POLICYMAKERS PLAY GOOD COP, BAD COP

- Canada’s Fall Economic and Fiscal Update offered few surprises today.

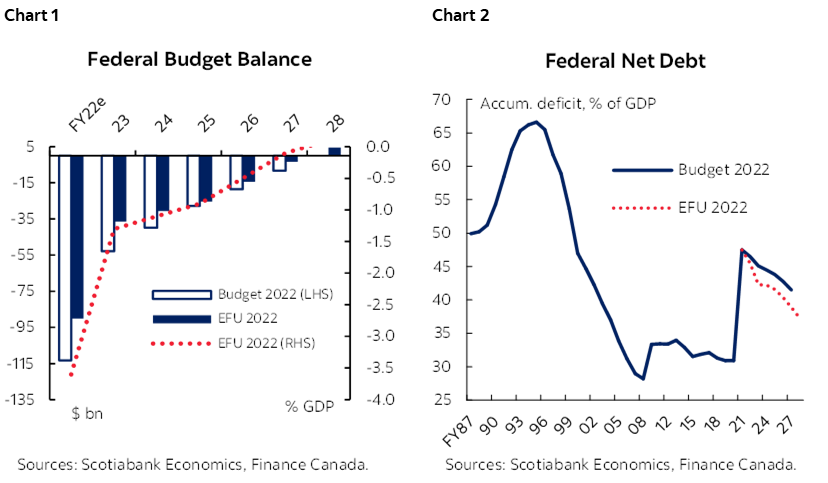

- Robust government revenue windfalls are driving sharp improvements in the fiscal balance in the near-term—$39 bn between FY22 and FY23 alone. While these drivers wane over the horizon with weaker economic activity, the strong hand-off underpins a slightly tighter bottom-line with the balance sitting modestly in surplus by FY28 (chart 1).

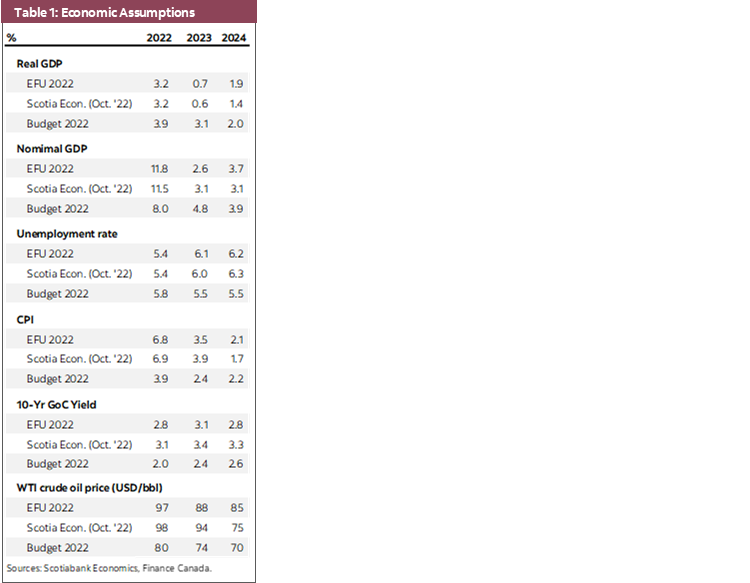

- After a material improvement in net debt (to 42.3% of GDP in FY23), a gradual descent is set to resume, landing at 37.3% of GDP by FY28 (chart 2).

- New spending announced in the Update is relatively contained (or contained at least from the perspective of a serial-spender government) at $27.4 bn over the horizon (FY23–28). This includes affordability measures targeting students and low-income workers amounting to $6.6 bn over the horizon (with about 1.2 bn or 0.05% of GDP flowing in FY24).

- Another signature measure is a $6.6 bn investment tax credit for clean technologies with strong messaging that this is a down payment towards a larger growth agenda in Budget 2023.

- The Finance Minister is signaling constraint in the Update, but the taps are hardly closed with more than $23+ bn set to reach pocketbooks in the coming quarters once provincial affordability measures are folded in (and provinces have yet to table their own updates).

- The Bank of Canada’s job is hard enough with very high uncertainty on the inflation and interest rate path (at home and abroad). A modest-but-persistent expansive fiscal stance adds to this uncertainty.

- Domestically-driven inflationary pressures—potentially compounded by an exogenously-driven weaker growth and/or higher interest rate environment—is an undesirable outcome worth hedging against.

- But for now, the Finance Minister will largely play good cop and leave the heavy lifting to the central bank.

IT’S THE ECONOMY (OR IS IT?)

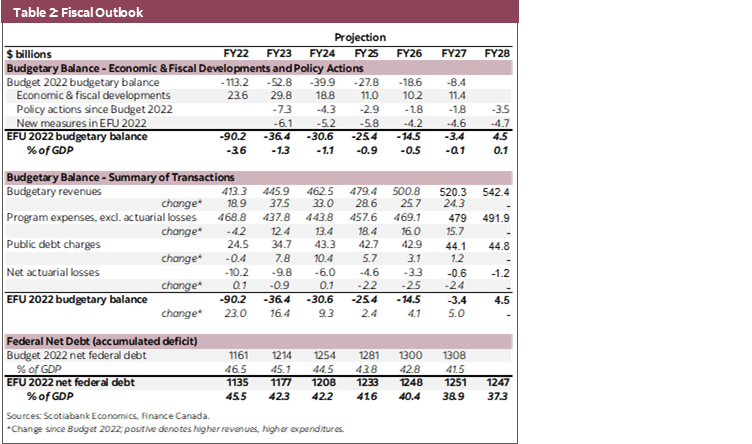

Uncertainty has been a theme since the pandemic struck. That has not changed in this Update which adopts a cautious tone as it lays out an economic path that faces more potential turbulence ahead on the path to “normal”. The economic outlook—an average of private sector economists’ views—shows a stalling economy into 2023 as elevated inflation and rising interest rates curb activity. The economic picture looks substantially different from budget time last April across almost all indicators (table 1).

While the forecasts do not detail quarterly projections, the math suggests the economy will move sideways for several quarters that at least. This clearly complicates fiscal planning, not the lease because the biggest risk is policy misstep—at home or abroad—that could drive a deeper contraction and a slower recovery. A dovish turn by the Bank of Canada arguably increases the sensitivity to miscalculations on the fiscal side. Relatively modest new spending in this Update is unlikely to move markets—especially given it is couched between yesterday’s US Fed rate decision and tomorrow’s job report in Canada—but the broader signal from Elgin Street remains mixed.

DEFICITS & SPENDING

The fiscal path looks modestly tighter relative to budget-time expectations, but that path masks a host of changes underpinning the balance (table 2). In the near-term, substantial revenue windfalls—corporate and personal income tax receipts in particular—drive material improvements to the balance. Estimates for the FY22 deficit (ended March 31, 2022) show a $23 bn improvement at $90.2 bn (or 3.6% of GDP) relative to last Spring’s outlook. Meanwhile, the FY23 shortfall is expected to continue contracting to $36.4 bn (or 1.3% of GDP) for a $16.4 bn improvement. Beyond that, a strong hand-off (for revenues and nominal GDP) drive continued improvements to the bottom-line over the horizon even as momentum wanes. The Update shows a modest surplus by FY28, but this can be faded for a host of reasons, including economic uncertainty, more spending to come in Budget 2023, and new mandates (and possibly new governments) over that horizon.

Modest new spending is folded into this profile. The update sets in motion an additional $30.6 bn in spending over the next six years (or $27.4 bn once netting out previously-announced Cost of Living Act which has been included above the line as parts are still moving through Parliament). This including $2.9 bn ($6.1 bn including the Act) over the remainder of the current year (FY23), of which $1.1 bn reflects relief funds for Hurricane Fiona. Incremental spending amounts to $5 bn in FY24. Meanwhile, other policy measures since the last outlook tally $21.6 bn over the six-year horizon. Otherwise, economic and fiscal developments drive the bulk of changes.

New measures announced today are relatively targeted. Key affordability measures include eliminating interest on student loans ($2.7 bn over FY24–28) and advance payments of the recently topped-up Canada Worker Benefit for low-income workers ($3.8 bn over FY24–28). In isolation, these two measures would deliver about $1.2 bn in FY24 (starting April 1, 2023) or about 0.05% of GDP to individuals with a high propensity to spend these amounts.

The Update nudges a growth agenda forward. A new Investment Tax Credit for Clean Technologies is a signature measure amounting to $6.7 bn over the horizon with details to come in Budget 2023. Intentions to proceed with the previously-announced hydrogen tax credit are reiterated without further detail. There are also modest skills and youth labour programs that don’t amount to big spends. Otherwise, announcements today mostly flesh out earlier pledges—for example, around the $15 bn Canada Growth Fund that will be launched by year-end and the new Canadian Innovation & Investment Agency announced in Budget 2022.

The Update signals that these are ‘down payments’ towards a bigger growth agenda in Budget 2023. The Finance Minister rightly continues to emphasize serious productivity and competitiveness challenges that hinder longer-term growth prospects and signals ambitions to level the playing field with the US. This level of ambition is warranted and daunting: investments consistent with net-zero would (or should) rival annual infrastructure spending before long, while avoiding the execution pitfalls of the latter. (In this regard, the Update follows up on a Budget 2022 threat to provinces—“use-it-or-lose-it”—with a scorecard on provinces’ uncommitted federal infrastructure funding.)

On the other side of the ledger, the Update perpetuates a mostly punitive approach with respect to businesses to fund a larger government. A 2% tax on share buybacks of public corporations is expected to pad coffers by another $2.1 bn over five years (coming into effect January 2024) on top of earlier special taxes and recovery dividends expected to bring in $6 bn by FY27. (Conveniently, a plan to spend another $2.2 bn on government services follows the new tax measure.) There is a re-iteration but no further details on an expenditure review that would yield an eventual $9 bn in savings. Calls should grow louder for a comprehensive tax review in Canada that strips out distortions (rather than layering them on) and supports a comprehensive growth agenda in a new world of labour scarcity, a consumption-bent economy, and an ambitious green agenda.

DEBT & BORROWING

Net federal debt dips with tighter deficits in the near-term, but improvements wane over the medium term. Narrower fiscal balances drive a sharp decline in the federal accumulated deficit to a forecasted 42.3% of GDP in FY23 (down from 45.5% in FY22 and almost 3 ppts lower than the Budget 2022 outlook). A then-gradual descent to 37.3% of GDP by FY28 is expected. This further secures Canada’s status among a dwindling club of countries with low and declining debt levels—especially on a net basis. Nevertheless, Canada’s lack of reserve currency status puts a lower tolerance on debt levels that limits the usefulness of such comparisons, particularly in times of potential market stress when flight-to-safety trumps fundamentals.

Higher interest rates are putting more pressure on debt servicing costs. The outlook for the 10-year Government of Canada bond yield, for example, is a 80 bps and 70 bps higher this year and next relative to the Budget 2022 outlook. This drives an additional $28 bn in debt servicing costs between FY22–27. As a share of GDP and as a share of revenue, these costs start to tick up this year, but from historically low levels. Debt service as a share of GDP is estimated at 1.0% in FY22 and is expected to peak at 1.5% of GDP in FY24 before trending down again under ‘neutral’ conditions. The impact on the bottom line is partially offset by downward revisions to actuarial valuations for government pension, but these have no bearing in economic (or socio-political) terms.

Borrowing activity has shifted lower relative to Budget 2022 expectations. With five months left in the fiscal year, bond issuance has been revised down by $21 bn—to $191 bn reflecting lower budgetary needs. The year-end Treasury bill stock has also been revised down by $21 bn relative to the Spring projection. There is no change to Green Bond issuance ($5 bn), while the $500 mn Ukraine Sovereignty Bond issuance is re-announced. Borrowing requirements for FY24 will only be set out in the winter budget when the fiscal picture might look different with potential new spending.

IMPLICATIONS

Near-term economic impacts are relatively contained in isolation. The newly-announced affordability measures at 0.05% of GDP put upward pressure on demand at the margin only. To put these amounts into perspective, Scotiabank Economics earlier estimated that the $20+ bn in affordability measures announced by the feds and provinces over the past few months could force the Bank of Canada to lean in further—potentially by an additional 25 bps—as the economy sits in excess demand. While today’s incremental pressures work against the Bank’s mandate, the impacts should not be exaggerated. It should not, in isolation, materially change our outlook for the Canadian economy, inflation, or the interest rate path.

At the same time, today’s Update should not be evaluated in isolation. The support announced today is additive—to measures announced earlier at the federal and provincial levels—with that stimulus-by-stealth number closer to $23 bn now. By year-end, that impulse could be higher as nine provinces have yet to table Fall updates. Importantly, developments south of the border will have clear implications for Canada, whether through trade, currency, or policy rate channels. An exogenously-driven weaker growth and/or higher interest rate environment, coupled with domestically-driven inflationary pressures is an undesirable outcome worth hedging against. With the balance of risk biased in this direction, fiscal prudence would be the safe bet.

The federal government has demonstrated restraint today only in so far as it plans to spend just a “little bit more” not “a lot more” while revenue drivers continue to carry the day. For now. That may come back to bite the government in the event of a sharper downturn, when support may be needed, but not necessarily in the places it is being directed today. And a tax-and-spend approach starts to stutter.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.