- Canada’s economy is growing much faster than the BoC forecast in Q1

- Despite restrictions, the economy still grew in January…

- ...and ripped in February

- Strength adds to the case for a hike of 50bps or more on April 13th

Canadian GDP, m/m % change, February:

Actual: 0.2

Scotia: 0.1

Consensus: 0.2

Prior: 0.1 (revised up from 0.0%)

February guidance: +0.8% m/m

Canada’s economy is on a tear with growth surpassing the Bank of Canada’s forecasts. That further amplifies the need to more aggressively tighten monetary policy with a hike of at least 50bps in April.

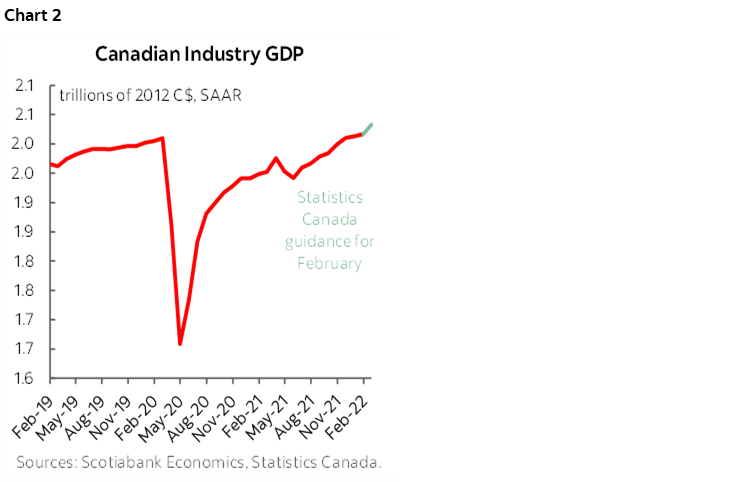

Growth of 0.2% m/m in January, plus an upward revision to December and a very strong reading for February (+0.8% m/m) net out to impressive Q1 growth.

Short-term yields moved a touch higher with the 2-year GoC yield up by 1–2bps. CAD depreciated a touch but was correlated with other movements across global crosses to the USD like the euro and more driven by external factors (OPEC, US releases).

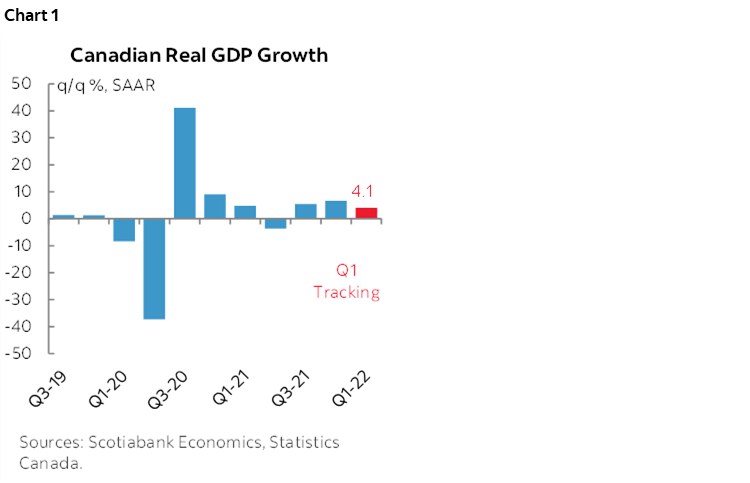

Q1 GDP growth is tracking well above the BoC’s 2% forecast that was last provided in the January MPR. Using monthly GDP figures we’re tracking GDP growth of 4.1% q/q at a seasonally adjusted and annualized pace based upon hard figures up to January, February’s preliminary guidance and assuming March is flat only to focus upon the growth effects of known information to date (chart 1).

A big caveat is that the BoC forecasts expenditure-based GDP whereas the monthly figures are based upon production/income side GDP accounts. The latter doesn’t generally consider factors like inventory swings and changes in import leakage effects. We think those effects will probably drive GDP growth in Q1 toward the ~5% annualized range.

That matters because it points to a faster closure of spare capacity and push into net excess aggregate demand than the BoC was assuming when it last put its forecasts together. Given that the BoC puts a lot of emphasis upon the gap framework, they’ll view this as a further inflationary impulse when they issue new forecasts on April 13th that have a lot of catching up to do to the war’s effects, commodity movements, easing restrictions etc.

Canada’s economy is now 1% larger than it was just before the pandemic (chart 2). That includes the effects of the preliminary estimate for February.

Details for the preliminary guidance for February is available only on a narrative basis from Statistics Canada with no breakdown of the numbers. That’s the practice when providing flash estimates. The agency noted that there were gains in mining, quarrying, oil and gas, accommodation and food services and construction. Utilities slumped after a strong gain in January when it was a gazillion below 0 degrees across much of the country.

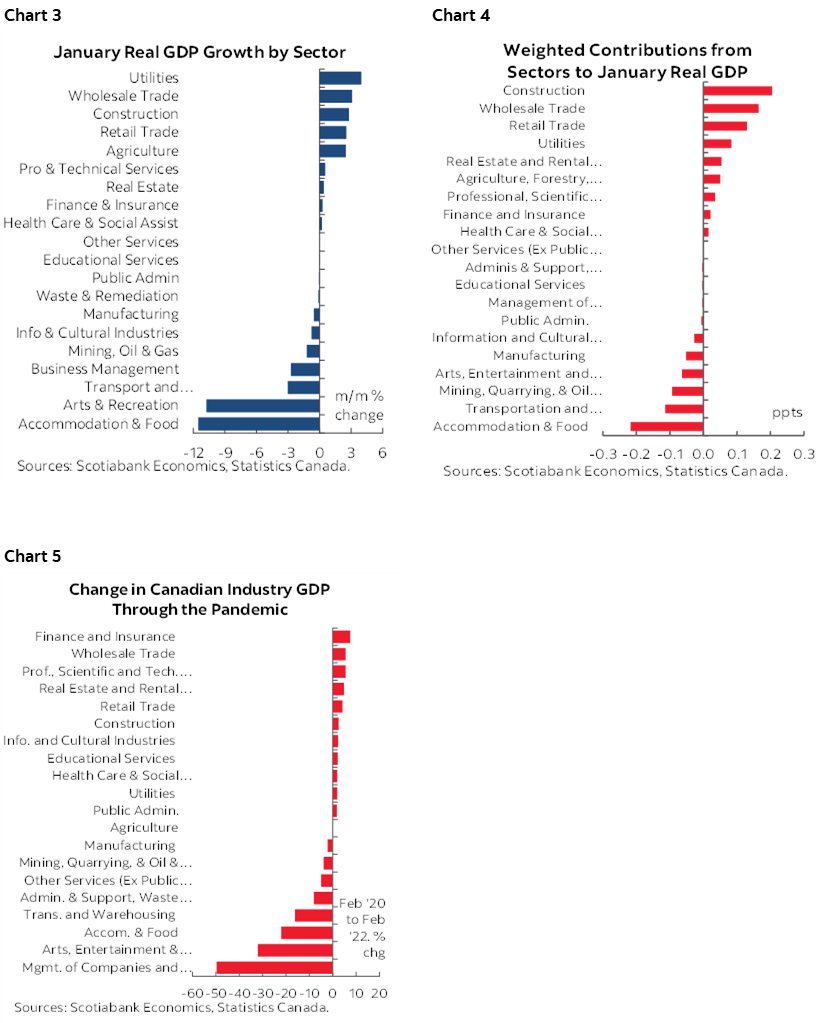

The fact the economy generated any growth in January is encouraging since much of the country had reintroduced COVID-19 restrictions starting in December through January. The break down by sector is shown in chart 3 while chart 4 shows the growth drivers in terms of weighted contributions to GDP growth. Cold weather popped utilities to the top of the list of growth drivers which was a transitory effect. Goods sectors led growth while the pandemic-affected services sectors that were subject to the restrictions contracted.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.