- Hawks prevailed...

- ...as the FOMC held its policy rate unchanged...

- ...but signalled at least 50bps of additional hikes this year

- Fed moves tee up more BoC hikes, while the ECB, BoJ and BoE are next

Have you ever tried to order food for home delivery with a group of folks with different tastes and wound up ordering from a few menus of different restaurants in order to keep everyone happy?

Well, that’s exactly what the FOMC did today by offering a little something for everyone but the hawks generally won out in a way that surprised markets. I’m a tad surprised that they pulled it all off in a way that kept the whole gang together which may be testament to Powell’s consensus-building skills, at least for now.

In reaction to the suite of communications, the dollar slightly strengthened by about ¼% on a DXY basis post-2pmET, the US 2-year yield closed about 7bps higher, and the S&P500 initially plunged but eventually righted itself to close flat on net compared to just before 2pmET. Fed funds held little changed around pricing in a significant chance at a 25bps July hike and raised terminal rate pricing by just 6bps. In general, the markets are discounting some of the hawkishness and what now sets in is a protracted period of monitoring the data but also the possible need for the Fed to persuade markets further.

I like the overall tone of the broad communications. Sensible people foresee many challenges ahead, but honest, candid analysis has to take it as a given that the entire point of the exercise is to invoke greater damage to the interest-sensitives in particular if the FOMC is to achieve its inflation goals.

POLICY RATE HELD UNCHANGED

There were no surprises on the policy rate itself that was held at 5¼% as widely expected. The surprises came in the forecasts and broad guidance that left the door open to materially further hikes in a plural sense versus the widespread market consensus that at most another 25bps was likely.

STATEMENT CHANGES

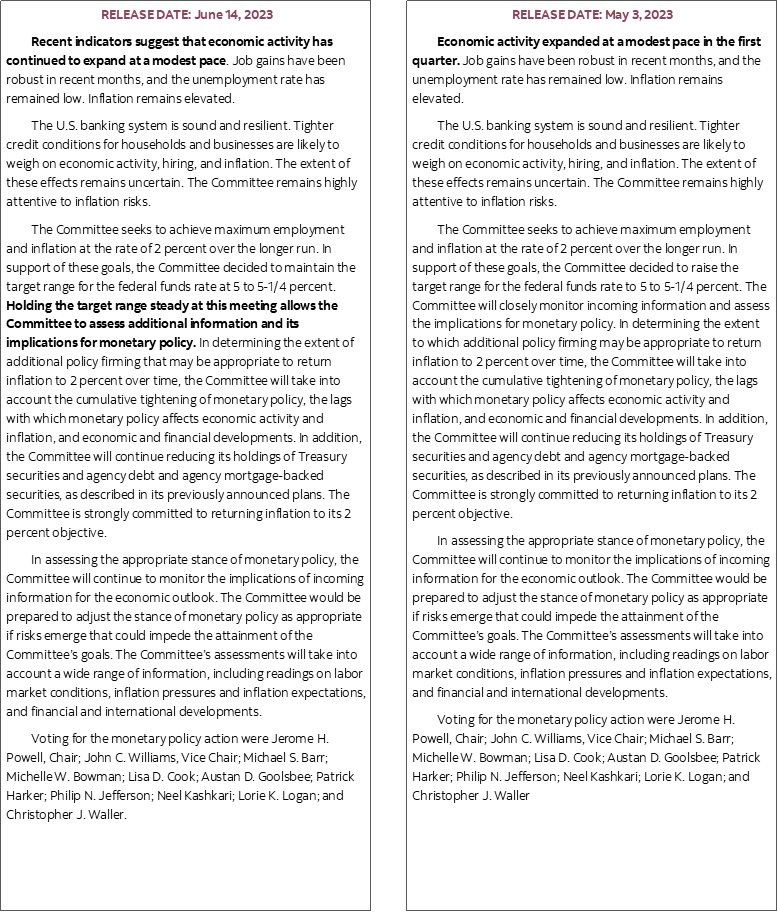

There were very few statement changes (here) that are summarized in the accompanying statement comparison at the back of this publication.

The main change among very few to the statement language was the insertion of the following sentence in the third paragraph:

"Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy."

Otherwise, the rest of that paragraph’s language including guidance toward how “additional policy firming that may be appropriate” was left identically intact. The first current conditions paragraph switched from referencing modest Q1 growth to how economic activity continued to expand at a modest pace which is largely just an update of the language. The fourth paragraph was left unchanged. To my surprise, there were no dissenters because they all got a bit of something they wanted.

THE DOTS MOVED UP—AND WHY YOU SHOULDN’T FADE THEM

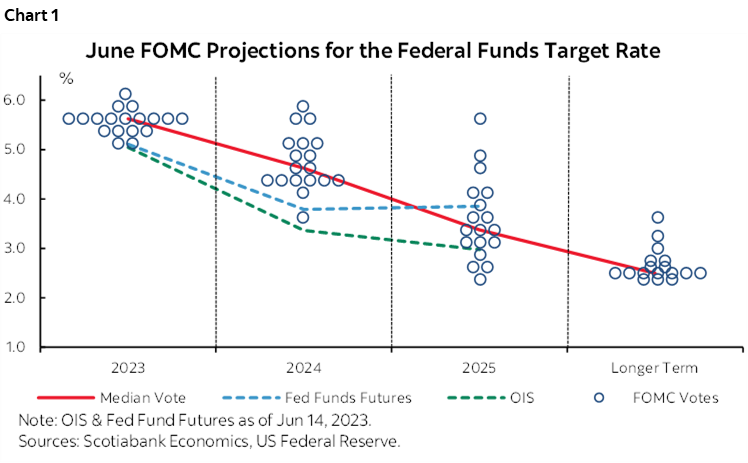

Now here’s where the proverbial rubber hits the road as shown in chart 1.

The updated dot plot and rate outlook in the Summary of Economic Projections (here) shows additional firming with the median projection at 5.6% up from 5.1% previously. This is accompanied by higher for longer forecasts next year with the fed funds upper limit target rate set at 4.6% by the end of 2024 instead of previously 4.3% by year-end, and ditto for 2025 that is now higher at 3.4% from 3.1%. There was no change in the Committee’s 2.5% assessment of neutral.

Therefore, the dots are guiding 50bps of additional firming this year to a new terminal rate of 5.75% with 5.625% their projected midpoint of the range. Much of that higher nearer term rate was carried through the projection horizon and indicated a sustained amount of greater tightening of monetary policy conditions.

The distribution of the dots indicates high conviction toward more tightening than markets expected. Only 2 members think they are done at the present 5.25%, four members think another 25bps hike is in the cards, but nine members think another 50bps is likely with 2 more thinking +75bps and one expecting another 100bps to a terminal rate of 6.25%. Powell backed up the dots by observing in the press conference that "nearly all" view "some further rate increases as likely."

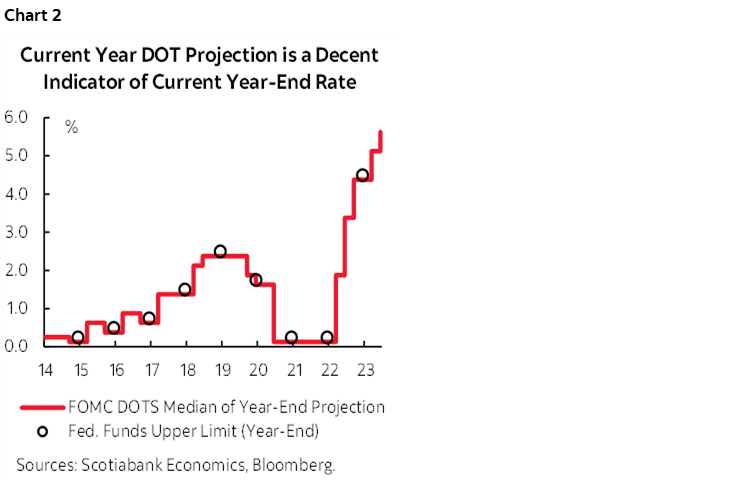

Chart 2 counsels against fading the dots at least in the near-term. The current in-year projection for the year-end level of the fed funds upper limit generally performs well as a guide to where the policy rate will indeed wind up by year-end. That’s especially true as the year progresses. That means one should largely bank on +50bps of hikes before the end of the calendar year.

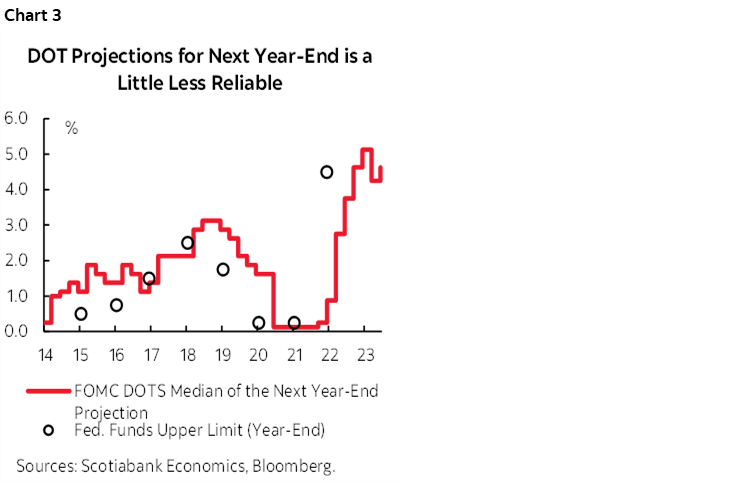

Chart 3, however, counsels against paying much attention to next year’s dots given that the second-year ahead projection for where the fed funds policy rate winds up doesn’t do very well as a guide to where they actually land.

FORECASTS—STRONGER GROWTH, MORE INFLATION, LOWER UNEMPLOYMENT

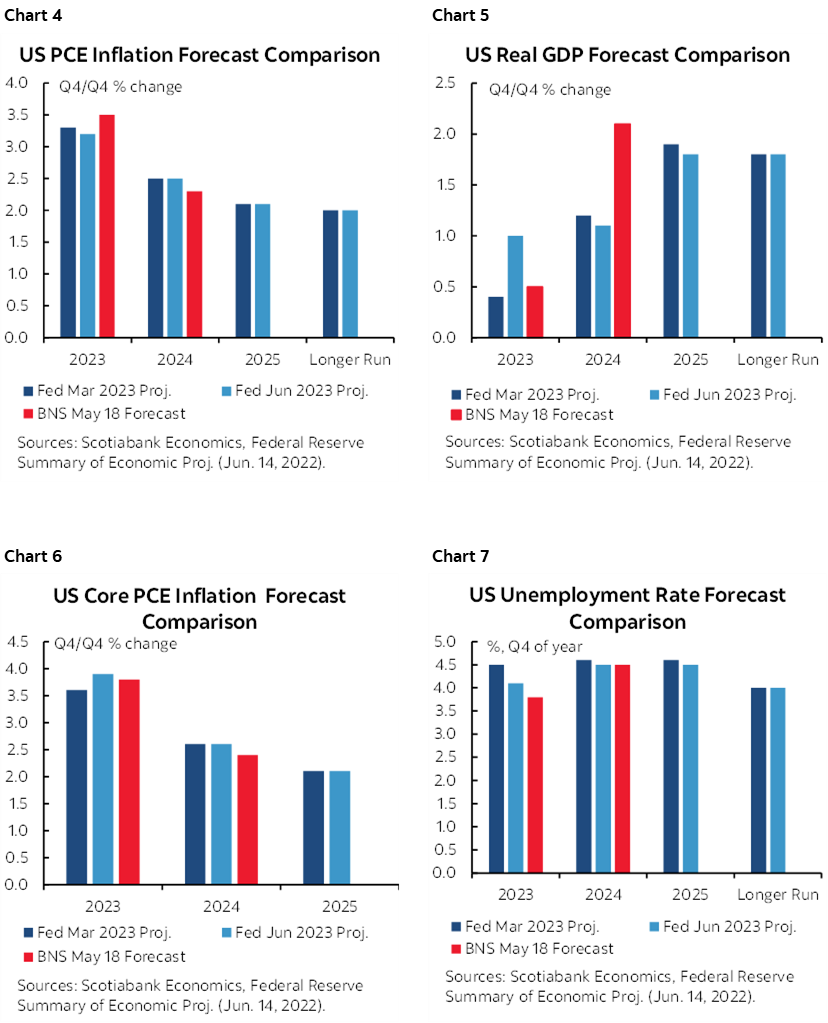

Charts 4–7 shows the updated macroeconomic projections from the FOMC members. In assessing these forecasts it is vitally important to recall the assumption of internal consistency behind the overall projections, meaning that these are the conditions that Committee members expect to prevail if the Committee hikes in accordance with each member’s views on the policy rate from here.

Growth was revised up to 1% in 2023 on the customary Q4/Q4 basis, from 0.4% in the prior March forecast. 2024 was revised down a tick to 1.1% from 1.2% and ditto for 2025 that is now set at 1.8%. There was no change to longer-run potential growth at 1.8%.

They revised core PCE inflation higher to 3.9% this year from 3.6% in the prior forecast which is largely just accounting for information to date. Next year’s core PCE forecast was left unchanged at 2.6%, but the year after that was revised up a tick to 2.2% and therefore signals a little less confidence toward getting down to 2% within their horizon.

Unemployment rate projections were lowered to 4.1% from 4.5% which is again largely an accounting issue. Next year’s projection was revised down a tick to 4.5% from 4.6% and ditto for 2025.

Chair Powell noted the following in the press conference:

“The conditions we need to see to bring inflation down are coming into place. That means growth below trend, goods pipelines getting healthier, but that process is going to take some time.”

Powell also sounded cautious toward the risk of renewed life being injected into interest sensitives. When asked whether he has seen sufficient cooling in the housing market to achieve his inflation forecast, Powell said:

“We now see housing putting in a bottom and maybe moving up a bit. We are watching this carefully.”

The BoC faces similar concerns, for different reasons.

JULY IS ‘LIVE’

When asked about timing future hikes, Powell said no decisions had been made but that “We didn't make a decision about the July meeting. I do expect it will be a live meeting.”

Recall that ‘live’ means very open to hiking if the data cooperates by July.

WHY SKIP AND HIKE LATER?

When asked during the press conference how to justify skipping now but signalling more hikes are still coming than markets expected, Powell offered a semi-convincing answer. He pointed toward the downshifting pace of hikes from 75bps to 50bps moves to 25bps moves and how at this point a skip and hike later approach is an extension of the gradually moderation of the overall pace. Powell concluded "It may make sense for rates to go higher but at a more moderate pace." That’s fair I guess.

Powell went on to offer further justification for this mixed set of messages by saying the following:

“Speed is very important. As we get closer to the destination, it's common sense to go a little slower just as it was reasonable to go from 75 to 50 to 25 and to now moderate the pace again if only slightly. It allows us to make better decisions and it allows the economy to more fully adapt and we don't know the full consequences of the banking turmoil. We're trying to get this right and the skip makes sense.”

But I think the real reason for skipping now and signalling more hikes to come was to achieve Committee consensus. The relative doves got their hold and pause. The hawks got the promise of more presents later and in the end, everyone put their stamps of approval on the overall statement. I also think that the reason for holding today is to extend the pattern of avoiding game day surprises on administered rate decisions, even if the forward guidance surprises.

WHY STILL HIKE AT ALL?

When asked during the press conference about why the FOMC would wish to signal more rate hikes if things are headed in the direction they want to see, Powell candidly responded with this:

“Remember we're two-and-a-quarter years into this. Forecasters and Fed forecasters consistently thought inflation was about to turn down and have been consistently wrong. You're just not seeing enough progress. We want to get inflation down with minimum damage to the economy but we have to get inflation down to 2%. That means further rate hikes by the end of this year but to moderate the pace at which we're moving.”

BUT WHAT ABOUT THE LAGS?

When asked about how to time the lagging effects of policy tightening and when they have their fuller effects, Powell candidly responded by stating:

“Tightening today happens sooner than in a past world when news was not on the wire and in the papers. But broader demand just takes longer. You can find research to support whatever answer you want on how long it takes. We're having to make these judgements and this is one of the main reasons why we think it makes sense to go at a slightly more moderate pace.”

That sounds to me like a Fed Chair who believes there to be lags but doesn’t wish to bet the house on policy lags saving the day absent further action in the meantime.

OTHER GUIDANCE

There was nothing further provided on balance sheet plans, not that there was anything expected for this meeting.

When asked whether the risks are still balanced and whether the Fed is now in the territory of providing a sufficiently restrictive policy rate, Powell said:

“The risks of overdoing it and underdoing it are getting closer into balance but the risks to inflation are still to the upside. We just are not seeing enough progress on core inflation that has been sticky over the past year. We would like to see credible evidence that inflation is topping out and beginning to come down. There are lags, but it's more than a year since financial conditions began tightening. Much of the tightening began last summer and onward and some of that may come into effect more.”

Powell was asked about what evidence he is seeing in terms of credit tightening and said:

“It's too early. If we were to see more tightening beyond what we would expect then we would factor that in when we make our rate decisions.”

Powell was also asked for his thoughts on systemic risk and risks to commercial real estate and whether higher rates for longer would add to those risks, and responded by saying:

“We're monitoring the commercial real estate risks and feel it will be around for some time as opposed to working it in systemic fashion. We'll be monitoring the banks very carefully. As we see things unfold with credit conditions and individual banks we can take them into account in our rate setting if there are macroeconomic effects.

BANK OF CANADA—CAUSE AND VINDICATION

After Macklem poked a finger in Powell’s eye last week, Powell returned the favour this week. Canada 2s were dragged higher here as well with the yield up ~5bps. BoC terminal rate pricing moved up by about 5bps after the FOMC communications. I'm open to 50+ more from the BoC on the back of this and prior views with +25bps being the minimum threshold for additional BoC rate hikes from here.

Central banks move in packs, and so the RBA, RBI, BoC and Fed can all point to each other as having embraced a more hawkish stance. The ECB is tomorrow and I’d watch for the pattern to continue. The BoJ closes out the week and this will be followed by the Bank of England next week in a manner that is consistent with the themes that were in this week’s Global Week Ahead (here).

CONCLUSION

I think a reasonable Fed forecast would be to add 25 in Q3, 25 in Q4 and adjust amounts and timing as data requires with the clear signal being that the FOMC is prepared to adjust in non-linear fashion from here. A cautious stance would show one 25bps move and track the data from there, but it’s with high conviction that we can say the FOMC is not yet done raising rates. Nor should it be in my opinion and as indicated in this morning’s note (here).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.