- The BoC cut its overnight rate by 25bps as expected…

- ...and continues to guide that further cuts are coming

- No changes to quantitative tightening balance sheet plans

- Scotia Economics still forecasts two more cuts in September and October this year

- Where the risk lies in the BoC’s narrative

- Canada 5s are priced for perfection and with that so may be 5-year mortgages

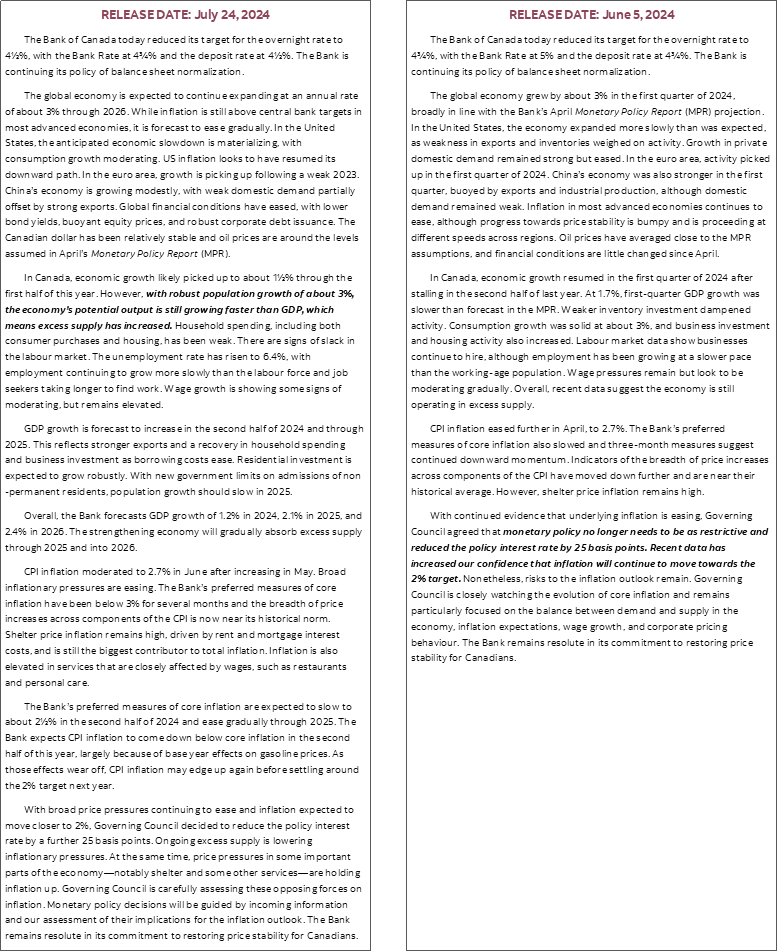

The Bank of Canada met our expectations in today’s announcements. The statement is here and see the statement comparison in the appendix. The MPR including updated forecasts is here. Governor Macklem’s opening remarks are here.

They cut the policy rate by another 25bps to 4.5% from a 5% peak. They also left balance sheet plans unchanged and signalled no nearer-term appetite for changing them. Guidance continues to leave open the prospect of further rate reductions this year in keeping with our unchanged forecast for another 50bps of cuts in the next two meetings.

The broad tone of the communications was dovish, yet hardly uncontestably so. I will explain how I think the BoC is banking upon several stretch arguments that have positioned markets to be priced for perfection. The 3¼% yield on Canadian government 5-year bonds leaves little room to rally further after taking account of reasonable neutral rate and term premia assumptions over the cycle. There is more upside risk to inflation than the BoC let on today that could challenge this pricing.

FURTHER CUTS COMING

Asked in the press conference about future rate decisions, Macklem said this:

“We cut today because our indicators suggest broad based price pressures are easing and we are increasingly confident that inflation will come back to target. Looking ahead, if inflation continues to evolve broadly in line with our forecast, it is reasonable to expect further cuts, but we are not on a predetermined path and we will take decisions one at a time. Inflation will not return to target on a straight line.”

He was also asked if there was any consideration given to a bigger 50bps cut, to which he basically said no:

“There was a clear consensus to cut by 25bps and that the expected path of the policy rate is lower but we're not on a predetermined path and will take it one meeting at a time.”

BALANCE SHEET PLANS UNCHANGED

The statement retained reference to the BoC “continuing its policy of balance sheet normalization.” The press conference indicated no appetite for changing QT any time soon as it remains on autopilot against some speculation elsewhere.

When asked during the press conference about what is driving the Canadian Overnight Repo Rate Average (CORRA) to rise toward 5bps over the policy rate over recent weeks and whether this signals that it is time to wind down the Bank’s quantitative tightening policy, Senior Deputy Governor Rogers said:

“There are a couple of things going on in the overnight market so we've been in with our overnight operations to smooth things out. The basis trade is still active in the market as one driver of the CORRA spread. Canada has moved to a T+1 settlement which has increased demand for overnight money. There are enough settlement balances in the system but not necessarily where they need to be, so we're doing what we normally do to smooth things out. We don't think we are at a normal state on our balance sheet but as we do get closer we'll be evaluating.”

SMALL FORECAST CHANGES

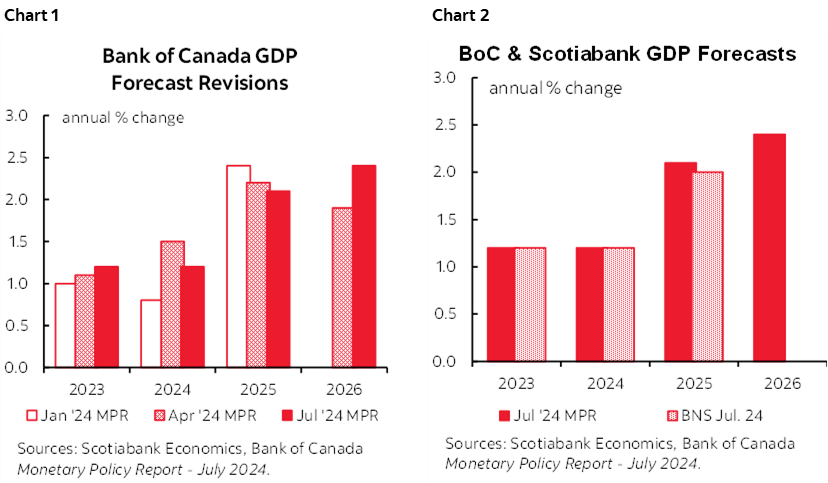

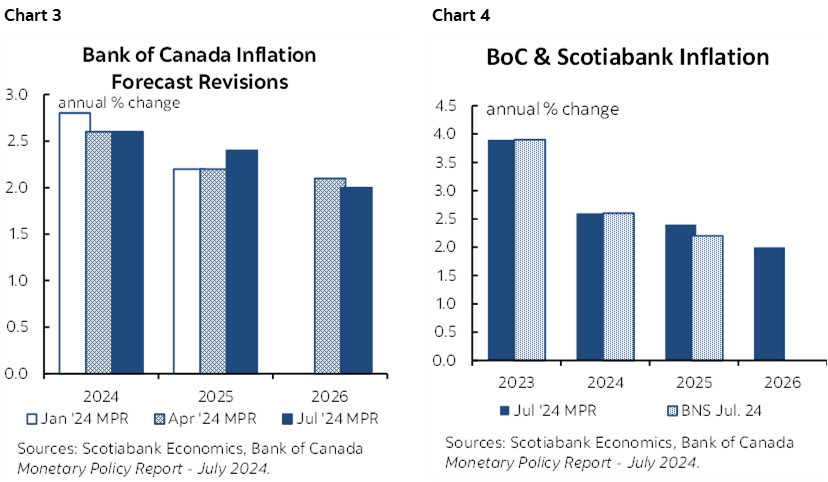

There were mild downward revisions to full year GDP growth shown in chart 1. Soft landing expectations remain firmly entrenched and we’ve always been in that camp. GDP is forecast by the BoC to grow by 1.2% this year (1.5% previously) and then 2.1% next year (from 2.2%) and 2.4% in 2026 (up from 1.9%). Always remember that their forecasts assume an embedded profile for the policy rate path that they do not disclose. Chart 2 compares our annual growth forecast to the BoC’s.

The BoC expects near-term GDP growth to be stronger than we have in our forecasts. They forecast Q2 GDP growth of 1.5% (Scotia 1.6%) but Q3 is forecast to accelerate to 2.8% (Scotia 2.2%). We both end the year similarly though on a Q4/Q4 basis (they have 2.0, we have 1.9).

The BoC revised up its 2025 inflation forecast a bit to 2.4% (2.2% previously) and left this year unchanged at 2.6% (chart 3). They forecast 2% inflation in 2026, but who cares that far out. Chart 4 compares their forecast to ours.

The BoC forecasts headline inflation to fall below core inflation over 2024H2 due to base effects and gasoline prices. By Q4, the BoC expects CPI to be 2.3% y/y but the average of trimmed mean and weighted median CPI to be 2.5% y/y.

WHAT MACKLEM MEANT BY REFERENCING DOWNSIDE RISKS

Governor Macklem’s opening remarks to his press conference referenced how “downside risks are taking on increased weight in our monetary policy deliberations.” This shouldn’t be interpreted to mean that they are increasingly worried about the growth outlook since their numbers don’t say that, even though that’s how some media outlets portrayed his comments. Macklem clarified what was meant when asked during the press conference about whether he was flagging the need to cut rates more rapidly to avoid a recession. Here is his answer:

“When inflation was well above the upper limit of our 1–3% inflation target range we were more focused upon upside risks to inflation. We're now back in the band, so in that situation, we need to be more symmetric in our treatment of the risks. We are equally concerned about being below target as above. With the target in sight, we need to be more concerned about downside and upside risks. Our assessment is that there is enough excess supply in the economy to bring inflation back to target. We need growth and jobs to pick up to absorb excess supply and bring inflation sustainably back to target. That need for growth was part of our reason to cut the policy rate today.”

So it’s not that they are more worried about the outlook, it’s that they need to raise the weight on landing too low on inflation relative to being too high simply as inflation has come down.

WHERE THE BANK OF CANADA’S NARRATIVE IS VULNERABLE

What the Bank of Canada is counting upon is that the supply side of the economy can grow at a rate relative to actual GDP growth in a way that creates ongoing excess capacity that is disinflationary. Macklem says because of this, they need to focus more upon getting actual GDP growth higher. They offer two arguments to back up this view.

First, their assumption is that potential GDP growth is faster than actual GDP growth because of population growth "which means excess supply has increased." More excess supply means more disinflationary pressure if they’re right.

And yet the assumption being made by the BoC is to treat all forms of population growth equally in adding to the economy’s productive capacity. That’s wrong in my opinion as I’ve repeatedly argued. Much of the surge in population growth has come from nonpermanent residents which is a category made up of international students, temporary foreign workers often working in seasonal sectors who send paycheques back home and or bring them back when they return home, and asylum seekers here for humanitarian reasons. They cannot be treated in equally weighted fashion to immigration via permanent residents and born in Canada residents. The nonpermanent category of immigration does not contribute equally to potential output and hence the BoC is overestimating growth on the supply side.

I think the BoC is making the same error in estimating slack in the labour market. Macklem said in the press conference that "There are signs of slack in the labour market. The unemployment rate has risen to 6.4%, with employment continuing to grow more slowly than the labour force and job seekers taking longer to find work." As argued here, the temporary resident category has driven basically all of the rise in the unemployment rate and as they exit the unemployment rate could move back down all else equal.

In plain english, a 20 year old student is treated by the BoC as having the same productivity and capacity to contribute to the economy’s growth to date and its potential as everyone else in the economy and that seems ludicrous to me.

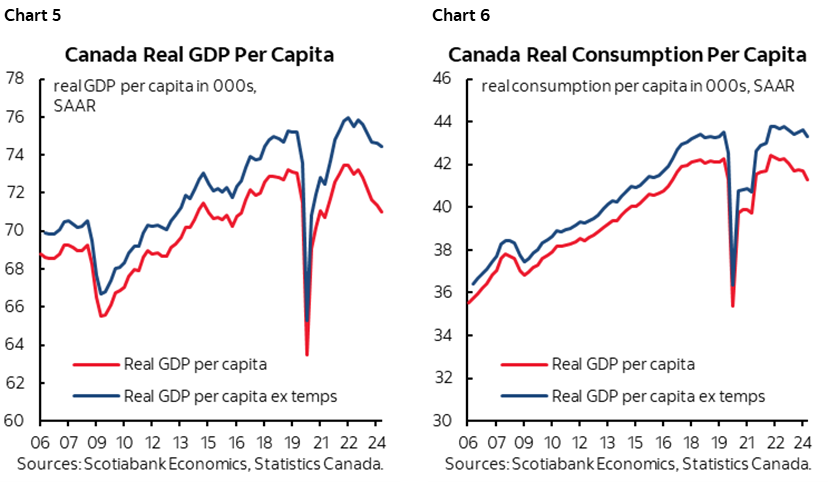

Why this all matters is because the BoC is falling for the argument that all of the real per capita GDP weakness indicates building slack in an underperforming economy. Charts 5 and 6 emphasize the sensitivity of this argument to whether total population is used in per capita GDP and consumption estimates or if the nonpermanent residents category is removed. The differences are meaningful. The levels of activity look meaningfully better if one takes out the nonpermanent category of arrivals.

Furthermore, the nonpermanent resident category is projected to slow markedly given Ottawa’s target to reduce their level. The BoC has an answer to that challenge as the second argument they are relying upon, but it too is a real stretch of imagination. In getting potential GDP growing by 2% next year as a modest slowdown from potential growth of 2.4% this year, they are assuming that productivity picks up as an offset to lower population growth given planned changes to the temp category. That seems arbitrary on the productivity side and in any event they signalled less confidence in this view by revising forecast productivity growth downward by 0.4 ppts in each of 2024 and 2025. I think they are still too optimistic that productivity will begin to trend upward in 2025 and 2026. They've been hugely wrong on this issue to date and keep pushing it out, which suggests that their potential GDP assumptions are too optimistic.

The BoC’s narrative on immigration’s effects is fluid to say the least. We can also see this where they reference that newcomers “….contribute slightly more to demand than to supply in the first few years after they arrive in Canada” which indicates net demand pressures, versus Macklem’s prior guidance that the effects on supply and demand cancel each other out.

THEY LEFT AN OUT

The BoC’s disinflationary forecast is vulnerable on other counts as well. Macklem doesn’t mention deteriorating global supply chains that are driving shipping costs rapidly higher all over again and therefore raising the risk of pass through to consumer prices in an open economy like Canada’s. They did not mention that real wage growth is accelerating and widening the gap relative to tumbling productivity, choosing only to say that nominal wage growth may be ebbing but remains above productivity growth. The BoC cannot incorporate assumptions on fiscal policy into an election year, but you and I should. A government polling as badly as this one is very likely to add fiscal stimulus into an election year; lessening monetary tightness if fiscal easing intensifies could be a very dicey development. The BoC does speak to housing imbalances and I think they represent inflation risk for years to come.

And it’s in the final paragraph to the statement where the BoC left an out on inflation risk:

"Ongoing excess supply is lowering inflationary pressures. At the same time, price pressures in some important parts of the economy—notably shelter and some other services—are holding inflation up. Governing Council is carefully assessing these opposing forces on inflation. Monetary policy decisions will be guided by incoming information and our assessment of their implications for the inflation outlook."

Compare that conclusion to what they previously stated this in the concluding paragraph of the June statement:

"Recent data has increased our confidence that inflation will continue to move towards the 2% target. Nonetheless, risks to the inflation outlook remain. Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour. "

BoC ACKNOWLEDGES INFLATION IS ABOUT MORE THAN JUST SHELTER

The MPR rejected the assertion from some competitor shops that inflation is only about the shelter component.

"For a closer look at the underlying inflationary pressures in services excluding shelter, Bank of Canada staff calculated a median inflation rate measure for this category based on the prices of around 10,000 individual services. This rate is still elevated relative to normal, suggesting underlying inflationary pressures remain."

I agree with them and have pointed out that core services inflation ex-shelter has been running at a persistently hot pace (here).

MISSING PRESS CONFERENCE QUESTIONS

A lot of pertinent questions were simply not asked nor were they addressed by the BoC’s communications.

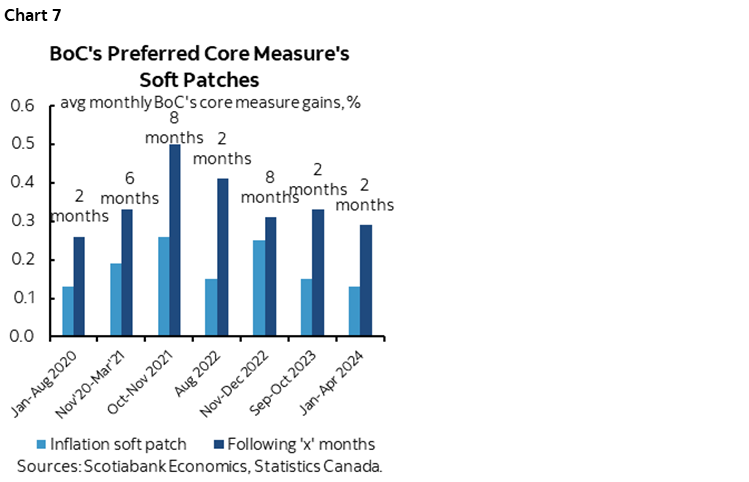

For one, there was not one mention of m/m SAAR trimmed mean and weighted median inflation picking up over the past two months. Didn't happen. Didn't see that. Look the other way. The reality is that Canada may be emerging from another false soft patch on core inflation (chart 7).

There was not one question about the US election and its possible effects. Macklem probably would have said they’ll deal with the implications when they see the outcome, the market response, and the policy implications

No one asked the BoC what they are counting upon to lift productivity growth, given that they forecast ongoing weakness in business investment.

No one asked about deteriorating global supply chains and soaring shipping costs.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.