PRE-EMPTIVE STIMULUS IN THE FACE OF LOOMING TARIFF THREATS

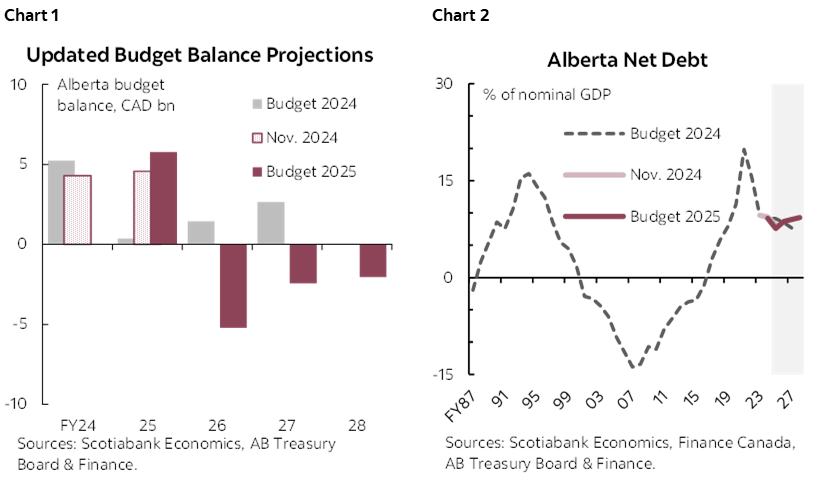

- Budget balance forecasts: Budget 2025 forecasts a surplus of $5.8 bn in FY2024–25 (FY25), higher than the previous Budget forecast of $0.4 bn and November update of $4.6 bn, before running deficits over the ensuing three years of -$5.2 bn in FY26, -$2.4 bn in FY27, and -$2.0 bn in FY28 (chart 1).

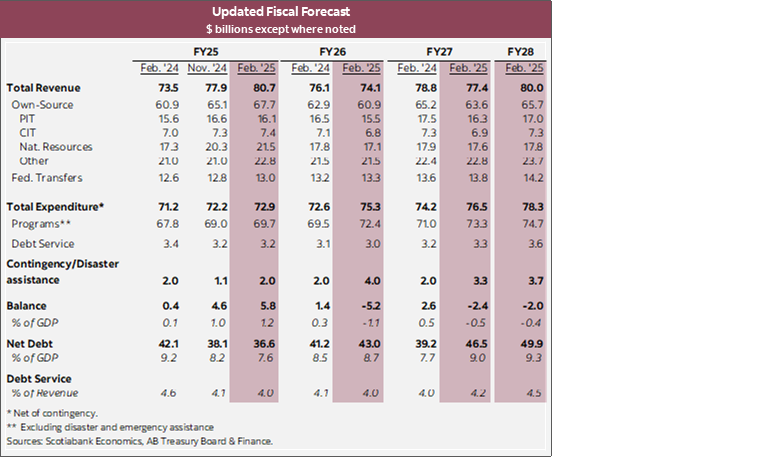

- Net debt: net debt level is projected to rise to $50 bn (9.3% of GDP) by FY28, with net debt as a percent of GDP projected to increase each year, reaching above 9% in the outer years (chart 2).

- Real GDP growth forecasts: economic growth is expected to be slower over 2025 and 2026 (base assumption of 1.8% and 1.7% respectively) than the estimated 3.0% growth for 2024.

- Borrowing program: Total borrowing for FY25 is expected to be $11.3 bn, lower than the $19.8 bn set out in the previous Budget, with borrowing of $11.4 bn in FY26, increasing to $13.9 bn and $20.8 bn in FY27 and FY28 respectively.

- Main takeaway: The economic risks over the horizon have deteriorated sharply nationwide. Alberta is additionally exposed through energy channels with marked downward revisions to oil price forecasts. The budget plan attempts to front-run some of these risks by pulling forward the government’s campaign promise to cut personal income taxes ($2.2 bn) over the next two years, otherwise setting aside substantial contingencies ($11.0 bn over FY26–FY28). Absent this prudence the fiscal balance would be flat to positive over the 3-year horizon. The net effect puts upward pressure on debt but the province still boasts the lowest debt levels across provinces. There may be upsides for the province including an improvement in the global geo-economic outlook, as well as renewed appetite for investment in energy security but it is premature to bank on those just yet as the downsides still loom large.

OUR TAKE

Alberta’s Budget 2025 budget balance outlook marks a sharp shift from the previous year’s expectations. While the province’s surplus forecast for FY2024–2025 (FY25) was revised up to $5.8 bn owing to revenue windfalls relative to expectations a year ago, the surpluses thereafter turn into deficits in the new outlook. The province now projects deficits over the next three years of -$5.2 bn (-1.1% of nominal GDP) in FY26, -$2.4 bn (-0.5%) in FY27, and -$2.0 bn (-0.4%) in FY28 as campaign proposed tax cuts are brought forward, combined with higher spending.

Alberta’s own-source revenue over FY26 and FY27 is projected to be $3.6 bn lower than Budget 2024. Of which, $2.2 bn of this downward revision is from lower personal income tax revenue as the province brings campaign proposed tax cuts two years earlier than previously planned. These tax cuts are estimated to save individuals up to $750 per year, and families up to $1,500 per year. Meanwhile, natural resource revenue is projected to be $1.1 bn lower over FY26 and FY27 compared to Budget 2024 as the outlook for WTI oil price is revised lower to 68 USD/bbl in FY26 and 71 USD/bbl in FY27 compared to the assumed price of 74 USD/bbl from FY25 onward in Budget 2024.

Total expenditure over FY26 and FY27 is also projected to be $5.1 bn higher than Budget 2024. This rise in spending is entirely from added program spending as debt servicing cost projections are mostly unchanged-to-lower over the same period due to funds pre-borrowed in FY25. Health is projected be the largest operating expense item, with spending expected to increase from $22.1 bn in FY26 to $23.7 bn in FY28, accounting for more than a third of total operating expense and nearly 30% of total expense (before contingencies) over FY26–28. Meanwhile, combined expense on education (kindergarten through grade twelve) and post-secondary education is projected to total $50.8 bn over the same three-year period. Budget 2025 also increases the amount set aside for contingency and disaster assistance, doubling the amount in FY26 to $4.0 bn, with contingency buffers of $3.3 bn in FY27 and $3.7 bn in FY28.

Net debt as a share of GDP is projected to rise over the budget forecast horizon, increasing from 7.6% in FY25 to 8.7% in FY26, 9.0% in FY27, and 9.3% in FY28. Net debt levels are projected to increase from $36.6 bn in FY25 to $43.0 bn in FY26, $46.5 bn in FY27, and $49.9 bn in FY28, higher than the previous Budget primarily due to the projected deficits versus surpluses over the forecast horizon.

The Budget baseline outlook assumes a moderate trade conflict owing to US policy risk, in which Canada faces average tariffs of 10 percent on energy products and 15 percent on all other goods with retaliatory tariffs on a broad range of consumer goods. The Budget also includes high and low scenarios for energy and economic assumptions to account for large uncertainty in the outlook. The high scenario assumes no tariffs are enacted, but that uncertainty continues to weigh on the outlook. Meanwhile, the low scenario assumes the US imposes tariffs of 25% on all imports from Canada except for energy products that are subject to a 10% tariff with retaliatory tariffs from Canada in line with what the Federal government announced on February 1, 2025. In the low scenario, the Budget expects these tariffs to largely be removed by 2027 as review of CUSMA/NAFTA 2.0 gets underway beginning in mid-2026. Real GDP growth is projected to slow from 3.0% estimate in 2024 to 1.8% (high scenario of 2.6% vs low scenario of 0.5%) in 2025 and 1.7% (2.7% high scenario, 0.6% low scenario) in 2026. Nominal GDP growth is projected to slow from 5.3% estimate in 2024 to 1.2% (3.7% high, -1.6% low) in 2025 before picking up to 3.0% (4.2% high, 1.8% low) in 2026.

Total borrowing requirements for FY25 is expected to be $11.315 bn, much lower than the $19.8 bn set out in the previous year’s budget. This is owing to no net change in money market borrowing ($2 bn in the previous Budget) and lower term debt borrowing of $11.3 bn ($17.8 bn in the previous Budget). Total borrowing requirements are expected to be marginally higher at $11.4 bn in FY26, increasing to $13.9 bn in FY27 and $20.8 bn in FY28.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.