STAMPEDE OF SPENDING CHIPS AWAY AT SURPLUSES

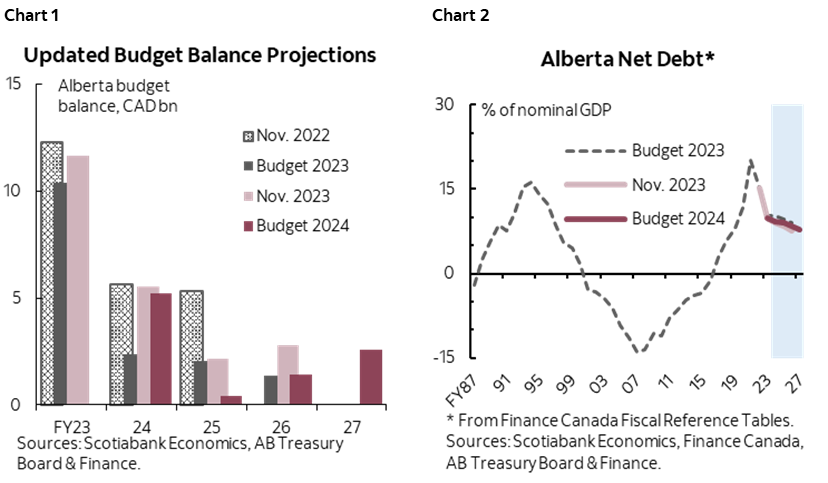

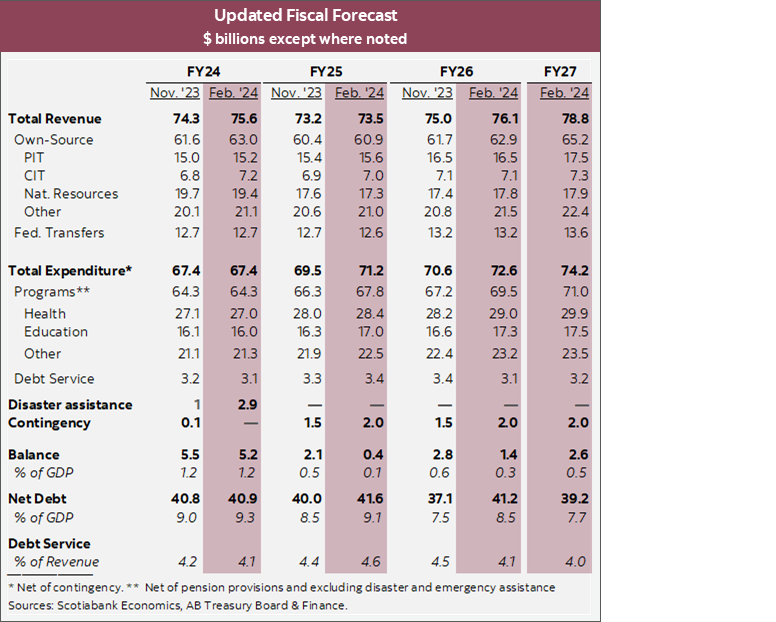

- Budget balances: +$5.2 bn (1.2% of nominal GDP) in FY24, +$0.4 bn (0.1%) in FY25, +$1.4 bn (0.3%) in FY26, and +$2.6 bn (0.5%) in FY27—a slightly weaker path than the surpluses of over $2 bn through FY26 projected in mid-year fiscal update (chart 1).

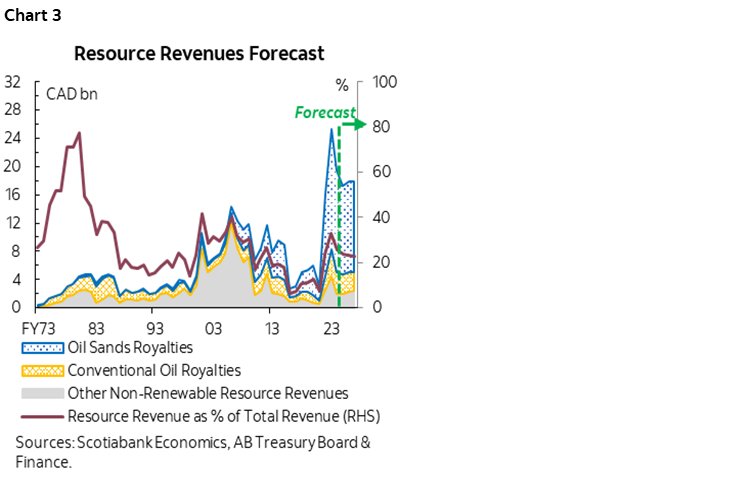

- Net debt: expected to remain flat at 9.1% of nominal output in FY25 before edging down to 7.7% by FY27 (chart 2).

- Economic forecasts: WTI price projections nudged down to US$74/bbl in FY25 versus the mid-year update, remaining steady through FY26 and FY27; nominal GDP forecast at +3.5% in 2024, +6.1% in 2025, +5.5% in 2026, and +4.9% in 2027. Population growth at 3.7% in 2024, 2.3% in 2025, 2.0% in 2026, and 1.6% in 2027.

- Program spending lifted by around $2 bn each year through FY25–FY26 relative to the mid-year update, with grow rates still below the bounds of the speed of population growth plus inflation. New spending appears properly targeted and could prove beneficial to the province’s long-run growth.

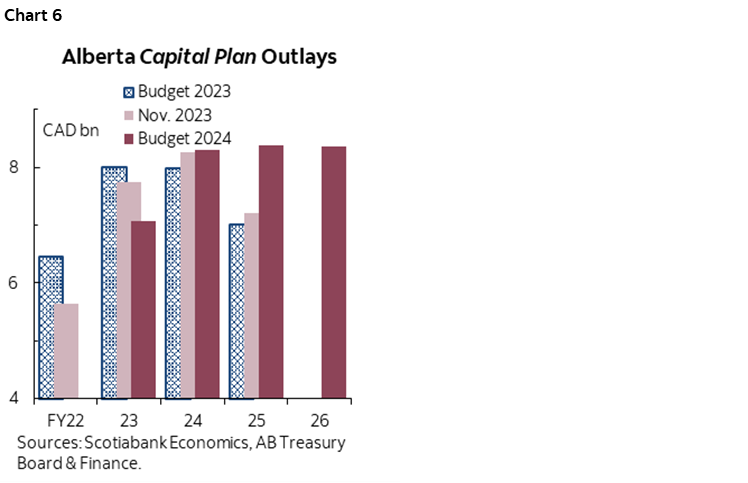

- Infrastructure spending: FY24 outlays revised down by $7.7 bn to $7.1 bn versus the mid-year update—still a 25.6% jump from the previous fiscal year; $8.3 bn planned each year through FY25 to FY27.

- Borrowing program: $13.8 bn in FY24, $19.8 bn in FY25, $4.4 bn in FY26, $8.0 bn in FY27; for FY24–26, updated borrowing requirements represent a total increase of over $10.2 bn from last year’s budget due to advance borrowing.

- With a notably optimistic view of the province’s economic outlook, particularly in the oil and gas sector, Alberta’s Budget 2024 unlocks funding to bolster the province’s essential services. The updated plan strikes a balance between preserving Alberta’s fiscal advantages and investing in the province’s growth.

OUR TAKE

In light of a less favourable commodity outlook, Alberta’s once-massive budget surplus is feeling the pinch as heightened spending takes centre stage. The FY24 surplus is expected to come in slightly lower but still at a hefty $5.2 bn (1.2% of nominal GDP). The FY25–26 surplus projections are slimmer than anticipated in the mid-year update owing to new spending initiatives and enhanced contingencies. The province expects to comfortably remain in the black by keeping spending growth well below strong revenue gains over the medium-term with a surplus of $2.6 bn (0.5% of GDP) projected in FY27. The Budget includes a sizable contingency of $2 bn each year from FY25 to FY27.

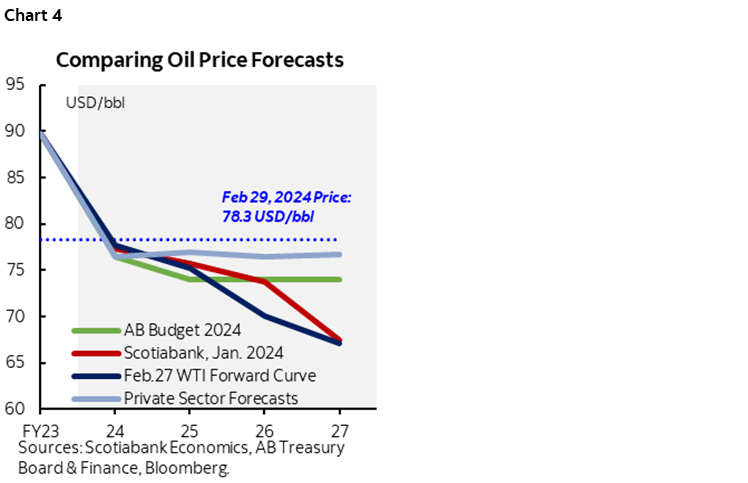

A series of upward revisions on the revenue side puts the province on a better trajectory, while anticipating stronger headwinds in the near term. The government forecast a $2.9 bn improvement in its FY24 bottom line relative to the last budget plan due to increases in personal and corporate income tax revenue, along with $1.8 bn more in bitumen royalties. Revenue is nevertheless projected to decline in FY25 by -2.8%, reflecting softer energy prices and a slower economy, mainly driven by the -10.8% contraction in natural resource revenue. Nevertheless, natural resource revenues, especially from oil sands royalties, remain pivotal to Alberta’s coffer, projected to contribute around 23% of the province’s revenue over the planning horizon (chart 3). With a narrower light-heavy differential expected, revenue from bitumen royalties is forecasted to grow over the next two years, contrary to declines anticipated previously. Over the medium term, the province remains optimistic and expects revenue to pick up rapidly by around 3.5% each year for the next two years.

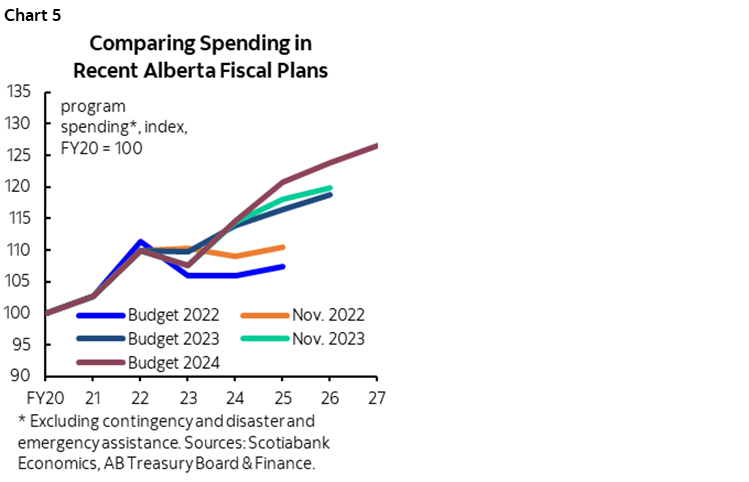

Economic assumptions underpinning the current plan, while prudently factoring in oil price risks, exceed private-sector growth averages, exposing the plan to potential downside risks. In the baseline scenario, WTI is assumed to average US$74/bbl each year over the planning horizon, well below the average of private-sector forecasts and the current market pricing for near-term prices (chart 4). Scotiabank GBM shares the cautious view on commodity prices, forecasting near-term pressure from macro headwinds to constrain WTI prices in 2024, with weaker medium-term forecasts reflecting softer demand. The government presented an alternative scenario where WTI prices dip below US$60/bbl in FY25 and remain subdued under US$67/bbl for the following two fiscal years. This alternative forecast suggests a potential shift back to deficits, with an estimated impact ranging from $7–8 bn annually on the province’s bottom line—an unlikely outcome in the prevailing demand-supply dynamic that keeps oil prices largely range-bound. The government foresees the province’s economy outpacing last year’s growth, fueled by increased business investments in both the energy and non-energy sectors. Projections indicate a real growth rate of 2.9% for the current year—1.6 ppts higher than the private-sector average—followed by an acceleration to 3.3% next year with sustained momentum thereafter.

The updated fiscal plan lifted program spending by around $2 bn each year through FY25–FY26 relative to the mid-year update, with increased outlays targeting essential services like health and education while still maintaining a surplus in the province’s budget. Excluding contingency and disaster assistance, program spending is projected to grow by 5.4% in FY25 (chart 5)—within the bounds of the speed of population growth (+3.7% in 2024) plus inflation (+2.5). Spending rises across key areas, notably in healthcare, as the government set aside $1.4 bn (+5.4%) more in operating expenses to overhaul the province’s health system. The government also plans a +5.1% rise in education operating expenses for FY25 to address enrollment growth, hire new staff and provide direct support to schools. Additional increases target supporting vulnerable populations, enhancing affordability (while remaining competitive compared to peers), and addressing rising costs due to still-high inflation. The budget also tackles risks surrounding the costs of climate change—which proved substantial in the ongoing fiscal year, amounting to $2.9 bn due to expenses related to wildfires, droughts and floods. The updated plan allocated $2 bn each year over the planning horizon in preparation for disasters and emergencies, an increase from the previous plan’s $1.5 bn.

We are encouraged by continued trends and new policy measures that contribute to the diversification of Alberta’s economy and the expansion of the province’s revenue base amid the transition to a sustainable future. Budget 2024 underscores growth in investments beyond the oil and gas sector, expected to grow by 11% in nominal terms this year and averaging around 10% per year from 2025 to 2027. This year’s plan provided more detail on the Alberta Carbon Capture Incentive Program (ACCIP)—an incentive program expected to help attract $35 bn in capital investment over the next decade. The budget also announces the implementation of the Alberta is Calling Attraction Bonus, offering a $5,000 refundable tax credit to eligible individuals who relocate to Alberta after April 2025, aiming at attracting skilled labour needed for the diversification of the economy.

Stepped-up Infrastructure spending should help support the province’s growth and diversification. Relative to the 2023 budget plan, capital expenditures have been increased by $2 bn (chart 6). Outlays under the Capital Plan were set to rise by 17% to $8.3 bn in FY25 and remain elevated through FY27. Projects targeted under the province’s Capital Plan include municipal infrastructure, healthcare system, education facilities, and various construction activities deemed likely to stimulate economic growth and local job creation.

Alberta’s balance sheet remains in great shape. As a share of output, net debt forecasts remain on a downward trajectory, with a terminal rate of 7.7 % of nominal GDP in FY27. Debt servicing costs remain affordable, projected to peak at 4.6% and stabilize at about 4% of total revenues throughout the forecast horizon. Based on the fiscal framework set up in last year’s budget, the government allocates surplus cash to repay taxpayer-supported debt as it matures and invest the rest. After the large repayment of $13.3 bn made in FY23, $3.2 bn is expected to be repaid in FY24. The remainder goes into the new Alberta Fund for future debt repayment, deposits into the Heritage Fund or funding one-time spending initiatives.

Borrowing requirement projections were revised higher than anticipated in the last budget as the government opted to borrow in advance for cost-effective refinancing of large bond maturities. The government now expects to borrow $13.8 bn in FY24, $19.8 bn in FY25, $4.4 bn in FY26, and $8.0 bn in FY27. For FY24–26, new figures represent a total increase of over $10.2 bn from last year’s budget due to a large amount of pre-borrowing planned in FY25 to prepare major debt maturities in 2025–26.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.