ECONOMIC GROWTH DRIVES SIGNIFICANTLY NARROWER DEFICIT

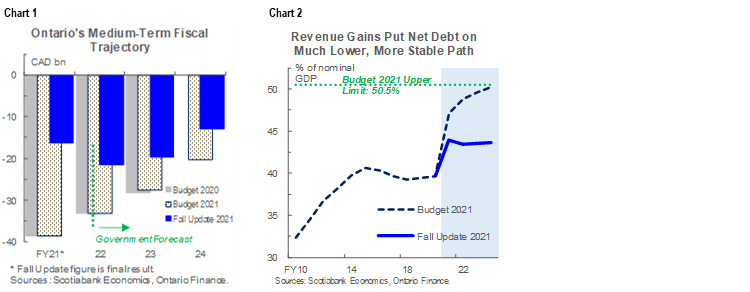

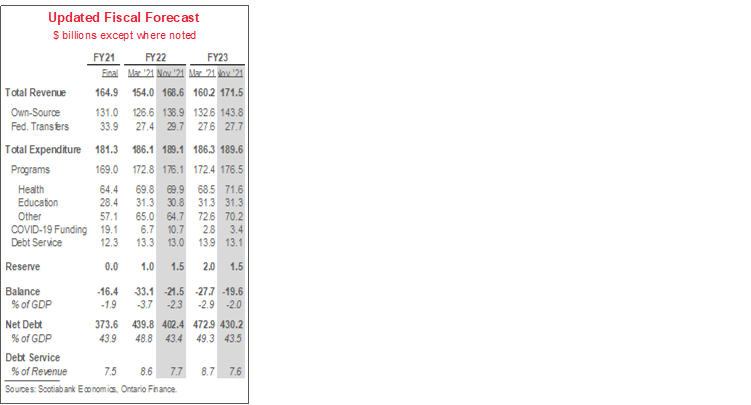

- Budget balance forecasts: -$21.5 bn (-2.3% of nominal GDP) in FY22, -$19.6 bn (-2%) in FY23, -$12.9 bn (-1.2%) in FY24. For FY22–23, that is a nearly $20 bn improvement versus Budget 2021 projections (chart 1).

- Net debt: expected to stabilize near 43.5% of nominal GDP in each of the next three years, 5–6 ppts lower than the rising trajectory outlined in Budget 2021 (chart 2, p.2).

- Fiscal anchors: province remains focused on containing net debt-to-GDP, debt service-to-revenue, and net debt-to-revenue ratios; all are now on flatter and much lower trajectories than forecast in Budget 2021.

- GDP growth forecast: +4.3% real growth in 2021 and +4.5% in 2022—stronger than prior projections—with nominal output and tax revenue forecasts revised significantly higher in light of recent GDP inflation.

- Borrowing program: total long-term public borrowing of $42 bn in FY22, $45.3 bn in FY23, and $45.9 bn in FY24; reductions versus Budget 2021 largely reflect improved budget balance projections.

- The Update’s much-improved fiscal trajectory should be well-received by rating agencies and Ontario’s creditors, and the plan leaves room for upside in the near-term.

- Despite supply chain issues and COVID-19 risks, stronger-than-forecast FY21 results and continued economic recovery likely mean that Ontario will not be the only province to report improved fiscal results this fall.

OUR TAKE

As widely expected following the budget balance improvement reported in the FY21 Public Accounts, Ontario finds itself on a much stronger fiscal trajectory. This reinforces the benefits of prudent fiscal planning, and reflects a degree of discipline. The March 2021 fiscal blueprint was based on conservative economic assumptions and built in substantial financial contingencies; both paved the way for an own-source revenue windfall in FY21. The Province has also—wisely in our view—held off on spending that windfall and opted to reduce its debt burden. The step change in this respect should be well-received by credit rating agencies.

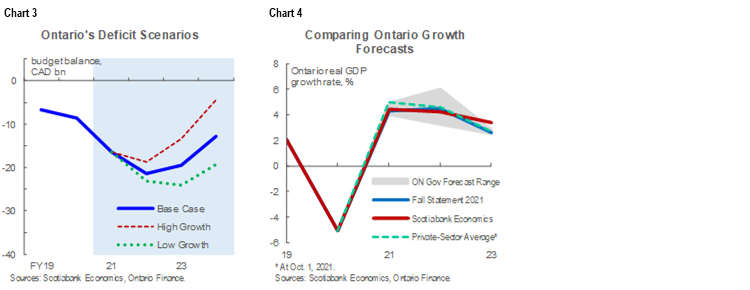

Continued prudence beyond this year and next leaves further upside for Ontario’s bottom line. Budget 2021 linked every 1 ppt in nominal GDP growth with $1.1 bn in tax revenues—on this basis, the nominal output growth forecast of 9% this year—1.4 ppts below the private-sector average—could be expected to add $1.5 bn in receipts to the bottom line. Another $10.7 bn in special COVID-19 funding—$4 bn more than in Budget—and a $1 bn forecast allowance in FY22 offer additional upside potential. Continued presentation of projected budget balances (chart 3, p.2) under higher- and lower-than-baseline growth scenarios (chart 4, p.2) provides welcomed transparency in light of a still-uncertain outlook.

The bulk of projected budget balance improvement stems from stronger revenues. This fiscal year, total revenues are expected to come in $14.6 bn higher than anticipated at budget time, while total spending was revised only $3 bn higher. The latter increase relates to new time-limited COVID-19 spending, which may be linked to a push-forward of health spending foregone last year as a result of a later-than-anticipated fourth pandemic wave. Outer-year program spending targets are only modestly higher than in Budget 2021.

Policy measures look appropriately targeted but unlikely to generate a significant boost to near-term economic growth. Further assistance for sectors like tourism and hospitality recognize that these continue to be particularly hard-hit by pandemic restrictions and uncertainty. Various measures to support retaining, upskilling, and workforce capacity growth acknowledge the challenges presented by acute labour shortage across the province. Planned infrastructure expenditures—estimated at $52.6 bn during FY22–24—represent an increase of only $1.3 bn for that period versus the March fiscal plan, though their 1.8% share of forecast nominal GDP is not inconsequential.

An increase in federal transfers also contributes to the expected improvement in the bottom line this fiscal year. The bulk of the $2.3 bn increase relative to the March Budget is sourced from the “Other Federal Payments” umbrella category, which presumably reflects additional COVID-19-related supports from Ottawa. Beyond FY22, transfer payment projections are in line with the previous financial blueprint.

Long-term public borrowing is forecast to total $42.0 bn in FY22, $45.3 bn in FY23, and $45.9 bn in FY24, respective reductions of $12.7 bn, $13.8 bn and $9.3 bn, versus 2021 Budget projections. Downward revisions mirror narrower-than-forecast deficits. This fiscal year’s $42 bn includes $6 bn in pre-borrowing for FY23; at October 19, 2021, 69% of planned borrowing had been completed. To date in FY22, about three-quarters of borrowing has been completed in Canadian dollars—via 25 syndicated issues and a Green Bond—within the 65–80% target range. In the lower-growth scenario, the government projected long-term borrowing to rise towards $52.3 bn in FY24. In the optimistic scenario, long-term borrowing eases to $37.5 bn by FY24.

Sovereign bond markets—Ontario’s included—continue to be driven by global developments exogenous to Ontario’s policy actions. Over the course of the pandemic, Ontario’s offerings have commanded high demand evidenced in tight spreads against GoC benchmarks, though more recent tightening at least partly reflects broadly improved risk sentiment. Smaller deficits today—and lower supply to market—may amplify that dynamic. As with all provinces, interest rate risk nevertheless persists, driven by central banks’ removal of support, but budget assumptions appear appropriate while continued efforts to term out its debt (projected at 10.9 years this year) and pre-borrowing activity provide a buffer against these exogenous risks.

SUMMARY OF KEY POLICY MEASURES AND ANNOUNCEMENTS

Policy measures detailed in the update were organized into three key categories: COVID-19-oriented support (“Protecting Our Progress”), longer-term infrastructure investments (“Building Ontario”), and “Working for Workers”, which consists largely of labour market-related measures.

COVID-19-oriented supports included: funds for continued vaccination efforts, money for additional hospital and intensive care unit capacity, and funds to hire more nurses, practical nurses, and personal support workers. The province also aims to expand home and community care services, will invest in new personal protective equipment with the new school year in full swing, and offer a range of supports for retirement and long-term care homes. Like other provinces, Ontario continues to advocate for greater levels of annual federal health care funding via the Canada Health Transfer (CHT).

Policies related to “Building Ontario” included details on a range of transit infrastructure investments—notably the promised Highway 413 that will serve the York, Peel and Halton regions and Toronto-area subway expansions. The government also announced a $1 bn allocation towards development of road network to support development of the Ring of Fire mining region in Northern Ontario. It will continue to expand high-speed internet access and will establish a new Housing Affordability Task force to complement ongoing efforts to boost residential construction.

Major initiatives in the “Working for Workers” category were the already announced increase in Ontario’s minimum wage to $15/hour on Jan. 1, 2022, extension of the Jobs Training Tax Credit to 2022, and enhanced eligibility for the Second Career Program—which retrains unemployed workers—for immigrants, gig workers, and persons with disabilities. The government will also offer a tax credit equal to up to 14.5% of Ontario residents’ eligible expenses on within-province tourist activities. The province further emphasized its estimated $10.1 bn in business cost savings this year through various tax incentives and fee reductions, and recent commitments from major auto manufacturers to invest in Ontario’s electric vehicle supply chain capacity.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.