ECONOMIC OVERVIEW

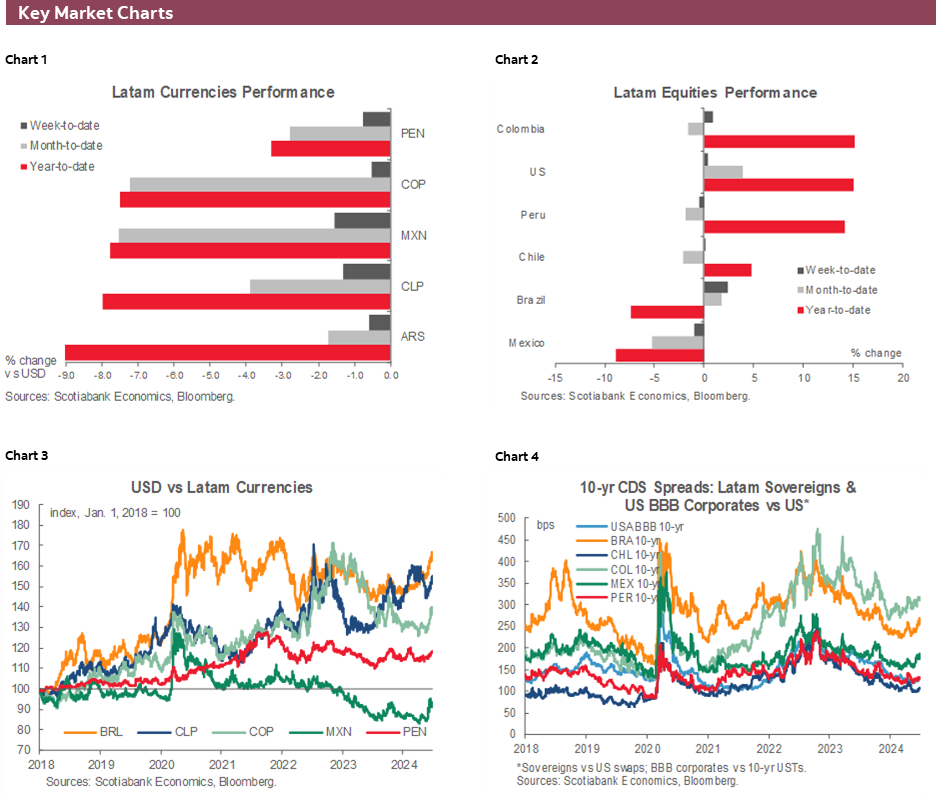

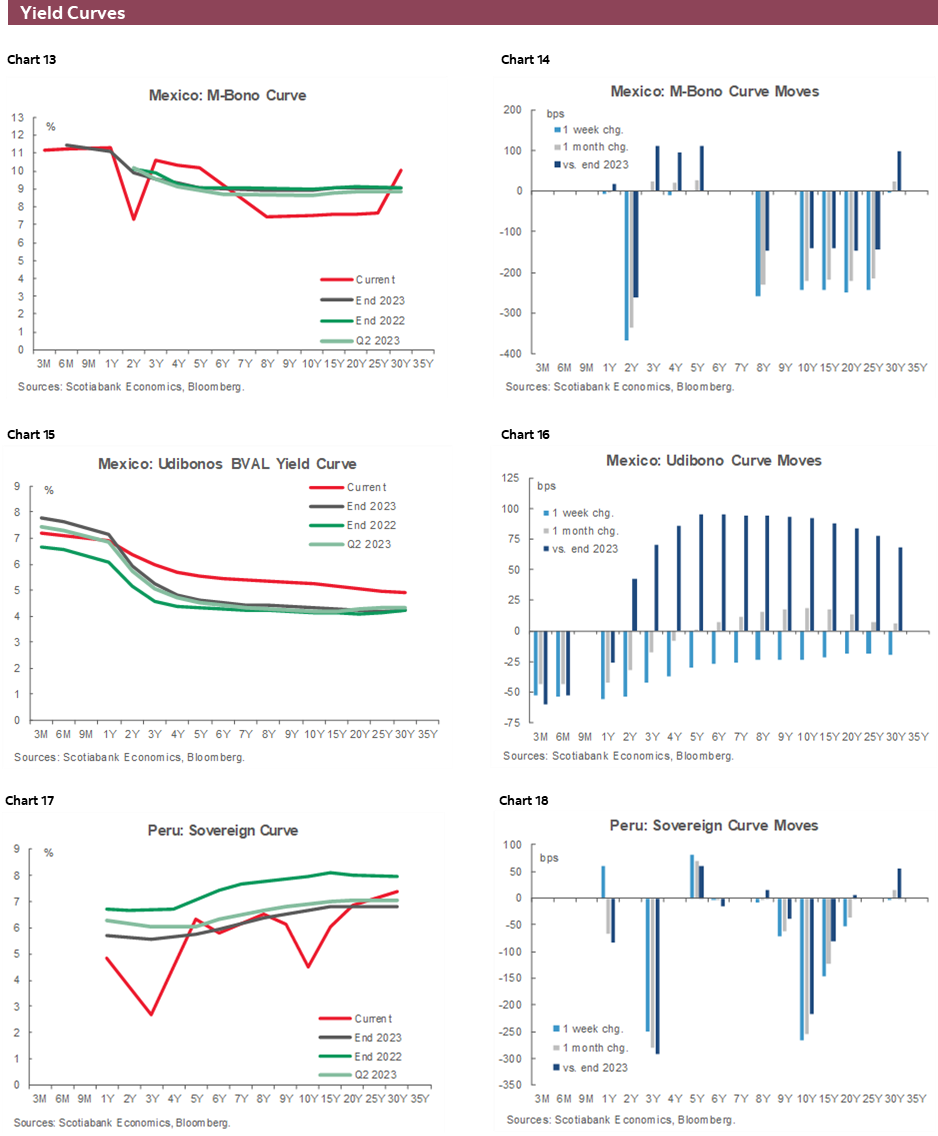

- After a noisy June of surprising Banxico and BCRP decisions and a stronger-than- expected showing for Morena in Mexico’s elections, July starts out quietly in Latam.

- Next week’s data highlights, Peru CPI and Chile economic activity, both come out on Monday, with regional markets looking perhaps more exposed to the results of France’s first round elections on Saturday, a flood of US data, and thin trading with holidays in Colombia, the US, and Canada.

- In today’s report, our team in Chile outlines the impact of the unfreezing of electricity fares on their inflation projections, while our economists in Colombia cover the main points of the country’s Pension Reform.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile and Colombia.

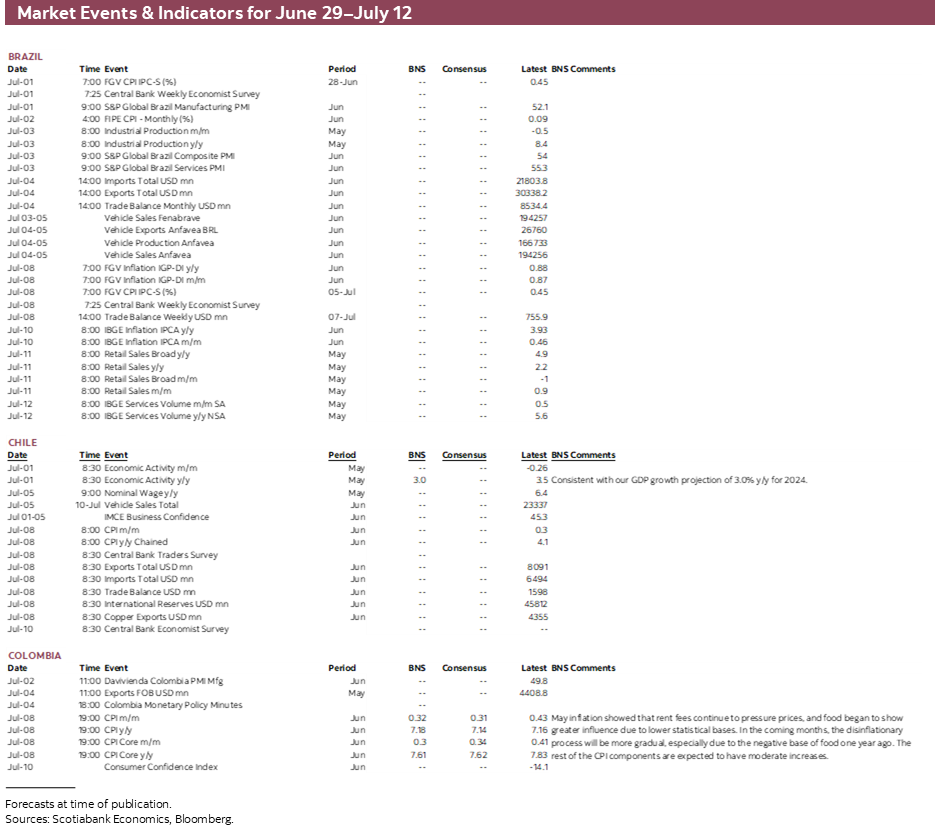

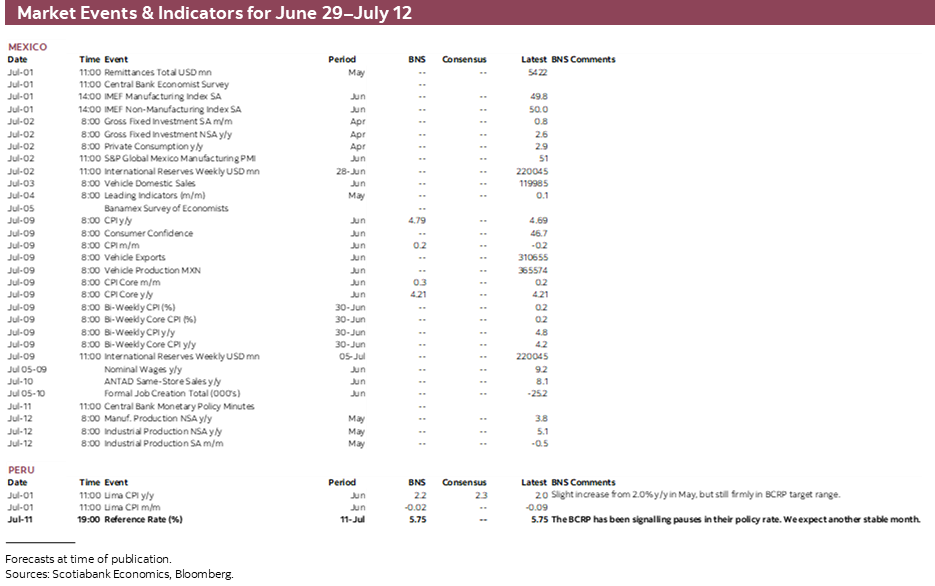

MARKET EVENTS & INDICATORS

- A comprehensive risk calendar with selected highlights for the period June 29–July 12 across the Pacific Alliance countries and Brazil.

ECONOMIC OVERVIEW: QUIET AT HOME, BUSY ABROAD

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- After a noisy June of surprising Banxico and BCRP decisions and a stronger-than-expected showing for Morena in Mexico’s elections, July starts out quietly in Latam.

- Next week’s data highlights, Peru CPI and Chile economic activity, both come out on Monday, with regional markets looking perhaps more exposed to the results of France’s first round elections on Saturday, a flood of US data, and thin trading with holidays in Colombia, the US, and Canada.

- In today’s report, our team in Chile outlines the impact of the unfreezing of electricity fares on their inflation projections, while our economists in Colombia cover the main points of the country’s Pension Reform.

We’re leaving behind a busy June—where a couple of central bank surprises (dovish Banxico and hawkish BCRP) and Mexican market volatility on political risks were the Latam highlights—to quietly kick off a new month in the region with a data calendar that has only a few items to follow. Next week’s data highlights, Peru CPI (see our preview here) and Chile economic activity, both come out on Monday, leaving the rest of the week relatively bare aside from a couple of economists surveys in Mexico and BanRep’s meeting minutes.

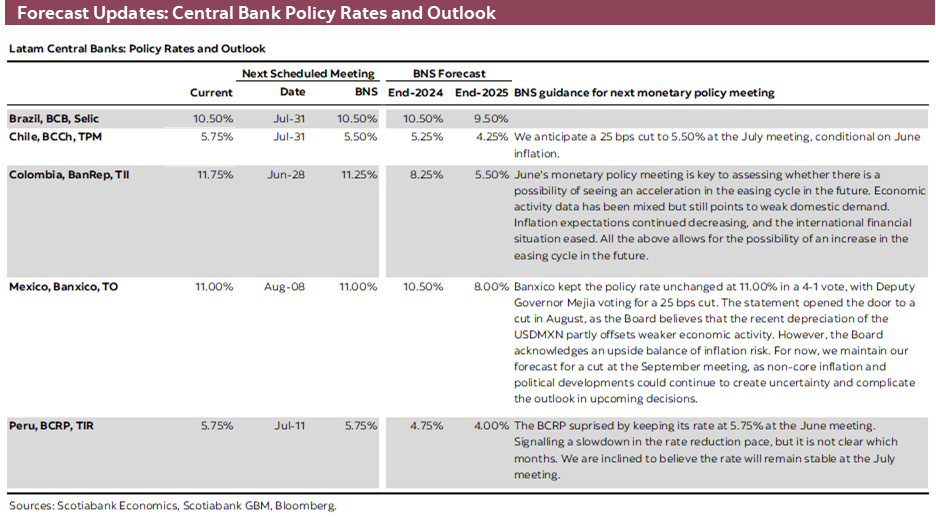

Given the quiet backdrop, regional markets look more liable to take their cue from developments abroad, where elections in France and the UK and a flood of US data will drive overall trading sentiment. Choppy trading may also be in store amid thin volumes with Canadian and Colombian markets shut on Monday and the US out on Thursday. Markets are liable to open with a bang on Monday to price in results from France, while Colombian trading will have to wait until Tuesday to react to BanRep’s likely 50bps rate cut today (Friday the 28th).

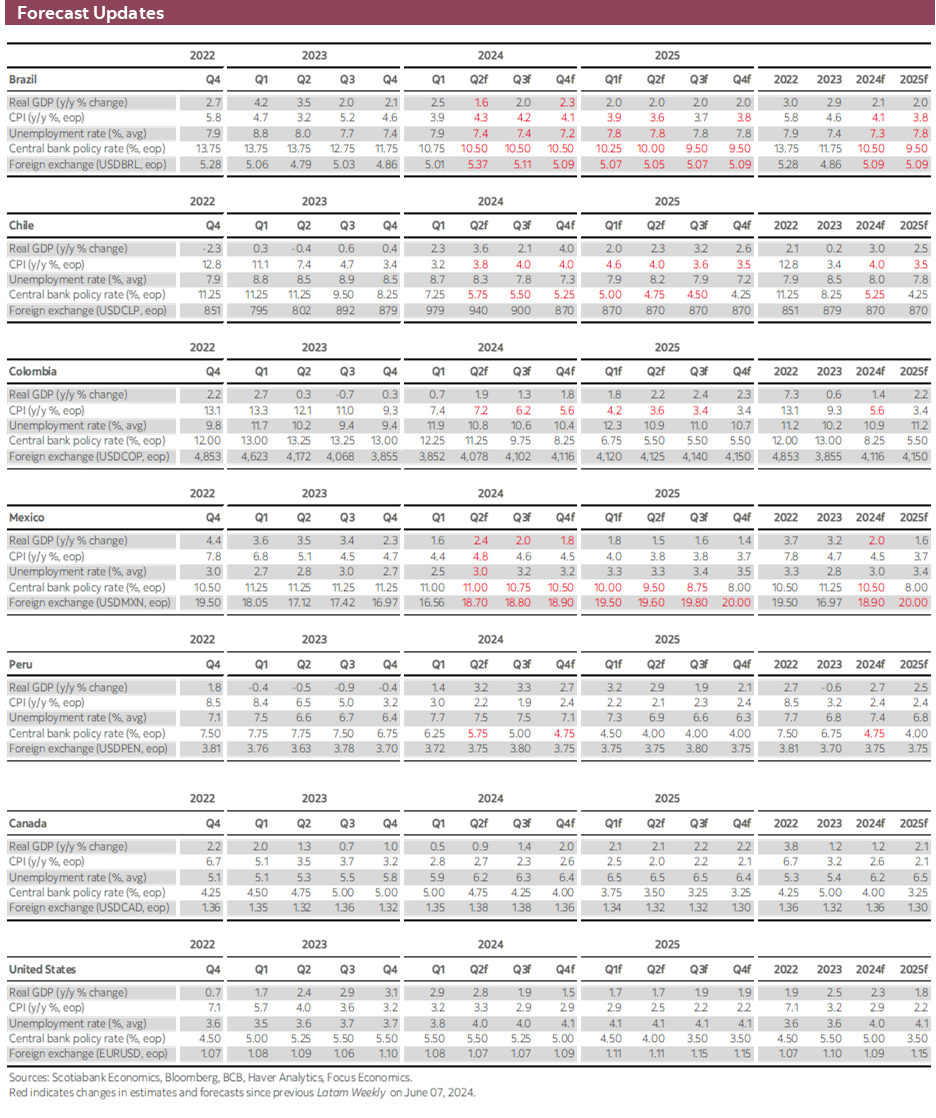

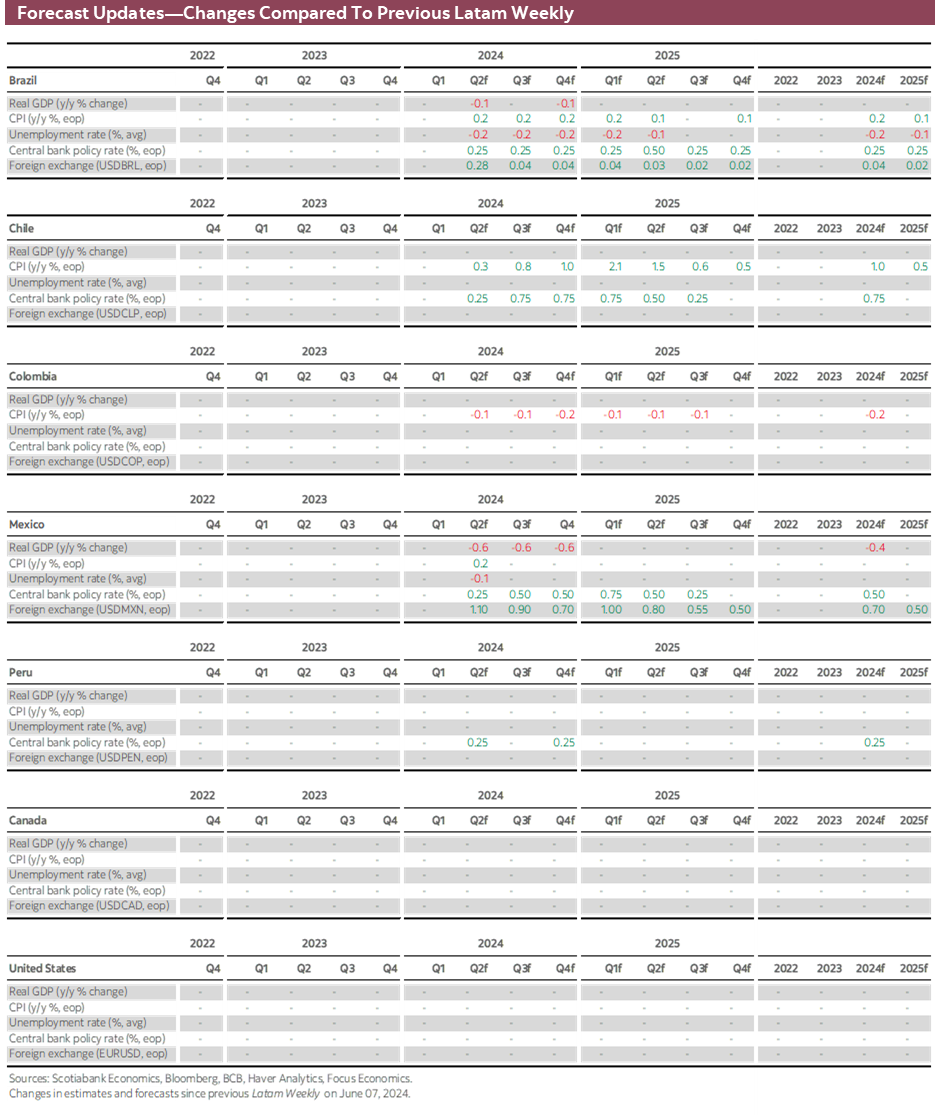

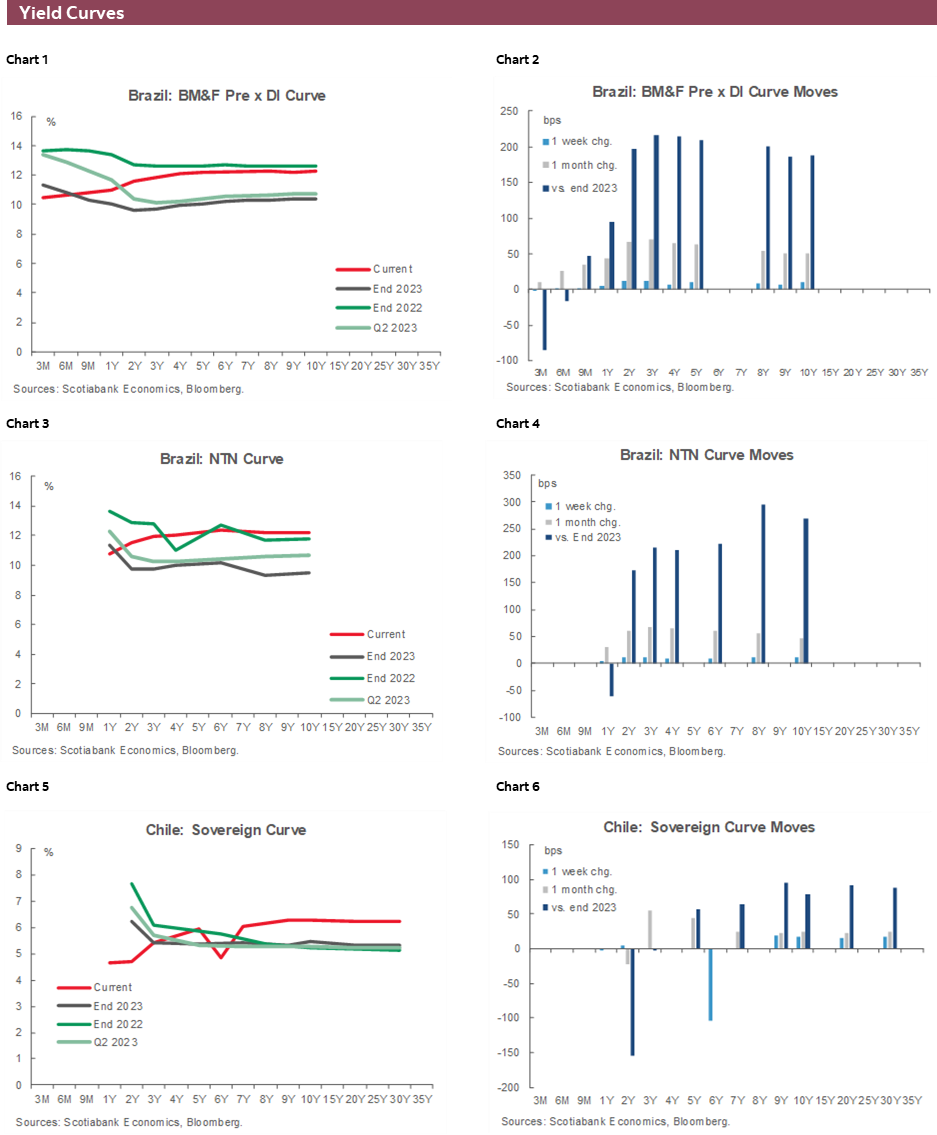

In today’s report, our team in Chile outline the impact on inflation from the unfreezing of electricity fares that Congress approved earlier this month. Based on a ~60% increase in household power bills by early-2025 (across likely three increases beginning in July), our economists have lifted their end-2024 inflation forecast to 4.0% from 3.0% previously (and to 3.5% from 3.0% at end-2025). Our Bogota team covers the main points of the country’s Pension Reform which, although approved by Congress, still faces some uncertainty around the timing of its entry into force.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—Increase in Electricity Fares and its Impact on Inflation

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

Unfreezing electricity fares would imply a cumulative increase in household bills of almost 60% through January 2025. After a prolonged period of frozen electricity fares for regulated clients (households and SMEs), Congress approved the plan proposed by the government to begin to pay off the debt with the electricity generating companies, which will imply strong increases over the next seven months. In this way, a significant increase in electricity fares for small consumption clients is projected for July 2024 due to upward adjustments in the charges of the different components of the rate. Additionally, a new and significant upward adjustment in the rate is expected for October of this year, which will be followed by another in January 2025. With this, it is projected that electricity fares for regulated clients would increase by close to 60% over the next seven months.

We estimate a direct impact of 1.1 ppts on the accumulated CPI to January 2025. The indirect impacts could be more persistent. Electricity fares represent 2.2% of the CPI basket, so the direct impact of the projected increases will be significant on the total CPI, but not on core CPI (ex-volatile CPI), as electricity bills belong to the basket of volatile products. Likewise, we estimate that the indirect impact is transmitted to the basket through different channels and at different times. Initially, those products where electricity is relevant within the cost structure would be the first to transfer part—or all—of the adjustment in the electricity rate. An emblematic example is bread, whose weight in the basket is 2.2%. Therefore, the increase in the Unidad de Fomento (UF) will imply that these highly inflation-indexed services build some persistence to the shock of higher electricity rates within the basket. Another key example is shelter, whose weight is 7.2%. Finally, there are several services that adjust their prices based on past year inflation, which would prolong the persistence of the shock even until the beginning of next year. This is the case for educational services, whose weight within the basket is 4.2%.

We reiterate the upward adjustment in our CPI projection for 2024 and 2025. The direct effects will be concentrated in July and October, which leads us to revise upward our inflation projection for December of this year, up to 4% y/y. In 2025, the rate increase would occur in January, which leads us to increase our projection to 3.5% y/y for December of next year.

Pension Reform in Colombia

Jackeline Piraján, Senior Economist

+57.601.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

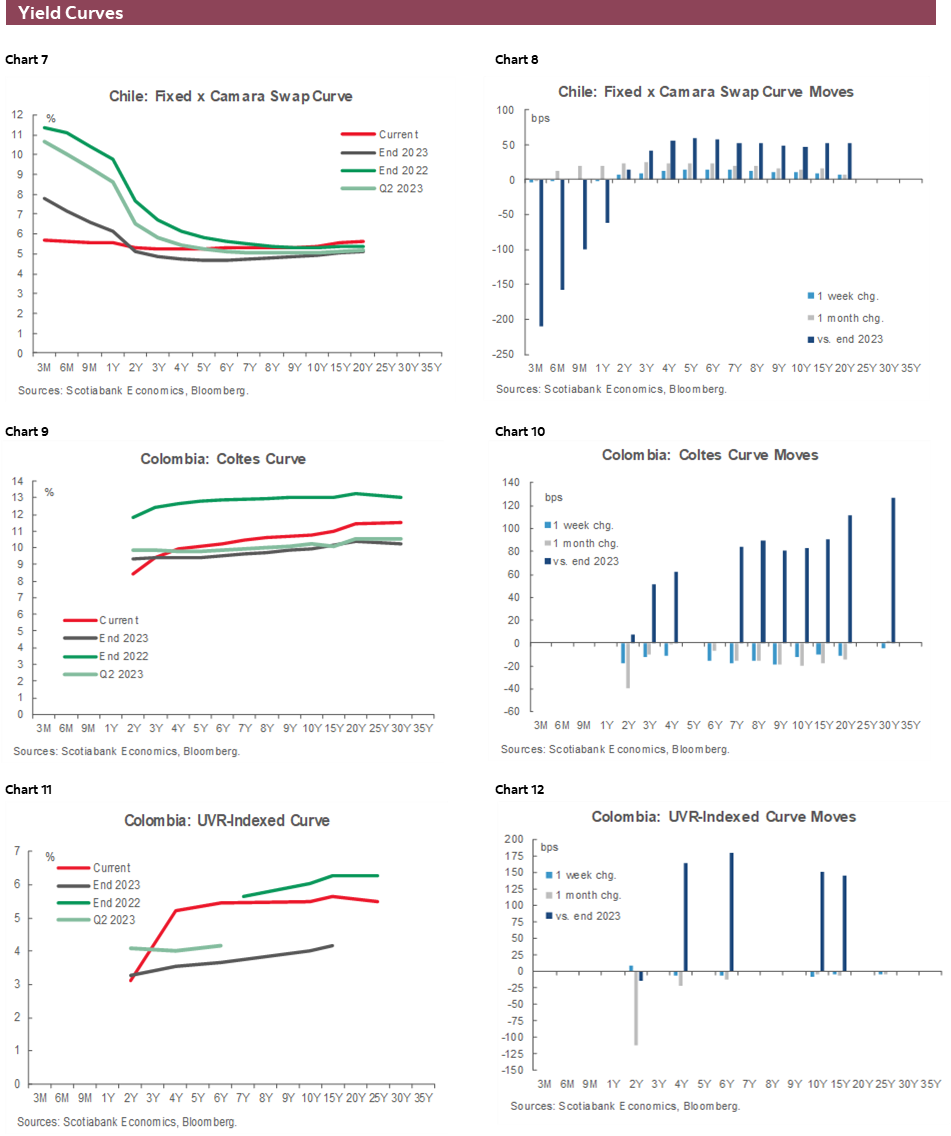

- Potential impacts on capital markets are contained. The regulatory framework of the reform should be in the spotlight.

The Pension Reform was approved in the House Plenary, the last of the four necessary debates, on Friday, June 14th, 2024. The approval took place under an unorthodox but still legal procedure: the House approved the same text that was approved by the Senate without further discussion and ignored approved proposals that took place during the third debate in the seventh commission of this chamber.

The reform is pending the presidential signature. However, if revised or sued by this instance, it could still face the challenge of the Constitutional Court. It could take many months before we hear the final word from this court. For now, Pension Reform is expected to be fully implemented in a year, and details around the legal framework of the pension reform are in the spotlight.

Key points about the reform:

- Implementation will take one year from the law’s sanction. This is a very ambitious deadline since it requires enormous legal frameworks and the creation of the public fund infrastructure, which we believe the government or Colpensiones is not ready to implement or receive in this timeframe.

- The pensions framework will consist of a system of integrated and complementary pillars. The first group, the solidarity pillar, guarantees a subsidy for those older adults who are in a situation of vulnerability; according to the MoF, the approximate cost will be ~0.2% of GDP. The second is the semi-contributory pillar, which provides a life annuity for those who contributed but did not meet the minimum number of weeks required for a pension. The third is the contributory pillar, in which all the formal employees in Colombia make mandatory contributions. This will create a new fund that guarantees a high replacement rate; however, it limits the benefit up to 2.3 minimum wages (which is currently around USD 730), which means that contributions to this pillar can be over a minimum salary and limited up to 2.3 minimum salaries. The fourth pillar is individual savings, which will be managed by existing private pension funds with contributions above the threshold of 2.3 minimum wage threshold.

- Population with more than 900 weeks of pension contributions (~17 years working) in the case of males and more than 750 weeks (14.5 years working) in the case of females will be excluded from the implementation of the reform. Having said that, we don’t expect a significant disruption in assets under management in the pension system. Instead, we could have a situation of increase in AUMs since the contribution of active affiliates in the public system will go to the sovereign pension fund instead of continuing to the pay-as-you-go scheme in which those contributions are used to fund current pension payments. It is worth noting that currently around 27% of total active affiliates on the pension system (2.8 out of the 10.2 million active affiliates) contribute to the public pillar.

- About the new sovereign pension fund. The central bank is in charge of safeguarding the resources of this fund. However, there is a lack of understanding of the specific role of the central bank. During the third debate, BanRep asked Congress to specify the scope of the responsibility with the fund. However, the final law is not so clear in that regard.

- The cumulation phase of the sovereign would last until around 2060, according to Asofondos (pension fund association). Total AUMs in the pension system could reach a maximum of around 32% of GDP before starting the decumulation phase. However, the maximum funding ratio (assets/Present Value of Liabilities) of the sovereign pension fund will be at maximum ~24%; that said, during the decumulation phase, savings could vanish significantly ~10% of PIB by 2070 (passing from 32% of GDP to 23% of GDP), which represents a challenge in the long term.

- The definition of the investment regime of the sovereign fund is key to assess the impact in the capital market. A liability-driven approach is appropriate to the sovereign fund, however it is important to see the assets allowed to invest in. Given current capabilities of the central bank we think the fund will be focused in traditional assets, since alternative investments demands a deeper expertise.

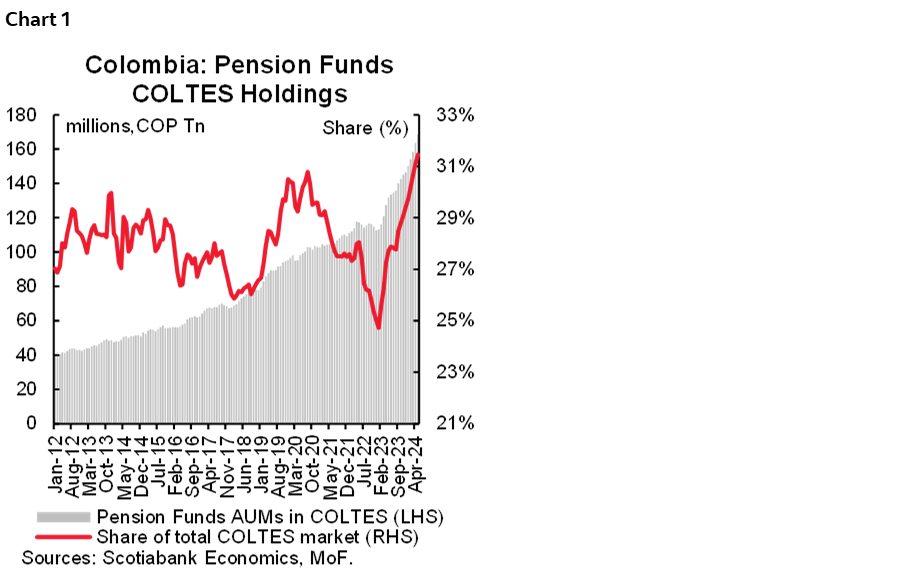

- Competition in the private pension system could maintain good liquidity in the COLTES market. Despite the current reform pension funds will be allowed to charge fees of 0.7% over AUMs (which is not a pro-performance-oriented incentive). We think competition will be motivated if other companies such as trust companies can enter into the market of private pension (mandatory and voluntary). In terms of voluntary pension, we think people now have more motivation to save for their retirement and it is good for capital markets and insurance markets of life annuities. Currently pension funds holdings in the COLTES markets is above 30% (chart 1).

- Pensions are an ongoing concern, so we see the necessity of further discussions in the medium term. As we highlighted before, the potential short-term shock from the pension reform is apparently low; however, Colombia needs to continue discussing a parametric pension reform in terms of the size of contribution (currently at 16% but only 25% of it in charge of individuals and the rest came from companies) and pension age (currently at sixty-two for males and fifty-seven for females). The discussion must be complemented by strategies to reduce the informality in the labour market (currently around 60% nationwide).

All in all, Colombia will start a transition to a new pension scheme. The impact in capital markets measured as pension AUMs in the system will be almost null, at least in the forthcoming thirty-six years; after that, the decumulation period of the new sovereign pension fund will be a concern. The regulatory framework around the investment regime of the new and existing pension funds will be relevant to assess the potential impact on capital markets, especially the COLTEs market.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.