ECONOMIC OVERVIEW

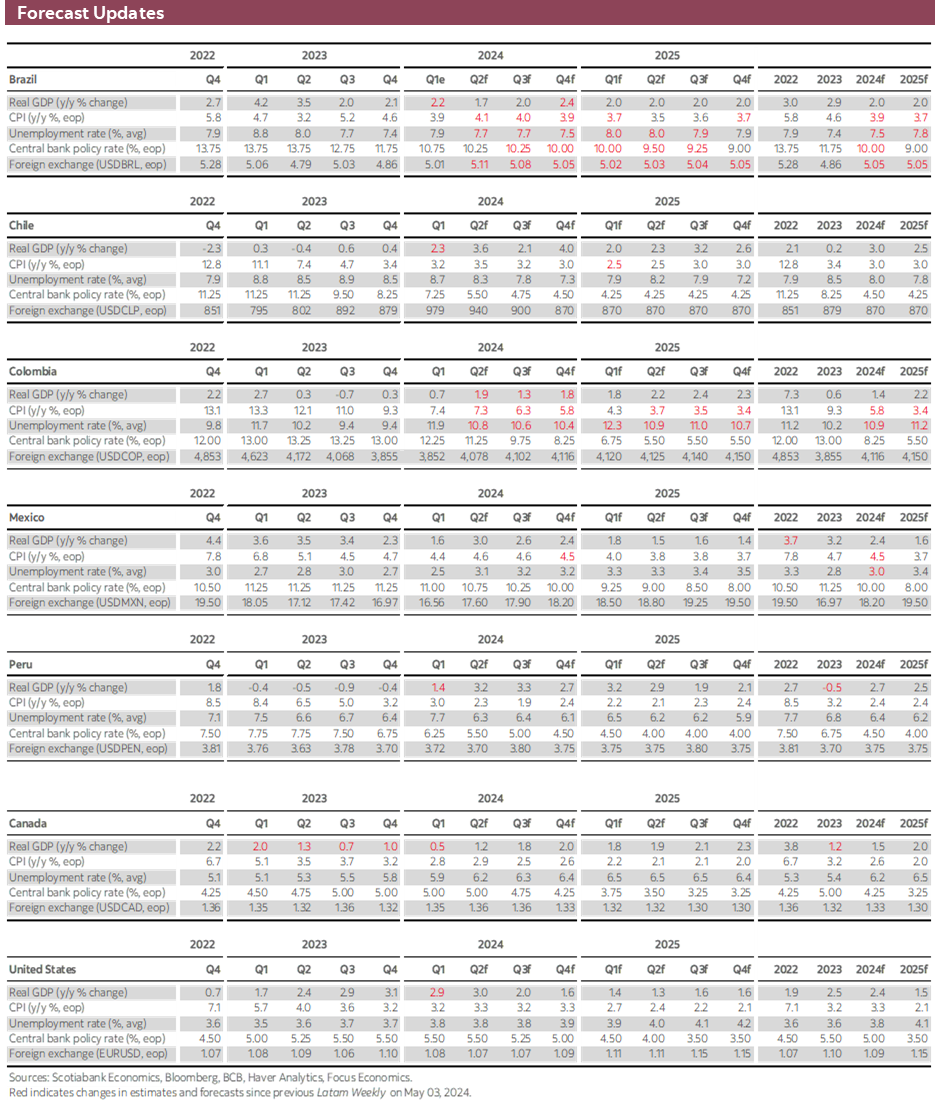

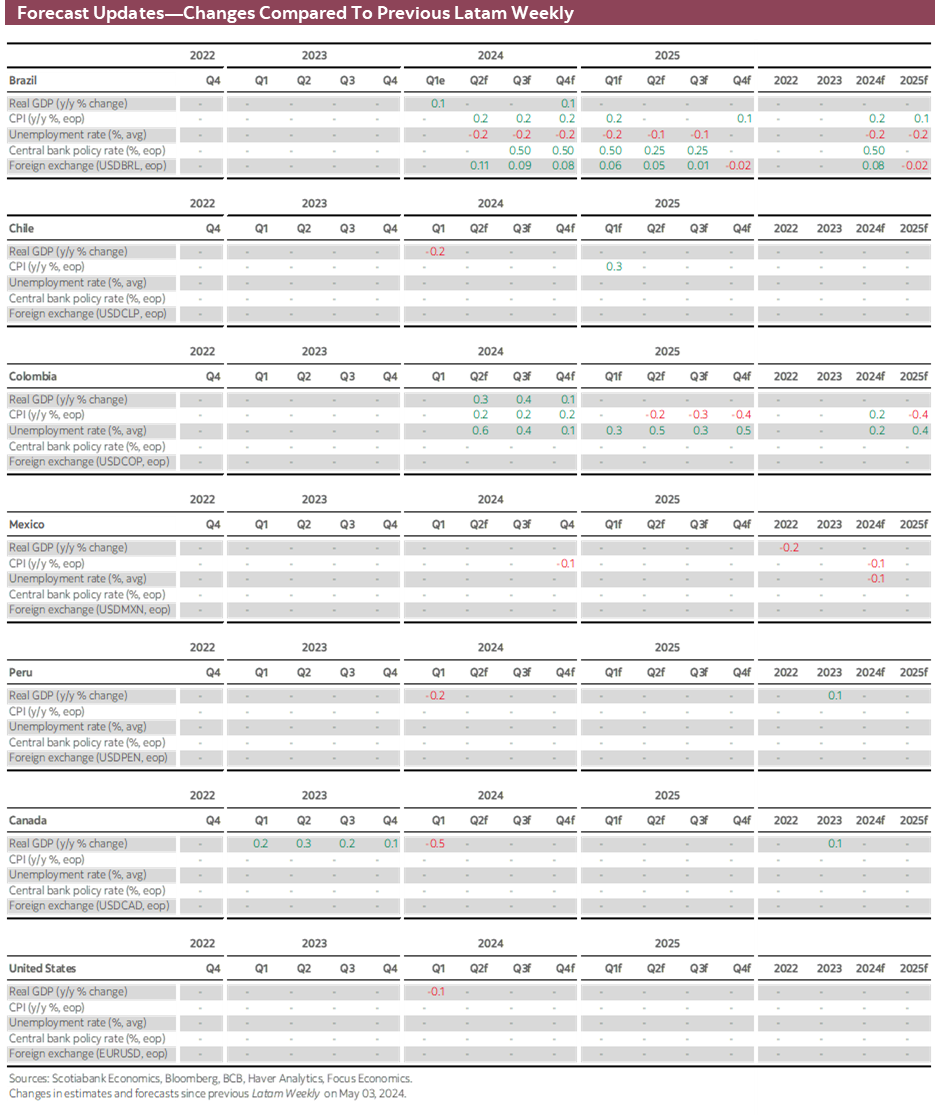

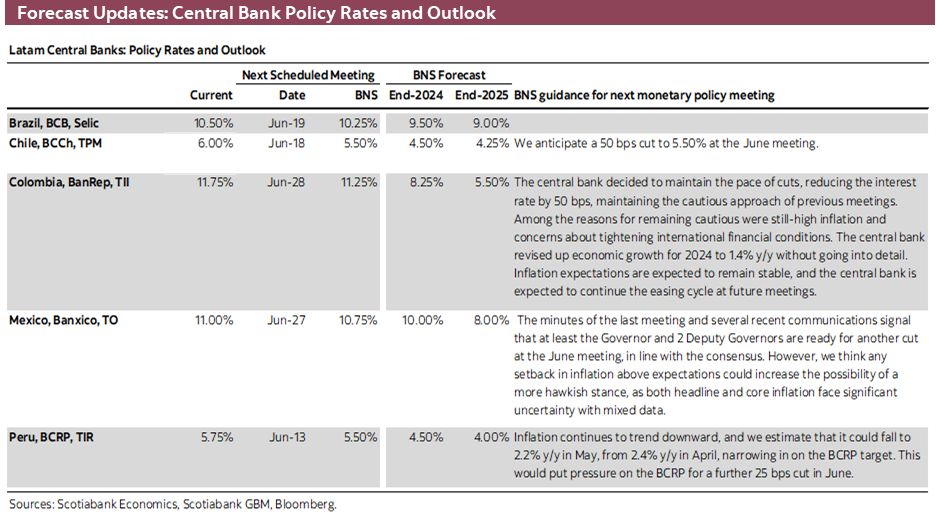

- The first week of June starts with a bang in Latam and G10, with inflation data from Peru, Mexico, and Chile, a flood of US releases from ISM to NFP, and rate decisions from the ECB and the BoC (where at least the former will kick off its easing cycle). Mexicans also elect a new president on June 2nd.

- Peruvian inflation is seen just a bit closer to the 2% mark, while in Chile it is due to sit practically on target. On the other hand, Mexican inflation is expected to accelerate, pressured by non-core prices that challenge inflation expectations normalizing. Colombia’s calendar is bare of major releases, but our team discusses the validity of concerns around fiscal accounts in today’s Weekly.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in the Pacific Alliance countries: Chile, and Colombia.

MARKET EVENTS & INDICATORS

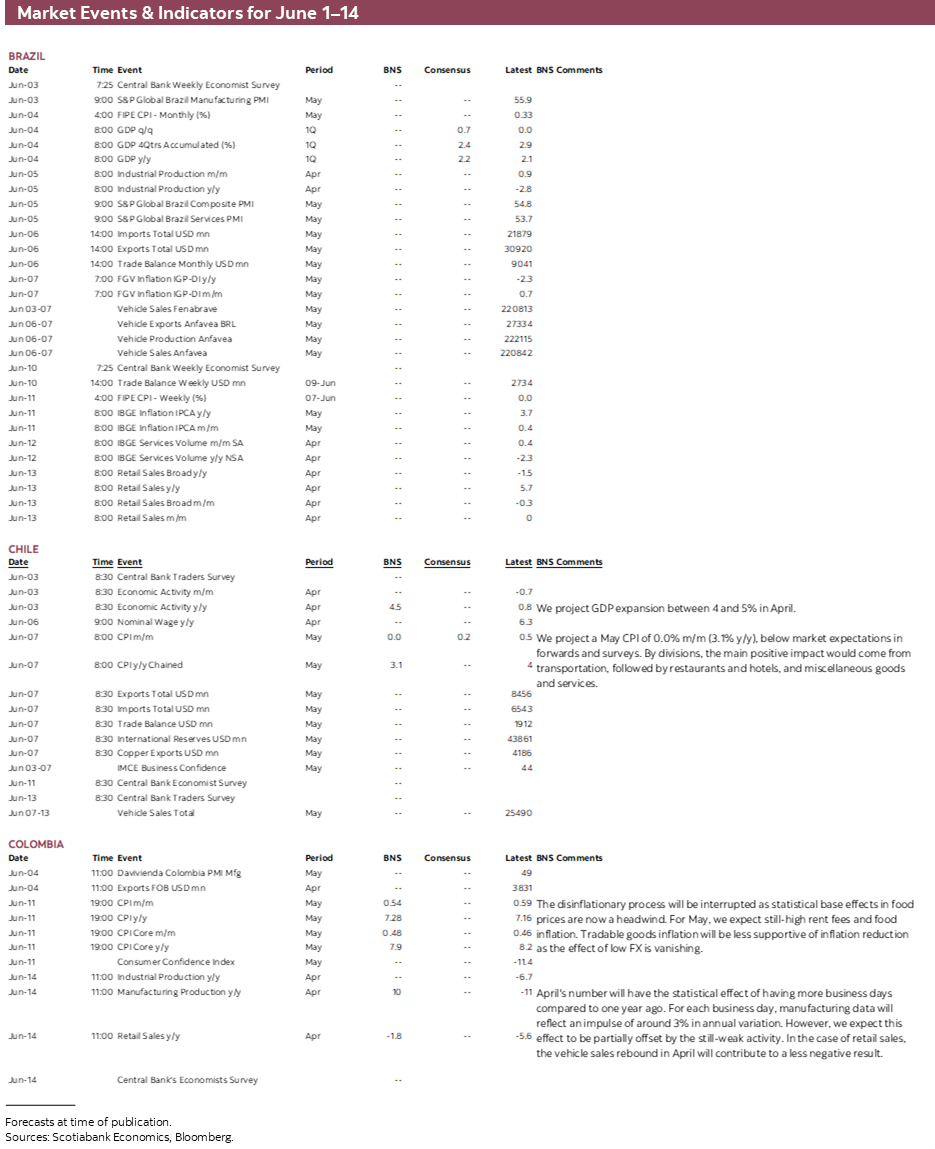

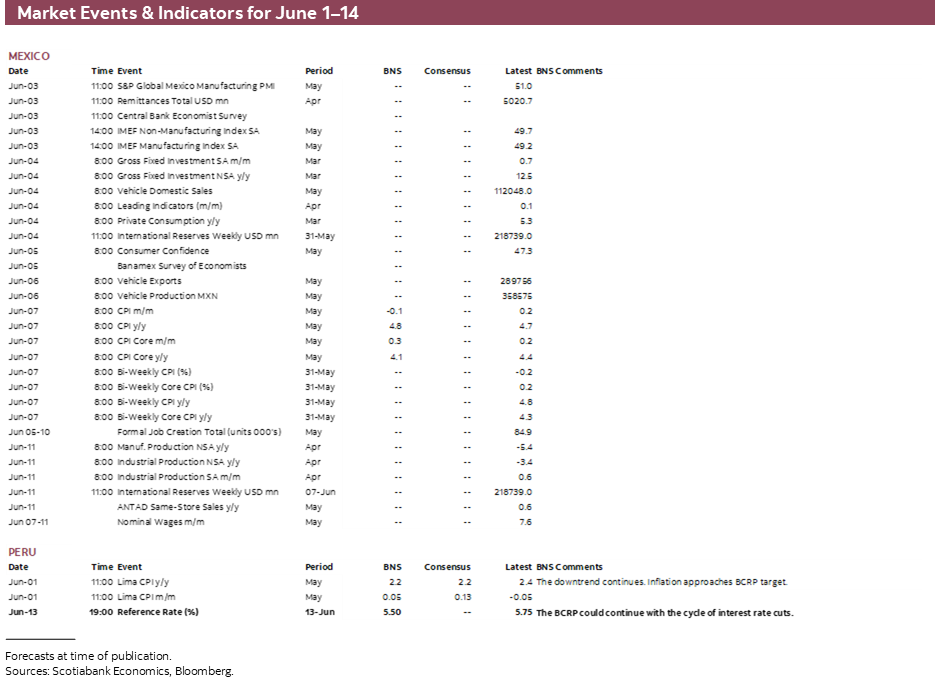

- A comprehensive risk calendar with selected highlights for the period June 1–14 across the Pacific Alliance countries and Brazil.

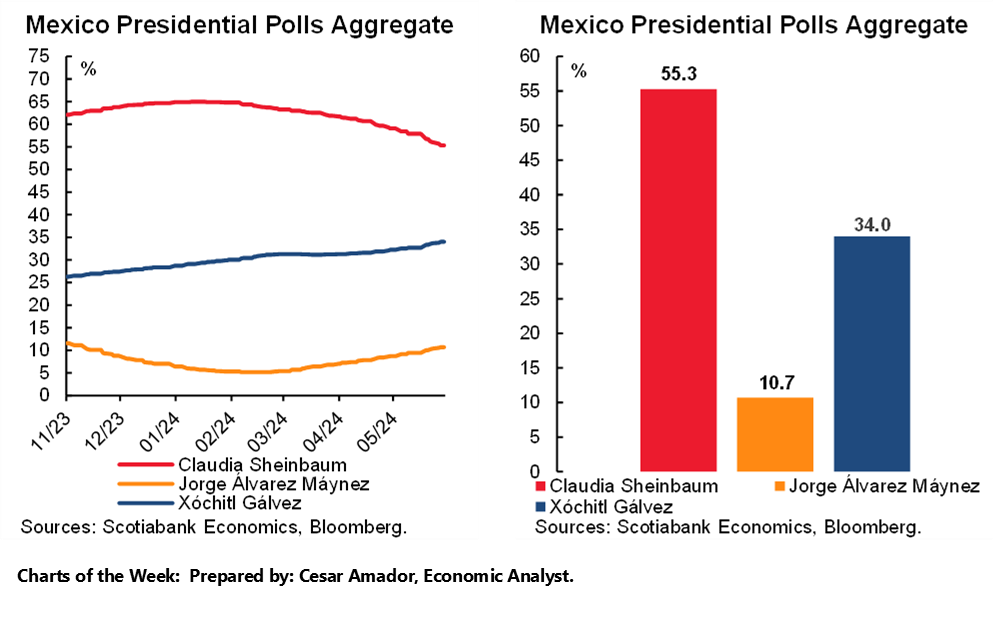

Charts of the Week

ECONOMIC OVERVIEW: PACKED LATAM AND G10 WEEK

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- The first week of June starts with a bang in Latam and G10, with inflation data from Peru, Mexico, and Chile, a flood of US releases from ISM to NFP, and rate decisions from the ECB and the BoC (where at least the former will kick off its easing cycle). Mexicans also elect a new president on June 2nd.

- Peruvian inflation is seen just a bit closer to the 2% mark, while in Chile it is due to sit practically on target. On the other hand, Mexican inflation is expected to accelerate, pressured by non-core prices that challenge inflation expectations normalizing. Colombia’s calendar is bare of major releases, but our team discusses the validity of concerns around fiscal accounts in today’s Weekly.

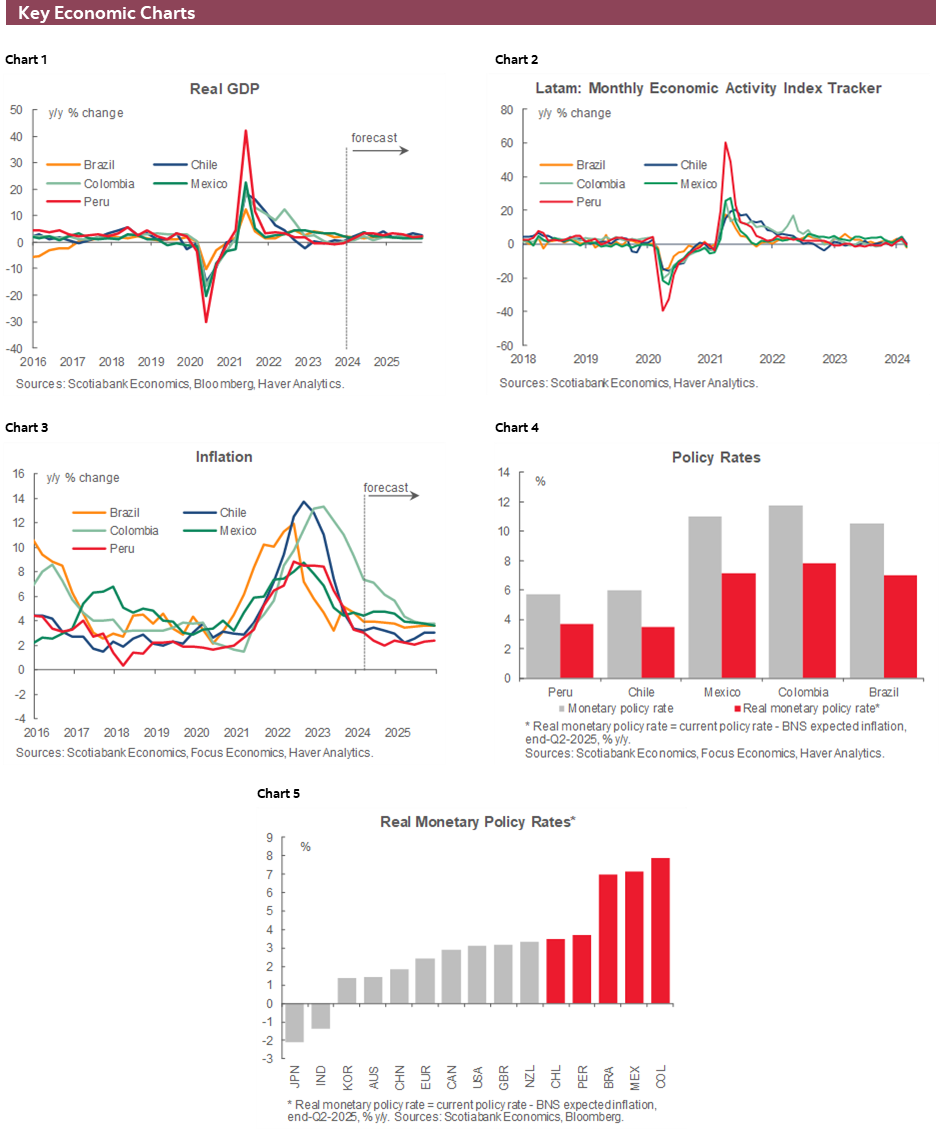

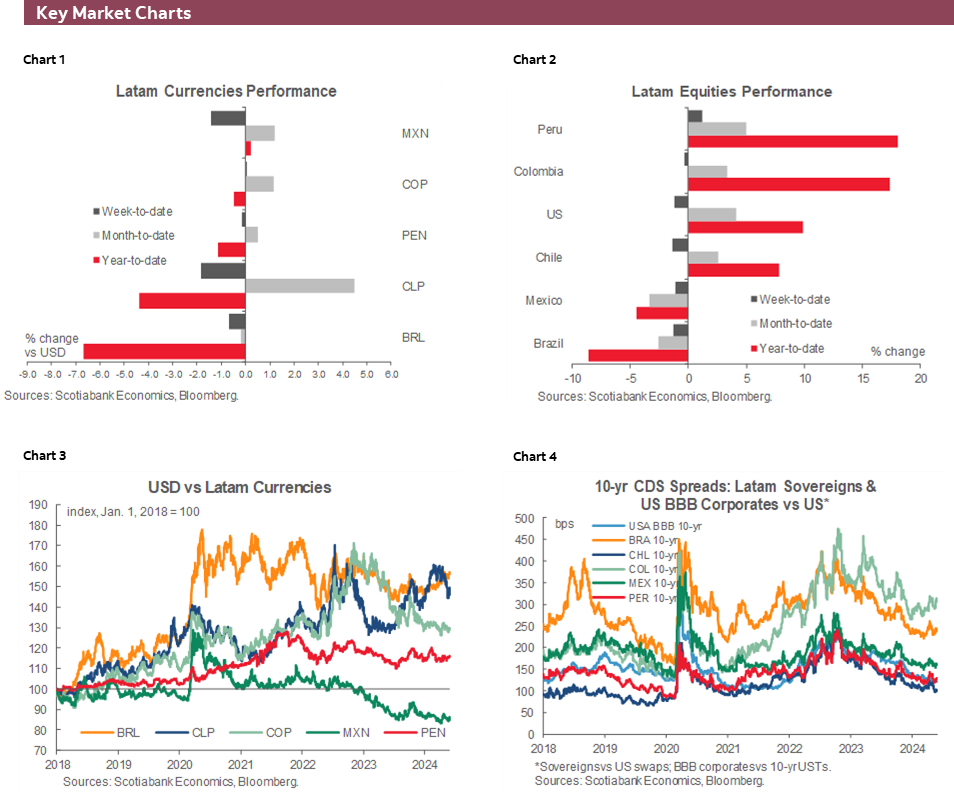

We have reached the final month of the first half of the year and it starts with a bang in Latam and the G10, full of key data and central bank decisions to tell us what the second half of 2024 may bring. It’s not like markets needed shaking up, however, as May has been a month of sharp swings in rates, currencies, and some commodity prices (namely that of, the ever-relevant for Latam, copper). Traders probably can’t wait for the summer lull to begin after a few challenging and unpredictable months, but we all just have to wait a few weeks longer before things calm down.

The Latam week ahead presents CPI data out of Peru, Mexico, and Chile, accompanied by GDP figures out of Chile and Brazil as well as surveys of economists or traders in each of Chile, Mexico, and Brazil. Of course, we have Mexican elections on Sunday, but we refer you to our team’s report here for their take on what to expect. Outside of the region, there’s a mighty string of releases out of the US (ISM manufacturing/services, JOLTS, ADP, nonfarm payrolls/wages) that at least coincide with the Fed’s communications blackout, rate decision in the Eurozone (-25bps) and Canada (hold), Canadian jobs, among others, as well as the OPEC meeting this weekend.

Colombia’s is the quietest data calendar of all in the Pacific Alliance + Brazil next week, but that does not mean there aren’t important local risks to monitor. We are getting very close to the June 20th deadline to approve the government’s pension reform proposal, and some final hurdles still need to be cleared, and political and fiscal noise has become a mainstay of everyday life for Colombian markets. In today’s report, our colleagues in Colombia discuss the validity of concerns about the country’s fiscal standing.

Sometimes economists don’t get a break on weekends since some Latam statistics agencies decide to publish data on their days of rest. We don’t directly point fingers in this report, however. We have a little more sense than that. Peru’s National Institute of Statistics and Informatics (INEI, see here) will publish from its offices in Lima consumer prices data for May on Saturday. It’s likely that, again, Peru’s central bank (BCRP) will get a near-zero month-on-month inflation reading, as our team details in the Latam Daily (see here); good enough to continue at its steady 25bps pace of cuts. We should also get a trickle of sectoral output or sales data that will help our economists refine their forecasts for April GDP growth.

Mexican and Chilean CPI data are scheduled for publication at the same time on Friday (8ET), but while one is expected to show no major progress made in inflation (Mexico), the other should show inflation virtually on target and allowing large rate cuts to continue (Chile). To be fair, we do see a bit of a downtick in core inflation in Mexico to move away from the mid-4s but Banxico is challenged by an acceleration in headline inflation that continues to buoy inflation expectations—forcing their hand in taking a more cautious stance.

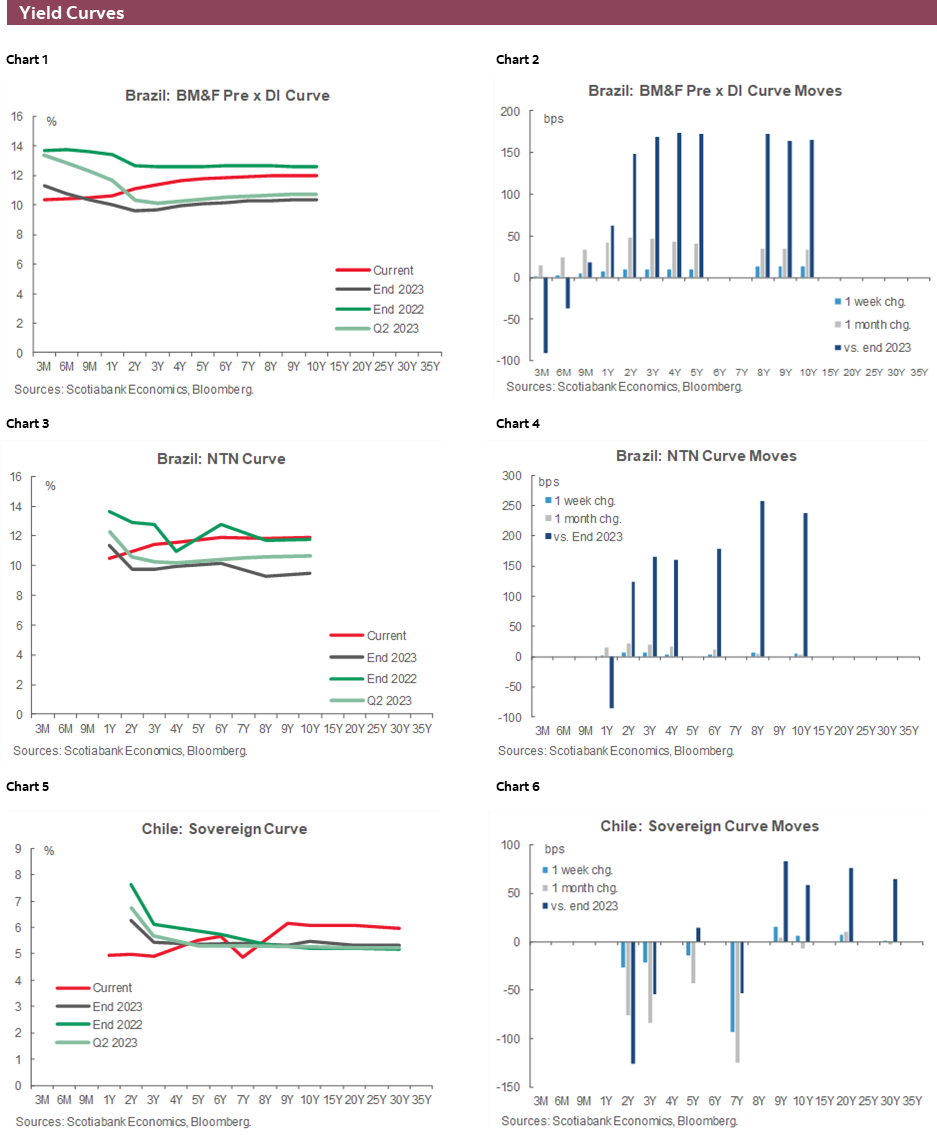

As for Chile, our team in Santiago outline in today’s report the drivers for an expected slowdown in headline inflation, with no growth expected in headline prices on a m/m basis and only a marginal m/m increase in CPI ex-volatiles. They expect another 50bps cut by the BCCh at its June 18th decision, a forecast that isn’t quite shared by traders as markets imply about 35bps in cuts; we will see how their forecasts are split in Monday’s results to the BCCh’s traders survey.

PACIFIC ALLIANCE COUNTRY UPDATES

Chile—We Project May CPI of 0.0% m/m (3.1% y/y)

Anibal Alarcón, Senior Economist

+56.2.2619.5465 (Chile)

anibal.alarcon@scotiabank.cl

- Annual inflation would fall to its lowest level in more than three years, practically at the BCCh target

We project a May CPI of 0.0% m/m (3.1% y/y), below market expectations in forwards (0.2%) and surveys (Traders’ Survey: 0.2%; Economists’ Survey: 0.3%). Likewise, we project that the CPI ex-volatiles would increase 0.1% m/m (3.2% y/y), mainly due to the contribution of services, leaving behind the indexation and second-round effects observed in Q1-24. For their part, ex-volatile goods would show no variation (0.0% m/m), reflecting part of the effects of the most recent fall in the exchange rate. It should be noted that we project falls in volatile items (-0.3% m/m), which would occur mainly due to the fall we project in international tourist packages and air transport.

By divisions, the main positive impact would come from transportation, followed by restaurants and hotels and miscellaneous goods and services. In transportation, the increase in the price of new cars and gasoline stands out. Regarding the latter, we project new price falls for the coming weeks, which will contribute negatively to inflation in June.

We project falls for the services CPI linked to the exchange rate. This would be the case of tourist packages and air transport, which would be experiencing drops on many of the most used routes. We also estimate decreases in the price of subscriptions to audiovisual content (Netflix and Spotify, among others), whose rates are in US dollars for some services and would reflect part of the fall in the exchange rate.

Inflation would reach the central bank’s target. If our projection is met, annual inflation would fall to 3.1%, its lowest level in more than three years (since March 2021). With this, the CPI ex-volatiles would reach 3.2%.

Colombia—Is the Noise Around Fiscal Accounts a Material Concern?

Sergio Olarte, Head Economist, Colombia

+57.601.745.6300 Ext. 9166 (Colombia)

sergio.olarte@scotiabankcolpatria.com

Jackeline Piraján, Senior Economist

+57.601.745.6300 Ext. 9400 (Colombia)

jackeline.pirajan@scotiabankcolpatria.com

After the pandemic, debt burdens increased significantly for governments and the private sector. According to the IIF, in Q4-23 global government debt accounted for 97% of GDP, while corporate debt rose to 95% of output. Household debt was 61% of the GDP. All of these remain around their highest levels of the millennium and are becoming a significant structural challenge in the context of “higher interest rates for longer.”

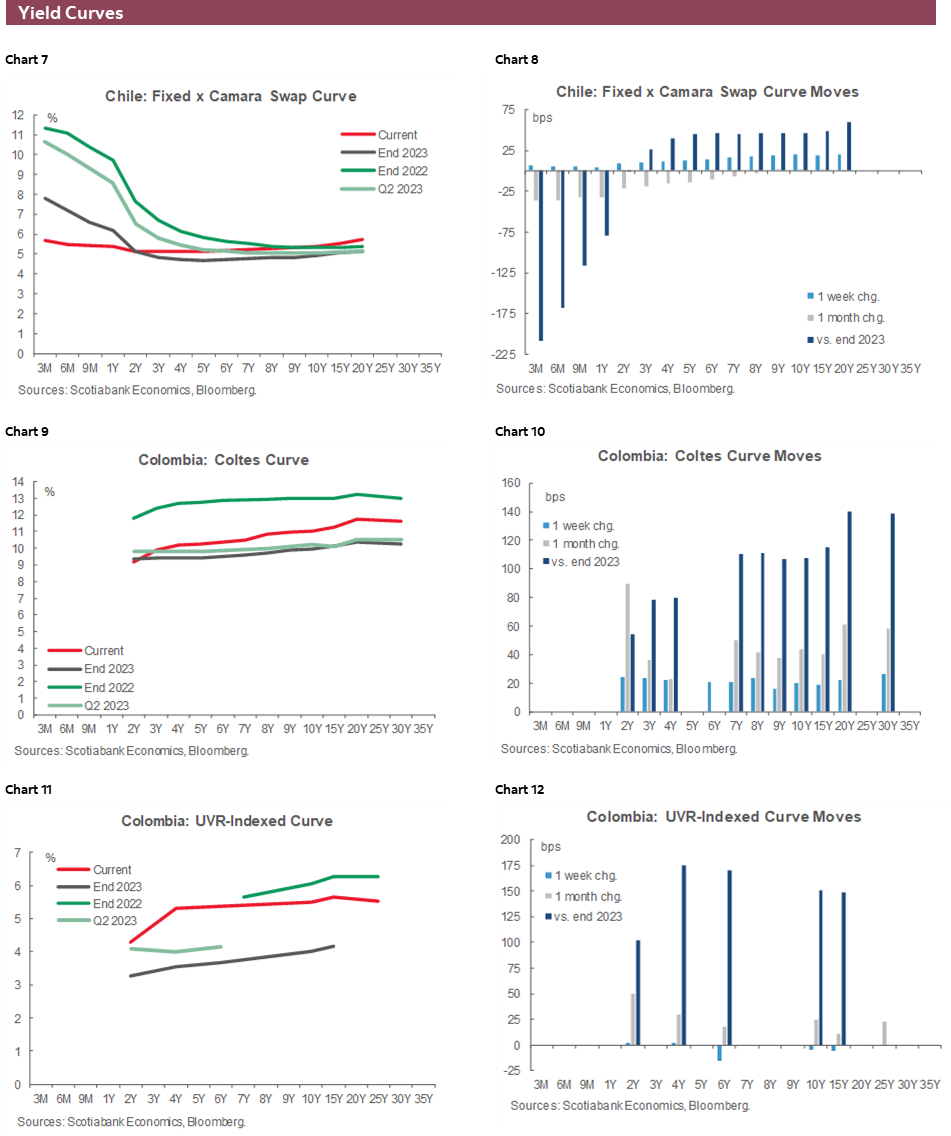

In Colombia, the increase in the debt burden, coupled with the credit downgrade after the social protest against the fiscal reform in 2021 and the volatility produced by the discussion about public policy changes from the government, increased the risk premiums in Colombia’s debt. Even though some of the uncertainty dissipated, Colombia still pays significant premiums. This year, external debt issuance in Colombia has been costly, with coupons above 8%, while financial private debt issuance in foreign currency needed to pay coupons above 11%.

Therefore, while the fears around structural changes in Colombia have vanished, inflation is gradually decelerating, and monetary policy is gaining credibility, fiscal sustainability is the main fear of the agents. Thus, the question arises: at what point are fiscal accounts at risk?

From a medium-term perspective, Colombia’s debt burden has improved from its peak post-pandemic. Colombia’s General Government gross debt burden increased from 52.3% in 2019 to 67.2% of GDP in 2020 and currently is around 60.3% of GDP, while the Central National Government gross debt to GDP passed from 50.3% of GDP in 2019 to a maximum of 67.5% of GDP in Q1-21 and stood at 56.7% in December 2023. A significant part of debt deterioration has reversed thanks to the economic growth and tax collection during the first part of the recovery. However, the noise has increased in the short term, and the analysis should focus on two sides: revenue and expenditure.

From the revenue point of view, the government has many challenges:

- After the stunning post-pandemic recovery, Colombian GDP grew only 0.6% last year, with a special deterioration in investment and durable goods consumption, making tax revenues particularly low this year. In fact, in Q1-24 tax revenues were 7% lower than expected.

- Most recent projections from DIAN say that one-time revenues from lawsuits with privates are not even half of what is expected in the budget of around COP 10 tn (0.6% of GDP).

- The recent ruling of the constitutional court about royalties’ deductibility for oil and mining companies, let the government with ~COP 3.4 tn (0.23% of GDP) lower revenues for this year and close to COP 17 tn over the next ten years.

All in all, revenues this year are expected to be around one percentage point of GDP lower than expected, which puts a significant risk on the fiscal rule if the government decides to go for 100% of budget execution.

Having said the above, there have been some buffers and lack in expenditure that can help to net the revenues shortage this year and can still comply with the fiscal rule:

- The government continued performing liability management operations with its debt to reduce the financial burden this year. Our calculations show that at least they are reducing by COP 7 tr the outstanding of COLTES 2024 and COLTES 2025, and we think they will continue doing debt swaps given that COLTES 2026 maturity is huge (COP 30 bn ~1.8% of GDP).

- Budget execution, especially in investment, was only 27.31% up to April. It is well known that around 80% of the budget is inflexible, and if the Government decides to cut, it will be on the investment side.

In terms of incentives, institutions in Colombia are very effective in motivating law enforcement. Not complying with fiscal goals without Congress permission is painful for the government, it is, in fact, in our opinion, political suicide since it shows incapacity for ruling the country and can trigger several political punishments facing the 2026 elections and several reforms to pass in Congress. On top of that, markets would react to an eventual non-compliance with the fiscal rule, as in 2022, bringing FX and TES rates to historical highs, which again, is very painful for the government’s party, Pacto Histórico, and its intentions of staying in power after Petro’s administration.

Therefore, we think the Medium-Term Fiscal Framework (MTFF) publication will be critical. In this publication, we expect to see an announcement of budget reductions and commitment to fiscal targets. If that happens, the capacity to implement a countercyclical expenditure diminishes. The concern is around GDP growth, employment, and structural revenues that will tend to be lower, which can materialize another downgrade from S&P by the end of this year or the first quarter of next year. But in any case, Colombia is already paying decent risk premiums for this risk.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.