BACK IN BLACK

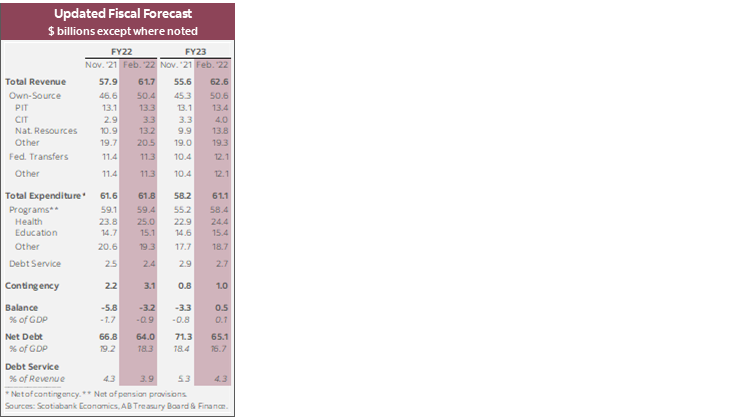

- Budget balances: -$3.2 bn (-0.9% of nominal GDP) in FY22, +$0.5 bn (+0.1%) in FY23, +$0.9 bn (0.2%) in FY24, +$0.7 bn (0.2%) in FY25, in contrast to deficits of between 1.7% and 0.6% of GDP through FY24 projected in mid-year fiscal update (chart 1).

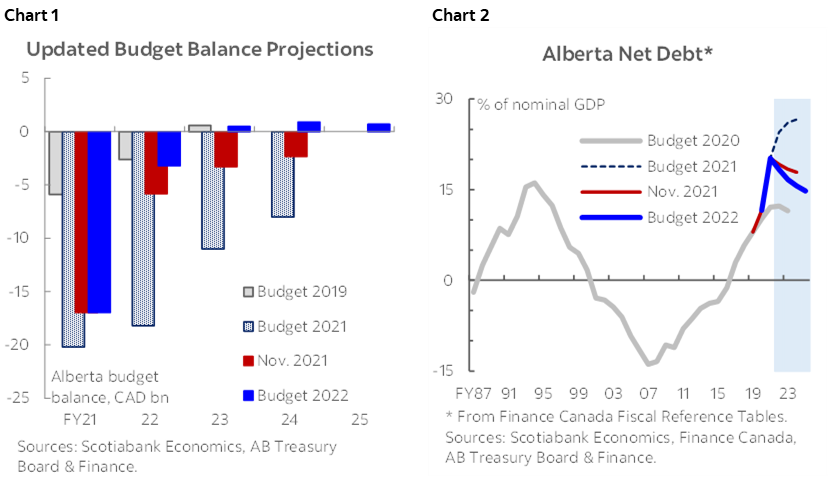

- Net debt: expected to decline steadily from 18.3% of nominal output this fiscal year to just 14.8% by FY25 (chart 2, p.2).

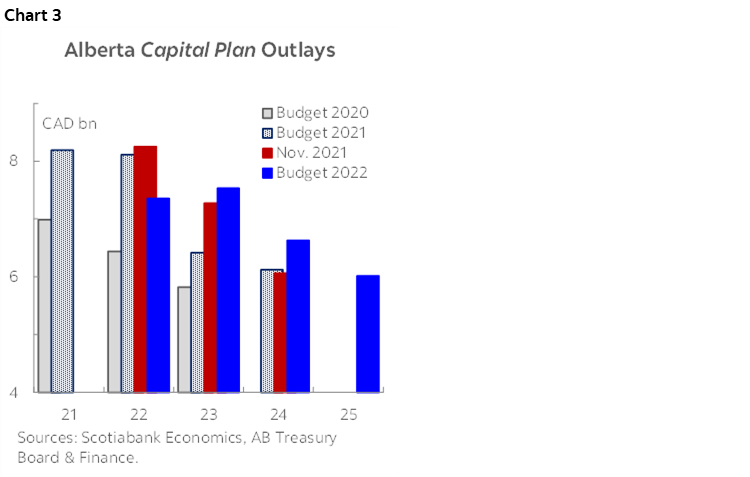

- Infrastructure spending: largely in line with mid-year update plans for FY22–24, with capital outlays delayed such that Alberta Capital Plan expenditures are now expected to increase by 2.4% in FY23 (chart 3, p.2).

- Borrowing requirements: $8.6 bn in FY22, $3.5 bn in FY23, $7.8 bn in FY24, $5.7 bn in FY25; for FY22–24, new figures represent a total reduction of $13.1 bn from the mid-year update estimates.

- Further gains in crude values and the structure of royalty payments contributed to the bulk of bottom line improvements since the mid-year fiscal update.

- New policy initiatives were incremental and concentrated in workforce training and health care capacity expansions; these result in more modest expenditure restraint than previously planned.

- Projections look prudent, Alberta maintains a strong fiscal position relative to other provinces, and non-energy industries have contributed strongly to the economic recovery; still, broadening the province’s revenue base must remain a priority.

As widely anticipated, Budget 2022 contains a lot of good fiscal news. Alberta now expects surpluses for FY23–25 instead of deficits through at least FY24 and—quite remarkably—is on track to balance the books for the first time since FY15 and just two years after a record $17 bn shortfall in FY21. A $9.6 bn total bottom line improvement for FY22–24 builds on the $26 bn gain announced just three months ago in the FY22 mid-year fiscal update. As a share of output, net debt forecasts remain on a downward trajectory, with a terminal rate less than 15% in FY25—the lowest among the provinces that have announced plans so far. Total debt servicing costs of about 4% of total revenues throughout the forecast horizon are both manageable and low relative to history, even after accounting for interest rate increases expected over the next two years.

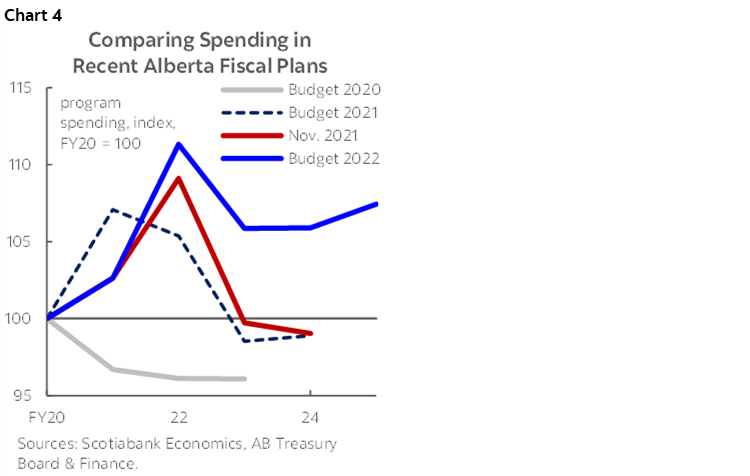

Projected FY22–24 budget balance improvements of $9.6 bn versus the mid-year fiscal update are roughly evenly split across the three years, and stem primarily from natural resources. Own-source revenue projections were increased by $15 bn during FY22–24—with $9.4 bn sourced from non-renewable resource revenues. Meanwhile, federal transfer forecasts were lifted by $3.2 bn over the three years, with support from a one-time Fiscal Stabilization payment in FY23 and funds for the Child Care Agreement with Ottawa. Program spending projections were raised by $8 bn over FY22–24 (0.7% of forecast GDP), Rather than November 2021 plans for program expenditure cuts of 9% (FY23) and 1% (FY24), outlays are set to fall by just 5% in FY23 and sit $3.8 bn (7%) higher in FY24 than forecast in the mid-year plan as well as 6% higher than FY20 levels in FY24 (chart 4, p.2).

Re-profiling of infrastructure outlays adjusts their expected contribution to economic growth. In the mid-year update, outlays under the Alberta Capital Plan were set to plunge by 12% in FY23. Budget 2022 lowered FY22 infrastructure plans by $760 mn to $7.4 bn (2% of nominal GDP) in respect of construction timeline changes for various health and school facilities, capital maintenance and renewal projects and federally funded ventures. However, Capital Plan outlays are now forecast to increase incrementally in FY23. The total spend expected for FY22–24 was largely unchanged.

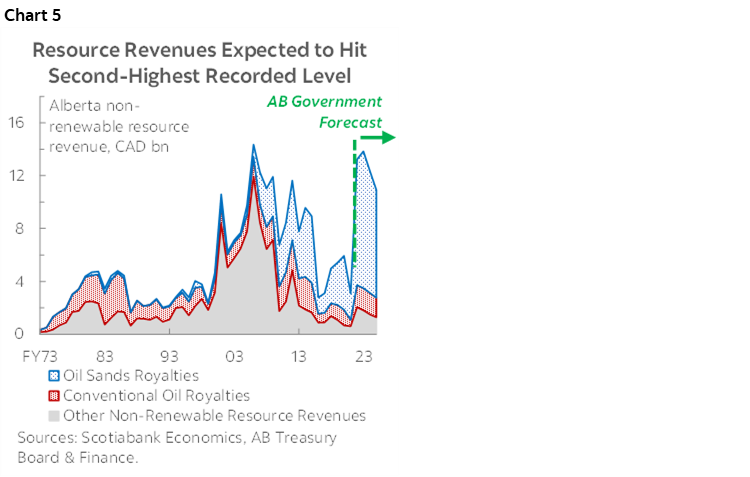

Further gains in royalties reflect both the recent oil price surge and the fact that many oil sands projects are now paying out a larger share of their net revenues. To offset the significant upfront costs of oil sands investment, Alberta’s royalty system offers low royalty rates until projects recoup their initial outlays; after that point, rates increase significantly. With support from this effect and rising production, bitumen royalties are expected to reach a record high of $10.3 bn in FY23 and remain historically elevated thereafter. Total natural resource receipts are forecast to reach their second-highest recorded level in FY23 (chart 5).

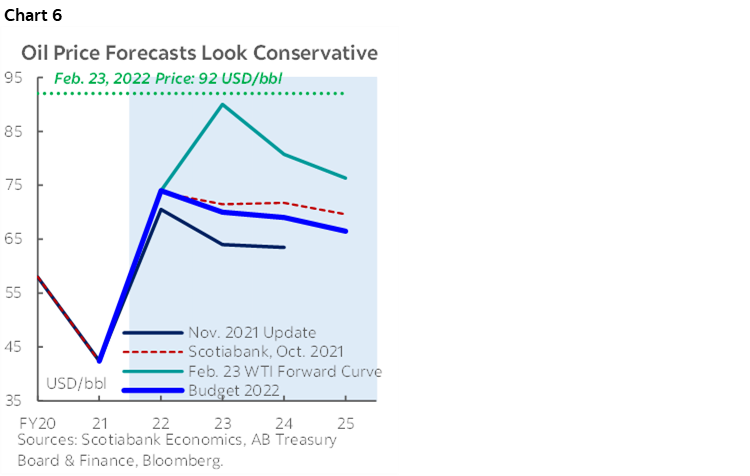

Fiscal plan projections also contain significant upside. WTI price projections—completed before the Russia-Ukraine geopolitical conflict surfaced and bid up crude prices—are about 2 USD/bbl below our January forecast for FY23 and more than 20 USD/bbl lower than the level at which crude closed on Feb. 23, 2022 (chart 6). With the estimated Budget net fiscal impact of $500 mn per 1 USD/bbl, this suggests bottom line improvements of at least $1 bn in the coming fiscal year. Budget also includes contingency and disaster assistance amounts of $1 bn in FY23 and $750 mn in both FY24 and FY25. Finally, potential increases to the Canada Health Transfer—per demands from the provincial and territorial premiers—could further boost Alberta coffers (as well as those of other regional governments). The government stated that it will consider dedicating surplus revenue to the Heritage Savings Trust Fund—an income-generating fund that helps finance key programs—or debt repayment.

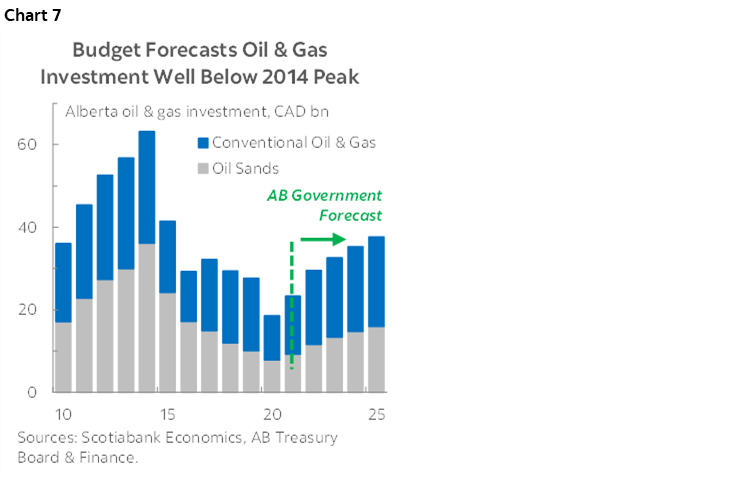

We’re encouraged by plans for and indicators of economic diversification contained in Budget. While crude prices currently sit well above pre-pandemic levels and close to the heights achieved before the prior market correction that began in 2014, the province still only expects oil and gas investment to reach about 60% of its peak by calendar year 2025 (chart 7, p.2). By the same token, Canada’s central bank and financial regulator recently outlined the economic risks associated with the climate transition. This year’s plan unlocks funding to expand enrolment in areas with skills shortages, enhance apprenticeship opportunities, and support technology sector development. Consistent with our own forecasts, the province also notes already underway and expected economic contributions from the technology, renewable energy, and petrochemicals manufacturing sectors. Economic diversification is an ongoing process, but continuation of these trends and implementation of new policies may eventually help to broaden Alberta’s revenue base in the absence of a consumption tax.

In line with the reduced deficit forecasts, the province lowered its projections for borrowing requirements. The government now expects to borrow $8.6 bn in FY22, $3.5 bn in FY23, $7.8 bn in FY24, and $5.7 bn in FY25. For FY22–24, new figures represent a total reduction of $13.1 bn from the mid-year update estimates. The province stated that most of the FY24–25 borrowing will be completed using long‑term debt. Borrowing strategy will remain anchored by three principles: “build liquid benchmark bonds in the Canadian bond market, target approximately 30 per cent to be issued in foreign markets and issue debt in multiple terms to maturity out to 30 years.”

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.