PROVINCIAL FISCAL ROUNDUP

- As budget season is set to kick off later this month, we set the scene with a round-up of the latest fiscal projections by provinces and the drivers behind the numbers.

- A stronger-than-anticipated economic rebound coupled with upside inflation surprises saw government revenues surge across the country with projected deficit spending by provinces slashed nearly in half , at an aggregate of $40.2 bn (1.7% of GDP) in FY22.

- Provinces signaled fiscal discipline by banking most of the revenue windfalls while maintaining spending levels largely as planned. Mid-year revisions to spending plans were modest compared to the large upward revisions in revenues.

- Nominal growth assumptions underpinning the largely improved budget deficits remain conservative and could have a positive impact of approximately $3–11 bn on the aggregate figure when the fiscal year comes to a close.

- Furthermore, about $20 bn has been set aside in various provincial contingency and reserve funds. Omicron-related impacts may absorb some of these, otherwise these funds could further reduce deficits.

- Provinces’ combined debt burden is substantially improved owing to better bottom lines in FY22, with expected net debt to run at 34.1% of GDP (versus earlier-projected 39%). This would put aggregate debt slightly down from 34.9% in FY21.

- Provinces’ borrowing requirements are also expected to come in much lower than previous estimates in budgets, totaling $93 bn for the four largest provinces (ON, QC, AB and BC). Additional narrowing of final deficits could further reduce provinces’ financing needs, possibly supporting pre-borrowing activity in light of rising rates.

- We expect revenue windfalls to wind down in FY23 and 24 as economic activity normalises. While provinces have maintained spending discipline so far, it may be increasingly challenging to hold the line against growing populations, no shortage of social spending pressures, and two provincial elections on the horizon. Provinces may want to continue holding that line to avoid adding fuel to already elevated inflationary pressures now that the output gap is closed.

PROVINCES HEAD INTO BUDGET SEASON IN GOOD SHAPE…

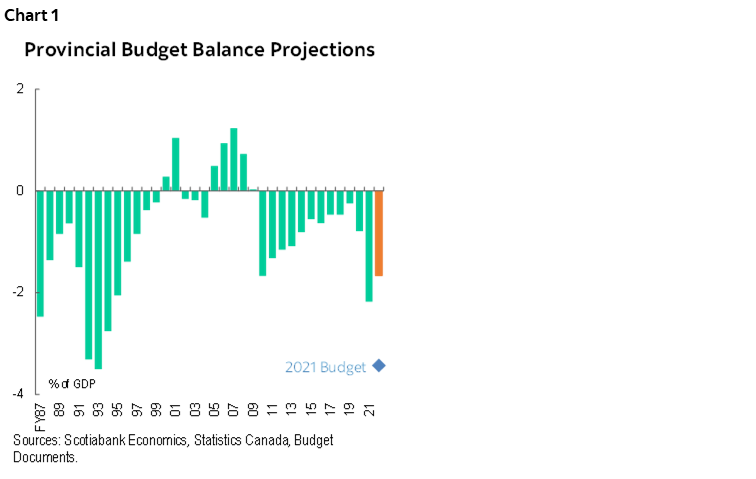

Heading into 2022, Canadian provinces found themselves on stronger fiscal trajectories, with the economic recovery across the country proving to be more resilient than anticipated at last budget time . In their fiscal updates released before the onset of omicron-related impact at the end of 2021, the ten Canadian provinces slashed their forecasted budget deficits by a sum of $39 bn, to an aggregate of $40.2 bn (1.7% of GDP) in FY22. This represents a slight improvement from the $47.4 bn (2.2% of GDP) aggregate deficits recorded in FY21, close to the level in the year following the GFC as a share of GDP, and well below those recorded amid the early 1990s budget crisis (chart 1).

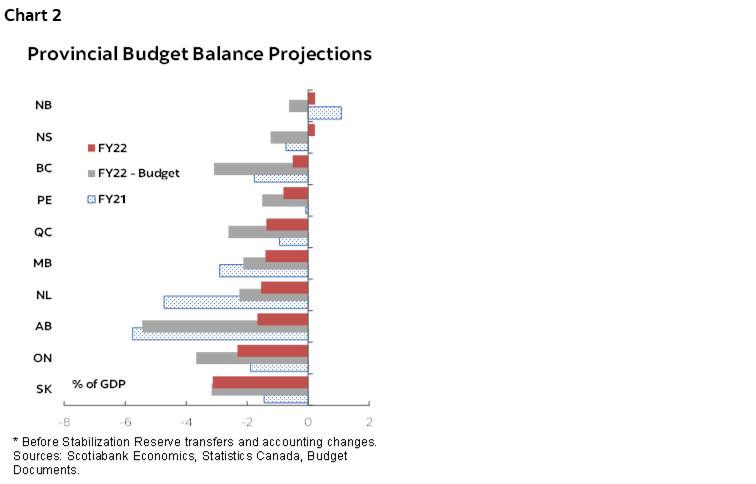

Revenue windfalls and prudent fiscal planning drove balance sheet improvements in some provinces, while lingering uncertainties still affect others (chart 2). Compared with FY21, five out of ten provinces (AB, NL, MB, BC, NS) are now projecting an improved budget balance in FY22, including NS looking at a year in the black (NB is the only other jurisdiction projecting a surplus in FY22). AB and NL have pencilled in the largest improvements, partly due to higher oil prices. Meanwhile, unforeseen drought-related increases in expenditures outweighed strong revenue gains in SK. ON also expects a larger deficit as a share of GDP in FY22 owing to a stronger starting point from FY21, as well as a postponement of previously planned FY21 pandemic spending.

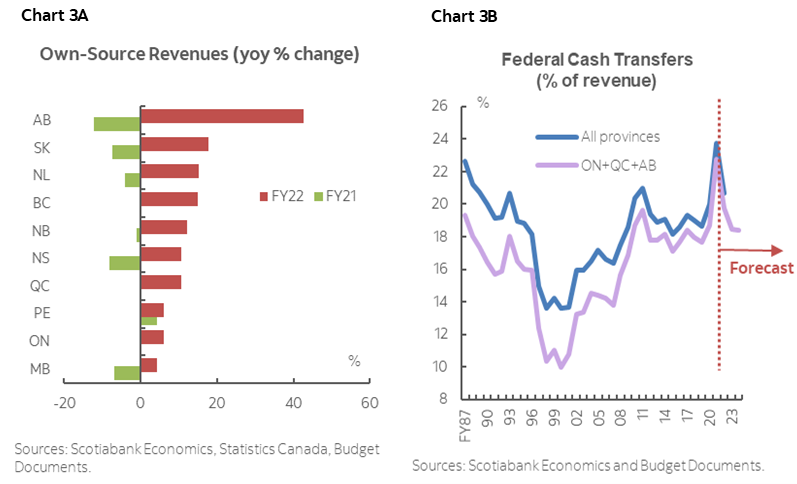

Stronger revenue outlooks stem from a combination of higher-than-anticipated growth (particularly in nominal terms), as well as additional federal transfers announced after provincial budgets. Provinces’ FY22 own-source revenues were revised up by a total of $43 bn to $392 bn, 12.7% higher than recorded in FY21. The largest year-over-year gains were seen in oil-producing provinces, which benefited from a more favourable oil price outlook after taking a hit from a slump in oil revenues in FY21 (chart 3A). Provinces also revised up federal transfers projections by a total of $8 bn, a combination of increases in proportion to the improvement of nominal GDP and one-time bumps related to COVID-19. Though less dependent on these pandemic supports than last year, federal transfers are still set to make up 21% of total revenues in FY22 (chart 3B). The major provinces (ON, QC and AB—no medium-term update on BC) currently expect federal transfers as a share of revenues to gradually return to the pre-pandemic normal in FY23 and FY24, largely due to the end of COVID-related funding.

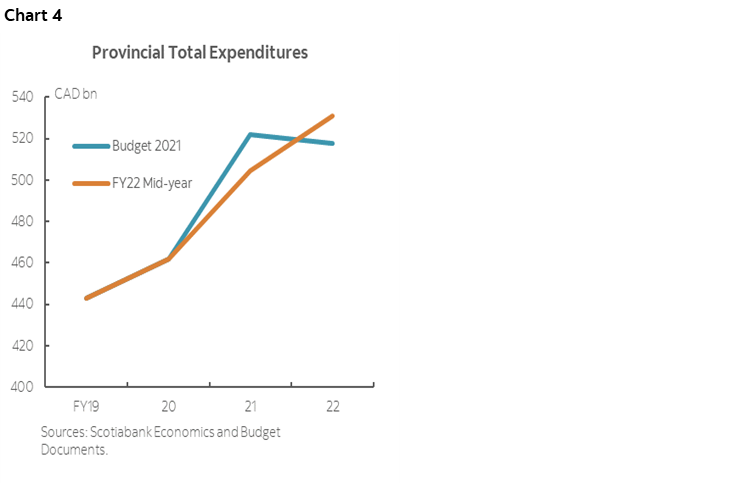

Provinces are banking these revenue windfalls while maintaining spending levels as planned. For the most part, these considerable revenue surpluses are expected to go into reducing budget deficits as most provinces refrain from spending it. Mid-year revisions to spending plans were modest compared to the large revenue revisions. On aggregate, provincial spending is set to grow further in FY22 (chart 4), mainly due to some carry-over expenses from the previous year’s delayed programs, as well as slightly increased fiscal outlays in health care for some jurisdictions. On net, the provinces’ aggregated spending is projected to be one percentage point lower than in FY21 as a share of GDP, but it would still remain elevated at 22% of GDP in FY22, versus the 20% average in the decade before COVID-19.

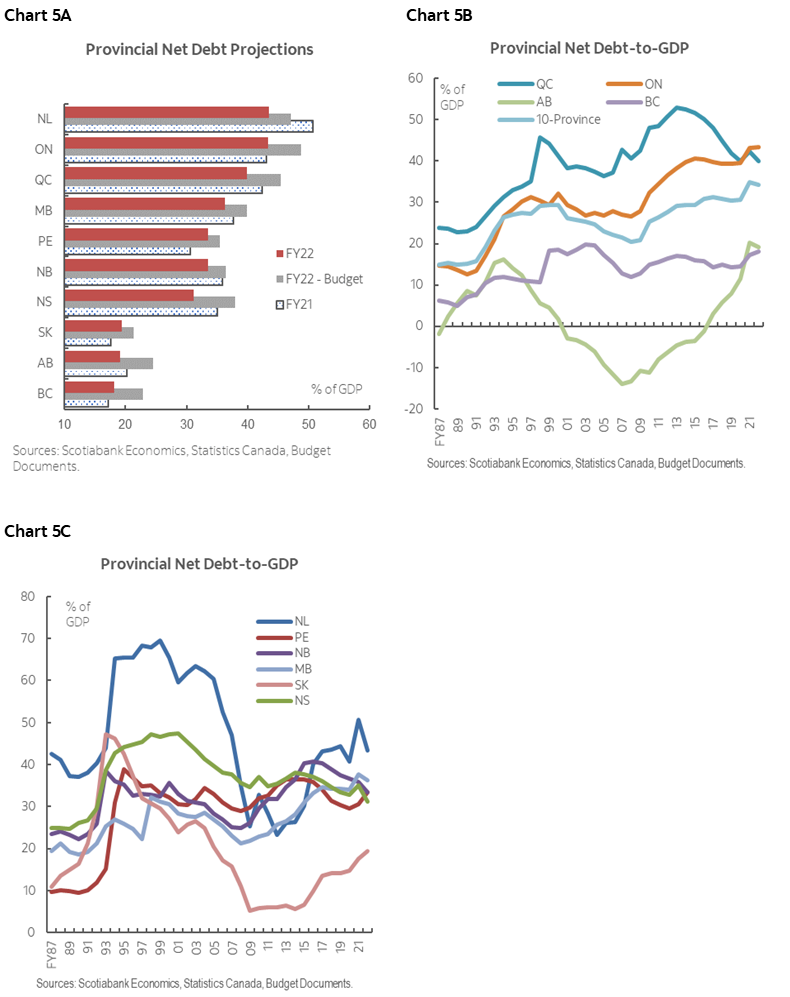

Helped by narrower forecasted deficits, the combined debt burden of provinces is substantially better than anticipated in FY22. With deficits coming in at half of the previously anticipated level, the aggregate provincial net debt is expected to run at 34.1% of GDP instead of 39.3% projected at budget time, and down from the 34.9% seen in FY21. Variance in debt trajectories across provinces reflects differences in starting positions, impact from commodities prices, COVID-19 impacts (and responses), as well as varying degrees of prudence built into fiscal plans (charts 5A, 5B and 5C).

… AND PRUDENCE REMAINS IN THE UPDATED BASELINE

Conservative economic growth assumptions relative to private sector forecasts could offer further upside. For calendar year 2021, ON and BC penciled in 9% and 11% respective growth in nominal GDP, roughly one percentage point lower than the latest private-sector average. Meanwhile, most smaller provinces (SK, NS and NB) displayed further prudence, discounting over three percentage points in nominal GDP growth from the latest private-sector average. Confident about the province’s economic rebound, QC did not factor in as much prudence as the other provinces, yet the optimistic growth projection is largely warranted. Absent an FY22 reserve, the province has less capacity to absorb omicron-related costs this year than some of its counterparts. However, strong revenue gains in the pre-omicron period may provide an offset, and the $1.3 bn reserve contingency baked into FY23 plans should limit any ongoing fiscal damage.

Strong momentum in oil prices could further reduce the deficits forecasted in oil-producing provinces. The AB government assumed an average WTI price of 70.5 USD/bbl throughout the fiscal year, lower than the average of 72.5 USD/bbl recorded as of January 2022, with two more months of positive outlook remaining. Altogether, we estimate this forecasting prudence could have a positive impact of approximately $3 bn on the aggregate figure, bringing the combined deficit down to as low as $37 bn (1.4% of GDP), with some uncertainties around omicron’s impact.

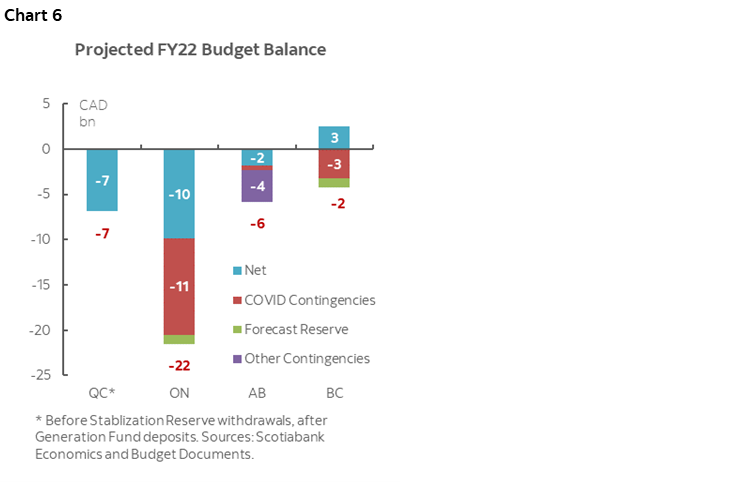

Further prudence was incorporated in the form of COVID-19 contingencies and other reserves to help absorb additional spending related to omicron and other uncertainties. Excluding COVID-related spending allocated to a variety of programs, the four largest provinces also set aside a total of $14 bn as contingencies for FY22, and roughly another $6 bn reserves for other forecast risks (chart 6). Depending on additional expenses incurred during the omicron wave, a fraction of this sizable fiscal buffer could also be used to reduce the final deficits in FY22.

Our expectation is that omicron-related impacts on provincial bottom-lines should be minimal. Even a more pessimistic shock to economic growth at the national level of around -5 ppts (saar) in the first quarter could translate into a revenue shock in the order of $300–400 mn. This is likely an upper-bound, and easily absorbed by conservative growth assumptions even before considering continencies and reserves. Additional spending poses an upside but the extension of federal programs offsets this and so far additional provincial measures have been relatively contained.

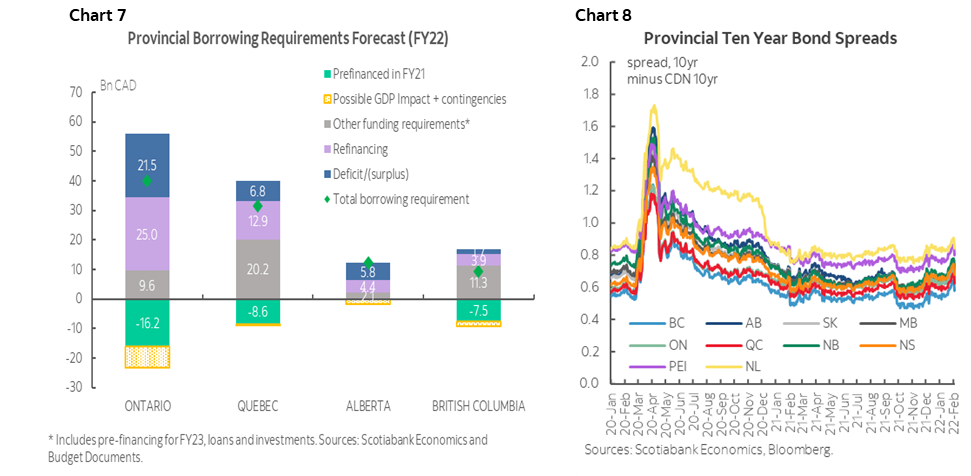

Provincial borrowing requirements in FY22 were largely reduced from previous estimates in the budgets, and the four largest provinces are projected to borrow a total of $93 bn (chart 7). The use of pre-financing helps reduce borrowings in FY22 by over $30 bn for the four provinces. Additional revenues that resulted from higher growth and inflation assumptions and/or unallocated contingencies could further bring down actual borrowing requirements by up to $13 bn (though omicron will likely erode some of this potential). Meanwhile, provinces may also opt to increase pre-borrowing for FY23 with an expectation of market tightening ahead. Provincial spreads have been tight throughout FY22 (chart 8), driven by central bank actions and global risk factors more so than by provinces’ fiscal positions.

AGGRESSIVE FISCAL CONSOLIDATION UNLIKELY IN OUTER YEARS

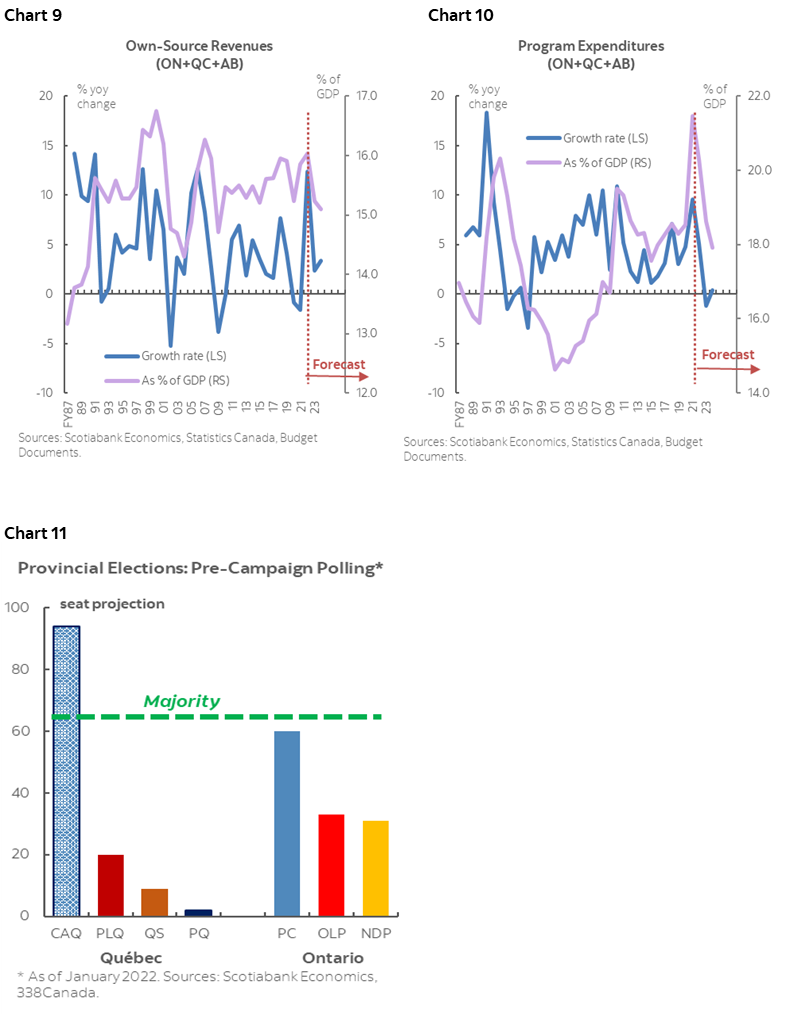

Looking forward, deficits should continue to moderate in the years ahead as pandemic-spending is unwound and contingencies released. Revenue windfalls have some momentum this fiscal year but will begin to wane quickly in the upcoming years (chart 9). With total spending projected by provinces to decline as a share of GDP (chart 10), aggregated budget balance in major provinces (ON, QC and AB— BC did not update its medium-term forecast) is expected to narrow gradually to just under 1% of GDP in FY24. Against the backdrop of resuming population growth and no shortage of pressure on expenditures, this is an important assumption to watch. Spending promises could also ramp up in the upcoming general elections in ON and QC, though risks might be largely muted given that pre-campaign polling shows leading parties in both provinces sit at or above majority thresholds (chart 11). That said, we are still months away and much can happen in the meantime.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.