- Peru: BCRP takes its reference rate below the Fed’s; Post-Fujimori politics; The Petroperú saga

PERU: BCRP TAKES ITS REFERENCE RATE BELOW THE FED'S

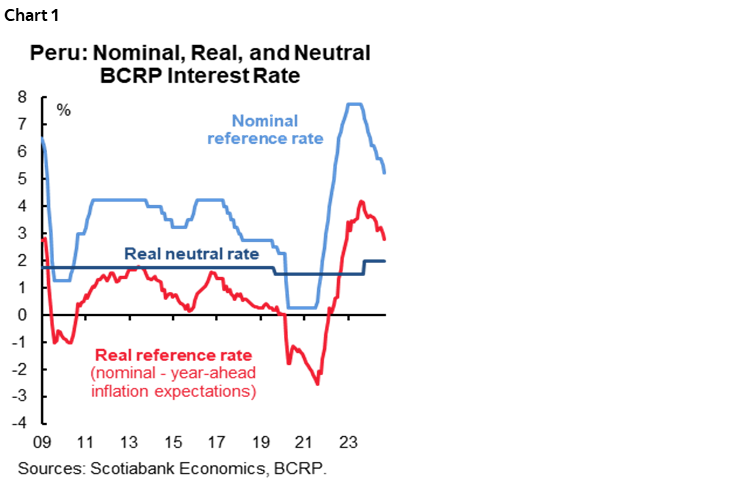

The board of the Central Bank of Peru (BCRP) was ahead of the Fed’s decision next Wednesday and cut its policy rate by 25 pbs, to 5.25%, contrary to our expectation at Scotiabank but in line with the market consensus (the Bloomberg median). With this decision, the spread between the BCRP and the Fed’s effective rate is negative.

The BCRP board highlighted in its statement that it cut the rate for two main reasons: 1) Core inflation decreased from 3.0% in July to 2.8% in August, within the target range (1%–3%) and forecasted that it would continue to decline; and 2) Local headline inflation decreased from 2.1% in July to 2.0% in August (the midpoint of the target range) and global headline inflation would continue to decline by year-end.

By cutting the reference rate at 5.25%, the spread with the Fed rate upper bound is now negative (-25 bps) and the real interest rate has fallen to 2.8%, approaching the 2.0% considered a neutral level. However, this still reflects a contractionary stance.

Despite the cut, the statement has a more cautious tone by specifying that the BCRP expects inflation to remain within the target range, unlike the August statement, which indicated that inflation would be around the midpoint of the target range (2%). That means that inflation would be above 2%. This was already anticipated by us, inflation will rise at the beginning of 4Q24, before moderating to 2.5% at the end of the year. On the other hand, the statement indicates that the decision does not mean consecutive cuts, a guidance that has not been present in the past.

Inflation is under control and the economic expectations are good. Considering that Fed does not meet in October, possible pressures on the PEN caused by strong maturities of derivatives placed by the BCRP and the negative spread, would lead the BCRP to keep its rate unchanged, due to wider short-term spreads that will keep the PEN on the defensive.

—Ricardo Avila

PERU: POST-FUJIMORI POLITICS

Former President Alberto Fujimori (1990–2000) passed away on September 11th. Curiously enough, this was the same date when his nemesis Abimael Guzman—who led Sendero Luminoso—died in 2021.

My initial impression was that Fujimori’s passing would not alter domestic politics significantly as Fujimori was currently no longer a figure of political prominence. That’s largely true, if you restrict your view to day-to-day politics.

However, at second thought, I wonder if his passing might have some bearing on the 2026 presidential elections. For one, it eliminates the rivalry in leadership between Keiko Fujimori and her father Alberto within the Fuerza Popular Party. And yet, that may not be the most important impact, in that it might not strengthen Keiko’s position within or outside of Fuerza Popular. Keiko’s political power relies largely on a team of political operatives that she has built. She began her political career as a stand-in for her father, and initially garnered support thanks to the prestige of her father. She has since lost much of this prestige, due to her own doing. She certainly does not enjoy the prestige that her father had. At least not currently, if ever at all. Nor does she generate the enthusiasm that her father did.

Without her father’s overriding presence and prestige as a backdrop, there seems to be a fair chance that Keiko will wield her unrivaled power within a Fujimorista movement that risks withering away over time. The test will be the 2026 elections. In past elections, Keiko seemed to enjoy a strong base support of between 10% and 15% of the population, enough to have secured a place in the second round in both 2016 and 2021, although not enough to win either election. But is this a strong Keiko base or a strong Alberto base? Alberto Fujimori’s passing could lead to people abandoning the Fujimorista movement, rather than to Keiko gaining new adherents. And, in elections as tight as they have been, every point that the Fujimorismo movement loses makes it more likely that another candidate will make it into the second round instead of Keiko. That would potentially make the 2026 election a very different process than the last two.

—Guillermo Arbe

PERU: THE PETROPERU SAGA

The other key issue that is making headlines is Petroperú. The government has us all waiting for the details of “urgency decree” (Decreto de Urgencia, DU) that the cabinet would have approved also on September 11th to deal with the Petroperú debt, solvency, and management issues. For some, the cabinet decision has come too late, occurring a day after Petroperú’s head of the board of directors, Oliver Stark, resigned. The reason given for the resignation was precisely the lack of response by the government regarding the Petroperú crisis. In particular, Petroperú was (is) apparently reaching the end of its tether in terms of the liquidity it requires to continue operating.

Underneath, however, the local press was reporting that the resignation also had to do with pressure coming from President Boluarte to have the board appoint Oscar Vera as CEO of Petroperú. Vera is widely viewed as having mishandled Petroperú when he was general manager of the company in 2022, and later as Minister of Energy & Mines from 2022 to early 2024.

Returning to the DU, the current Minister of Energy and Mining, Rómulo Mucho, gave a press conference that gives us an idea of what the DU may contain.

The first thing to state is that Minister Mucho is well perceived as a serious and knowledgeable authority. His words carry weight, and it is a good thing that he is the spokesperson for the government on this issue.

These are the main ideas that we have been able to extrapolate from Minister Mucho’s press conference:

- The main objective of the DU (decreto de urgencia) would be to make Petroperú “financially viable”, in words of Minister Mucho.

- Minister Mucho used the term “aporte”, which broadly translates to a financial support commitment. How much of a commitment and of what nature, we don’t know.

- To stress the point of providing financing, Minister Mucho stated that Petroperú must continue honoring its commitments and have sufficient available liquidity to purchase fuel. This alludes to the fact that Petroperú is running out of liquid resources to operate. The DU would presumably ensure that Petroperú is provided with the liquidity it needs to operate.

- Minister Mucho also suggested that the DU would introduce “radical austerity measures” at Petroperú. For starters, there would be a 10% decrease in spending this year, with consideration given to a possible 30% decrease in 2025.

- There was no mention of Oscar Vera being designated CEO. Hopefully, this means his name is no longer on the table.

- Although Minister Mucho mentioned the possibility of hiring an outside manager, this is apparently not included in the DU. What’s more, Minister Mucho stated that Petroperú “has a structure that includes certain methods” that have become entrenched during its 50-year history, perhaps suggesting that it might not be easy to find an outside manager. My interpretation: the groups resisting change within Petroperú would offer such a strong resistance to an outside manager, that the government feels this may not be a viable option.

Meanwhile, the situation is in flux, but we expect to things to begin to get defined fairly soon. The question is how convincing the solution will be in terms of short-term costs and long-term sustainability.

—Guillermo Arbe

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.