- Data surprises didn’t stick to markets...

- ...as the US consumer drove a solid GDP gain…

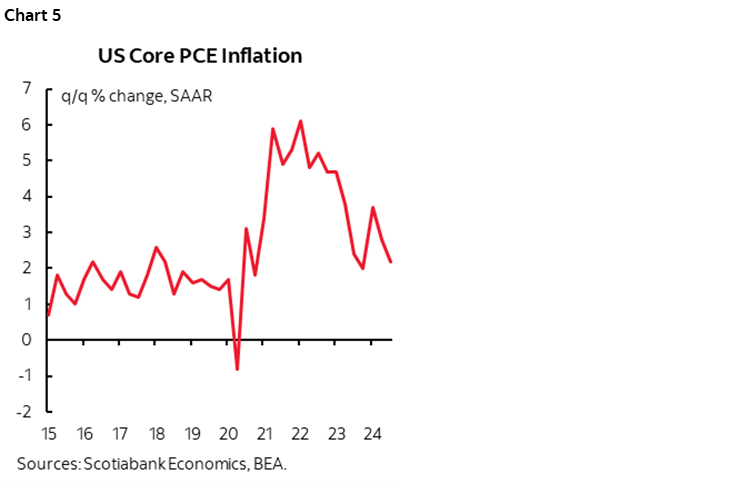

- ...and slightly firmer than guesstimated core inflation

- Did Q4 consumption get a running head start?

- ADP private payrolls signal a low probability of very weak nonfarm payrolls

- US pending home sales soared by the most since the start of the pandemic

- US GDP, q/q SAAR, Q3:

- Actual: 2.8

- Scotia: 3.0

- Consensus: 2.9

- Prior: 3.0

Ok that title won’t win any prizes, but it gets across the point.

The US economy grew strongly while generating light, but slightly stronger than expected inflation as ADP payrolls ripped higher and a leading indicator of existing home sales jumped higher. Key is the strength of the consumer.

Bonds didn’t like that so much at first, with the 2-year yield rising by about 5bps post-releases before moderating this response as the UK budget’s effect on gilts with some spillover effects arrived, and the US launched missile strikes on ISIS targets in Syria. The dollar strengthened and the s&p at first moved slightly lower into the cash open but has since recovered.

GDP growth of 2.8% q/q at a seasonally adjusted and annualized rate (SAAR) was slightly softer than estimates, but still strong especially on the heels of 3% growth in Q2. After showing tentative signs of slower growth in Q1 at 1.6% q/q SAAR, GDP is venturing back toward the growth rates over 2023H2.

And Q4 could well extend this performance. To understand how involves delving into the consumer’s role in the math.

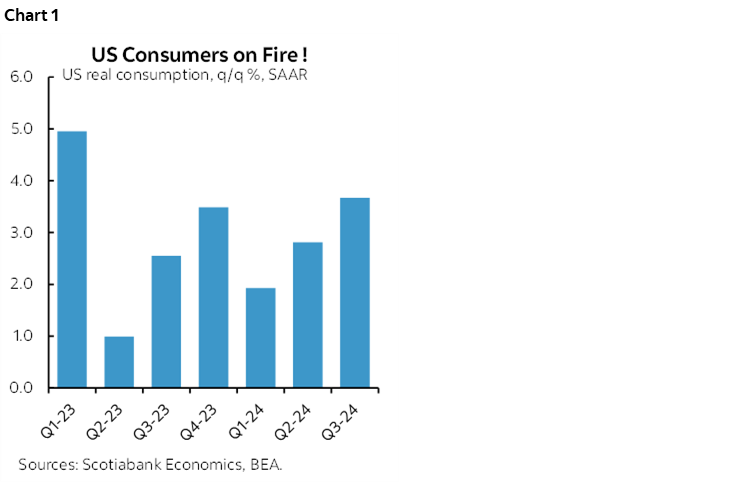

US consumer spending in Q3 grew at the fastest pace since 2023Q1 (chart 1) and depending upon what tomorrow reveals there may be baked-in momentum into Q4. In order to arrive at today’s estimated consumption growth of 3.7% q/q SAAR in Q3 we would have to see September’s tally land at +0.6% m/m, or double the consensus when the figures arrive tomorrow. This is assuming no revisions to prior monthly data which may not be true. If it is true, then the monthly math for the consumer bakes in strong momentum into Q4 before we even get any Q4 data. If there are no revisions to prior months, then the way Q3 ended could bake in 1.8% q/q SAAR consumption growth in Q4 as a running head start before monthly Q4 spending data begins rolling in. Then bring on the holiday shopping season backed by strong consumer fundamentals.

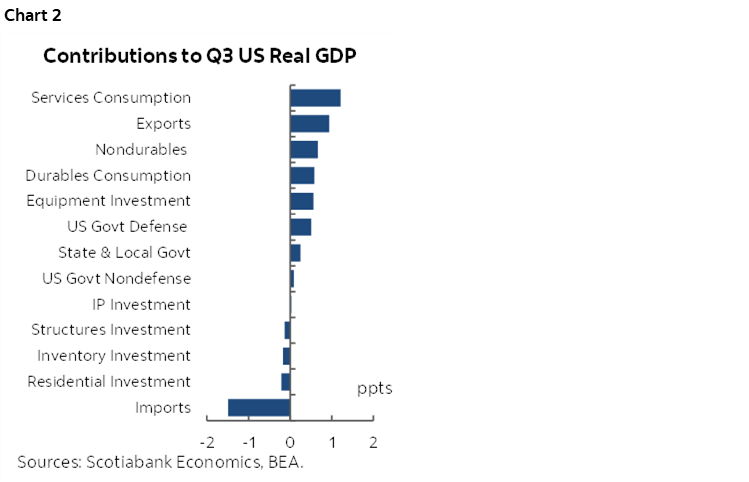

Chart 2 shows a breakdown of the whole set of contributions to GDP growth by component. Consumer spending added 2.5 percentage points of the 2.8% GDP growth rate and thereby played a dominant role. Goods spending added 1.25 ppts and services spending added 1.2 ppts to GDP growth for roughly equal performances from a compositional standpoint.

Investment was mixed as equipment spending added 0.56 ppts to growth in weighted terms, but nonresidential structures subtracted 0.1. Residential investment subtracted 0.2 ppts from GDP growth.

Inventories played a minor role, subtracting -0.17 ppts from growth, so growth may have been even stronger if not for mild inventory shedding.

Net trade was a drag, subtracting -0.56 ppts as exports added 0.9 ppts and higher imports increased the leakage effect on GDP accounting to shave 1.5 ppts off of GDP growth. That’s not necessarily a bad thing in that it could well reflect a pull effect from the domestic economy.

Government added 0.85 ppts to growth led by the Federal government's 0.6 ppts contribution.

So overall, the composition is decent with the consumer clearly the leading force

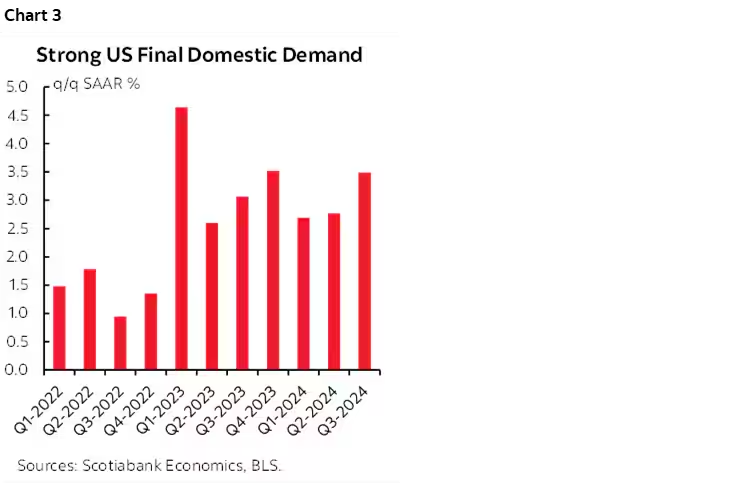

Strip net trade and inventories out of the picture and Final Domestic Demand is doing rather well (chart 3). But at a cost.

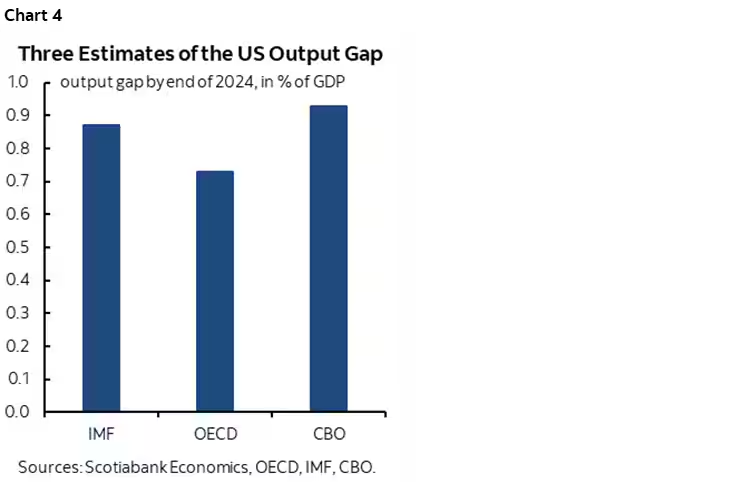

The broad narrative is that this is not really a cooling US economy so far. It's one in which the FOMC probably did a mistake in September imo. The economy remains well in excess demand with a positive output gap (chart 4) and a tight job market generating ongoing wage pressures. There are plenty of data issues in the US now including the reliability of seasonal adjustment factor estimates that are distorting payrolls and inflation given the recency bias involved in the current SA factor estimates that is now skewed to the distorted post-pandemic environment.

So what does the FOMC do? For now, they’ll look at chart 5 and reflect on dual mandate progress that merits easing. Depending on the data, I think there is a high credibility bar set against knocking the FOMC off the dot plot for this year (-50bps) but next year is a massive question mark in my opinion with forecasts to be treated as guesswork. That's partly because of the above comments on not even taking steps toward creating any disinflationary slack and then lagging out the effects on inflation. And it's partly because of the potential effects of the US election including the risk that the terminal rate is set higher than would otherwise be the case and the bond market’s inflation and supply concerns wind up sterilizing fiscal policy in a very different environment from 8 years ago.

Anyway, the first pass at US quarterly growth is always a guesstimate, so treat accordingly. There is a lot of incomplete data and the revision risk can be high in the first revision and the second one when fuller services data gets incorporated. It could be faster or slower than first reported, we just have to track the fuller set of data as it comes in

ADP SIGNALS SOLID NONFARM PAYROLLS

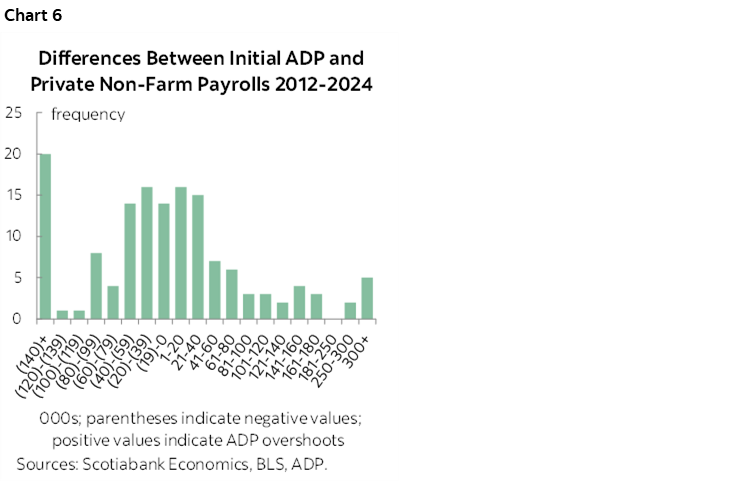

US ADP private payrolls were up by 233k in October. This morning’s estimate signals that Friday’s nonfarm payrolls could be firmer than some fear.

Chart 6 shows the historical spread between changes in ADP payrolls and private nonfarm payrolls on first estimates pre-revisions. There is only about a one-in-ten chance that private nonfarm payrolls land around 100k or less on Friday given ADP at 233k. There is only a <5% chance that private nonfarm payrolls turn negative based on ADP.

In other words, it is statistically improbable, but not impossible, that nonfarm payrolls turn up very weak. As a reminder, the biggest ADP—private nonfarm deviations were in the early stages of the pandemic.

Still, payrolls may be so distorted by hurricanes and strikes that the FOMC will shrug and walk on.

PENDING HOME SALES SURGE

Lastly, pending home sales—an advance indicator of completed resale transactions, surged 7.4% m/m SA higher in September for the strongest gain since June 2020 in the initial stages of the pandemic rebound.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.