ECONOMIC OVERVIEW

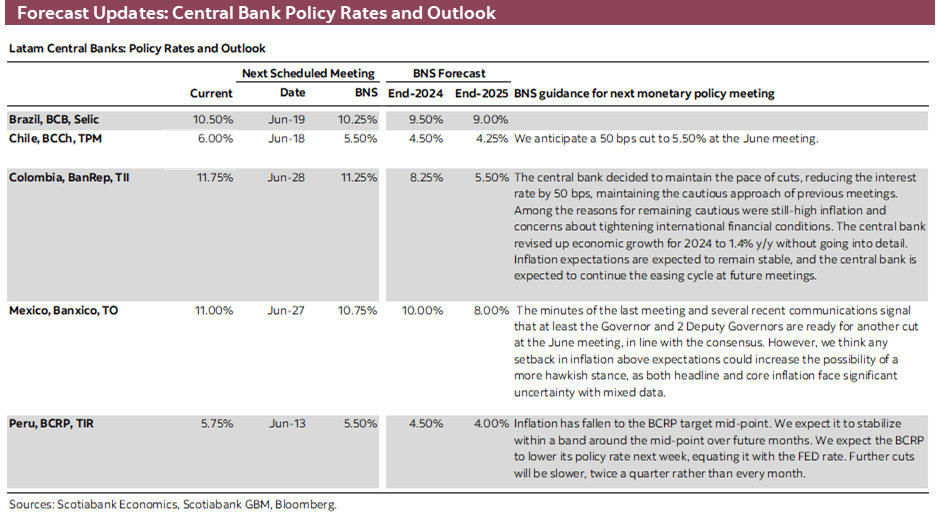

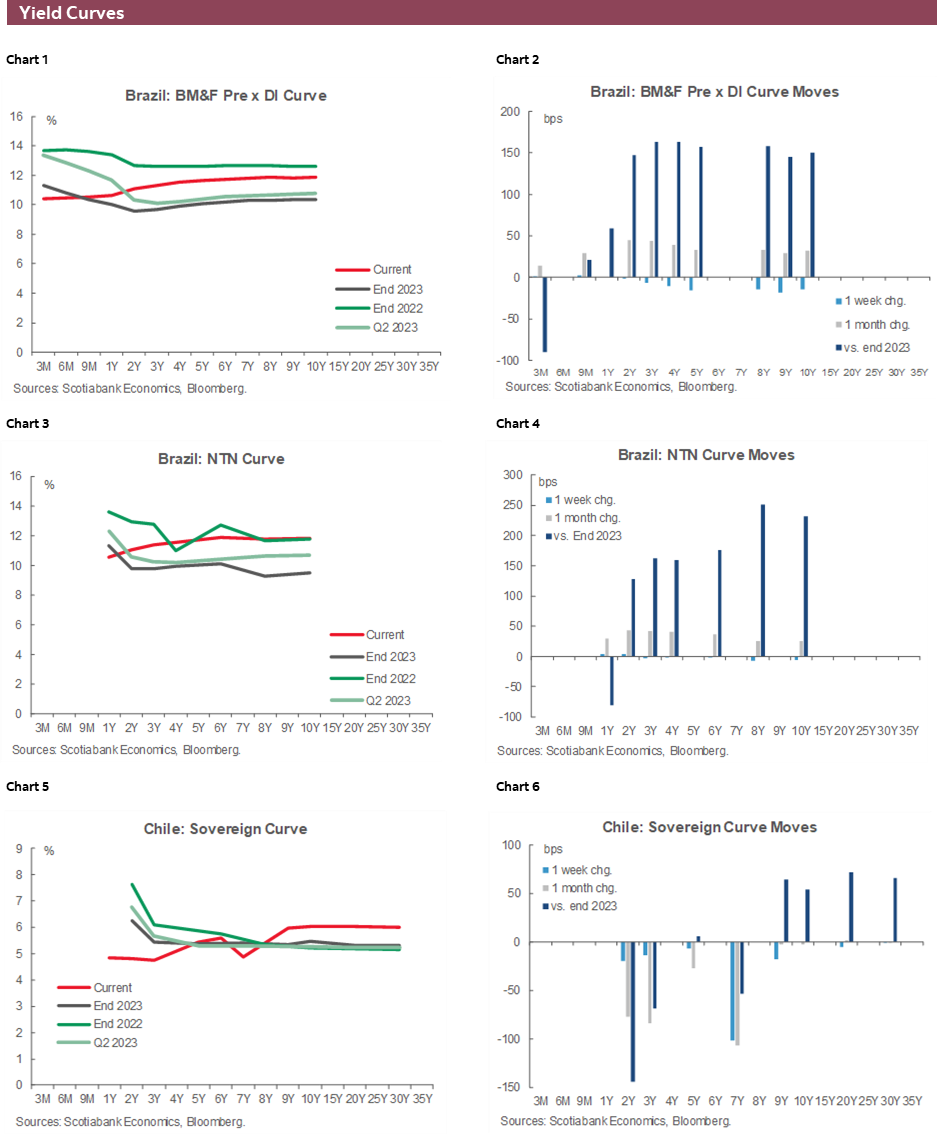

- It’s another big week in Latam and the G10, with the string of CPI figures in the Americas continuing, with Colombia, the US, and Brazil on tap and central bankers around the globe updating policy settings. The Fed is expected to hold and show fewer expected cuts. The BCRP will cut 25bps to match the upper bound of the Fed’s target rate band, helped by on-target headline inflation.

- Colombian inflation is seen practically unchanged or even accelerating slightly as food prices pressure headline readings higher; services inflation is expected to slow, but not that much, and remain high. In Brazil, an expected acceleration in inflation in May could keep the BCB from cutting this month amid rising inflation expectations.

- A quiet data calendar in Mexico may contrast with a loud political backdrop as markets remain on edge after Morena’s stronger than expected performance in the June 2nd election. Chile’s data slate is also uneventful outside of the BCCh’s economists and traders surveys.

PACIFIC ALLIANCE COUNTRY UPDATES

- We assess key insights from the last week, with highlights on the main issues to watch over the coming fortnight in Peru.

MARKET EVENTS & INDICATORS

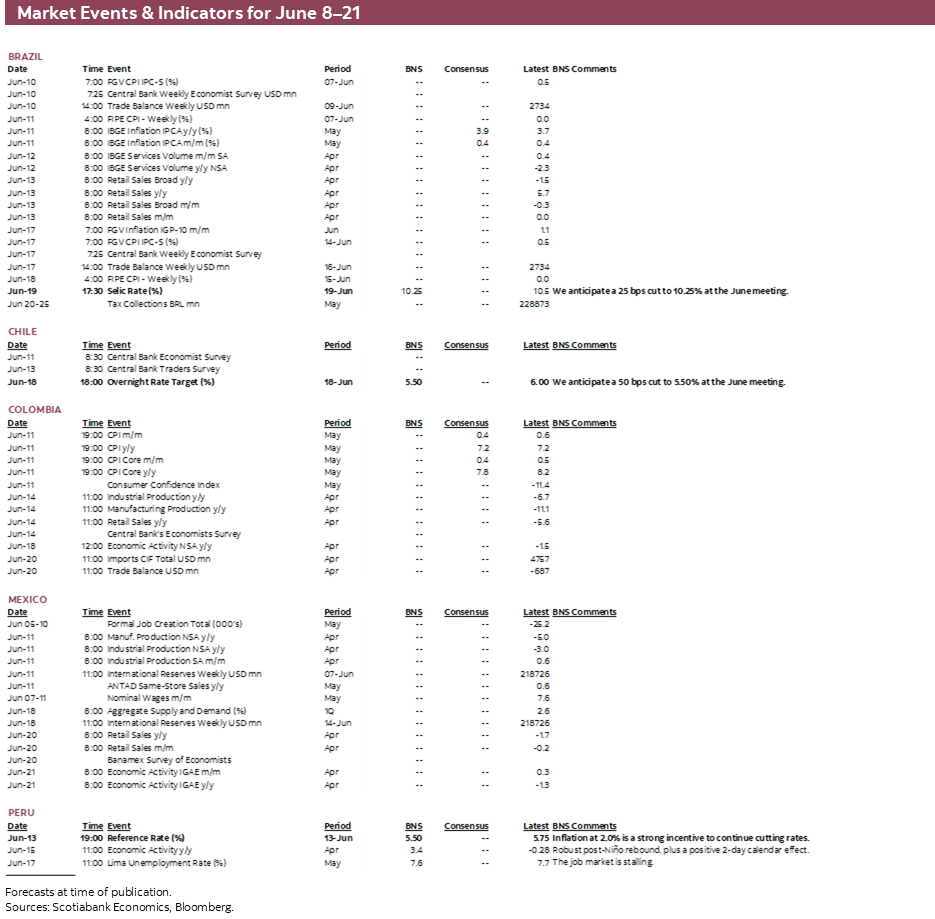

- A comprehensive risk calendar with selected highlights for the period June 8–21 across the Pacific Alliance countries and Brazil.

ECONOMIC OVERVIEW: ANOTHER BCRP CUT, COLOMBIA, BRAZIL, AND US CPI

Juan Manuel Herrera, Senior Economist/Strategist

Scotiabank GBM

+44.207.826.5654

juanmanuel.herrera@scotiabank.com

- It’s another big week in Latam and the G10, with the string of CPI figures in the Americas continuing, with Colombia, the US, and Brazil on tap and central bankers around the globe updating policy settings. The Fed is expected to hold and show fewer expected cuts. The BCRP will cut 25bps to match the upper bound of the Fed’s target rate band, helped by on-target headline inflation.

- Colombian inflation is seen practically unchanged or even accelerating slightly as food prices pressure headline readings higher; services inflation is expected to slow, but not that much, and remain high. In Brazil, an expected acceleration in inflation in May could keep the BCB from cutting this month amid rising inflation expectations.

- A quiet data calendar in Mexico may contrast with a loud political backdrop as markets remain on edge after Morena’s stronger than expected performance in the June 2nd election. Chile’s data slate is also uneventful outside of the BCCh’s economists and traders surveys.

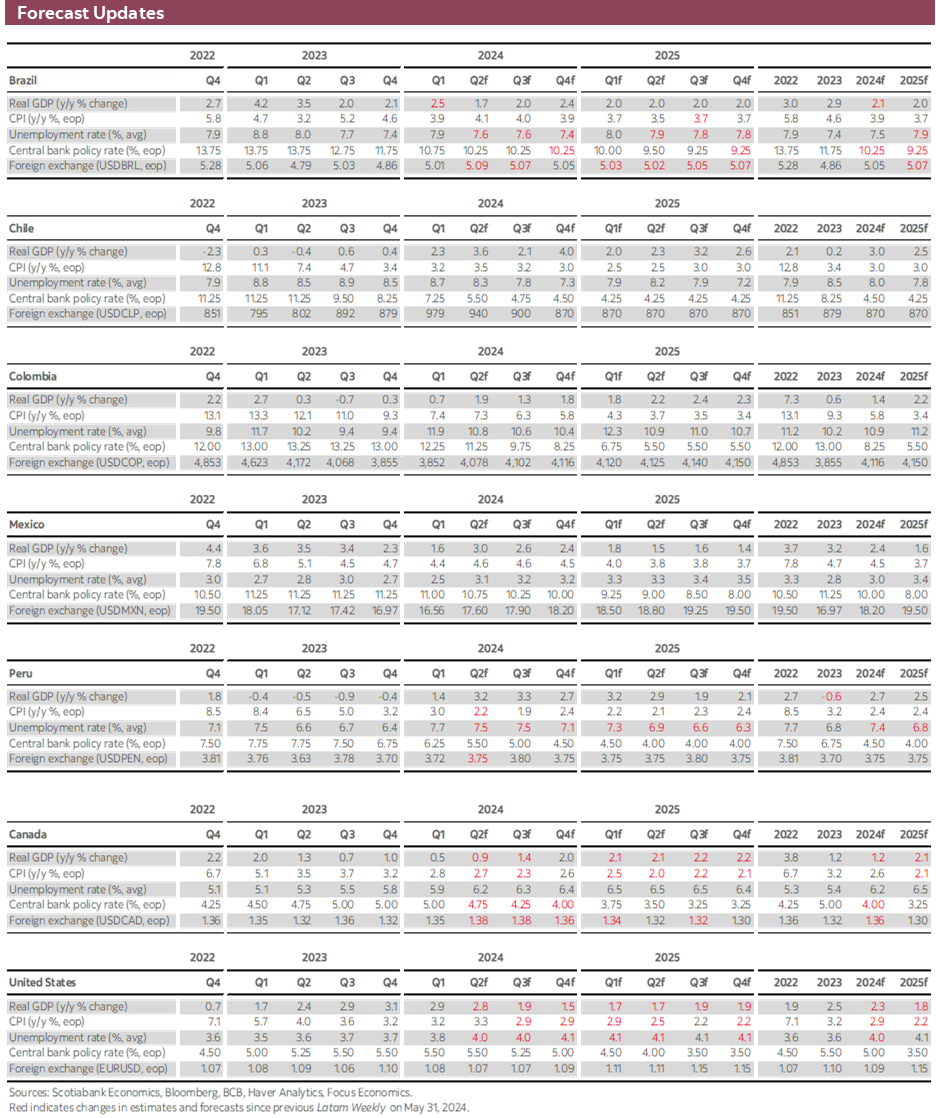

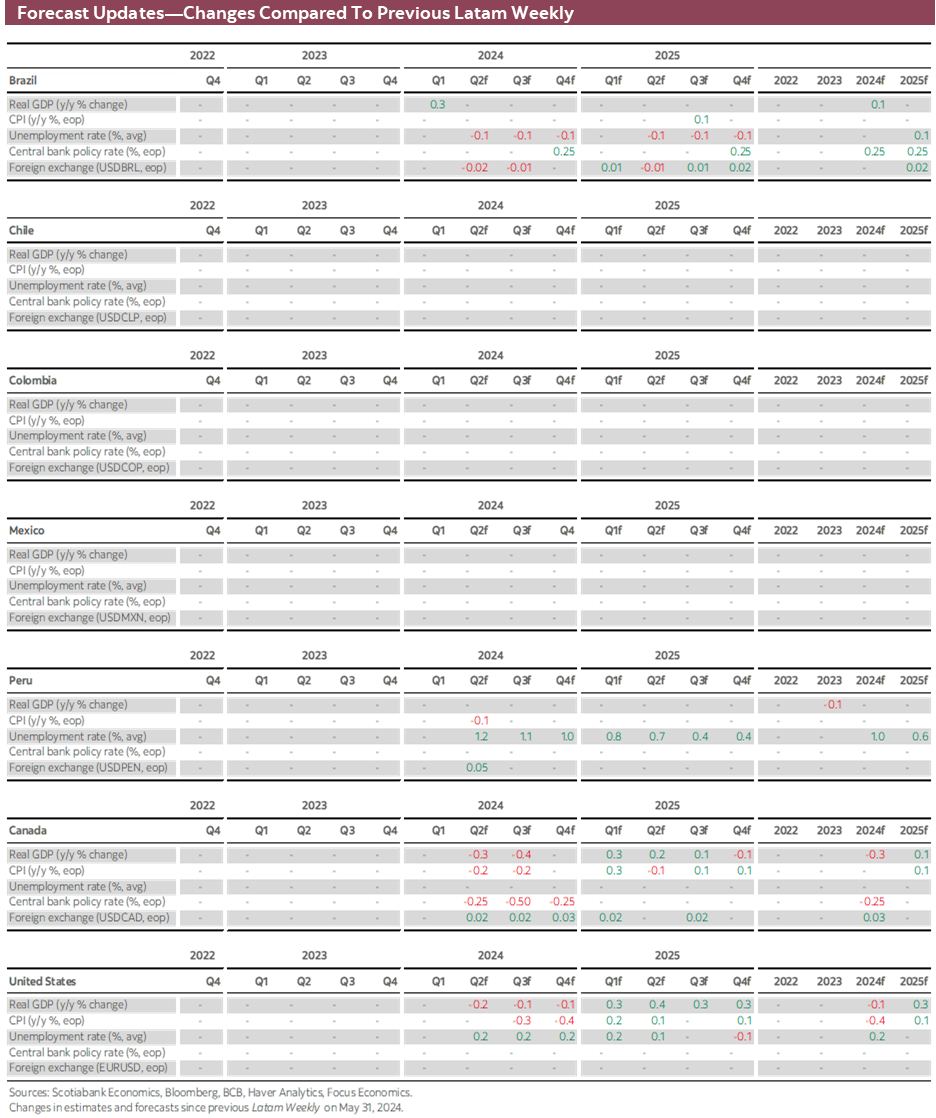

Here comes another big week in Latam and the G10, with the string of CPI figures in the Americas continuing and central bankers around the globe updating policy settings. On the topic of updates, we include in today’s Latam Weekly our freshly-updated macroeconomic projections for the Pacific Alliance and Brazil (you can also see our global forecasts here). Outside of Chile’s empty calendar (aside from surveys), the Latam week ahead is fairly busy, but the biggest driver of local markets may end up being the Fed’s rate announcement on the 12th, with most expecting a hawkish decision with fewer cuts projected this year. The BoJ’s decision, US CPI, and a UK data flood (including jobs and GDP) also figure as important market influences over the next few days.

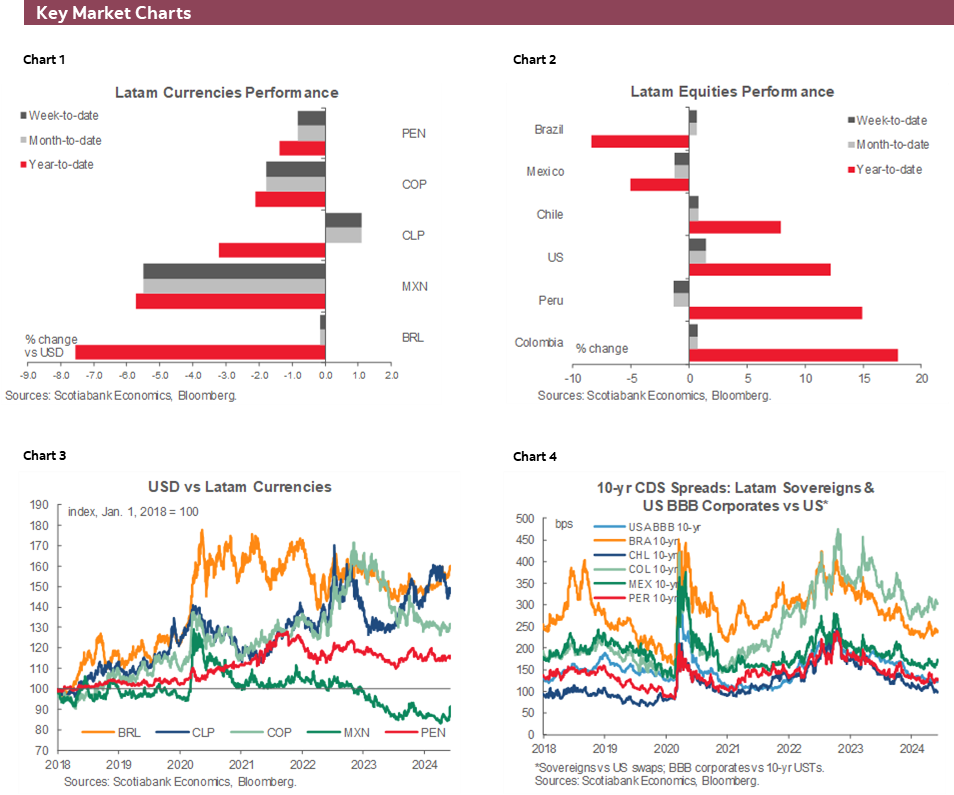

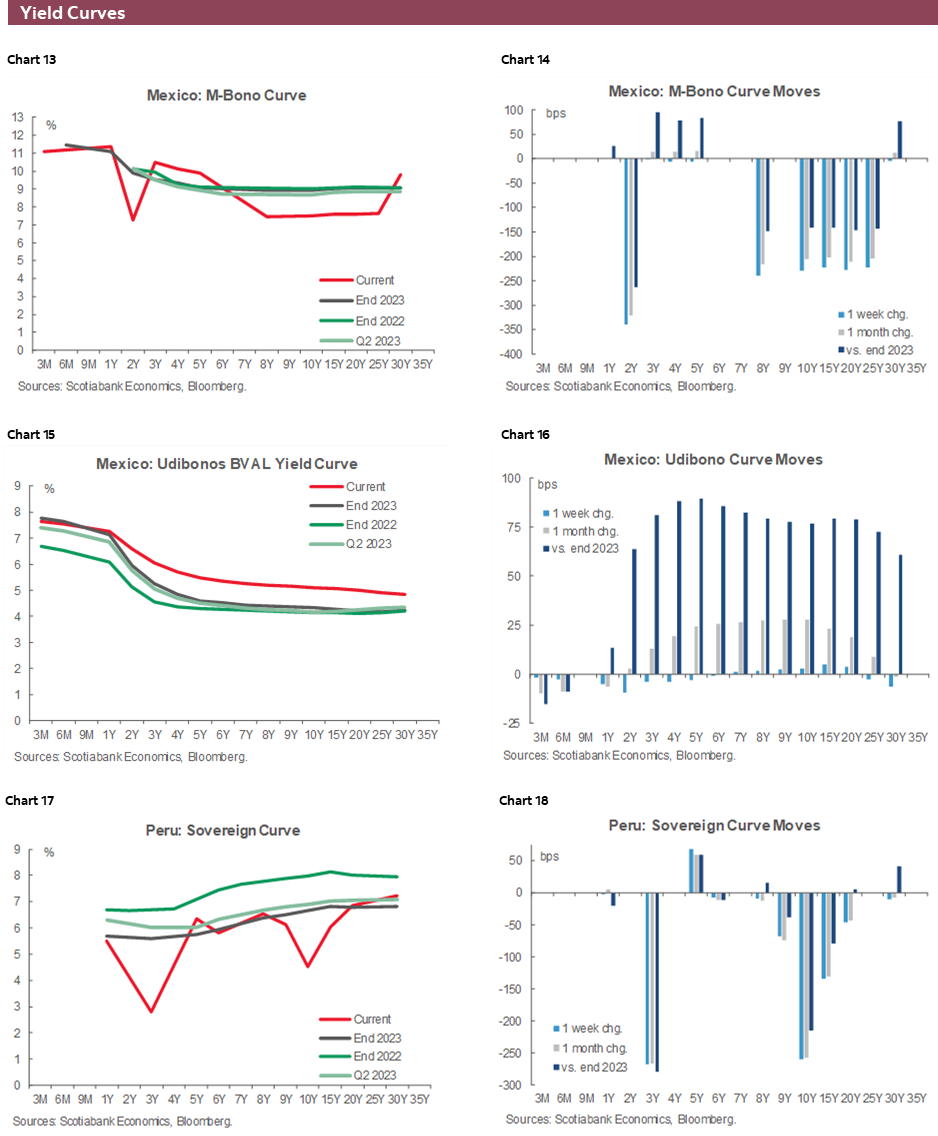

Mexico’s calendar is thankfully relatively quiet next week—with only industrial production on tap on Tuesday—after a hectic few days for Mexican markets that were surprised on Monday by election results that virtually tee up a Morena bloc supermajority in Congress. The risk of AMLO passing several constitutional reforms during the one-month overlap he will have with the new Congress sent the MXN to its weakest levels since Q3-23 (excluding pop in April 2024 on Israeli strikes on Iran) through the 18 pesos mark. Morena’s intention to work these reforms through, and comments related to this, are the main local risk for Mexican assets over the next few days (and in a way could stay Banxico’s hand at the June 18th decision). With uncertainty over whether Banxico may cut this month, we’re also hoping to get some clarity from Gov Rodriguez Ceja at the release of the Financial Stability Report on Wednesday.

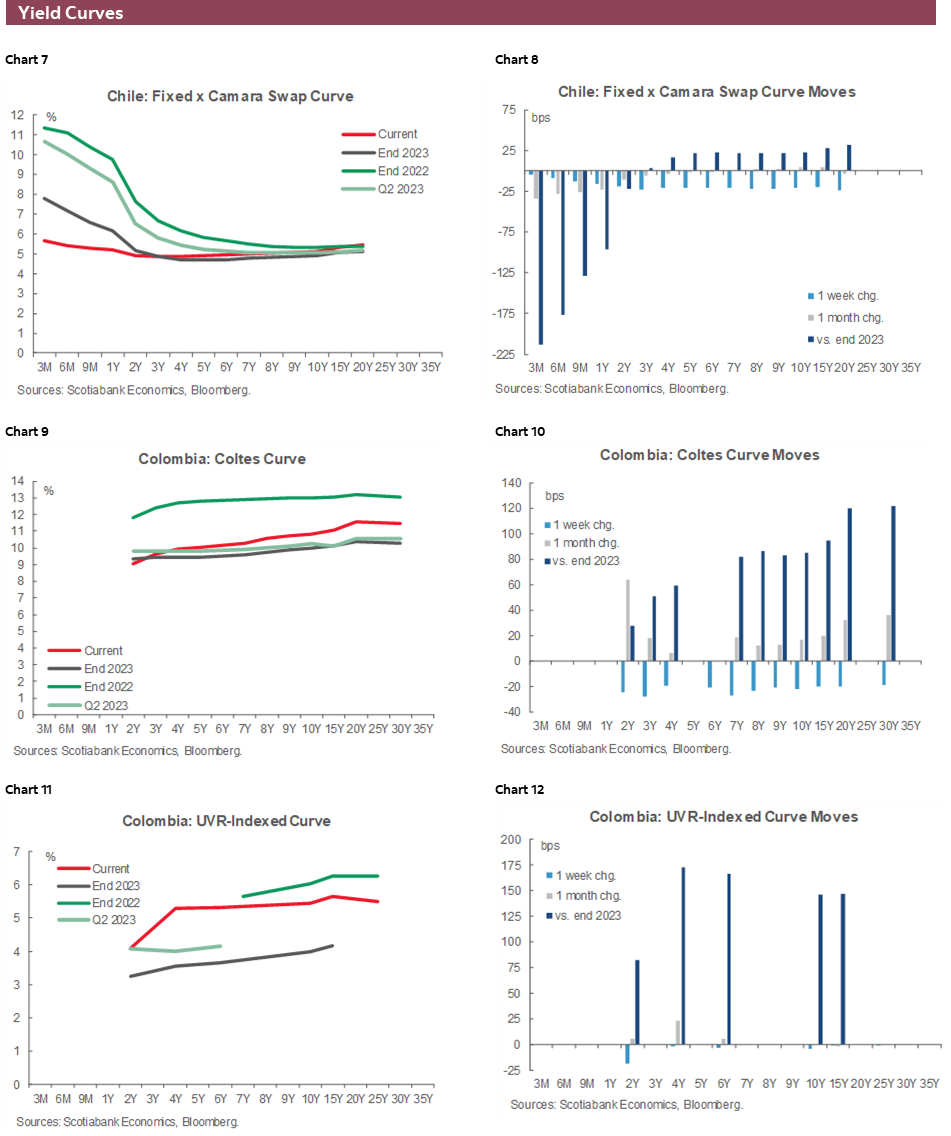

In contrast, Colombia’s week has been quiet and now we have a few key data prints next week to practically finalize expectations for BanRep’s June 28th rate announcement. On Wednesday, May inflation is seen awkwardly holding little changed in the low 7s by the median economist, but our Colombia team even expects a small acceleration to 7.3% (from 7.2% in April). It’s important to highlight here that food prices are turning from a base effect inflation headwind to now a base effect tailwind to keep headline inflation little changed while we expect that core inflation will decelerate to 7.9% from 8.2%. Industrial production and retail sales data, and the BanRep economists survey result on Friday are also important to watch, as are developments on the pension reform front with lawmakers due to resume discussions on the matter on Monday—ahead of a June 20th deadline.

Peru’s central bank is due for another 25bps cut at its rate announcement on Thursday night. Our local team discusses in today’s report their expectations for next week’s decision. There’s no strong excuse not to cut. Inflation in May was right at the mid-point of the 1–3% target range and a slightly above target core reading (3.1%) is a bit stickier but not worthy of holding steady. The BCRP is probably reaching a point where it has to decide which meetings to skip, and whether it can build too much of a spread to Fed policy; with next week’s cut to 5.50% it will match the upper bound of the Fed Funds target rate. We don’t think that is really a concern (yet, at least) with the BCRP squarely focused on its domestic inflation dynamics—maybe even inflation expectations stuck in the mid-2s are of greater concern.

Brazilian IPCA data out on Tuesday will not sit well with the BCB as economists expect an acceleration in prices growth to 3.9% from 3.7% y/y with a high 0.4% m/m rise; again, food prices are challenging officials. BCB president Campos Neto is clearly not happy with worsening inflation expectations that he feels are becoming unanchored and certainly a near -4% reading doesn’t help, and this has needed a looser stance of forward guidance than before where they laid out their intentions more clearly. The BCB shifted to a 25bps pace at its May meeting. The median official may end up preferring no cut at the June 19th announcement, to the objection of Lula-appointed board members that favoured a half-point cut last month. Economists polled by the BCB expect only one more cut by year-end, to 10.25%; as late as mid-April, the median projected an end-2024 Selic rate of 9.00%.

PACIFIC ALLIANCE COUNTRY UPDATES

Peru—Differential Between BCRP and Fed Reference Rates to Disappear

Guillermo Arbe, Head Economist, Peru

+51.1.211.6052 (Peru)

guillermo.arbe@scotiabank.com.pe

Inflation in Peru ended 2023 at 3.2%. It has since fallen to 2.0%, yearly to May. That is exactly the point the BCRP was looking for, right smack in the middle of the BCRP target range (if only it would stay put).

This figure is likely to be the main indicator that the BCRP will be looking at when it makes its monetary policy decision on June 13th. Considering that it is part of a downtrend in inflation, this 2.0% figure warrants another 25bps reduction in the BCRP reference rate next week, from 5.75% currently to 5.50%, which is what we expect.

There are other factors that are somewhat less conducive to a rate cut, although not so much so as to prevent it from happening, in our view. One caveat to a rate cut is that core inflation is stuck at 3.1%. This divergence with the headline trend makes sense, as the negative impact of El Niño 2023 on agriculture and fishing GDP fueled a rise in food prices that is reversing now that the weather is fine and sunny and raining only when it should be. The decline in food prices is registered in headline inflation, but not in core inflation. The divergence between headline and core inflation may continue, as the decline in food prices is likely to persist throughout much of the year.

Another caveat is that inflation expectations also seem stuck at 2.6%. This is a bit more surprising, as inflation expectations generally accompany the ongoing trend in headline inflation. It may be simply a question of there being a lag, however, inflation expectations could decline again soon.

However this may be, the real reference rate now stands at 3.1%. This compares with a neutral rate of 2.0%, which gives the BCRP plenty of room to reduce rates further. With inflation well-ensconced within the target range, and no domestic demand pressures to speak of, there is no reason for the BCRP not to close gap between the current and neutral real reference rate.

Except that there is one reason! The Fed policy rate. When, as we expect, the BCRP lowers its rate next week to 5.50%, it will have closed another gap, the gap between the BCRP and Fed reference rates. And, of course, the lower the Peru rate is, compared to the Fed rate, the more likely it is that this will trigger flows out of PEN assets and into USD assets, thereby weakening the PEN. Some analysts will point out that a PEN depreciation is mildly inflationary in itself, although past experience suggests that the pass-through is actually quite weak.

Is the BCRP prepared to live with a reference rate that matches the Fed rate? Yes. And more. We know this because BCRP president Julio Velarde has stated as much himself, suggesting that the BCRP rate could indeed fall below the Fed rate for a period. Our view is that Velarde was preparing the markets for something he has come around to viewing as pretty much unavoidable. Between responding to declining domestic inflation on the one hand and propping up the PEN on the other, the BCRP will favour the former.

As long as inflation continues to decline. Will it? It depends on the time-frame. Inflation in June 2023 was a whopping… negative 0.15%. Despite monthly inflation in April–May 2024 being similarly negative, we might be pushing our luck to expect inflation in June to be as or more negative than June 2023. We do expect inflation to be low in June, but even if it is nil, this would take yearly inflation to June up to 2.2%.

So, looking a bit further forward, the June inflation figure will be known by the time of the BCRP’s policy meeting in July, and could just maybe give the BCRP the excuse for a pause in reducing the rate, if only to reduce the period of time in which the BCRP rate falls below the Fed rate.

None of this modifies our year-end forecasts of 2.4% inflation and 4.50% reference rate, although we are tweaking the monthly trajectory. We expect inflation to increase mildly in June, then fall again, dipping briefly below the 2.0% mid-point, and then rise mildly once more in Q4, due to comparison with low-to-negative inflation in Q4-2023.

Similarly, we expect Peru’s reference rate to be cut to 5.50% in June, with cuts afterwards in 2024 slowing to twice a quarter. That means a pause in one month per quarter. For Q3, July is a candidate for a pause month, given the slight rise in inflation in June. However, it is hard to presume beforehand which month will be a pause month for each quarter.

| LOCAL MARKET COVERAGE | |

| CHILE | |

| Website: | Click here to be redirected |

| Subscribe: | anibal.alarcon@scotiabank.cl |

| Coverage: | Spanish and English |

| COLOMBIA | |

| Website: | Click here to be redirected |

| Subscribe: | jackeline.pirajan@scotiabankcolptria.com |

| Coverage: | Spanish and English |

| MEXICO | |

| Website: | Click here to be redirected |

| Subscribe: | estudeco@scotiacb.com.mx |

| Coverage: | Spanish |

| PERU | |

| Website: | Click here to be redirected |

| Subscribe: | siee@scotiabank.com.pe |

| Coverage: | Spanish |

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.