Overview

- Key Insights from Customer Transactions

- COVID-19, the Canadian Economy and Scotiabank’s Transactions Data

- Business Transactions Data Details

- Retail Transactions Data Details

- Other High-Frequency Indicators of Activity

1. Key Insights from Canadian Customer Transactions

This presentation is part of the weekly series intended to draw insights about the state of the Canadian economy from the flow of Scotiabank’s retail and non-retail transactions data

Key takeaways from the payments data in this week’s publication:

- Business transactions updated to July 9th rose slightly and started showing some tentative improvement in the last few days of the reporting period:

-Incoming transactions via automated funds transfer (AFT) in the manufacturing industry rose slightly, adding to the significant improvement at firms in the finance and insurance sector.

-Having remained in negative territory since mid-March, y/y growth in outgoing payments has also risen lately, reflecting higher general bill payments as well as rising rent payments. - Relative to 2019, growth in consumer transactions, available through July 13th, continued to increase further, underscoring an improving outlook for retail spending:

-Automotive, clothing and health-related card spending rose further since the previous report, with y/y growth turning more positive. - Some caution is warranted in interpreting the data. First, some of the improvement in card spending is likely due to a substitution away from cash. Second, some of the recent rise in spending may reflect the cumulated but temporary impact of purchases that had to be temporarily postponed due to the pandemic (e.g. car maintenance). Finally, the usual seasonal patterns may have shifted since the start of the pandemic, in particular around large holidays like Canada Day.

2. COVID-19 and the Canadian Economy: Scotiabank Transactions Data

- We present data on retail and non-retail transactions, which capture distinct but related aspects of economic activity in Canada.

- The data comprises actual observed daily transactions going through debit or credit card payment networks in the retail space, and automated funds transfers (AFTs) in the non-retail space.

-The transactions are anonymized and aggregated to protect the privacy of Scotiabank’s clients. - In the current circumstances, comparing the dollar volumes of transactions in the current year and in 2019 can be indicative of the depth of the decline in economic activity in Q2-2020 and help track growth through the re-opening phase.

-Note that the mapping from the volume of transactions to measures of economic activity (e.g. GDP) is imperfect, and so care must be taken when drawing the implications. - The AFT payments show bill payments to/from companies in Canada.

-Incoming payments can be associated with company revenue, and outgoing payments can be associated with costs. - Debit and credit card payments can be used to measure the evolution of retail spending at various types of establishments.

-The transactions can serve as a measure of economy-wide retail spending, and of the extent to which households are resuming pre-COVID levels of activity.

-Note that the use of electronic payments has increased because of COVID-19, so comparisons to year-ago levels can be misleading. These data are best used to observe directional movements rather than to make specific assessments on the level of activity.

2. COVID-19 and the Canadian Economy: Caveats

There are important caveats to analysis based on the payments data:

- The data is observed at daily frequency and embeds different types of seasonal patterns.

-For retail payments, the volume and types of payments are different depending on the day of the week and the season.

-For non-retail payments, both the day of the week and the season are important. In addition, some payments are tied to the calendar date (e.g. rent payments are made on the first day of each month), some payments have a bi-weekly schedule, etc.

-To smooth out most of the day-to-day seasonality we use a 14-day moving average of the dollar volume of transactions, taking a y/y% change to remove any remaining seasonal patterns related to the calendar date. - In addition to seasonality, there is normal payment volatility related to the random nature of the transactions process and the impact of regional and economy-wide events (weather, labour strikes, etc.).

-The volatility of this nature may or may not be related to economic activity as measured by GDP and so, as mentioned above, care must be taken in drawing inference. - For business transactions, which are inherently more lumpy compared to retail spending, data towards the end of the sample can be revised as some AFT payments are recorded with a lag. As a result we exclude the last few days of data of business transactions only.

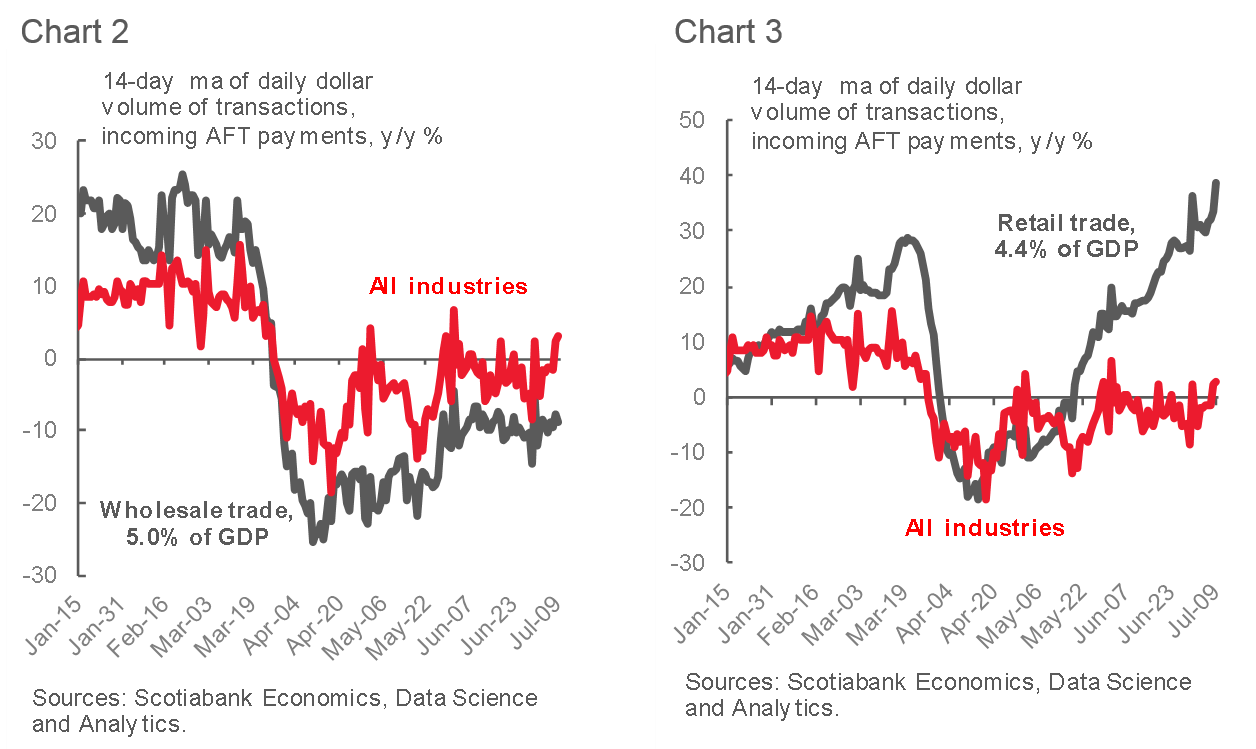

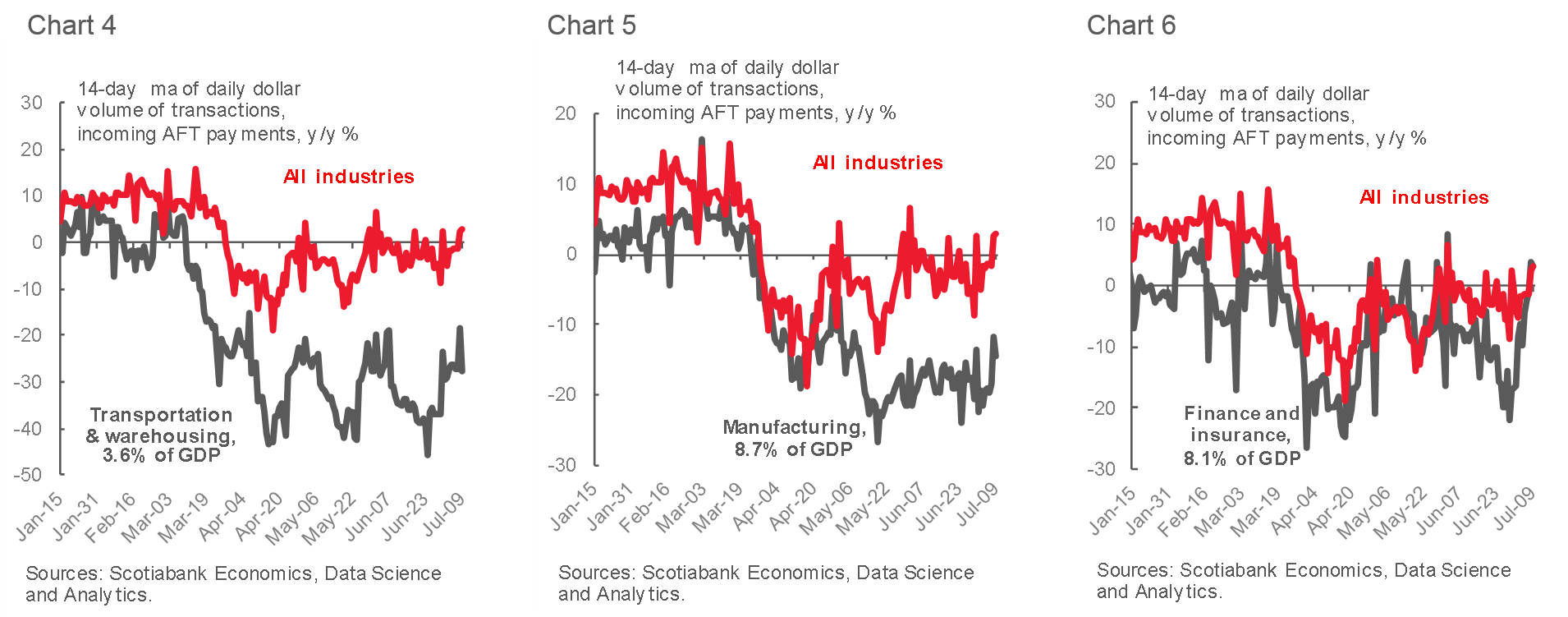

3. Business Transactions Data: Y/Y Growth in Incoming Payments Picks Up

- Automated Funds Transfers (AFT) are used for:

-rent and mortgage payments;

-payroll deposits; and

-other bills. - Having remained consistently below the levels of 2019, incoming business transactions showed tentative improvement during the last few days:

-Incoming transactions to firms in the manufacturing sector improved slightly, while those in the finance and insurance have seen a substantially better payment flow (see Charts 2-6).

3. Business Transactions Data: Retail Trade Rises, Wholesale Trade Levelled-Off

3. Business Transactions Data: Manufacturing and Finance Show Recent Improvement

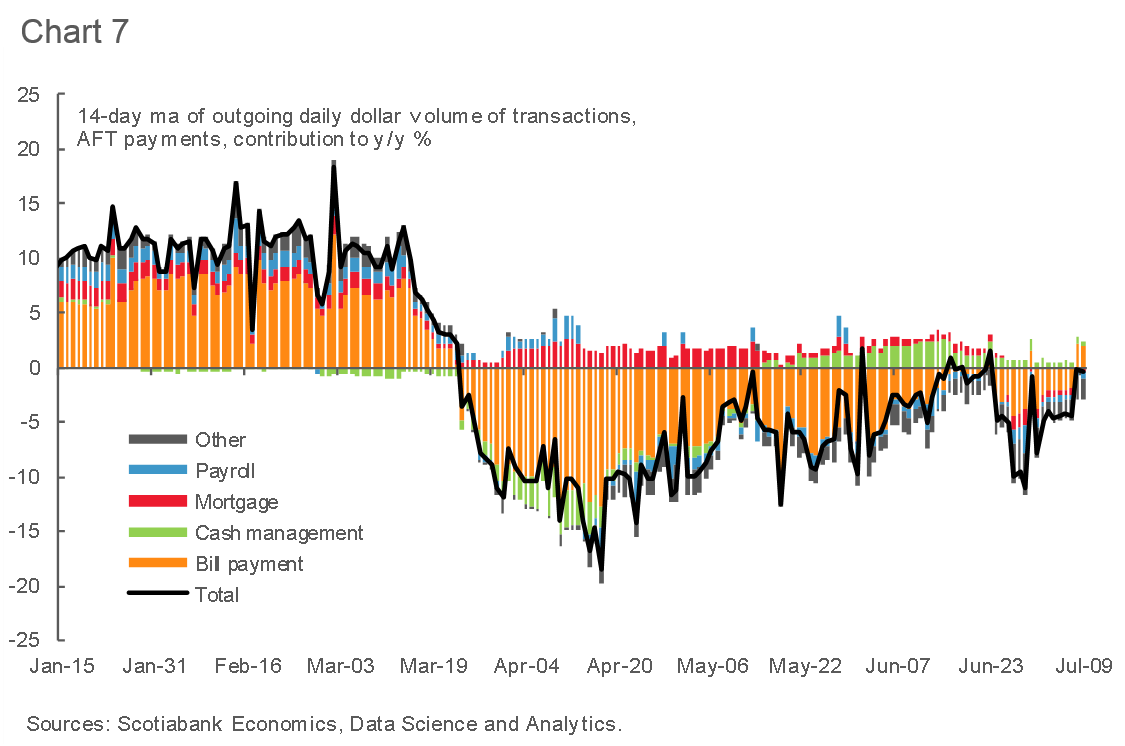

3. Business Transactions Data: Outgoing Bill Payments Rise Recently

- Outgoing AFT payments have started to rise recently (Chart 7):

-General bill payments recently climbed above the year-ago levels. It remains to be seen whether the rise is durable.

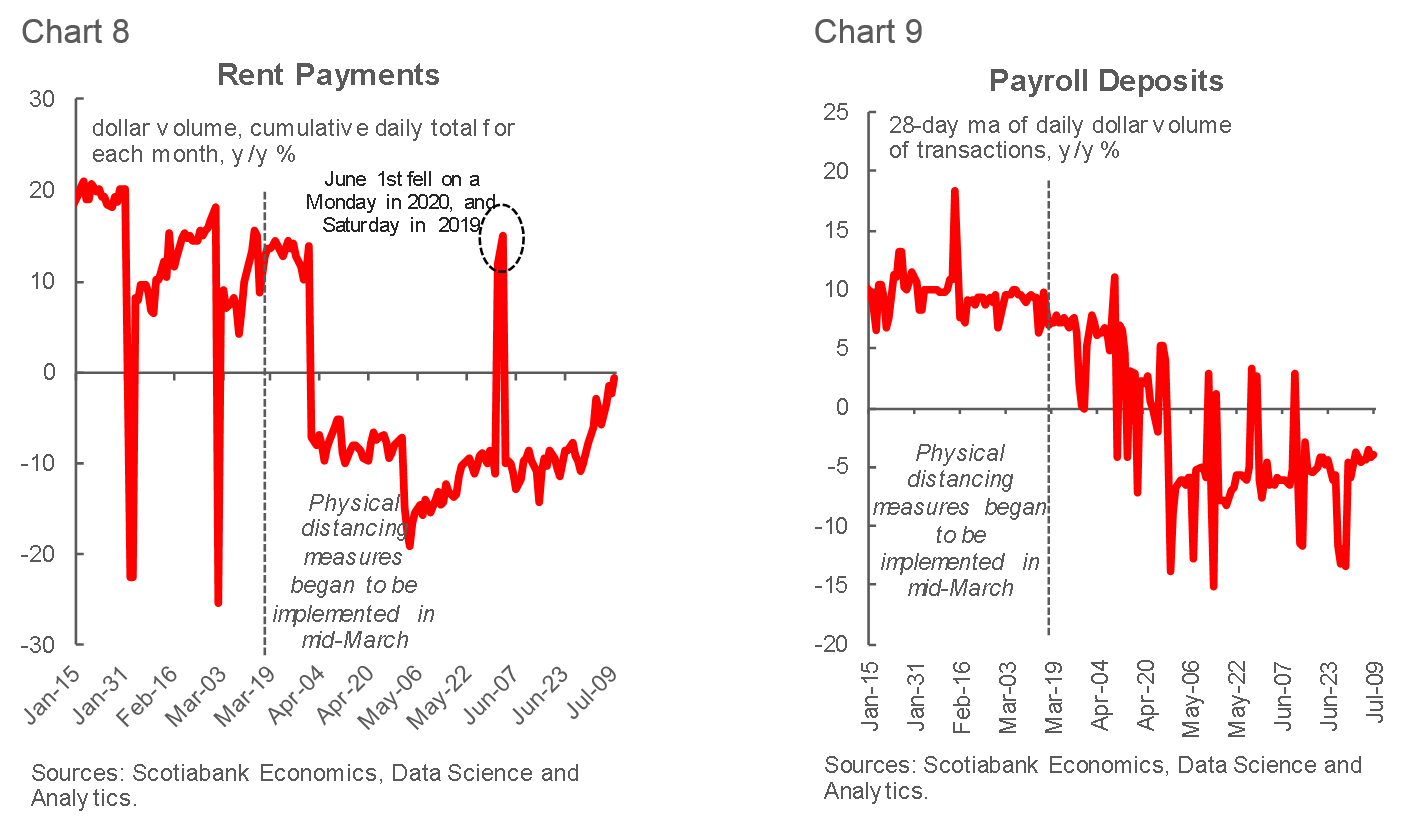

-Payroll deposits and rent payments suffered unprecedented declines in late March. While rent payments started to pick up in the most recent reporting period, payroll deposits have yet to reflect the recent rise in employment (Charts 8 and 9).

3. Business Transactions Data: Rent/Payrolls Ticked Up Recently

4. Retail Transactions Data: Card Spending Improved Further

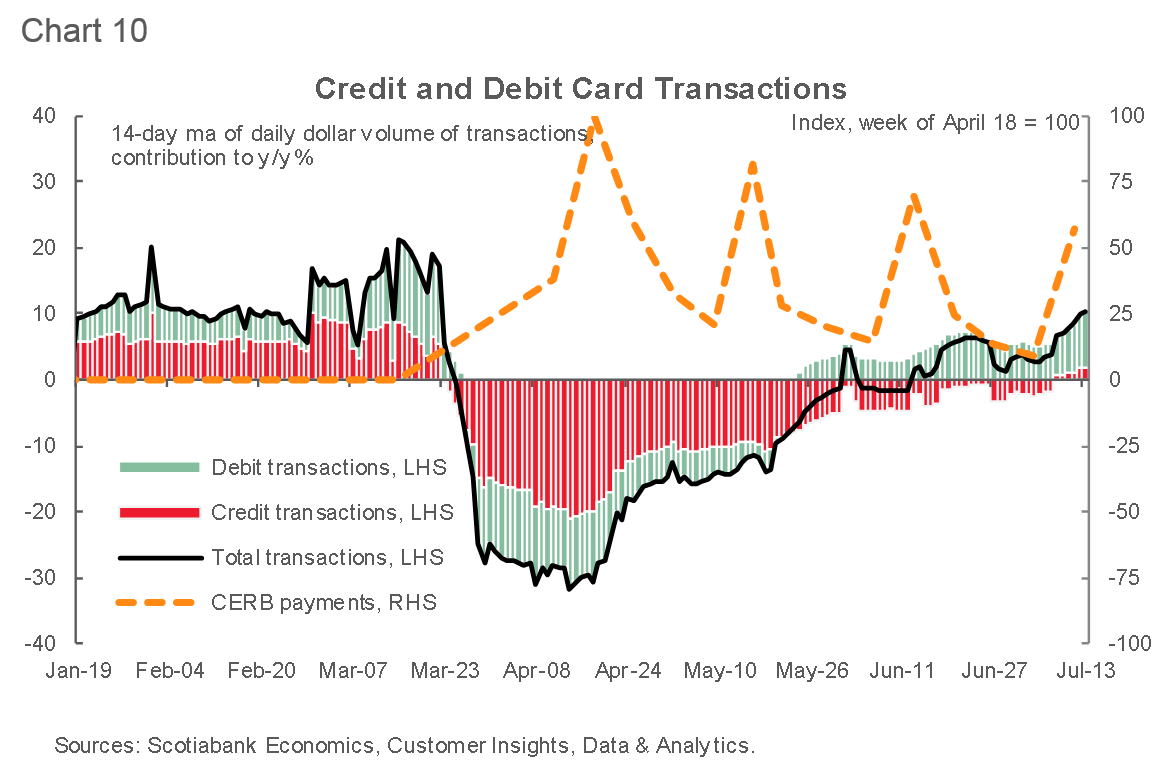

- Card spending shows growth picking up further in mid-July (Chart 10):

-Debit card spending explains most of the recent rise and has remained above the 2019 levels since the end of May.

-Y/Y growth in credit card transactions has been oscillating around zero over the past few weeks. - Some caution is warranted in interpreting the data, as some of the improvement in card spending is likely due to a substitution away from cash.

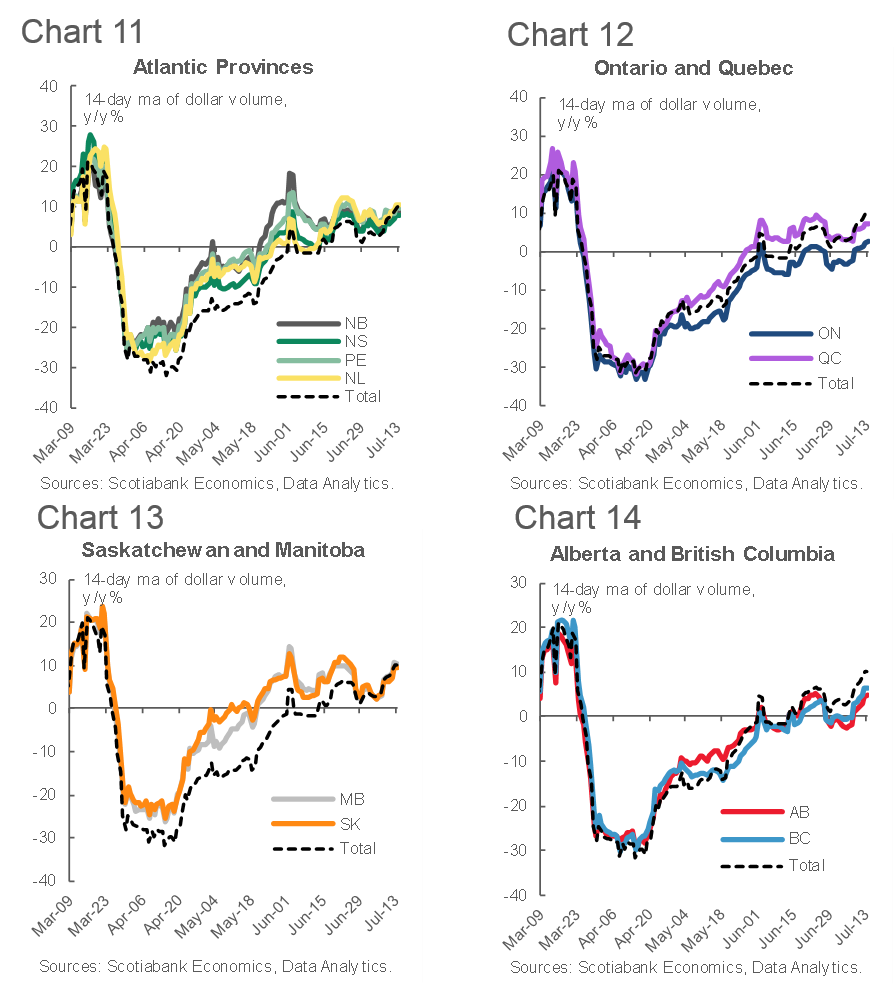

4. Retail Transactions Data: Pace of Recovery Broadly Consistent across Provinces

- Province-level data shows a consistent trend across provinces.

- The recent pickup in overall card spending can be seen across most provinces to a greater or lesser extent.

- Growth in Ontario has started to catch up to that of Quebec (Chart 12), while Alberta and BC remained below average Canada-wide rate over the past few weeks (Chart 14).

- Note that the share of card transactions not tied to a particular province has been on the rise recently, explaining some of the divergence between the Canada-wide trend and provincial totals.

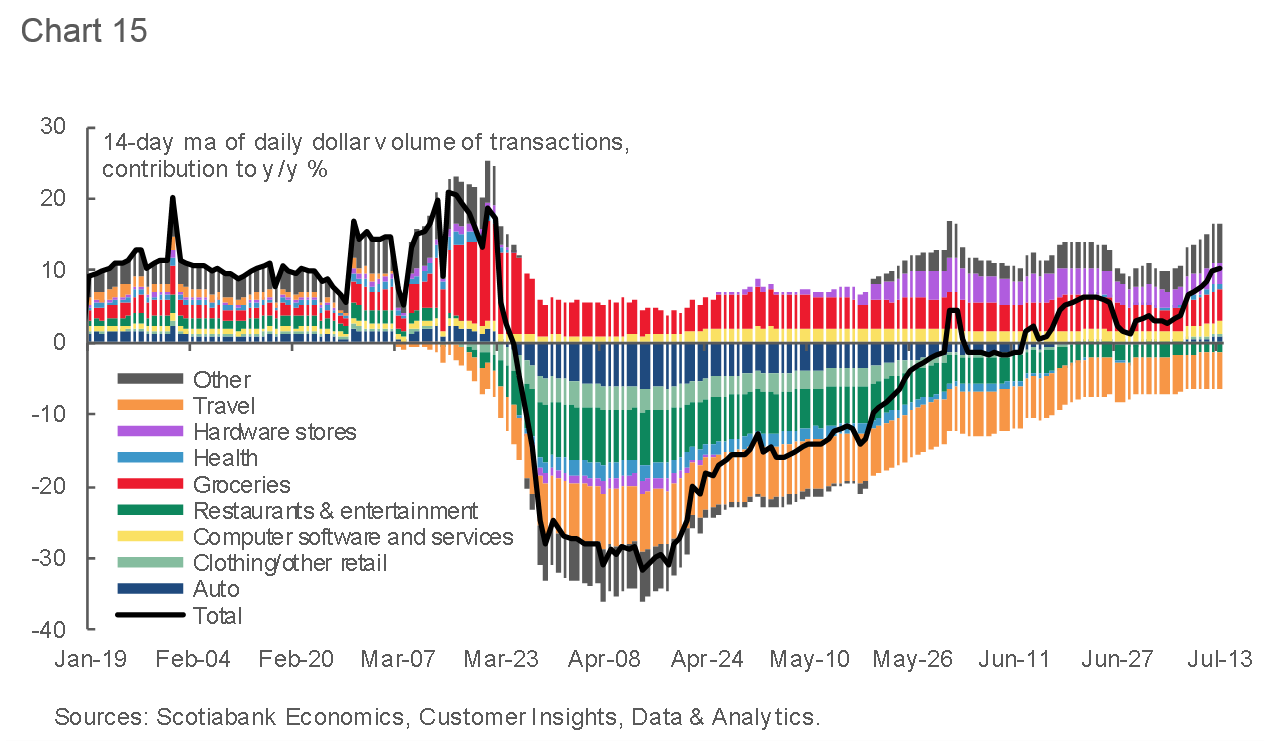

4. Retail Transactions Data: Card Spending Across Most Categories Rises Further

- By merchant type, the only remaining broad categories that are still below the 2019 levels following the most recent rise are travel and restaurant spending (Chart 15).

- Travel spending continues to run significantly below last year’s levels, and a durable recovery is unlikely until international and interprovincial travel normalizes.

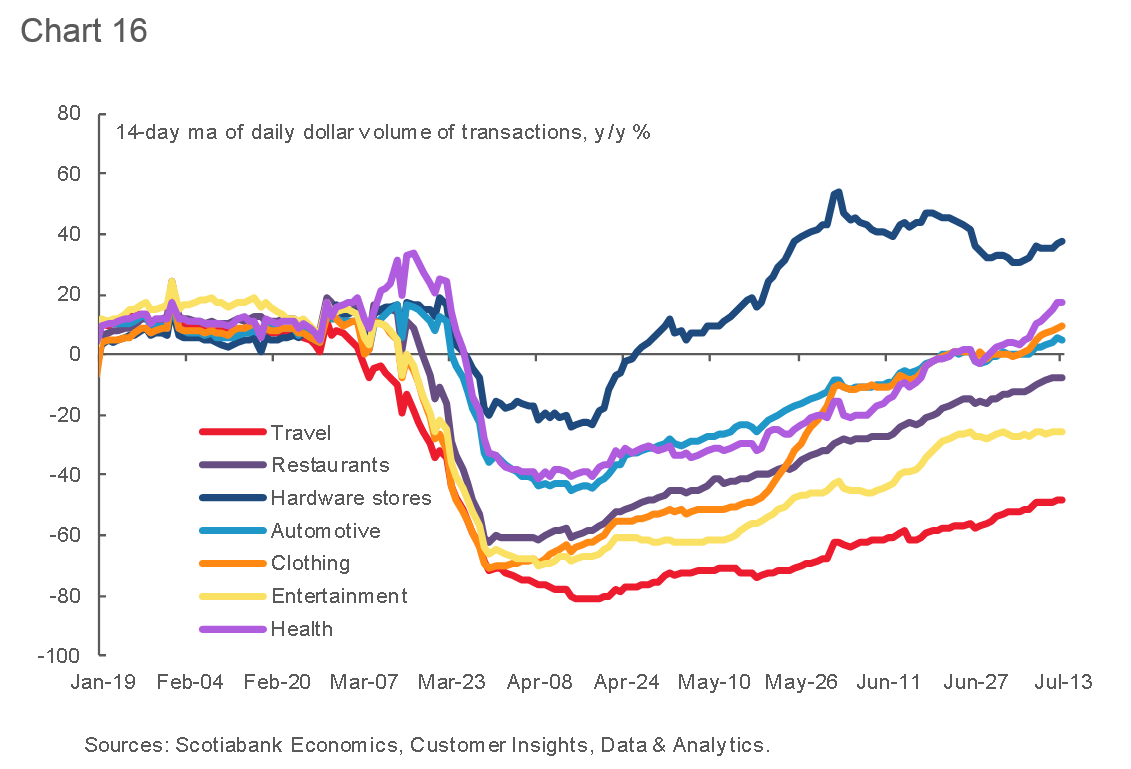

4. Retail Transactions Data: Travel, Restaurants and Entertainment Slow to Recover

- As spending on travel, restaurants and entertainment continues to be held back by the fallout from the pandemic, other categories have improved significantly to surpass last year’s levels (Chart 16):

-Automotive, clothing and health-related card spending have risen further in the last week, and hardware stores see steadily high growth.

-Growth in card spending on entertainment has levelled off at low levels, while re-opening of restaurants continues to slowly improve the spending in that sector.

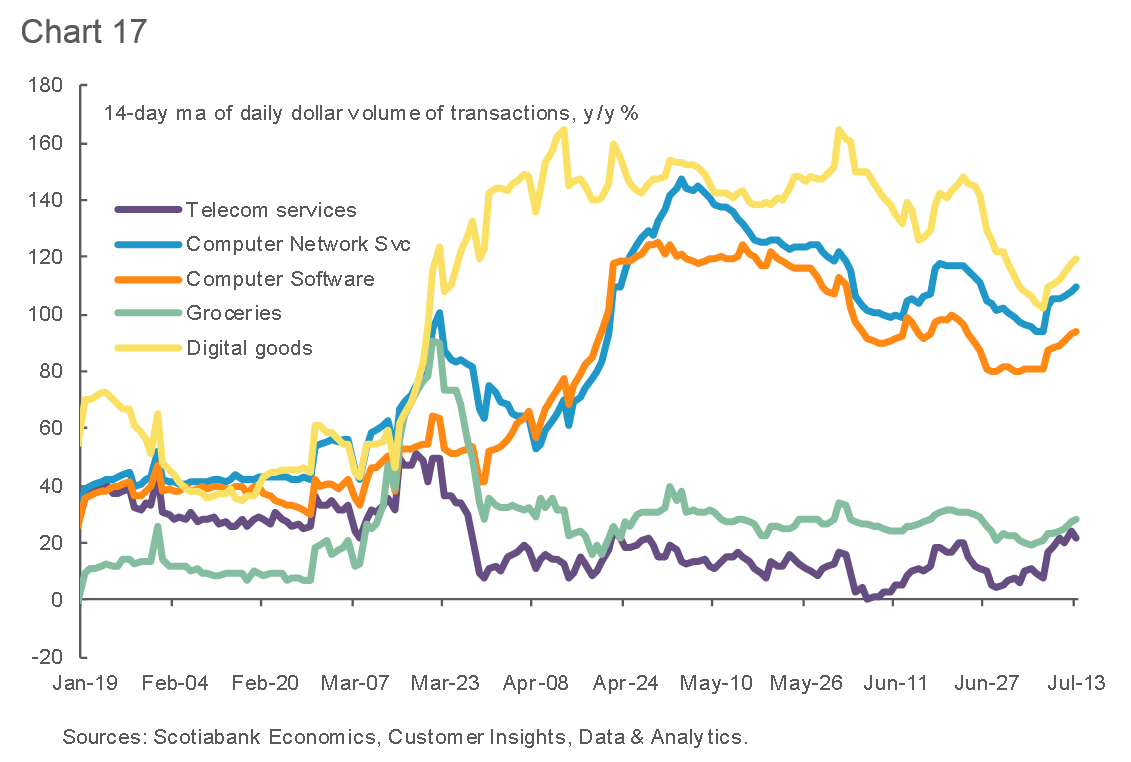

4. Retail Transactions Data: Digital Spending Picked Up Again

- In contrast, categories that have been outperforming since the start of the pandemic still experience strong growth relative to last year and the tentative slowing that started a few weeks ago has been halted for now (Chart 17).

-Growth in spending on consumer network services (e.g. Amazon), computer software and digital goods (e.g. videogames) picked up again over the last week.

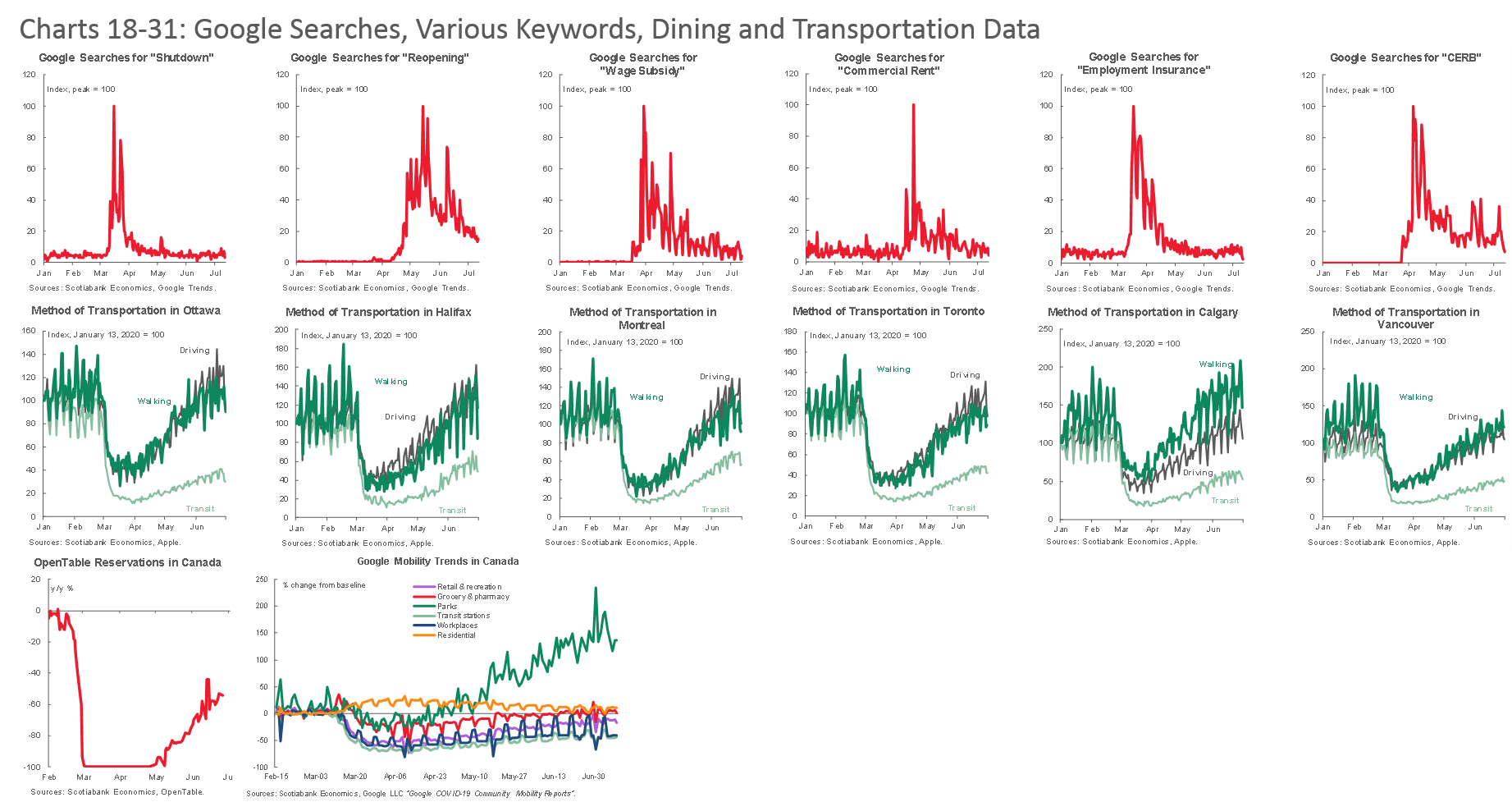

5. Other High-Frequency Indicators Of Activity

Nikita Perevalov* (Scotiabank Economics)

Taha Jaffer, Jason Liang (Data Science and Analytics)

Roland Merbis, Artur Motruk (Customer Insights & Analytics)

* Director of Economic Forecasting, 437.775.5137, nikita.perevalov@scotiabank.com

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including, Scotiabanc Inc.; Citadel Hill Advisors L.L.C.; The Bank of Nova Scotia Trust Company of New York; Scotiabank Europe plc; Scotiabank (Ireland) Limited; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Scotia Inverlat Casa de Bolsa S.A. de C.V., Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorised by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorised by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V., and Scotia Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.