mexico, which you can read about here.

—Juan Manuel Herrera

CHILE: LABOUR MARKET SUPPORTS GOOD GDP FIGURES IN APRIL

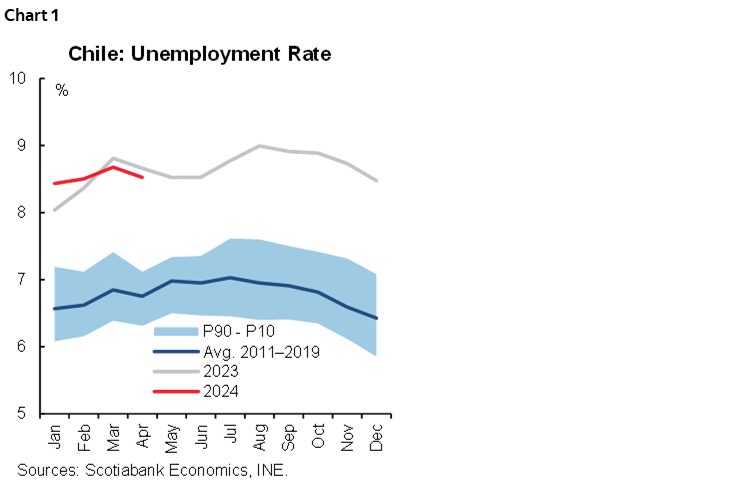

- Strong job creation—although with a high contribution of self-employment and informality—reduces the unemployment rate to 8.5%

The unemployment rate fell to 8.5% in the quarter ending in April (chart 1), positively surprising market expectations (consensus: 8.6%), partly thanks to renewed job creation (+31k) and a lower dynamism of the workforce (+16k). While the record is positive and reflects a dynamic labour market, at Scotiabank we are cautious about the recovery as the composition of employment remains fragile. On the positive side, the creation of jobs in sectors linked to investment (both public and private) stands out, while on the negative side, the destruction of salaried employment in commerce stands out, a sector that would be undergoing a re-composition towards informal employment.

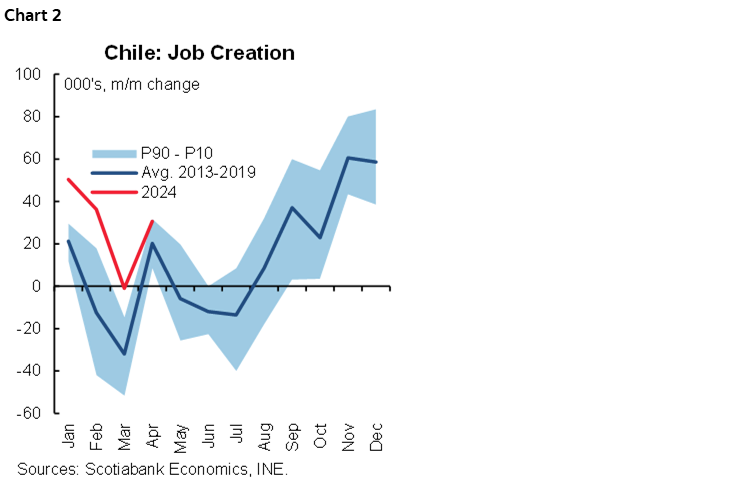

Strong dynamism in employment since Q4-23 is thanks to greater dynamism in public investment. In April, 31k jobs were created, once again at the top of its historical range (chart 2), while the labour force moderated the dynamism shown in recent months. As in the previous moving quarter, public administration stood out as one of the sectors that created the most salaried employment in April, which has contributed to sustaining the good dynamism of the labour market in the first months of the year. For its part, professional activities recovered the dynamism lost in March (possibly due to Holy Week) and contributed 28k new jobs. Much of this performance would be related to the strong rebound in public investment and the incipient improvement in private investment, increasing the dynamism in legal and accounting activities, consulting activities, architecture, engineering, among others. Along the same lines, salaried employment increased in the manufacturing industry and construction, the latter continuing the recovery observed since the end of last year.

Job destruction in commerce reflects the still weak performance of private consumption. The National Accounts for Q1-24 once again reveal that private consumption has remained practically flat for a couple of quarters, a trend that would continue at the beginning of this second quarter. Along these lines, 16k jobs were lost in the commerce sector, most of them salaried, reflecting a re-composition of employment in this sector where self-employment and informality would be gaining participation. Although these employment categories continue to lag far behind—so an increase in their participation is to be expected—it is still worrying since it implies lower quality and less sustainable employment. All in all, in April 20k informal jobs and 65k self-employed jobs were created, a figure higher than what was observed seasonally for the month of April.

—Aníbal Alarcón

PERU: EVENTFUL START TO JUNE, FROM LOW INFLATION TO GREATER GROWTH TO PENSION FUND DEVELOPMENTS

May Inflation

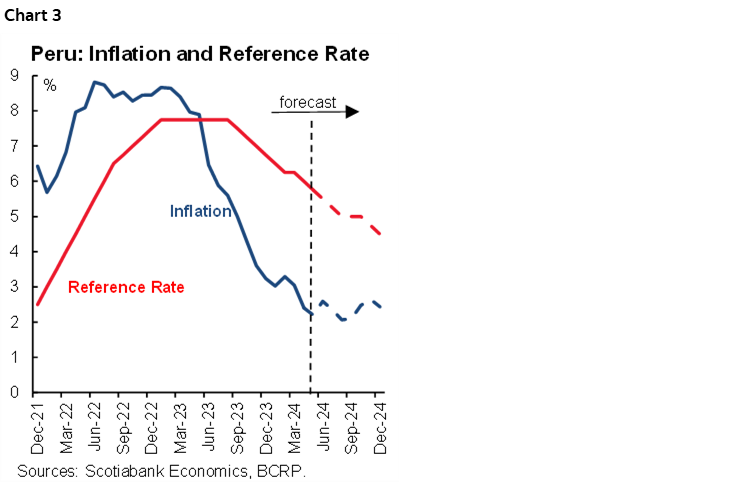

On Saturday, June 1st, the inflation figure for May will be released. The trend of key prices that we follow indicates that monthly inflation is likely to be very low, and has an equal likelihood of falling on either side of nil (chart 3). Low-to-nil inflation could take yearly inflation down from 2.4% in April, to 2.2% in May, very close to the elusive mid-point of the BCRP target range. It would be very hard to conceive that the BCRP would not reduce the reference rate again when it meets on June 13th under these circumstances. More so considering that the real rate is 3.1%, and would likely rise further, given the downtrend in inflation expectations, if the BCRP were not to lower its rate. Given all of this, we expect another 25bps decline in the reference rate, to 5.50%.

Note that this would close the gap with the FED rate. Would this worry the BCRP? Yes. But not enough, we believe, to prevent it from continuing to lower the reference rate as inflation falls. What’s more, BCRP president Julio Velarde has stated as much, explicitly stating that Peru’s reference rate could well fall below that of the FED. This suggests that Velarde may be coming around to the idea that this may be unavoidable, given the trend of Peru’s inflation versus stickier U.S. inflation.

April GDP

We are also expecting early data on April mining GDP, fishing GDP, cement sales and public sector investment in the coming days. We already know that fishing GDP growth will be very strong, perhaps rising as much as 145% YoY, given a robust fishing season this year, compared to last year’s extended fishing ban. We also expect other indicators, from mining to those linked to domestic demand, to have benefitted from the two additional days this April versus April 2023, given the Easter holiday date change. All in all, we remain comfortable with our forecast of 3.6% GDP growth for April. The data that will be released in coming days should ratify, or perhaps mildly modify, this view.

Pension Funds

A lot is happening these days. People with worker’s compensation accounts were given access to the full amount of funds in their individual accounts beginning in the last week of May. Worker compensation accounts are Peru’s substitute for unemployment insurance. The macroeconomic impact of withdrawals will likely be mild in itself, but will add to the much more important withdrawals from the private pension funds system, as authorized by Congress. The Superintendency of Banks has estimated, presumably based on withdrawals requests so far, that the full amount of withdrawals could surpass a hefty PEN28bn (USD700mn). Even though a good chunk of this is likely to be used to reduce debt, short term, and only part will filter quickly into consumption at first, it should still be enough to move domestic demand a bit in coming months.

Congress has the pension system very much in mind these days. On May 29th, the Congressional floor voted in favour of a pension fund reform. A second vote is needed, and the vote during this first round was tight enough (56 yays, 47 nays and 10 abstentions) to make it difficult to portend what the second round vote might be, when it takes place. It’s easy to vote in favour of something when you know you have the opportunity to re-think your position and vote differently in a future round.

As for the reform itself, the way the AFPs operate and manage individual accounts currently is not affected. Rather, the reform seeks to expand the scope of pension funds to those outside the system. However, it does so at a potentially high fiscal cost. The reform proposes to include those that are not affiliated to the current private or public pension fund format, by assigning 1% of their billed purchases of consumer goods to individual accounts. Presumably, this 1% would be subsidized by the State. One wonders if Congress has contemplated the logistics of implementing this aspect of the reform. Additionally, the reform would institute a PEN600mn minimum pension for retirees, also presumably state financed. The initiative, however, still has a way to go before it becomes law, and a lot may happen along the way.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.