SUMMARY

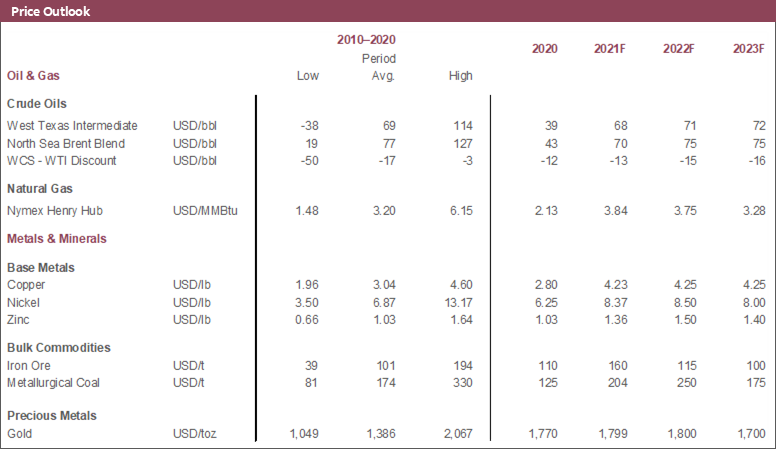

- Our January 19, 2022 economic projections assume: a significant but short-lived drag from the omicron variant, stronger inflation, and a monetary policy response; still, we expect commodity prices to remain elevated this year and next (chart 1).

- We anticipate that crude values will remain well-supported above the 70 USD/bbl mark in the next several years, but ease from their current levels near 85 USD/bbl.

- We expect WCS’s discount to WTI to hover between 14.50 and 15 USD/bbl in 2022, with new egress capacity offsetting rising production, still-recovering refinery activity, and more abundant heavy sour crude in the US Gulf Coast (USGC).

- Our copper price forecasts are unchanged—we still expect the red metal to fetch a record high 5 USD/lb by mid-decade—while we’ve raised our projections for nickel values higher in respect of late-2021 momentum.

- With US interest rate hikes now expected to come earlier and more frequently this year, we have lowered our gold and silver price forecasts incrementally.

MORE RESTRICTIONS, MORE INFLATION, MORE RATE HIKES

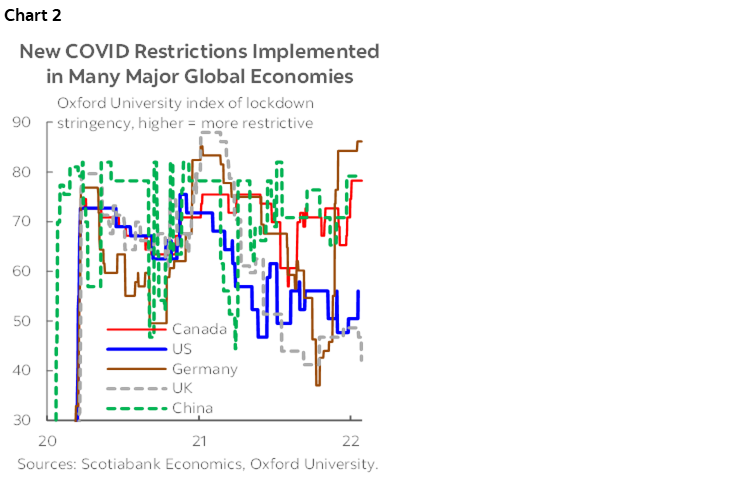

We have updated our economic projections in two key ways: a) a more significant, though short-lived drag from omicron variant restrictions, b) stronger inflation globally. Stricter containment measures in many countries (chart 2) will bite in the first quarter of 2022, but we foresee a bounce-back in global growth in Q2—caseloads have peaked in many jurisdictions and restrictions have begun to ease. With capacity limitations across much of the world and our updated assessment of supply chain constraints’ outsized impacts on inflation, we have also upped our forecasts for price growth, and penciled in a greater degree of persistence through 2023.

In light of those changes, Scotiabank Economics predicts more robust monetary policy responses across the world. Even with a Q1 slowdown, we now expect both the US Federal Reserve and the Bank of Canada to increase policy rates by 175 bp by the end of this year. This was our view before last week, when markets caught up with the latest central bank communications.

CRUDE FORECASTS RAISED, BUT PRICES TO EASE FROM CURRENT HEIGHTS

Our latest commodity price forecasts assume that crude values will remain well-supported in the next several years, but ease from their current levels near 85 USD/bbl. We expect WTI to average 71 USD/bbl this year and 72 USD/bbl in 2023; for Brent, we anticipate an annual average of 75 USD/bbl in both years. Upward revisions since our last set of projections reflect the degree of global market tightness that has lifted prices since October. They also incorporate our expectation that—eventually—the global economy will continue to recover as COVID-19 is brought under control, reopening proceeds, and supply chain issues ease. Our view that crude values will fall from current heights is based on the assumption that OPEC+ production increases will go ahead as planned, leading to an inventory build and pushing global supply above demand in H1-2022.

Yet, with such a strong first month of 2022 and two of the drivers of the recent spike in crude values likely to persist in the coming months, there is upside risk to our latest set of projections. For one, several reports have broken that some OPEC+ members have not been able to ramp production up to target rates. We expect Libyan crude output in particular to continue to be impacted by domestic political challenges; broadly, recent years’ underinvestment amid a volatile price environment could contribute to declining spare capacity. Second, Russia-Ukraine tensions appear likely to persist for some time. This could continue to boost crude values directly if sanctions on Russia’s oil industry disrupt supply, or indirectly if a spike in natural gas prices fuels more gas-to-oil substitution.

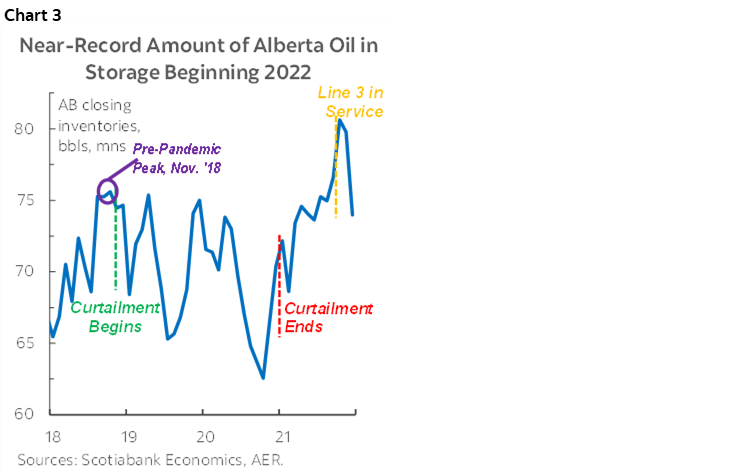

For WCS, we expect the discount to WTI to hover between 14.50 and 15 USD/bbl in 2022. This year, rising Canadian output and a high number of barrels in storage (chart 3) should contribute to looser market balances, and we begin 2022 with seasonally weak USGC refinery activity. As more OPEC+ barrels are pumped, that should also increase the availability of heavy sour crude in the USGC, thereby reducing Canadian barrels’ recent competitive advantage. The good news is that we expect these forces to be roughly offset by new Canadian pipeline egress capacity in the form of the now operational Line 3 conduit. The completion of TMX—which we anticipate in H1-2023—should add further support over the longer-run.

INDUSTRIAL METALS OUTLOOK SOLID

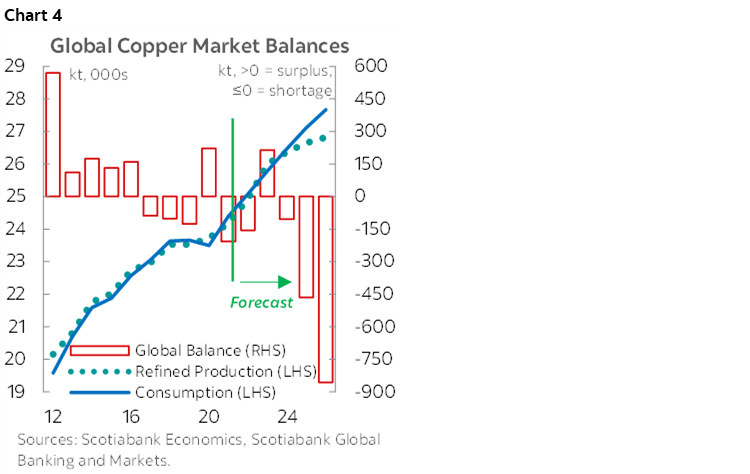

We continue to anticipate that copper values will climb from an average of about 4.25 USD/lb towards a record level near 5 USD/lb by mid-decade. In the next couple of years, we expect the global recovery to keep values of the bellwether red metal strong, with supply disruptions via Latin American geopolitical developments likely to provide additional pricing support. Over the longer-run, we assume that strong demand growth will come via global decarbonization efforts—copper is expected to be a key input for battery production and climate infrastructure construction. With few new copper mines or major capacity expansions expected in the next few years—we assume production growth of just 1% per year from 2024 to 2026—weak supply growth (chart 4) should further contribute to price gains.

Since the last quarterly update in October 2021, we have increased our nickel price projections for 2022 and raised our long-run price assumption from 8 USD/lb to 8.50 USD/lb. Demand for stainless steel products—for which nickel is a key input product—drove a supply-demand deficit in 2021, but we still expect the metal’s global market to be oversupplied for the next four years as Indonesian production ramps up.

For iron ore, we anticipate stability following a turbulent 2021. In the summer of last year, a combination of hefty gains in Chinese steel production—into which iron ore is a key ingredient—and tight supply out of Brazil drove prices to record highs near 230 USD/t. Second-half output curbs in the Middle Kingdom to meet emissions targets then anchored a plunge towards 90 USD/t. We anticipate virtually flat steel production out of China this year, with support from the infrastructure and manufacturing sectors ramping up after the Winter Olympic Games, though a more significant-than-expected real estate market correction presents downside risk for steel demand. Guidance from company statements also suggests that major iron ore producers will remain challenged in increasing shipments.

PRECIOUS METALS PROSPECTS STRONG DESPITE MORE AGGRESSIVE MONETARY POLICY

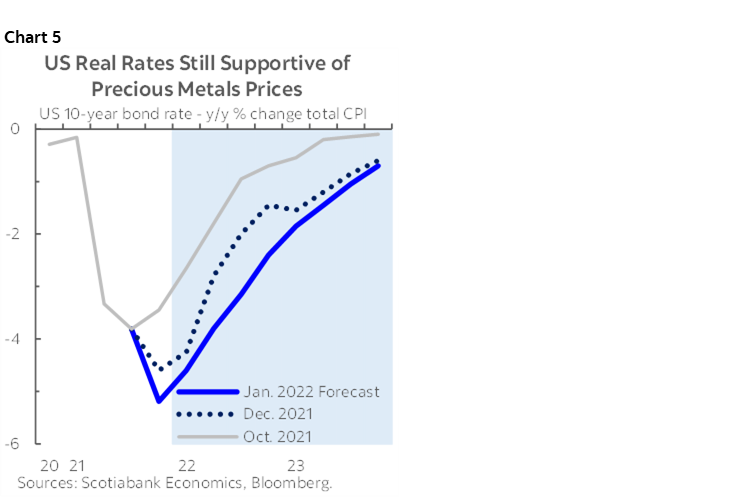

With interest rate hikes now expected to come earlier and more often this year, we have lowered our gold and silver price forecasts incrementally. For bullion, we now project an annual average of 1,800 USD/oz—$50/oz lower than previously—with silver’s 2022 mean revised 0.50 USD/oz lower to 24.50 USD/oz. Despite the downgrade, our projection for gold in 2022 would still be the highest annual average price since at least 1988. Given the acceleration in inflation, the rate environment remains very accommodative despite our more hawkish shift—our forecast is consistent with negative real US 10-year rates through 2023 (chart 5). Market uncertainty should also remain elevated albeit easing as we continue to grapple with COVID-19, which supports the attractiveness of precious metals as safe haven assets.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.