- Canada’s economy looked good for weak reasons

- Government drove 80% of Q2 GDP growth…

- ...mainly because governments gave their workers retroactive hand-outs

- The private economy largely stalled out

- There is no baked-in momentum into Q3 GDP growth

- As the government effects shake out in Q3…

- ...GDP growth will require consumers to unleash their horded savings

- BoC to cut –25bps next week, monitor pent-up arguments, avoid up-sizing

- US consumers may have Canada’s back

- Canadian GDP, Q2 q/q SAAR, %:

- Actual: 2.1

- Scotia: 1.8

- Consensus: 1.8

- Prior: 1.8 (revised up from 1.7)

- Canadian GDP, June, m/m SA, %:

- Actual: 0.0

- Scotia: 0.0

- Consensus: 0.1

- Prior: 0.1 (revised down from 0.2)

- July GDP ‘flash’: 0% (“essentially unchanged”)

Canada’s economy put in a weak performance in Q2 if we take government out of the equation and also appeared to lose momentum as the calendar quarter flipped over from Q2 into Q3. This is the perspective I shared with staff and clients quickly off the 8:30amET mark as opposed to the initial newswire interpretations.

LOOKS GOOD ONLY ON THE SURFACE

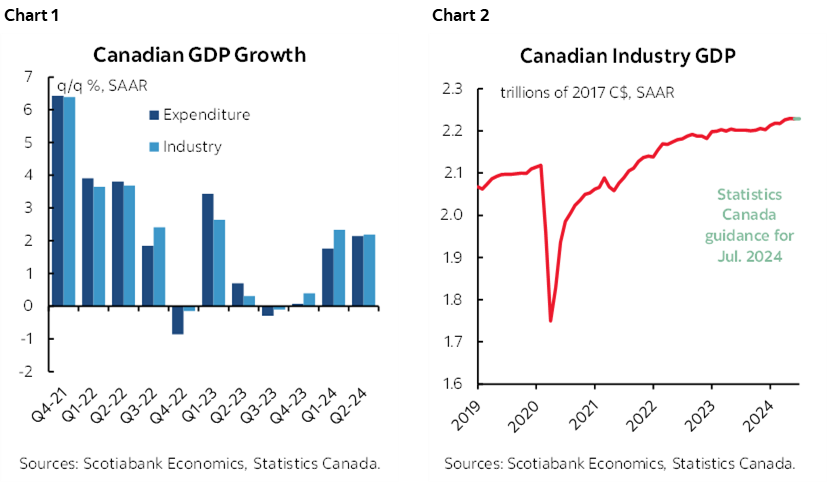

On the surface, Q2 growth of 2.1% q/q SAAR beat expectations by a handful of tenths. It was also revised up a tick to 1.8% in Q1.

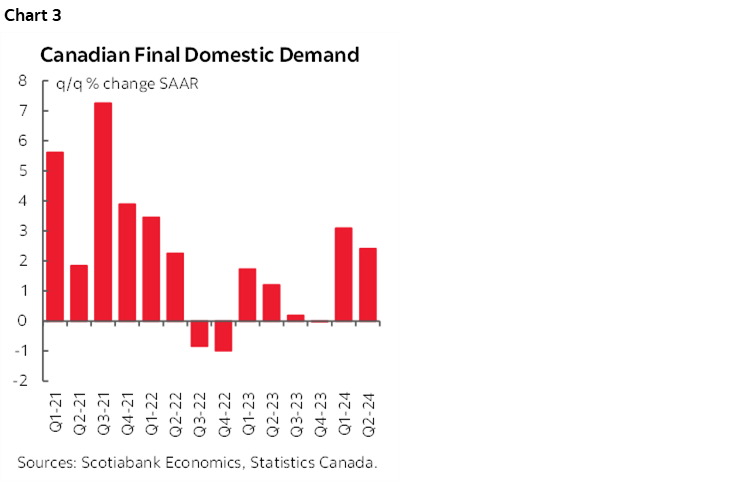

Chart 1 looks impressive compared to the distortions that dragged growth lower in 2023. So does chart 2 that shifts gears to plotting monthly GDP.

So does chart 3 that shows Final Domestic Demand (which removes inventories and trade to get at the domestic economy).

The problem lies in what drove that growth—and what did not—and the fact that the growth drivers were probably very short-lived. It’s a textbook example of how GDP can be misleading.

MOST GROWTH CAME FROM GOVERNMENT HAND-OUTS TO THEIR WORKERS

The composition of growth in Q2 was not great as shown in chart 4.

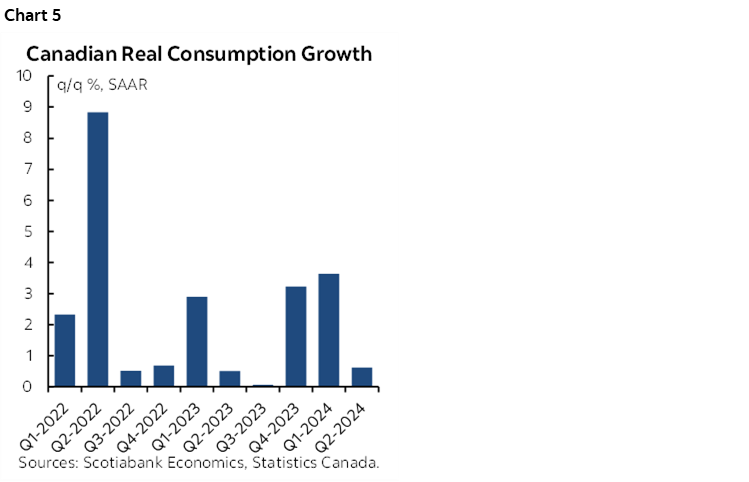

After two quarters of strong 3%+ q/q SAAR gains in real consumption in Q4 and Q1, Q2 flat lined with real consumption up by only 0.6% q/q SAAR, contributing just 0.3 ppts to Q2 annualized growth (chart 5).

Q2 GDP growth came from government spending that contributed 1.3 ppts to q/q SAAR GDP growth in weighted contribution terms. Further, government capital investment added another 0.4 ppts. All combined, government accounted for about 80% of Q2 GDP growth. This reliance on the public sector is disconcerting. For the most part, governments do not create wealth. They can set positive or negative conditions for growth and transfer riches around, but it’s the private sector that creates wealth and the private sector was weak during Q2.

Where did all this government spending come from? Largely via retroactive wage increases given to their workers at various levels of government which counts as government expenditure in the GDP accounts. Statcan noted that retroactive wage increases by the Federal government played a transitory role in boosting gov't spending:

"Government expenditures rose 1.5% in the second quarter, as there were increases in compensation of employees, which is an expense for governments, and hours worked across all levels of government."

But the gain in government spending seems widespread across levels. Statcan also had this to say:

"Compensation of employees rose 1.6% in the second quarter after increasing 1.5% in the first quarter. Growth in the second quarter was led by increased wages in health care and social assistance, educational services and finance and insurance. Retroactive payments associated with arbitration decisions for members of the Ontario Secondary School Teachers' Federation and Elementary Teachers' Federation of Ontario were a large contributor to the wage growth in educational services."

Talk about government taking care of itself. Perhaps making sure their workers remember it come election time. Canada’s economy will lose this effect in Q3, so other growth drivers had better pick up!

Housing investment dragged 0.6 ppts off of GDP.

Business investment added 0.9 ppts mainly through equipment spending which is welcome.

Exports subtracted 0.6 ppts. Imports added 0.2 ppts.

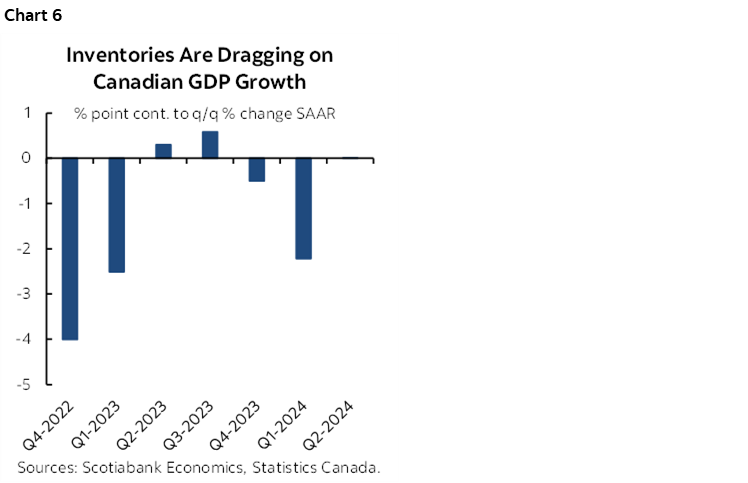

Inventories were soft and made no contribution (chart 6).

In short, Q2 was a government report on Canada with an assist from equipment spending.

HOW GOVERNMENTS WILL PLAY THIS REPORT

So, bring on momentum toward the Federal fall economic and fiscal update. Freeland & co will treat this as evidence that gov't spending is the main game in town and gosh it couldn’t possibly go away now could it. That's exaggerated in a trend sense and it's just one quarter, but still, an election year beckons and the free spending Trudeau-Singh-Freeland team will probably prime the pumps especially given their awful polling.

WILL CONSUMPTION PICK UP?

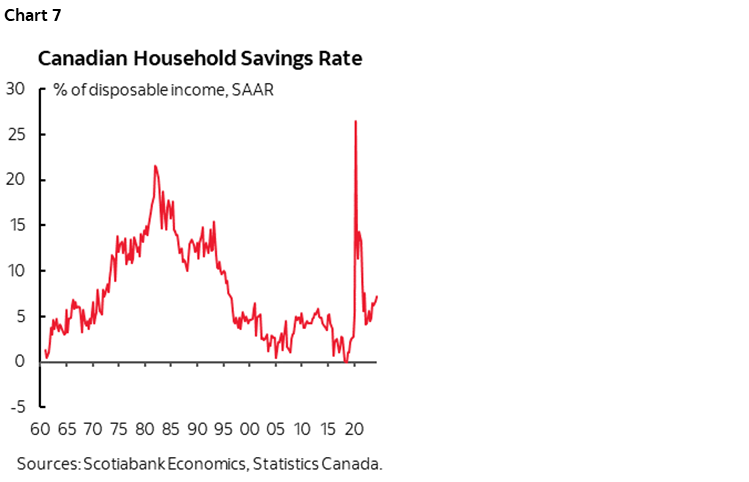

One possibility is that this sudden embarrassment of riches bestowed upon government employees may be spent into Q3 and/or the holiday shopping season. That’s assuming that the disbursements don’t continue to be horded. The personal saving rate has been climbing for a while now (chart 7) perhaps partly driven by precautionary motives and, for some, to prepare for mortgage resets albeit that the rally in bond market drivers of fixed rate mortgages is lessening this effect. It’s not clear whether horded savings will be spent or continue to be stockpiled and for how long, but an acceleration of consumer spending into Q3 is likely to be required in order to offset the impact on GDP growth of when the lift to government spending caused by retroactive wage disbursements reverses and drags growth lower.

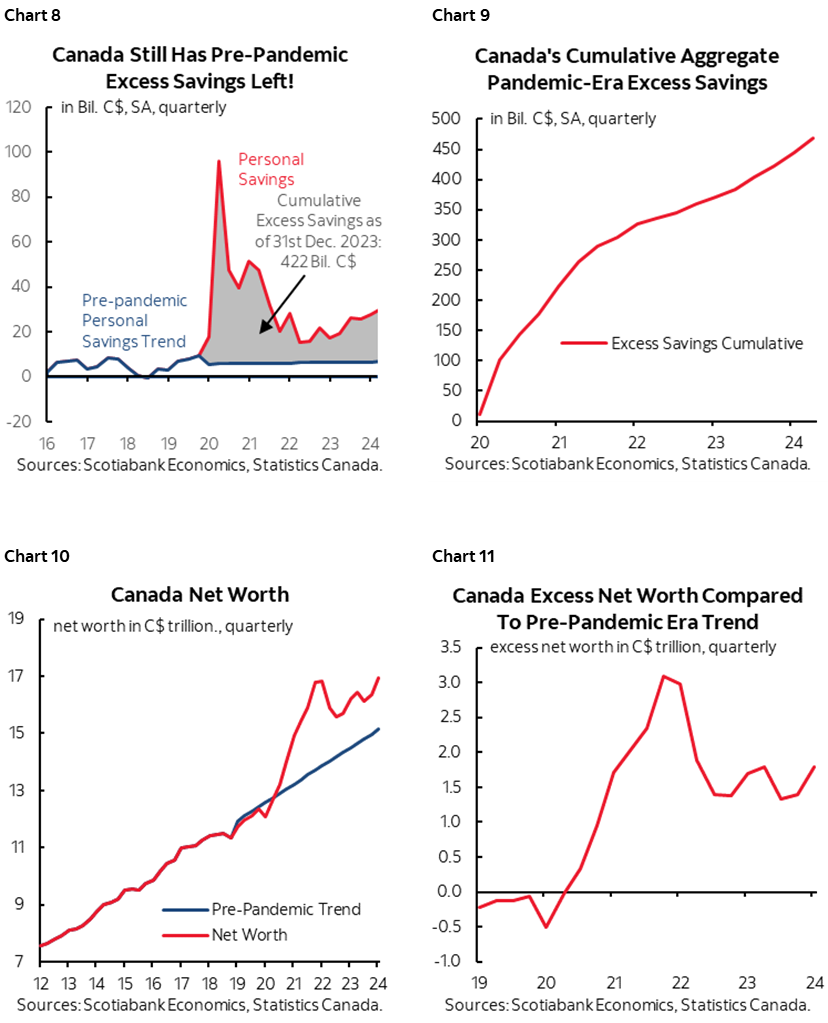

Nevertheless, Canada’s household saving rate is relatively high at 7.2% of disposable income. Unlike the contestable case stateside, Canadian households have been accumulating excess savings.

Charts 8–11 update points I’ve previously made on this topic. Whether on a narrowly defined basis (charts 8–9) or looking at broader net worth (charts 10–11), Canadian households appear to be saving plenty for either a dark, rainy day, or a heckuva party.

LOSS OF MOMENTUM

This issue of whether pent-up savings get spent is key to the outlook. As government spending on retroactive wage disbursements reverses in Q3, consumption must accelerate. That’s especially the case since the monthly GDP figures point to a total loss of economic momentum into Q3.

Both June GDP and initial guidance for July GDP were flat. I'm surprised by the July numbers given strength across other readings and hence also skeptical until we see the firmed up readings in a month’s time.

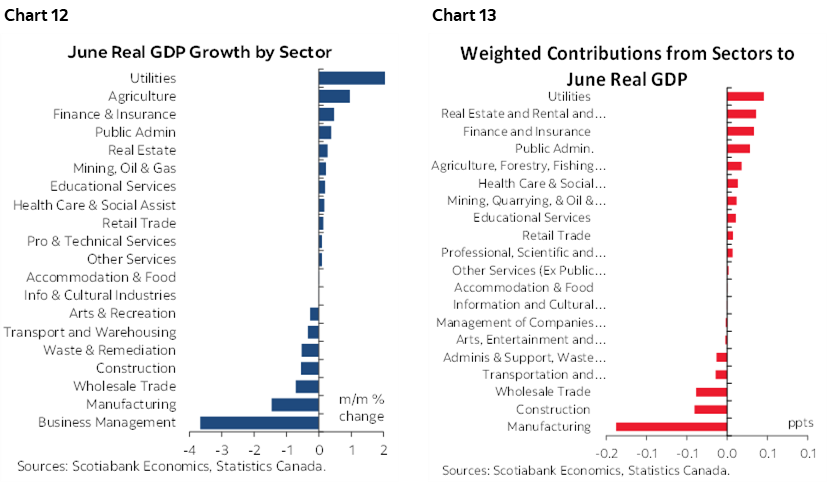

Charts 12–13 show June GDP growth by sector in raw terms and in terms of sectoral weighted contributions to overall GDP growth. Details for July are not provided other than very light verbal guidance.

For now, Canada has no baked-in momentum into Q3 GDP. I’m tracking just 0.1% q/q SAAR GDP growth in Q3 based on Q2 and the flash estimate for July. The loss of momentum in June/July harmed the Q3 math.

What is at risk is the BoC's 2.8% q/q SAAR projection for Q3 GDP given zero momentum to date. The rail strike and preparations for it may be a mild dampener on August GDP.

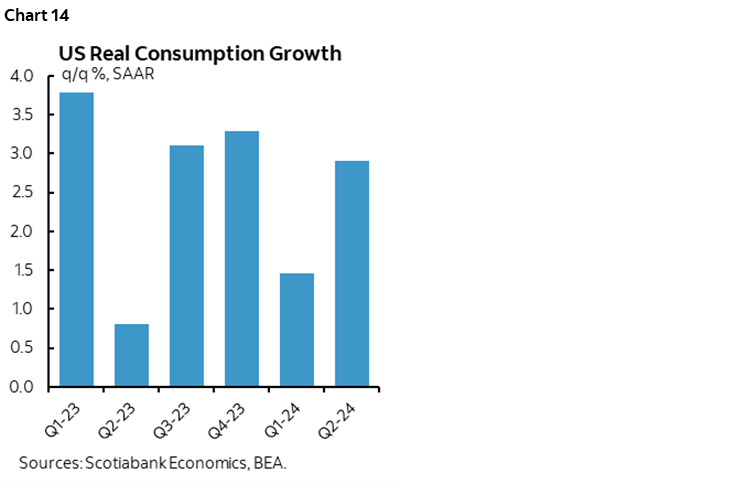

One friend to Canada’s economy may continue to be the US consumer via the trade account. This morning’s numbers showed US real consumer spending tracking 3% q/q SAAR consumption again in Q3 (chart 14).

BOC TO CUT –25BPS NEXT WEEK

The BoC will take this overall report as justification for a widely expected quarter-point cut next Wednesday and ongoing dovish bias that defers to the October decision with its full forecast update. I would think they are likely to revise down their Q3 GDP estimate of 2.8% q/q SAAR from the July MPR in the October MPR, but for now, they will wish to monitor the pent-up demand arguments. Uncertainty toward whether stalled consumption in Q2 after strong Q4 and Q1 gains is an emerging trend, or a temporary one if pent-up demand gets unleashed, should keep them guarded against up-sizing cuts among other reasons for not doing so that I’ll write in my weekly later today.

An added inflation caveat for the BoC is that Q2 labour productivity in the business sector (next Thursday) is looking awful. Real wage growth is climbing while productivity is tanking which reinforces inflation risk. Business sector output looked very weak in Q2 alongside a large gain in hours worked which means productivity problem fell significantly.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.