- Core inflation gauges were soft for a second month...

- ..driving markets to party hard, ask questions later

- Several key drivers may have been temporary...

- ...while some big categories signal persistence

- The big picture drivers of inflation risk have not changed one iota

- The BoC will probably require a lot more evidence of softening...

- ...but the biggest risk to Canadian rates is a dovish policy error

- CPI m/m % NSA // y/y %, February:

- Actual: 0.3 / 2.8

- Scotia: 0.7 / 3.2

- Consensus: 0.6 / 3.1

- Prior: 0.0 / 2.9

Who doesn’t like lower inflation?? Yes of course it’s nice to see weaker inflation than everyone expected for a second consecutive month after all of the challenges that Canadians have faced over the years. I would, however, caution against overreacting for four main reasons.

THE BoC WILL REQUIRE MUCH MORE EVIDENCE...

One is that the BoC will require more than just a lousy couple of months of soft inflation data before deciding to pull the trigger on a rate cut and especially on meaningful rate cuts in a plural sense. All of their communications have pointed toward wanting to see durable evidence and having the confidence that it will persist before commencing a dialogue on easing. We’re not there yet. Nor is the Fed which keeps pushing out easing as a complicating external factor for the BoC via the exchange rate implications. A warning to the BoC is that the Fed got lulled into watching a soft patch only to see core inflation boomerang on it.

....AS SEVERAL TEMPORARY FACTORS WERE AT PLAY...

Second is that a considerable part of the softness may have been driven by temporary factors. I’ll elaborate upon this point as I go through the details and the pertinent categories. These categories have idiosyncratic drivers that cannot be modelled.

...AND KEY CATEGORIES SHOWCASED UNDERLYING PERSISTENCE

Third is that some of the biggest categories remain under notable and ongoing upward pressure which suggests that inflation danger continues to lurk beneath the surface.

A key point to bear in mind when going through what follows is that reading the inflation tea leaves is much more difficult so far this year and particularly in terms of separating out what may signal persistence versus what does not. In all, this feels like the start of a party when everyone is first arriving amid great expectations for how the night may unfold. The evening is young, however, and we’ll just require more evidence before being able to pass greater judgement.

I’ll conclude this note with the mystery fourth factor after delving into the market response and details.

MARKETS DIDN’T FUSS OVER THE REASONS

Forget about all of that caution from a markets standpoint. They didn’t care, they just partied and popped the champagne corks. They didn’t much stop to parse through the evidence and drivers and debate it all. They just bought bonds. A lot of them. The two-year Canada yield is the star pupil this morning as it’s down by 13bps and outperforming front-ends elsewhere by a country mile. Markets added 5bps to pricing for a June cut with nearly 75% odds and have a half point cut fully priced by September. I think that’s too much. Markets also initially sold CAD relative to the USD but most of the nearly half cent post-data depreciation has since been reversed.

THE DETAILS—KEY DRIVERS ARE PROBABLY TEMPORARY

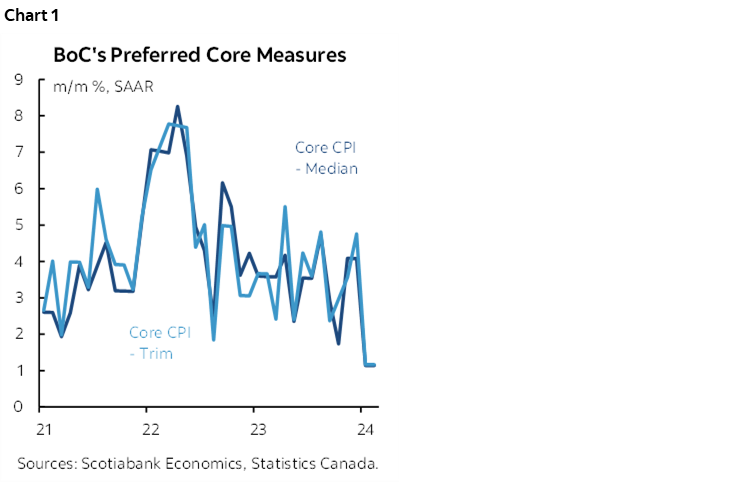

Key is that the trimmed mean and weighted median CPI components were soft for a second consecutive month. Trimmed mean CPI was up by 1.2% m/m SAAR (seasonally adjusted at an annualized rate) for a second month and weighted median CPI was up by 1.1% m/m SAAR, also for a second straight month. Chart 1.

Those numbers lowered the three-month moving averages to 2.4% m/m SAAR (trimmed mean) and 2.1% (weighted median). The six-month moving averages also pulled back to 2.7% and 2.5% m/m SAAR for trimmed mean and weighted median CPI respectively.

That’s great. Wonderful. It’s a very rapid turn of events considering that back in December we were still dealing with four-handled readings for both gauges. The suddenness of the deceleration should merit caution that markets are not embracing.

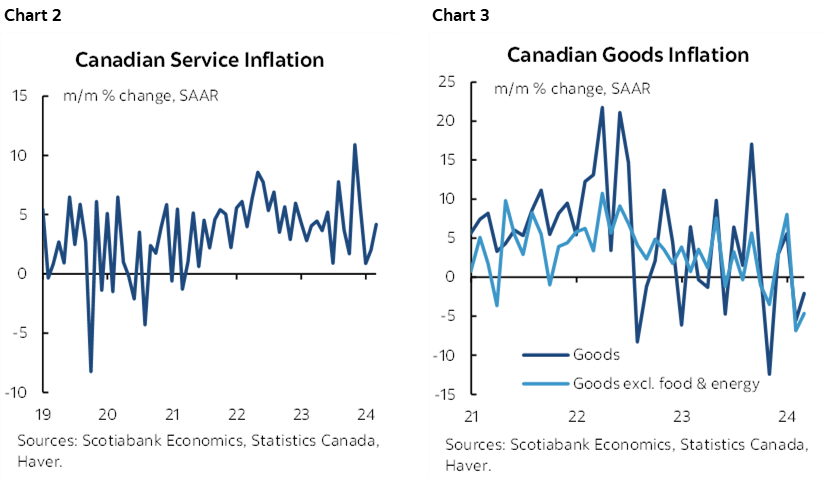

Good inflation was particularly soft this month while services inflation remain hot (charts 2, 3).

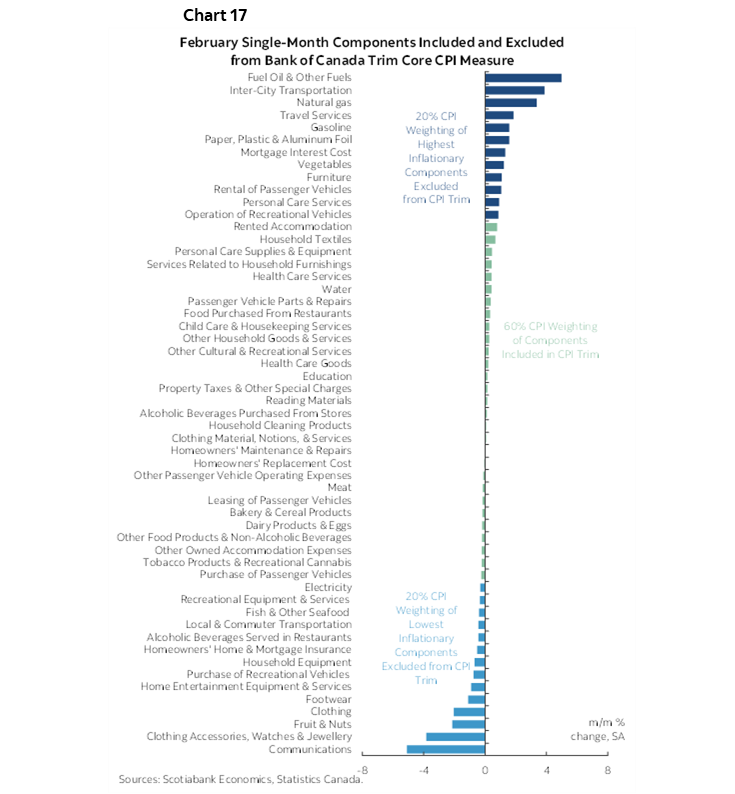

Some of the categories I’ll flag below fell out of the trimmed mean CPI basket into the tails and so their previously warmer contributions were lost as an influence. That could be temporary.

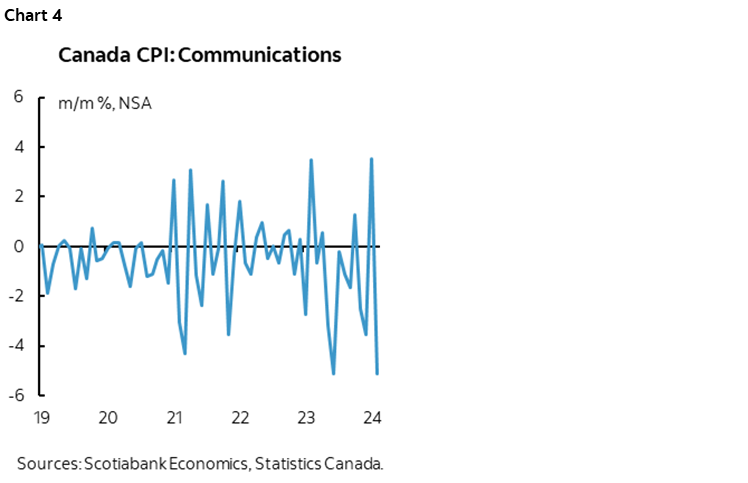

For one thing, the communications category knocked 0.1 ppts off of m/m CPI NSA because it fell by 5.1% m/m NSA when it’s normally little changed in February. The declines we’ve been seeing in this category have been quite large (chart 4). Why? And is this sustainable? StatCan tells us that nationwide prices for cell phone plans fell 26.5% y/y and this was “driven by lower prices for new plans and increases in data allowances for some cellular service plans.” Recall that CPI considers prices as well as changes to features and quality. Statcan also says that internet access service prices fell by 13.2% y/y and 9.4% m/m and this was “attributable to specials offered by internet service providers.” I highly doubt that telecoms and ISPs are going to be sustaining this pace of declines. If it does, then Canadians could be enjoying free cell phone and internet services later this year...

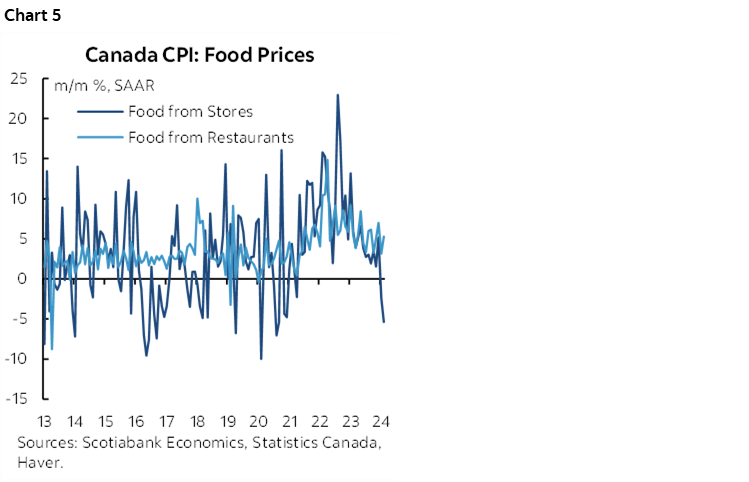

For another, political pressure on grocers may be having at least a temporary effect as the food from stores category fell sharply and by the most since early in the pandemic (chart 5). The price declines in m/m NSA terms during both January and February were highly unusual compared to seasonal norms in categories such as meat, fish, dairy, bakery, and fruit. Compared to the seasonally normal average pace of increase in food prices during February over recent years, the flat print this February knocked about 0.1 ppts off of headline CPI. Once again, is this going to be a durable effect, or should the BoC look through what may be policy-induced pressures that could be temporary?

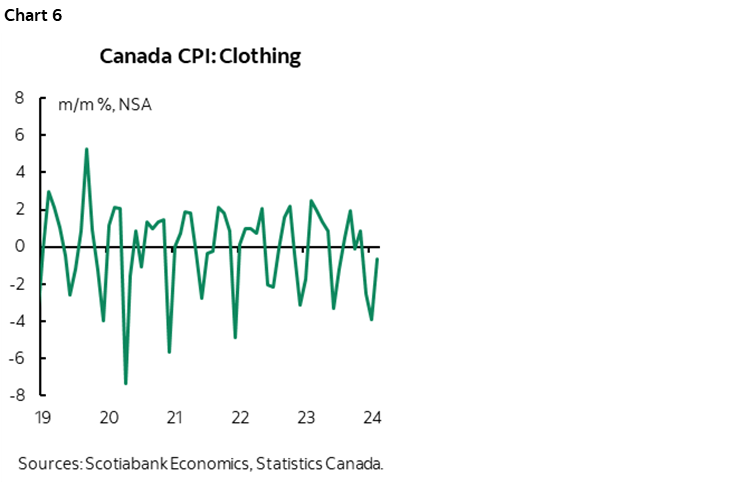

Third is that clothing prices fell again, this time by 1.1% m/m NSA and 2.7% m/m SA with the latter figure driving home the point about how seasonally unusual such softness may be (chart 6). A warmer and drier than normal winter probably drove considerable discounting over the winter. Anecdotally I’ve certainly noticed that retailers have a lot of winter parkas they’re trying to ditch with very large discounts. Clothing knocked another 0.1 ppts off of m/m CPI especially in seasonally adjusted terms.

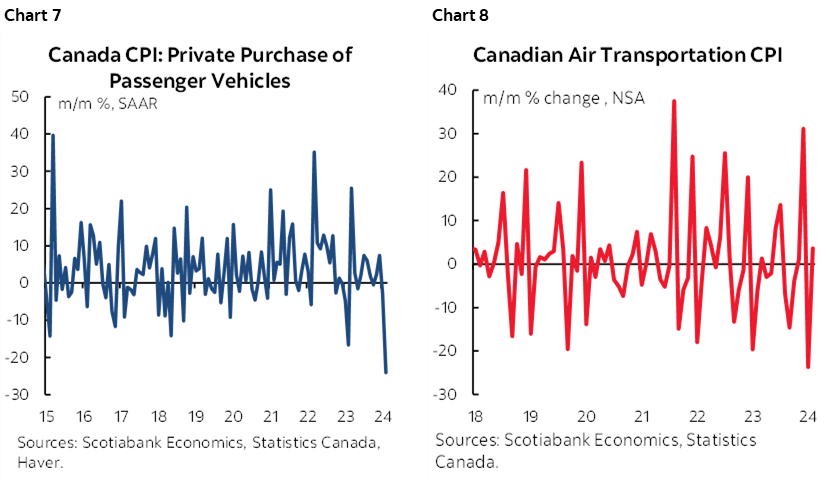

Fourth, vehicle prices fell by the most since August 2020 and toward the beginning of the pandemic (chart 7). That was driven by a large 2% m/m NSA drop in used vehicle prices. Who knows if that’s a durable effect, but I doubt it in light of the highly volatile pattern over time. Also unusual is that the steep decline in airfare during January was followed by such a tepid rebound in February; that might be a prolonged effect of weakened demand during a warmer and drier than usual winter (chart 8).

UNDERLYING PRESSURES

Were the downward pressures on inflation more durable in terms of some of the biggest categories? Not really.

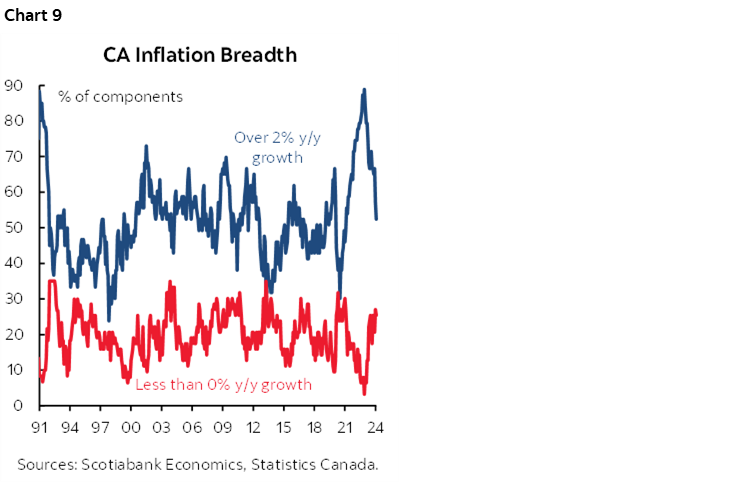

For one thing, we still have about half the basket that’s up by 3% or more in y/y terms which is a measure of breadth that Governor Macklem has flagged (chart 9). It’s coming down, especially in terms of the biggest gains of 4%+, but it’s still too high for the BoC.

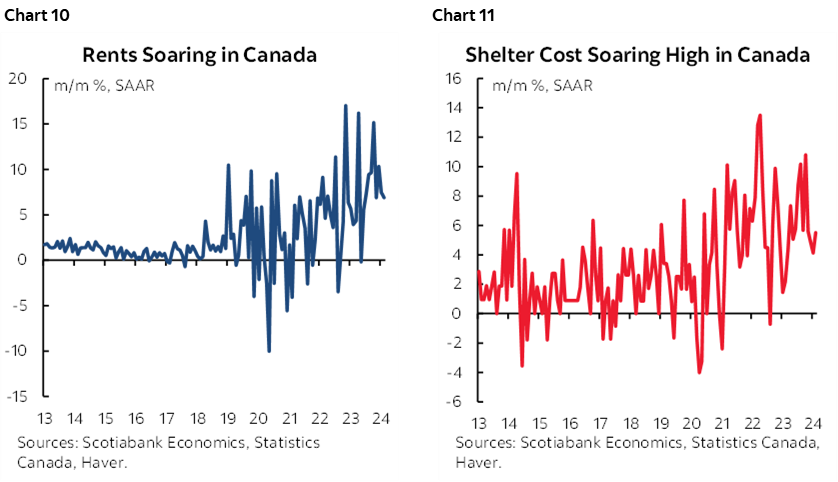

Chart 10 shows that rent continues to soar. Chart 11 shows likewise for shelter costs that account for about one-quarter of the CPI basket excluding mortgage interest. And no, the BoC cannot just ignore one quarter of the basket.

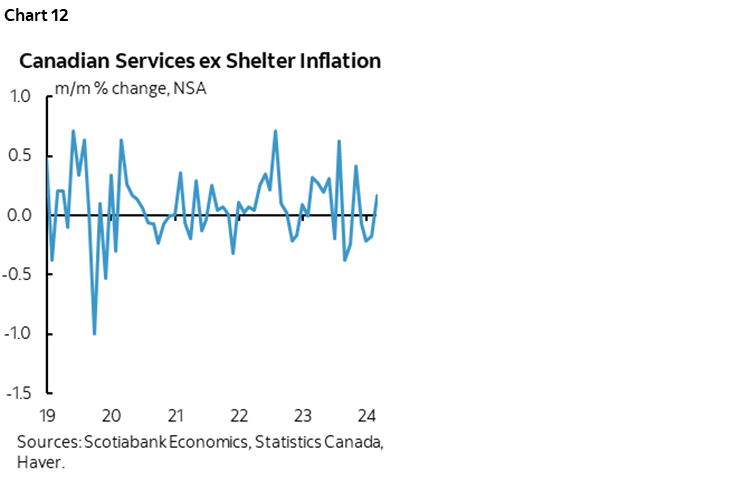

Chart 12 shows that core service price inflation—after stripping out shelter—was up by 0.2% m/m NSA after prior softness. That’s not hot, but it suggests a volatile pattern of mild trend gains.

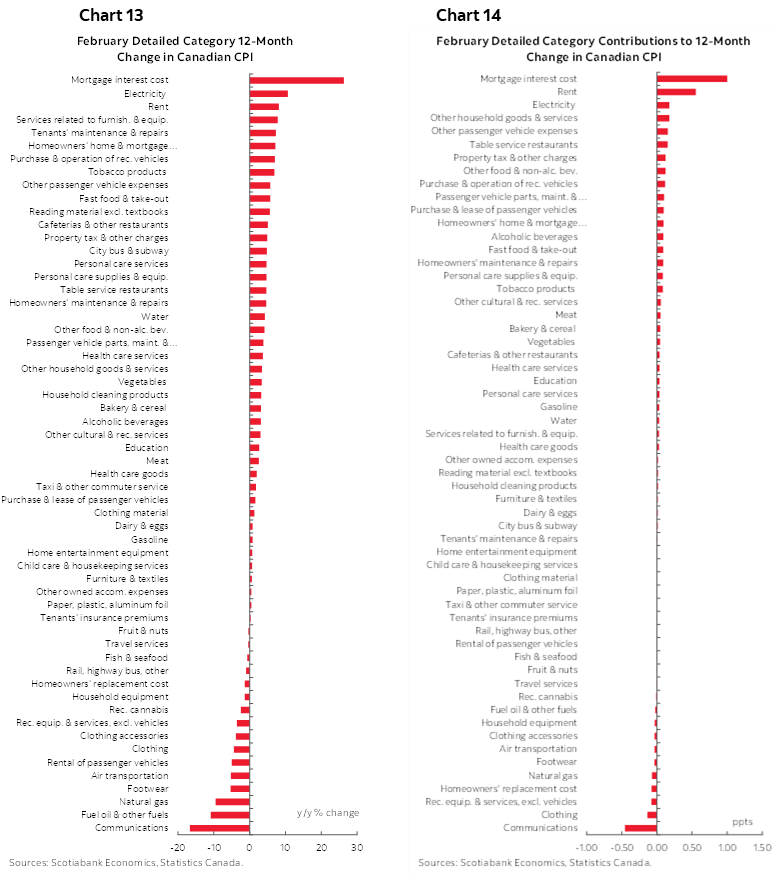

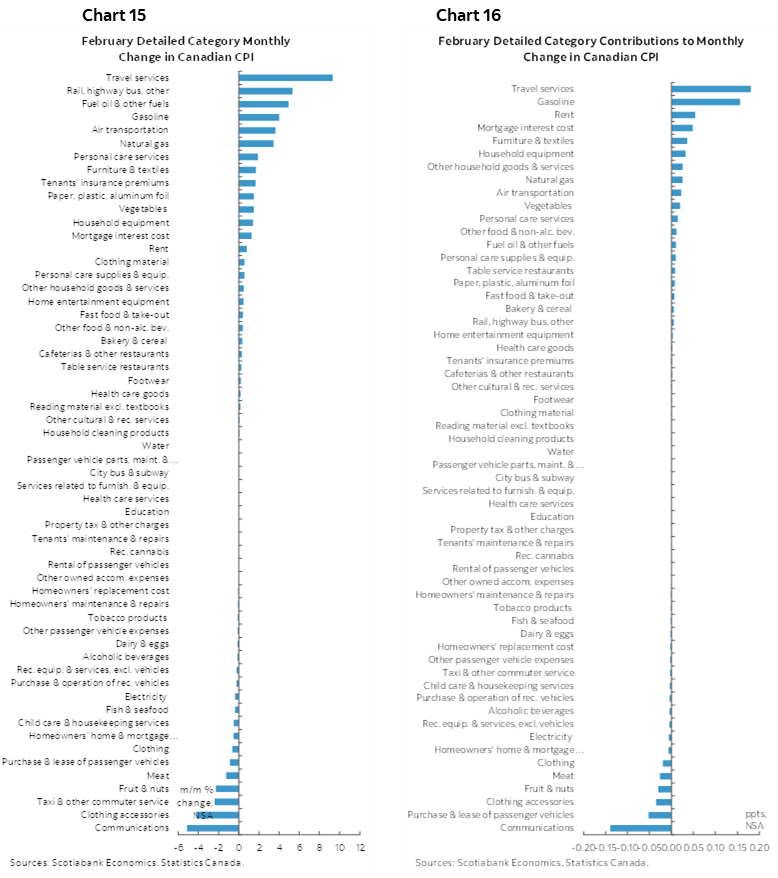

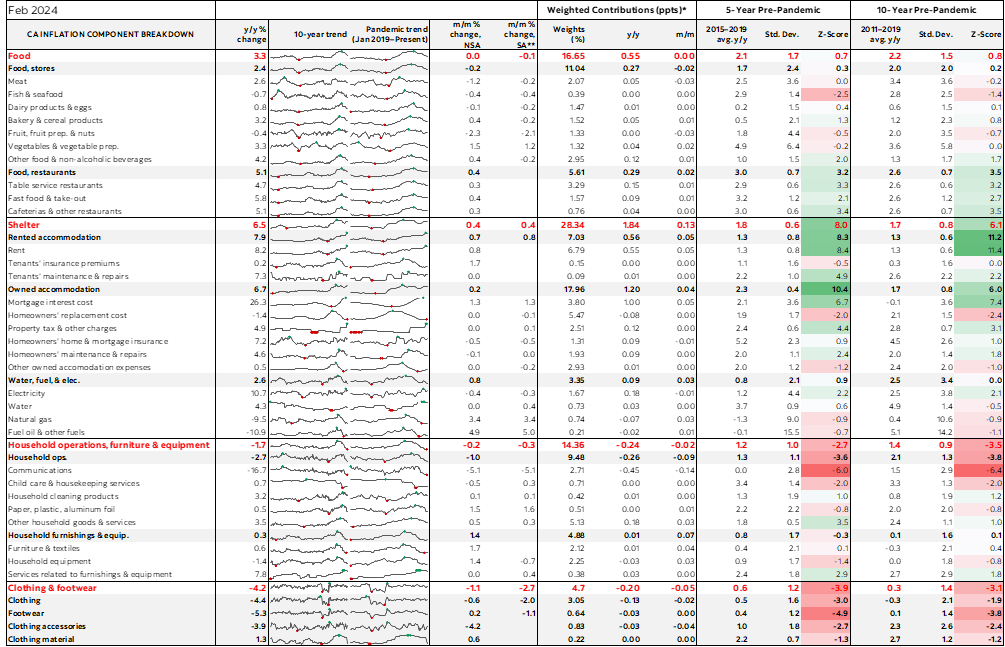

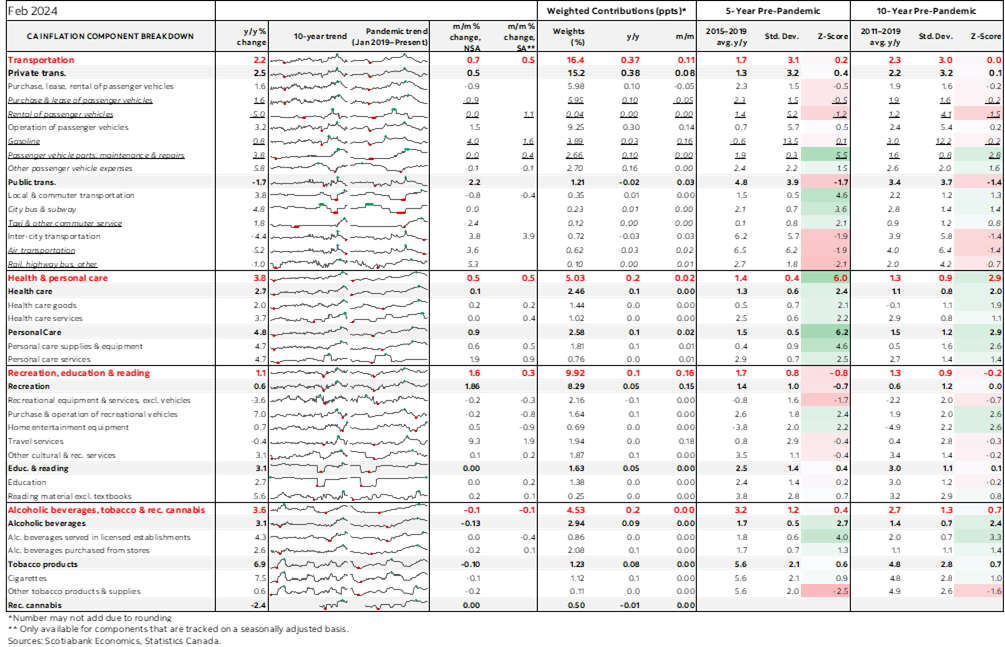

Further details are available in charts 13–17 and in the full table at the back that includes micro-charts and z-score measures of dispersion.

THE BIGGER PICTURE

Apart from the data nerd stuff above we have to step back and ask ourselves what has really changed in terms of inflation risk in the span of just a couple of months. Not much in my view. The BoC cannot do anything about last month’s inflation data but has to have a leery eye toward the balance of inflation risk going forward.

Productivity remains miserable and wages continue to explode with fresh wage settlements data pending release shortly and that will capture the effects of the deals with Quebec’s public sector unions and the multi-year consequences.

Unit labour costs continue to rise out of control.

Governments are adding more fiscal stimulus including budgets from Quebec, BC, and Alberta plus smaller provinces and with more stimulus likely in the cards from the Feds and Ontario. Fiscal stimulus is easing; the BoC should not.

Immigration remains ridiculously excessive relative to the ability of the country to house all of the new arrivals and accommodate them from an infrastructure shortfall perspective. The narrative that this is net demand stimulus to the economy is unchanged.

And there is a lot of pent-up housing demand on the sidelines that’s just chomping at the bit to drive a hot market.

Last, the economy is mildly rebounding to start the year and progress toward creating disinflationary slack is inadequate to date relative to the myriad of inflation drivers we’re dealing with.

So cut? On the back of two soft months of inflation data? I know I wouldn’t. The biggest risk in my opinion is nevertheless a central bank that has fouled up throughout the whole pandemic fouling up once again under pressure to ease prematurely. It took way to long to begin tightening while denying all of the inflation evidence. That made it have to tighten more than it would have had it acted faster. It went on pause and contributed to renewed pressures only to have to come back with more hikes. To ease too soon would be the final straw. It would be a high stakes gamble that could easily backfire and add another black mark against Macklem’s leadership in the role.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.