LARGE SURPLUSES UNLOCK NEW SPENDING

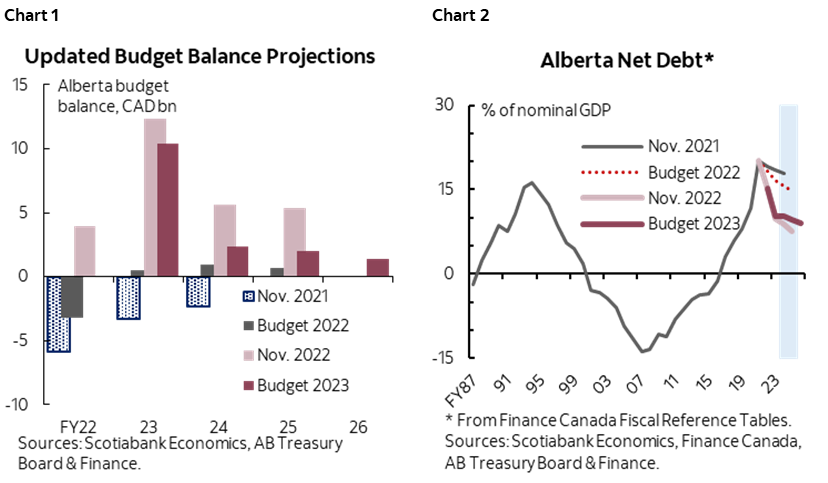

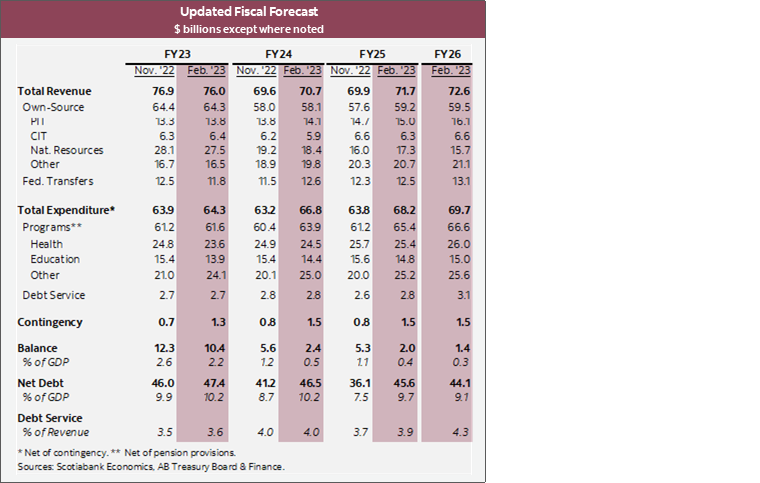

- Budget balances: +$10.4 bn (2.2% of nominal GDP) in FY23, +$2.4 bn (0.5%) in FY24, +$2.0 bn (0.4%) in FY25, and +$1.4 bn (0.3%) in FY26—a slightly weaker path than the surpluses of over 1% of GDP through FY25 projected in mid-year fiscal update (chart 1).

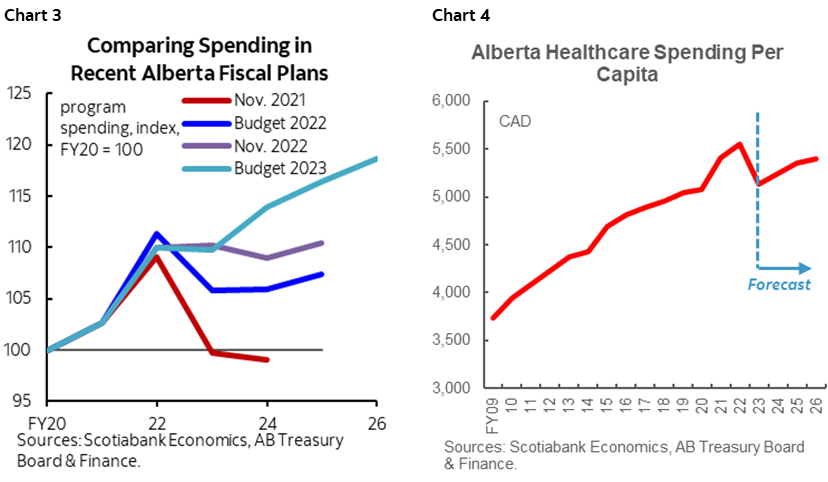

- Net debt: expected to remain flat at 10.2% of nominal output in FY24 before edging down to just 9.1% by FY26 (chart 2).

- Economic forecasts: WTI price projections nudged down to US$90.5/bbl in FY23, and lifted slightly to US$79/bbl in FY24 and US$76/bbl in FY25 versus the mid-year update; nominal GDP forecast at +24.0% in 2022, -2.2% in 2023, and +3.5% in 2024.

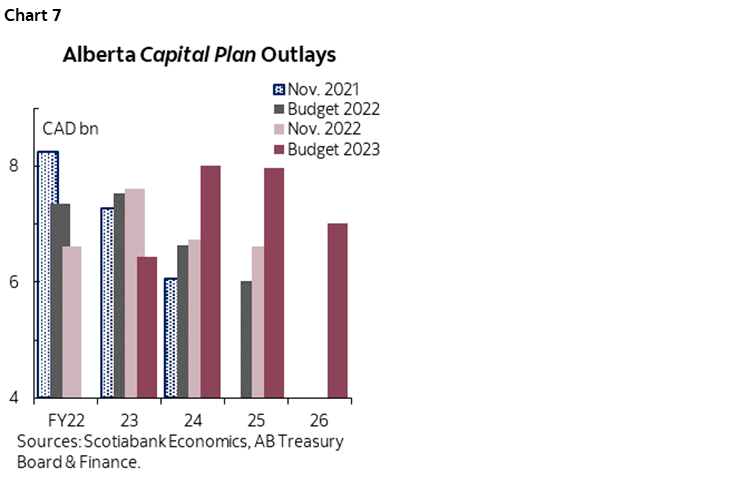

- Infrastructure spending: FY23 outlays revised down by $1.2 bn to $6.4 bn versus the mid-year update; $8.0 bn planned each year in FY24 and FY25, before moderating to $7.0 bn in FY26.

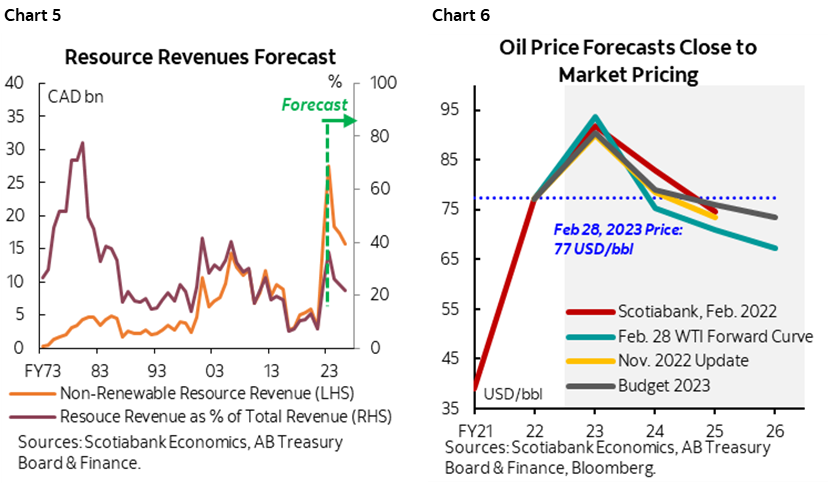

- Budget 2023 reversed the near-term spending restraint put in place in previous plans, but the growth rate in expenditures seems relatively modest and well within the bounds of the speed of population growth plus inflation—though the $600 one-time payments to seniors and parents with household income below $180k will likely run counter to efforts to reign in inflation.

- Borrowing program: $3.3 bn in FY23, $6.7 bn in FY24, $6.1 bn in FY25, $15 bn in FY26; for FY23–25, updated borrowing requirements represent a total increase of over $10 bn from the mid-year update estimates.

- As widely expected, the budget delivers on a path of surpluses driven by windfall revenue and royalty developments built on a strong oil outlook. Volatility in the commodity markets could lead to material downside risks in the coming fiscal year, and the substantial contingencies built into the planning should provide some flexibility to maneuver going forward. A set of fiscal rules is introduced to dampen the boom-bust cycle which is a welcomed development but alone likely won't be enough.

OUR TAKE

Alberta is projecting another surplus in FY24 following a strong handoff from FY23 as the tight oil market is expected to continue to boost the province’s resource revenue. The FY23 surplus estimate was revised down slightly but still at a hefty $10.4 bn (2.2% of nominal GDP). The FY24–25 surplus projections are slimmer than anticipated in the mid-year update owing to new spending initiatives and enhanced contingencies. The Budget includes contingency and disaster assistance amounts of $1.3 bn in FY23, and $1 bn each year from FY24 to FY26.

The budget introduces a new fiscal framework including a balanced budget requirement with some exemptions. There are a series of rules under the new framework including keeping spending growth within the bound of population growth and inflation. New rules allow deficits only when revenue projections change drastically or unanticipated costs occur, and deficits would need to be eliminated within two years. In cases of surplus, 50% of the surplus cash must go to repaying maturing debt, with the rest allocated to the new Alberta Fund for future debt repayment, deposits into the Heritage Fund or funding one-time spending initiatives. In theory, this should blunt somewhat the boom-bust cycle though in practice it may not be terribly binding.

Released shortly before the provincial election scheduled for May 29, Alberta’s Budget 2023 raised the province’s spending profile once again, targeting the rising cost of living (chart 3). Total expenses are expected to rise 3.8% (before contingencies and allowances) in FY24 instead of the slight dip anticipated in the mid-year update, and are set to grow further by over 2% each year in FY25 and FY26. The budget includes $8.7 bn over FY24–26 in policy initiatives supporting households with rising cost of living, which are primarily measures already announced such as the indexation of personal income tax and the fuel tax relief, with $1.1 bn new spending in affordability payments of $600 to seniors and parents with household income below $180k. With the COVID-19 spending surge behind us, the province continues to grow healthcare expenses by 4.1% in FY24 and an average rate of 3% each year in FY25–26, bringing the per capita expenses on a steep upward trend (chart 4).

The revenue outlook remains largely unchanged from the mid-year update with significant bandwidth around oil price assumptions. Revenues are projected to decline by -7.1% in FY24 relative to FY23 driven by the $9.2 bn drop in resource revenues, which should continue to normalize in FY25–26, but still contribute to over 20% of total revenues (chart 5). The Budget assumes WTI prices to average US$79/bbl in FY24—close to the level at which crude closed on Feb. 28, 2022, acknowledging the recent softening of oil prices, but the outlook remains optimistic over the planning horizon compared to prices suggested by the futures (chart 6). The Budget assumes slight moderation in oil prices in FY25 and FY26 to an average of US$76/bbl and US$73.5/bbl, respectively. Given the near-term wild swings in oil prices, these assumptions are not as conservative as the ones in the last budget, and could lead to material downside risks considering the high sensitivity to oil prices—the budget links 1 USD/bbl with a net fiscal impact of $630 mn.

The budget also notes significant business investments flowing into the province’s non-energy sectors, such as tech, manufacturing and petrochemicals, expanding the province’s non-energy tax base. Non-energy investment growth is expected to slow to 5.6% this year from a whopping 14% growth last year, owing to higher borrowing costs. The share of non-energy to total business investment is expected to remain close to 60%, well above its 10-year historical average of about 47%. Oil and gas investment is expected to continue to grow amid favourable oil prices, but will remain well below its pre-2014 peak with spending focusing on clean energy projects and optimizing existing infrastructure. Capacity expansions in petrochemicals and other non-energy sectors should support steady growth in Alberta’s manufacturing exports over the planning horizon.

The government plans a steep increase in capital spending during FY24 to $8.0 bn and keep it elevated in the following two fiscal years (chart 7). Infrastructure expenditures are expected to total $23 billion over the next three years, $2 bn higher than planned last November. The investments will help improve transportation infrastructure and healthcare services.

FY23–25 borrowing requirement projections were revised higher than anticipated in the mid-year update. Borrowing requirements are estimated to come in at $3.3 bn in FY23, up from the previously anticipated $1.4 bn, and are expected to total $6.7 bn in FY24, $6.1 bn in FY25 before jumping to $15 bn in FY26. The province continues to dedicate surplus cash to repaying maturing debt, with $13.4 bn debt repaid in FY23 and another $1.4 bn planned in FY24. As a share of output, net debt forecasts remain on a downward path but from a higher base than projected in the mid-year update. Projected to remain flat at 10.2% of GDP in FY24 before trending down to reach 9.1% by FY26, Alberta’s net debt burden is far lower than all provinces’ latest estimates.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.