Next Week's Risk Dashboard

- Kamala Harris represents her own set of policy risks

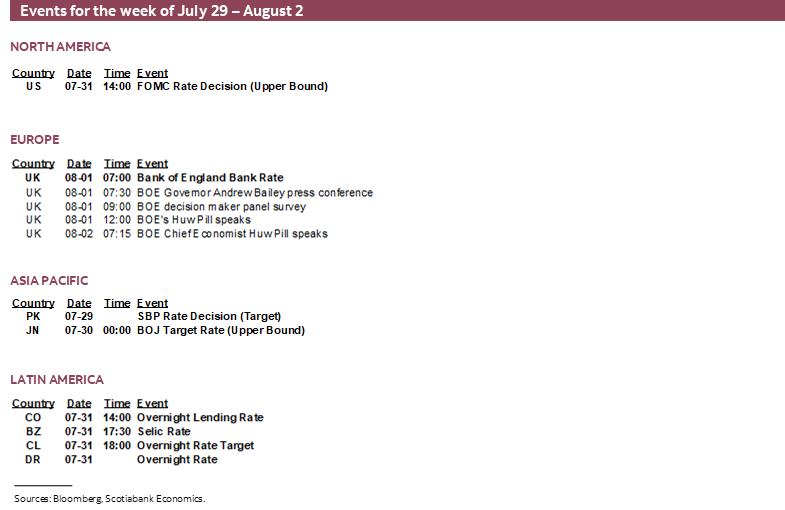

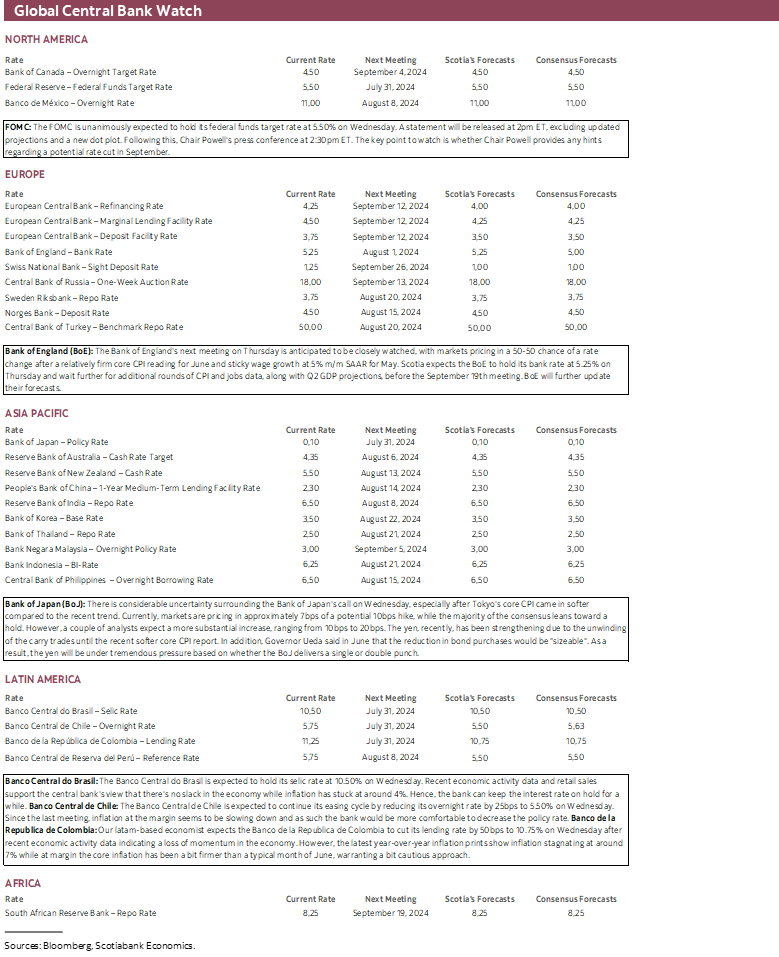

- Summer’s last great central bank blow-out

- Will the FOMC signal more confidence to cut?

- The vulnerable carry trade…

- …has markets on BoJ hike watch…

- …amid expectations it will slash JGB purchases

- The BoE’s ‘finely balanced’ cut or hold choice

- US nonfarm payrolls still resilient?

- Canada’s economy to exit Q2 softer…

- …but my longstanding resilience bias remains intact

- Eurozone inflation to begin informing the ECB’s September choice

- Eurozone economy could eke out slow growth

- Three LatAm central banks decide on Fed day…

- …with BanRep is expected to cut…

- …BCCh is a closer call…

- …and BCB is expected to remain on hold

- ‘Big tech’ earnings risk

- RBA hike risk to be informed by CPI

- Mexican GDP growth to pick up

- China’s PMIs likely to reaffirm slight growth

- Other global macro

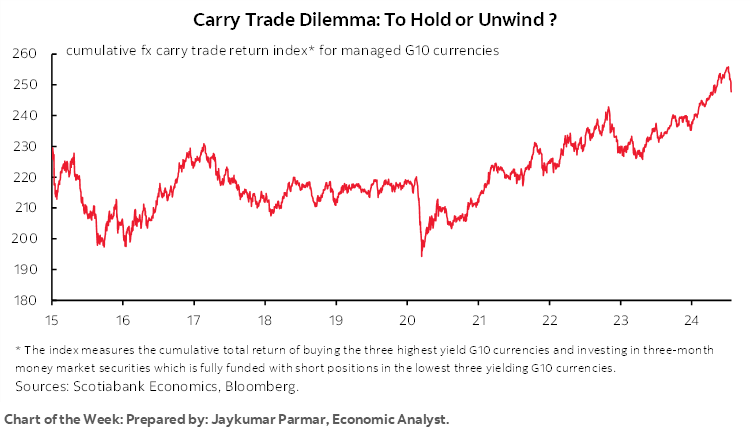

Chart of the Week

This week could well be described as the last big hurrah for (most) central bankers before the relative calm of August vacations and lighter market volumes sets in. Each of the Fed, BoJ and BoE could all spice it up. So could a trio of LatAm central banks.

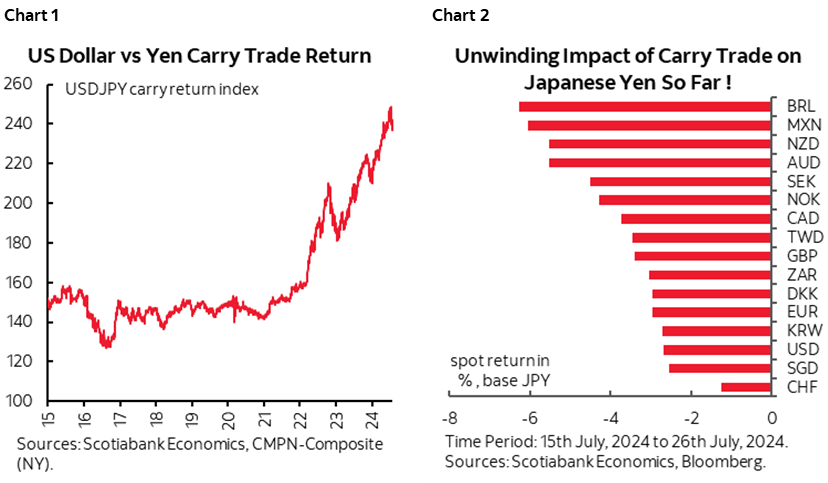

The show stealer risks being the BoJ’s expected reduction to JGB purchases and a possible rate hike. As Jay Parmar’s chart of the week (and chart 1) showcase, the carry trade out of cheap Japanese financing into the rest of the world has been a very powerful force in global markets over the past 2–3 years but is being reevaluated and the BoJ’s potential actions are a risk. Chart 2 shows the recent unwinding of yen strength against a large variety of FX crosses.

But move over, central bankers, you will face stiff competition from a wave of earnings reports from recently out-of-favour big tech firms, plus top shelf data. Nonfarm payrolls, Eurozone inflation, GDP reports from across the Eurozone, Canada, Mexico and Chile, Australian CPI, and Chinese PMIs will pose significant data risk across many markets. What gives? Oh yeah, best to cram it all in before vacay.

BEFORE ALL OF THAT—CHECKING THE KAMALA HARRIS ENTHUSIASM

But there is one issue I’d like to address again before turning to all of that. It is the false perception that if only Kamala Harris won the US Presidency, then all policy risk would go away because the craziest aspects of Donald Trump’s platform would be thwarted.

I’m not buying it. You shouldn’t either. In fact, what gets up my nose is when I see a selective filter being applied to the two candidates’ platforms that assumes Trump will do all that he says including the craziest ideas, but that we shouldn’t treat seriously anything that Harris has said about her policy stances to date. That might be true to an extent but it’s too extreme. That risks embracing a politically motivated confirmation bias that could blind clients to the risks and opportunities that both candidates represent.

Trump’s proposals—from tariff wars to tax cuts to highly restrictive immigration and probably blown-out deficits are pretty well understood. The sense he would deliver on all of that due to GOP unity is exaggerated. In fact, their unity is already wavering as J.D. Vance is polling the worst VP numbers since 1980 amid calls from some within the GOP for Trump to change his choice. The unity theory also ignores the still significant centrists within the Republican Party that don’t subscribe to all of Trump’s ideas but is laying dormant until the first crisis. It also assumes the GOP will take the Senate and House, and yet projections point to only slim advantages thus far and a lot could change by November 5th. Besides, why take Trump at his full word about his policy intentions? He talks a lot, huffs and puffs a lot, throws tantrums, lacks composure, typically under-delivers (like infrastructure) or backs down (like NAFTA 2.0), may need Congress for at least some of what he plans and some of it might be contested to the Supreme Court or tensions within the business community and across other levels of government.

Nor should we assume that Harris would have the full support of her party. That’s what I want to turn the attention toward next. She is no moderate. She has been a highly divisive voice with natural tendencies aligned toward the far left end of the Democrats along with the likes of Elizabeth Warren, AOC and Bernie Sanders. She had a choice in the 2019 Dems leadership campaign to compete against Biden closer to the middle of the party but chose to remain faithful to her tendences on the far left. Maybe that’s why Obama was slow to endorse her.

I’ve outlined below the vision that she has articulated over recent years. I don’t know how much of this she would actually deliver nor how much of what Trump says he would do would see the light of day. Those matters require evaluation over time. For now, we can only dig into Kamala’s past and present policy biases to balance the debate. I believe her past stances reflect who she really is and what she stands for as opposed to viewing her past stances as a product of past circumstances. If her past views instead reflect political circumstances and pressures of the time—like the heat of running for the Dems leadership in 2019—from which she now distances herself, then in my books she is as susceptible to the charge of being a political chameleon as J.D. Vance’s sudden transformation. That could mean that her future policy stances could be highly unpredictable and drive high uncertainty.

Trade Policy

- Harris opposes Trump’s tariff proposals. That’s the good news.

- The bad news? Unfortunately, she has a track record of opposing trade deals because of loosely defined ‘progressive’ considerations.

- She opposed the CUSMA/USMCA agreement when she was just one of 10 Senators who voted against it on environmental grounds. This could be a risk in upcoming negotiations when NAFTA 2.0 expires in July 2026. Canadians are gushing over her connections to the country, but her stance on trade agreements could well make her no friend to Canada.

- Harris also opposed Obama’s Trans-Pacific Partnership and once again because of concern about insufficient environmental and labour regs. Biden supported it, Trump killed it.

- Harris supports Biden’s China stance and may escalate it in terms of seeking environmental and labour protections.

Unions

- Harris has recently said she would boost union organizing rights.

Climate

- When she was a presidential candidate, Harris supported an eye-watering US$10 trillion climate plan that was multiples larger than Biden’s plan. How to pay for it and the macroeconomic consequences for considerations like inflation and markets were not addressed.

- She advocated a climate pollution fee and ending federal subsidies for fossil fuels.

- She was a key sponsor of a Green New Deal designed to achieve full reliance on ‘clean’ energy in just ten years.

- She has previously proposed a ban on fracking.

- She appears to have since rescinded her support for a fracking ban and a costly Green New Deal but that may require clarification and these stances show her policy bias.

Taxes

- In her 2020 campaign, Harris said she would fully repeal the TCJA’s corporate tax rate cut from 35% to 21% by putting it back up to 35%. Her present stance is unclear but must be clarified as it would be highly destabilizing to markets.

- It’s unclear if she supports Biden’s proposal to deal with expiring TCJA provisions by ending some, but not hiking taxes on people making <$400k/year.

- Harris consistently supports higher taxes on upper income earners and a tax credit for lower income earners.

- In her 2020 campaign, Harris advocated taxes on stock (0.2%) and bond (0.1%) trades and a smaller tax on derivatives. The usual criticisms against a form of Tobin tax apply, not least of which being difficulties implementing one and pushing activity offshore. Here too her stance must be clarified or she risks only appealing to the far left.

- She has favoured raising estate taxes.

- She supports tax credits for renters and parents.

- She supports higher taxes for fossil fuel companies and pharma cos.

Regulations

- Harris wears as a badge of honour her prosecution of banks and would very likely lean more toward tighter regulations than looser. She is also supportive of plans to regulate AI which could be a downside risk to big tech.

Immigration

- Harris advocates restrictions at the Mexico border and yet her track record in handling the immigration file that Biden handed her has been unimpressive. She supported Biden’s bipartisan border security deal that Trump led opposition against for purely political reasons. She is supportive of citizenship for immigrants in the US including so-called Dreamers. She is viewed as supportive of liberal immigration goals that could benefit labour force growth but raise debates on the composition of immigration and imbalances.

Tuition and Student Debt

- Harris has advocated free college tuition and student loan forgiveness.

Spending

- She supported a “medicare for all” bill.

- She wishes to expand the child tax credit.

Geopolitical Risk

- Harris called for an immediate ceasefire in Israel earlier this year versus Biden’s support. She reiterated this stance this past week. She could be an unreliable ally to Israel and it’s uncertain to what extent that may impact developments in the middle east.

- She backs unwavering US support for Ukraine and is much more critical of Putin than Trump who is not.

In short, Harris has a vision alright. That vision, however, is aligned with the far left 'progressives' in the Democrats. Her tax proposals don’t sound like they would be sufficient to fund her spending bias. That could put further upward pressure upon fiscal deficits, inflation risk, and bond supply pressures that risk higher borrowing costs. She would likely benefit ESG, health and education sectors whereas Trump would not. Harris is much les of a threat to Fed independence if ‘project 2025’ is indicative of the Trump administration’s intentions to end the dual mandate. Granted, social media stocks would likely do much better under Trump.

My purpose is not to predict who will win or what policies will be embraced as both are highly uncertain. The way I see it, the US election is 50–50 in terms of who wins. Polls are useless a) because they're often inaccurate like in 2016 with the US election and Brexit, and b) because you can win the US election (and others elsewhere) without winning the popular vote like Trump did in 2016. Both candidates represent big risks to the outlook. Trump is a bigger danger to the outlook in my view.

Having said that, one narrative that will be tested is whether opposition and guardrails around a Harris presidency could be more material than around a Trump presidency. What shape Congress takes will also matter to a degree.

FOMC—JACKSON HOLE CARRIES HIGHER ODDS OF A TEE-UP

Wednesday’s 2pmET FOMC statement is not expected to deliver any policy changes to either rates or balance sheet plans. This decision is in between the June and September forecast rounds and so there will be no dot plot updates of policy rate expectations. Chair Powell’s usual press conference will follow at 2:30pmET.

Scotia Economics continues to expect the FOMC to cut the fed funds target rate range by 25bps at the September 18th meeting. 1–2 more cuts are feasible at the November and December meetings.

Probably the smartest thing to do would be to change the date on the June 12th statement and reissue. That would leave the FOMC with considerable flexibility to assess the two rounds of CPI and one more PCE inflation reports plus other data such as two job reports between now and the September meeting. A change toward more explicit guidance could arrive before the September meeting at the annual Jackson Hole retreat on August 22–23 by which point another CPI report will be available.

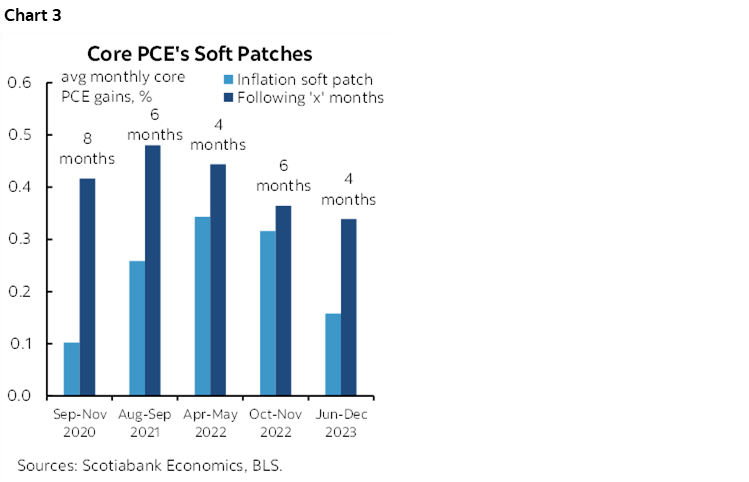

The US is in a soft patch on core inflation, but a couple of months of soft readings still leave the Committee vulnerable to being surprised by another rebound like the multiple such cases during the pandemic era that are shown in chart 3. To have truly ‘greater’ confidence that the FOMC is making progress toward 2% inflation and full employment likely requires more data.

The FOMC should tentatively have greater confidence that this isn’t quite another one of those prior false hope periods for low inflation. US GDP growth has clearly slowed over H1 from 2023H2 while the noninflationary speed limit to growth has probably picked up with population growth and smoothed productivity trends. Employment growth has cooled while the breakeven rate of job growth has probably moved higher due to population growth.

If this narrative is wrong, then it could be wrong if Chair Powell’s press conference is more explicitly dovish than what he has said to date which is to signal rising confidence but not enough just yet. It could also come through statement tweaks. Watch the opening paragraph and whether “there has been modest further progress” toward achieving the 2% inflation target or something that signals more confidence. Keep an eye on whether the third paragraph’s reference to the Committee holding off on rate cuts “until it has gained greater confidence” that inflation is moving toward 2% is strengthened to signal that this is being achieved.

BANK OF JAPAN—TREAD CAREFULLY

Could this be the BoJ’s second rate hike of the cycle after the BoJ raised its target rate by 20bps in March? Will the BoJ cut back on JGB purchases and, if so, how? We’ll find out on Tuesday when the statement lands (after 11pmET Tuesday) and during Governor Ueda’s ensuing press conference (probably 2–3amET Wednesday). The implications for global financial markets could be quite stark.

A hike to the unsecured overnight call rate could add further trend strength to the yen and would be disruptive to the carry trade out of cheap Japanese borrowing costs into more attractive yields elsewhere. That could be incrementally destabilizing to global bond markets. The impact on markets could also depend upon Ueda’s guidance.

A hold with cagey guidance could take some steam out of the yen and motivate incremental buying of higher yielding bonds abroad.

Out of 46 forecasters within consensus, only 9 expect a hike. Markets are assigning a higher probability to a 10bps hike that has been floating around 70% odds with about 7bps priced.

The case for hiking rests entirely upon gauging the degree of the BoJ’s confidence that it is durably on the path toward achieving 2% inflation over the medium-term horizon while getting further distance away from the distorting near-zero policy rate of 10bps.

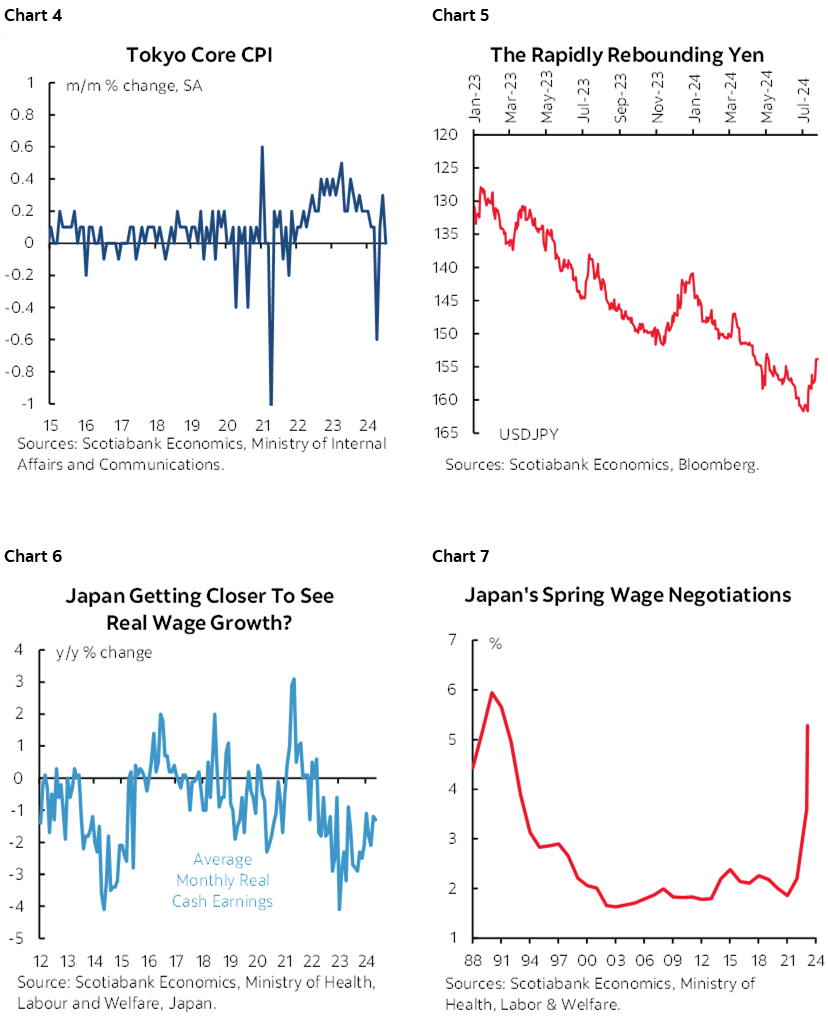

I’m not sure they should have such confidence. Tokyo core CPI just reversed prior progress toward firmer readings which sends a cautious signal (chart 4). The yen has sharply appreciated in a very short period of time (chart 5). There is little evidence that Japan is escaping the grips of falling real wages (chart 6). While the annual Shunto rounds of negotiations with unions has driven a sharp acceleration of wage growth over the past two years (chart 7), this has a concentrated effect on less than 20% of Japanese workers and the evidence this is spilling over into lifting wages elsewhere is very limited. Oil prices have ebbed somewhat of late but more importantly have been broadly trended sideways through much of the year; since Japan imports so much, the pass through to inflation risk has ebbed.

The BoJ’s decision arrives before what we hear from the Federal Reserve. If the BoJ through communication channels believes in a more dovish than expected form of guidance from the Fed then that could lessen the BoJ’s confidence that it should be going the other way with a hike at this meeting as a narrower rate differential would likely only add to yen strengthening. This would run counter to concerns recently expressed by Japan’s currency czar, Masato Kanda, Vice Finance Minister for International Affairs who pleaded with G20 leaders to be careful toward wild, disruptive swings in FX markets.

As for bond buying, Ueda said at the June 14th presser that a cut in JGB purchases would be “substantial” but that how long the cutbacks last is uncertain. A detailed plan is expected at this meeting and it’s the details on both magnitudes, terms, length and degree of retained flexibility that will be key. Estimates are all over the map, but something in the range of cutting monthly purchases in half wouldn’t surprise markets. The BoJ wants a gradual exit from pandemic buying and to encourage curve steepening.

BANK OF ENGLAND—ABOUT THAT 7–2 SCORE…

The Bank of England will be the third of the week’s biggest central banks to weigh in on Thursday after both the BoJ and Fed. Markets are pricing half of a quarter-point cut. Bloomberg consensus is more convinced that a cut will be delivered with 75% of forecasters expecting a cut. The lack of recent communications nevertheless maintains significant uncertainty into the call. I wouldn’t be terribly surprised if they cut given what they said at the last meeting but lean slightly more toward a hold to evaluate further evidence until the next decision on September 19th.

Key is the hint provided at the June 20th decision. Seven Monetary Policy Committee members including Governor Bailey opted to hold with two (Dhingra, Ramsden) preferring a cut. Guidance nevertheless indicated that for some of the seven who opted to hold the decision was “finely balanced.” That indicated they could have gone either way. How many of the seven were of this view? Have they changed?

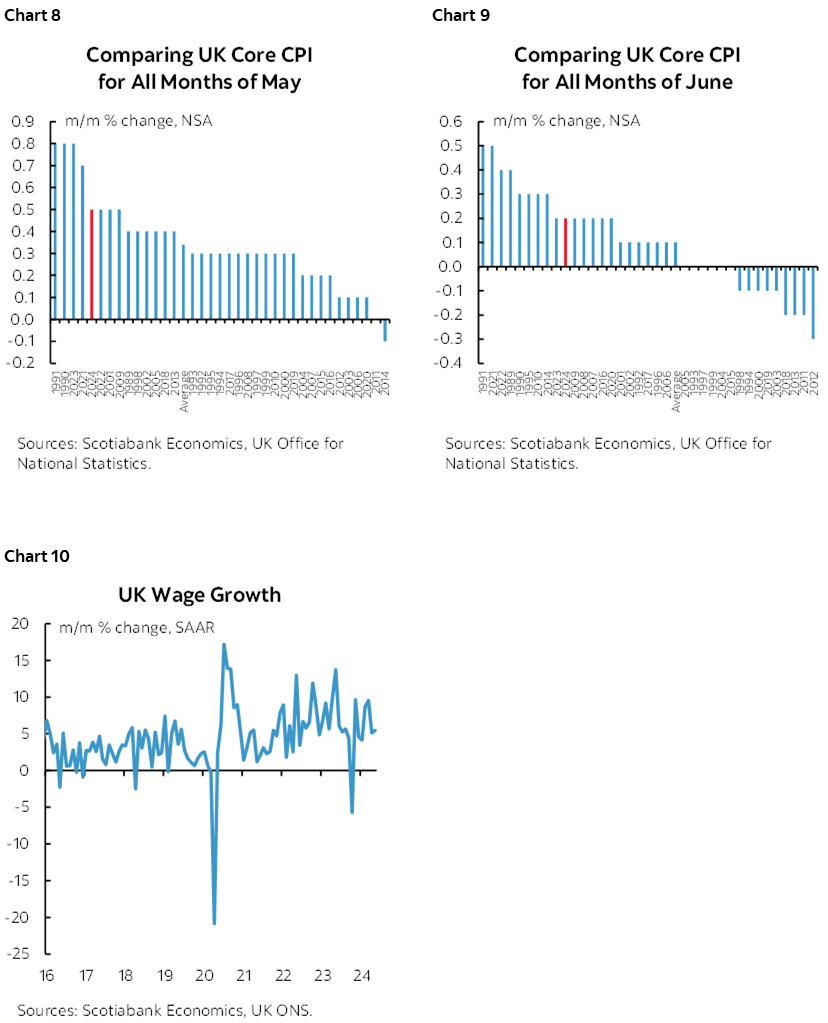

What has happened since then doesn’t offer clear support for a cut now if the MPC remains more skewed toward data dependency over forecasts. GDP growth was solid at 0.7% q/q SA nonannualized in Q1and 0.4% m/m in May. Core CPI over the past couple of months has been running a little hotter than like months in history (charts 8, 9). Wage growth remains quite warm (chart 10).

A fresh Monetary Policy Report will be delivered with updated forecasts this time. The next forecast is not due until November. If they wished to deliver a cut or tee one up more explicitly then an updated forecast framework would be a good backdrop for doing so.

BANREP—EBBING GROWTH SUPPORTS ANOTHER CUT

A trio of Latin American central banks weigh in with decisions on Wednesday. Colombia’s central bank will be first off the mark at the exact same time as the FOMC statement lands. A 50bps cut is widely expected including our Bogota-based economist Sergio Olarte.

That would take cumulative easing to 250bps since cuts began at the end of last year while still leaving the minimum repo rate at 10.75% and hence far above the pre-pandemic level of 4¼%.

Core inflation has continued to ebb to 7.65% y/y from a peak of 11.6% and with m/m readings running well below peak rates. Growth has been ebbing as indicated by the economic activity index that shrank -0.4% m/m SA in May and is slowing to 2½% y/y. BanRep may continue to place more emphasis upon forward-looking inflation expectations over recent data.

BCCH—WEAK GROWTH LEANS TOWARD A CUT

Banco Central de Chile is a closer call than BanRep at 6pmET on Fed-day. Most forecasters expect a 25bps rate cut but a minority think BCCh could hold. Our Santiago-based economist Aníbal Alarcón also expects a 25bps cut.

Chile’s economy has ground to a halt. June’s monthly economic activity index fell by -0.4% m/m SA and 1.1% y/y. Inflation progress has stalled out at 4.2% y/y this year but is well below the 14% peak. BCCh is likely to be more concerned about growth and downside risk to future inflation.

BCB—TAKING A BREATHER

Banco Central do Brasil is widely expected to leave its Selic rate unchanged at 10.5% for the second straight time on Wednesday. Inflation progress has stalled with the year-over-year rate stuck around the 4% y/y range this year, giving room for BCB to assess the effects of its cumulative 325bps of cuts since mid-2023.

GLOBAL MACRO REPORTS & EARNINGS

This section will do a round-up of the week’s main global economic indicators. In addition, this will be another heavy week for global earnings reports especially with the continued focus upon big tech names like Apple, Amazon, Microsoft, Meta, Intel, Qualcomm.

Canada—Positives and Negatives

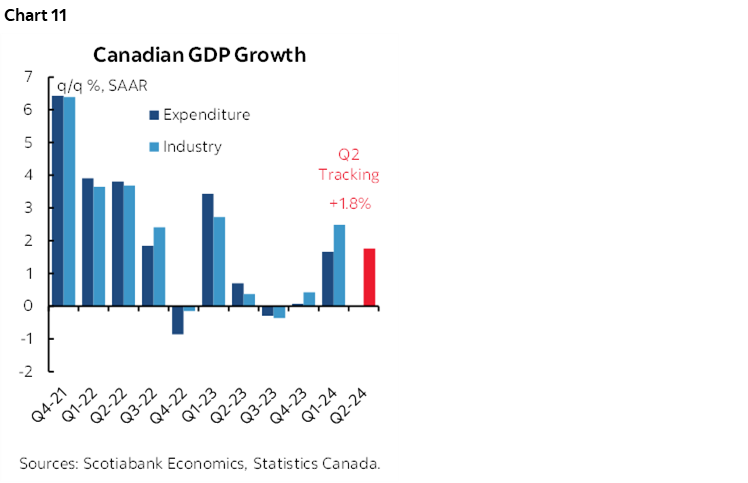

Wednesday’s GDP figures for May and June will further inform Q2 growth tracking. Growth probably weakened after a whopping 0.5% m/m expansion in April to start Q2. Statcan had guided that May GDP was up 0.1% m/m SA and my updated estimate since that guidance is the same. June faces more downside risk based on limited readings such as a drop in hours worked. Growth is probably tracking just under 2% q/q SAAR in Q2 using the monthly GDP estimates after expanding by 2.5% in Q1 (chart 11). That’s decent for the year as a whole especially since the BoC came in at the start of the year warning about the first half only to revise up its forecasts later.

Throughout the last 2–3 years I have been on the optimistic side of the debate over the health of the Canadian economy. When the ‘r’ word was bandied about last year I leaned against, saying that GDP was artificially soft but still trending on the positive side. Strikes aplenty, wildfires, and industry-specific one-offs distorted GDP growth along with aggressive inventory shedding. I also argued coming into the start of the year that the BoC and others were too negative and that the conditions for a rebound were lining up and that’s generally what we’ve seen. A significant part of this narrative has included leaning strongly against overly negative views expressed by others about the impact of mortgage resets on the consumer. Consumer spending grew by 3%+ q/q SAAR in each of Q4 and Q1.

Optimism relative to other views on the economy has made me more cautious toward inflation risk and cutting either prematurely and/or too aggressively. That concern is still at the forefront of my thinking. Housing shortages are severe. Immigration remains excessive. Wage growth continues to outpace tumbling productivity. Fiscal policy is still adding to GDP growth long after it should have stopped and there is likely more coming into an election year which will make the combination of monetary and fiscal easing a dicey bet. Global shipping costs are soaring again as supply chains are going through geopolitical problems especially in the Red Sea.

US—Jobs and Consumers in Focus

Job market readings will dominate the US macro calendar other than the FOMC’s communications.

Friday’s nonfarm payrolls is what it will all lead up to. My estimate is for a gain of 205k with an unchanged unemployment rate of 4.1%. Wage growth is estimated at 0.3% m/m SA.

This view may be informed by readings along the way. JOLTS job openings in June (Tuesday) will help to understand whether the increased number of unfilled jobs in May was just an aberration along a five-month downward trend. ADP payrolls for July on Wednesday and Thursday’s Challenger job cuts for the same month are not expected to be terribly useful to the nonfarm call.

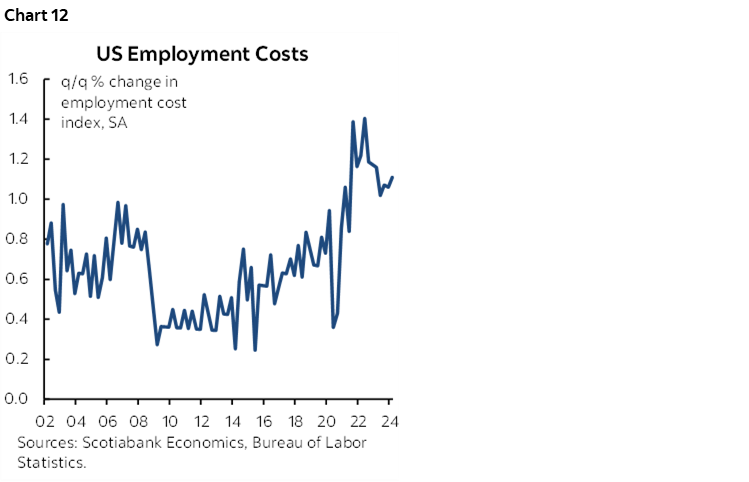

Employment costs are expected to grow by another quite warm 1% q/q SA nonannualized pace on Wednesday and therefore extend the pattern of similar readings since 2021Q3 (chart 12). If productivity growth is around 2% q/q SAAR in Q2 as expected then unit labour costs could post another roughly 2% gain after a hot 4% reading in Q1. Recall that ULCs measure productivity-adjusted overall employment costs and combine into one measure an assessment of whether costs are being paid for through higher productivity (they’re not).

The consumer may have started Q3 with a bang. Thursday’s vehicle sales for July are guided by industry sources to have increased to 16.7 million at a seasonally adjusted and annualized rate for a rise of over 9% m/m SA. Part of that reflects pent-up demand from the prior month when a software hack rippled through auto dealers, but the guided rebound would be more than twice the decline in June over May which signals more than just a pent-up demand rebound.

The consumer and housing markets will figure prominently across other readings as well such as house prices (Tuesday), consumer confidence for July (Tuesday), pending home sales (Wednesday) and construction spending in June (Thursday).

ISM-manufacturing is likely to remain in contraction during July when the estimate lands on Thursday but the pace of contraction could ebb based in part on regional surveys. Those regional surveys, however, underweight the transportation sector that recently dragged down durable goods orders.

LatAm—Important Updates from Chile, Mexico and Peru

It will arrive too late for BCCh’s decision on Wednesday, but Chilean GDP growth during June follows the contraction in May.

Mexico’s economy is expected to accelerate when Q2 GDP figures are released on Tuesday. That could be the fastest growth in three quarters.

Peru’s inflation rate might stabilize around 2.3% y/y while core CPI is likely to be closer to 3%. Peru’s central bank has been on hold for the prior two meetings with its next decision coming on August 8th. 200bps of cuts to date since last September still leaves policy relatively restrictive.

Eurozone—Growth and Inflation!

Q2 GDP figures from the Eurozone and individual countries including France, Germany, Italy and Spain (Tuesday) are expected to show very marginal growth across all countries perhaps with the exception of a slightly stronger outcome in Spain. Unless there are material revisions to Q1, then no major country is expected to face a technical recession call that would be marked by back-to-back contractions.

The full Eurozone add-up won’t arrive until the following week, but CPI figures from major economies on Tuesday (Germany and Spain) and Wednesday (France and Italy) start the march to the September 12th ECB meeting. There will be another round of inflation figures at the end of August before that meeting, but the pair taken together with the ECB’s negotiated wages figure for Q2 on August 22nd should provide most of the information needed to inform what is thus far a mostly priced quarter-point rate cut at that meeting.

Asia-Pacific—Is the RBA at its Terminal Rate?

The two most important developments out of Asia concern the Chinese economy and the RBA.

China’s economy is stagnating, at least according to purchasing managers’ indices. The state’s versions will be updated with July readings on Tuesday night (ET). The composite PMI has been sitting a hair above the 50 dividing line between expansion (above) and contraction.

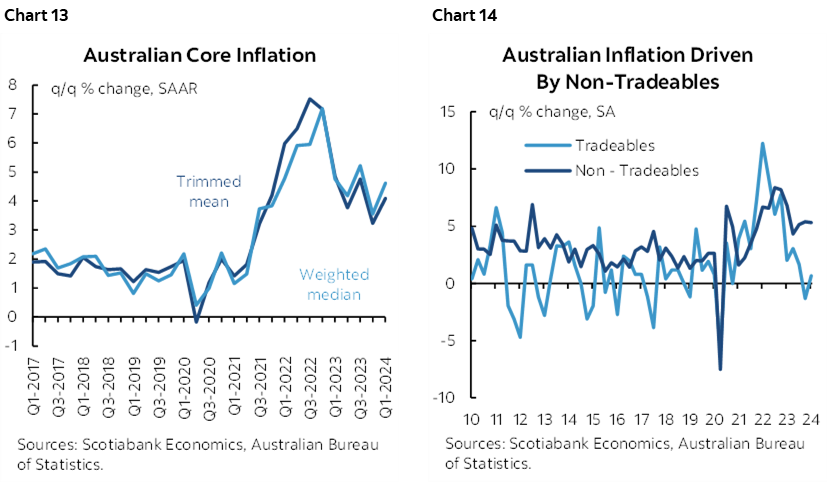

Australia’s Q2 CPI report will be key to RBA watchers. Governor Bullock has placed significant weight on the reading to inform the rate path going forward and into the August 6th decision for which markets are pricing about 25% odds of a hike. Core inflation has been persistently above the RBA’s 2–3% headline CPI target and mostly due to non-tradeable prices that are more driven by domestic drivers (charts 13, 14).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.