SUMMARY

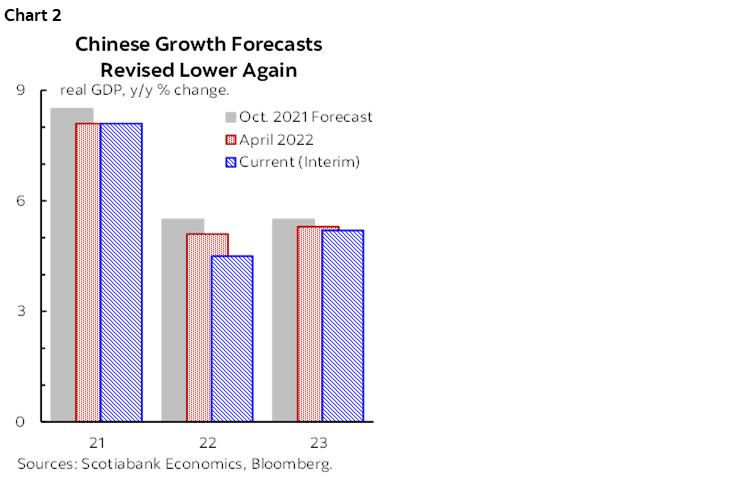

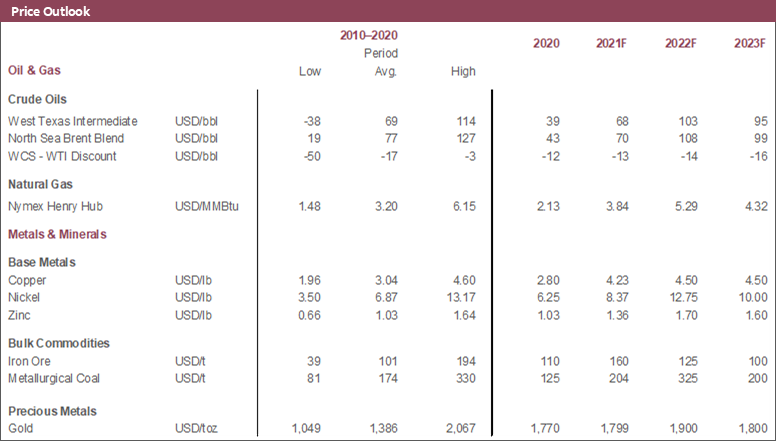

- We remain confident in our call for a strong, albeit easing global expansion this year and next despite some negative data prints and bearish financial markets, but deterioration of China’s growth poses downside risks to the commodities outlook.

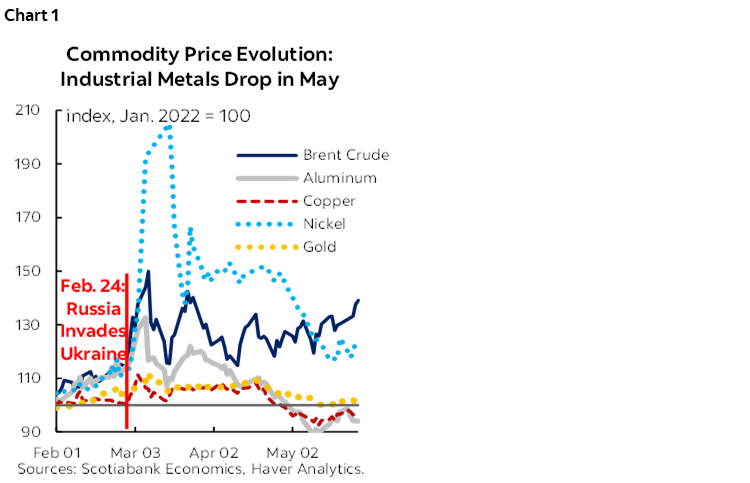

- The impacts of that weakening are most evident in prices of industrial metals, many of which have fallen from record highs to levels below those attained before the Russian invasion of Ukraine (chart 1).

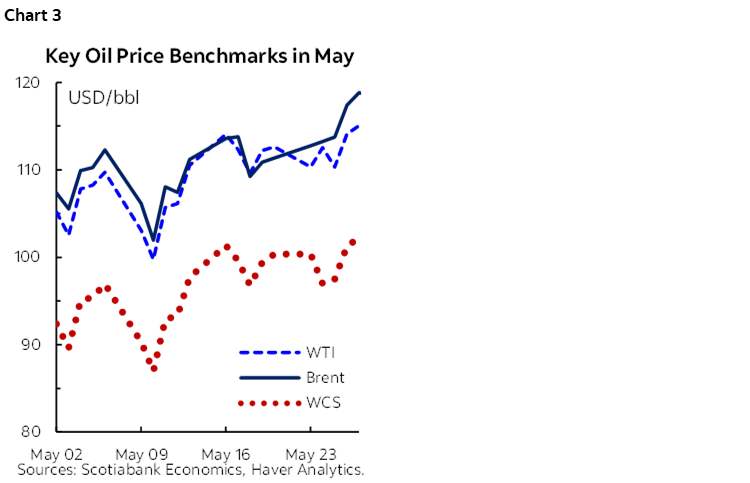

- Both light oil benchmarks began May weakly but then rallied towards 120 USD/bbl as peak US gas consumption season began; this is broadly in line with expectations outlined in our last quarterly forecast publication.

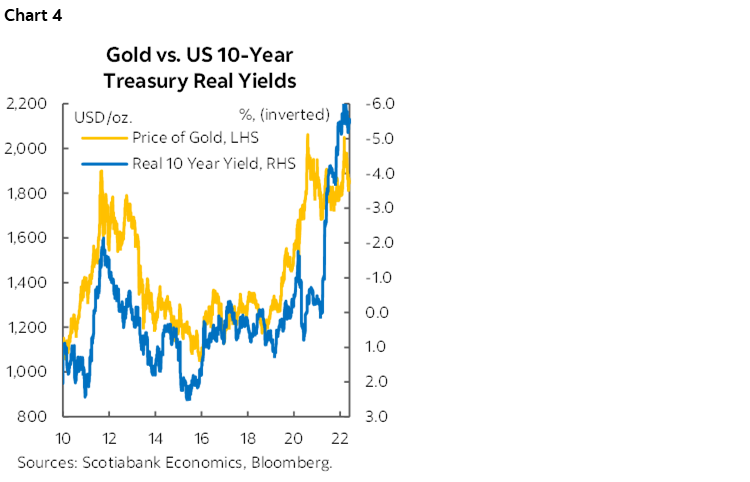

- Gold prices averaged about 1,850 USD/oz this month—about 90 USD/oz lower than in April—hurt by increasingly hawkish signals from the US Federal Reserve.

CHINESE SLOWDOWN HANGS OVER GLOBAL OUTLOOK, COMMODITY PRICES

Despite some negative data prints and the broad downturn across financial markets, we remain confident in our call for a strong, albeit easing global expansion this year and next. In particular, we note much-better-than-expected retail sales and industrial production numbers coming out of the US. These reinforced our view that the world’s largest economy is running hot alongside signs of robust domestic demand in the Q1-2022 GDP print (beneath the disappointing headline). With inflation still setting multi-decade highs across the world, we expect global central banks to continue to raise their policy rates aggressively, but that still-low borrowing costs plus pent-up demand and capacity pressures should keep the world economy from recession. The 50 bp hike and forward guidance on offer from the Federal Reserve in May appear to confirm our take.

If there was a major change in global economic prospects this month—and the outlook for prices of major commodities in our coverage universe—it was the deterioration of growth in China. We have revised our forecast for the world’s second-largest economy to 4.5% real growth this year—weaker than the 5% pencilled in in April (chart 2)—given the severity of April–May lockdowns to stop the spread of the latest COVID-19 wave wreaking havoc across the country. Those should have a pronounced impact on growth in Q2-2022, in which premier Li Keqiang has admitted could see a contraction. We anticipate that further easing of restrictions plus stimulus measures planned by the central government will contribute to a rebound in H2-2022. Yet, it will likely be a more modest one than in 2020 following the initial pandemic wave given local government financing constraints.

AS DRAGON’S FIRE COOLS, SO DO INDUSTRIALS

The impacts of weakening Chinese growth are most evident in prices of industrial metals. Their values have fallen below their levels from before the Russian invasion—a striking result given the record highs attained just a few months ago. Copper traded near 4.25 USD/lb for most of May—some of the lowest levels since early 2021—hurt not only by the fact that the Middle Kingdom makes up more than half of global demand, but also by the recession narrative that has pervaded financial markets. The metal is often viewed as a bellwether of world economic conditions given its widespread use in the manufacturing and construction sectors. Nickel values have also fallen back on these signals plus an unwinding of previous speculative activity. In a heightened risk environment, appreciation of the US dollar—in which these commodities are priced—created downward pressure.

Our forecasts assume that still-strong economic growth and China’s eventual recovery will put a floor under prices for industrial metals as the year progresses. However, there is a real risk of volatility in the coming months as financial markets work through their current bout of risk-off sentiment and Chinese lockdowns continue.

CRUDE RALLIES FOLLOWING EARLY MONTH DIP

At the intersection of multiple forces, oil markets began the month weakly but rallied above 120 USD/bbl to conclude the month; for now, this does not impact our forecasts. Initially, crude values followed the pessimistic economic growth and fuel consumption narrative that pervaded financial markets, which dominated tightness via soft OPEC+ output numbers that were held back by the bloc’s capacity limits. WTI also notably surpassed Brent for a short time (chart 3) in part because anticipation of Europe’s potential all-out ban of Russian oil imports prompted traders to flock to non-European oil. Even though talks have stalled, some relaxation in Chinese COVID-19 restrictions has buoyed crude just as the US begins the peak gasoline consumption season. Ultimately, however, WTI and Brent have averaged about 105 and 108 USD/bbl, respectively, so far in Q2-2022—roughly in line with our last set of projections. We continue to anticipate that both light oil benchmarks will trade in the 100–130 US/bbl range over the next 12–18 months.

WCS’s discount to WTI hovered in the 12.70–12.90 USD/bbl range in May—roughly in line with the April average. The Canadian benchmark largely appears to be following global demand. Production continues to trend generally higher in Western Canada amid strong prices but will likely be held back by broad capital discipline and diminished turnaround season activity. Beyond this quarter, we still expect the WCS- WTI differential to hover in the 13–15 USD/bbl range.

SAFE-HAVEN PRECIOUS METALS PRICES DROP DESPITE RISK-OFF MOOD

Gold prices averaged about 1,850 USD/oz this month; the nearly 90 USD/oz drop versus April’s mean was the largest one-month decrease since March 2021. Though bullion is traditionally seen as a safe-haven asset in times of economic uncertainty, it is also priced in US dollars, which have been significantly bid up amid the risk-off mood in financial markets. That has weighed on yellow metal values writ large. More broadly, the softer profile for gold mirrors an increasingly hawkish Federal Reserve. Over the long-run, the metal tends to correlate negatively with US real rates (chart 4); those are trending higher with policy rates set to rise aggressively and as US personal consumption expenditure inflation gains appear to be tentatively moderating. Any surprises with respect to US monetary policy will surely impact gold values going forward.

Silver prices fell by nearly 3 USD/oz in May—their worst decline since March 2020. Influenced by the same forces as gold, silver is also a key input into a range of industrial sector applications and was surely weighed down by expectations of slowing global growth.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.