KEY POINTS:

- Stock gains reinforced by vaccines, stimulus talks

- Fauci: most Americans vaccinated by Q2, herd immunity by Fall

- US stimulus talks resume

- Light overnight calendar risk

- ADP payrolls will have to be an outlier to matter to nonfarm bets

- CDN bank earnings to continue

- Powell round 2, Beige book ahead

TODAY’S NORTH AMERICAN MARKETS

Beyond this morning’s influences, markets digested additional information that was generally constructive from the standpoint of building risk appetite. Anthony Fauci said he thinks “overwhelming majority” of Americans could be vaccinated by Q2 next year and that herd immunity could be achieved in the fall.

Mnuchin and Pelosi spoke about stimulus prospects as new US stimulus proposals have resurfaced but it’s unclear whether they’ll be more successful than past negotiations that underwhelmed the Democrats while being too rich for Republicans yet with a less engaged President now. One bipartisan group has advanced a US$908 billion proposal, but only about one-third would be new spending with the remainder drawing on residual funds from the Paycheque Protection Program and Fed facilities. The proposal would include: about US$300B to PPP funding; US$240B for states and local governments; another US$180B to extend unemployment benefits otherwise slated to expire at year-end; US$45B in sector aid; and the rest scattered for other purposes.

- The S&P500 closed up by about 1.1%. The TSX had been up by over 1 ½% at the starting bell this morning but closed up 0.6%; tech, utilities, health care and communications services weighed on momentum. European cash markets closed up by between ¼% and 1¾%.

- Sovereign curves exploded by cheapening across all maturities but especially toward the longer end and especially in the US on global bear steepeners. The US 30 year yield was up by 10bps with 10s up 9bps. Canada’s curve also cheapened but by a little less than stateside with 10s and 30s up 7bps. Gilts and EGBs cheapened by a little less than Canadas.

- The US 10 year TIPS breakeven inflation rate edged up to 1.825%, the highest since May 2019. Canada’s breakevens have also risen but by slightly less (chart 1).

- Oil prices fell by another 50–75 cents a barrel with OPEC+ meetings slated to resume on Thursday.

- The USD depreciated against most major currencies but CAD and the A$ underperformed others.

OVERNIGHT MARKETS

Calendar risk quiets down temporarily overnight and through tomorrow. It will be a temporary respite ahead of the resumption of OPEC+ meetings on Thursday and then nonfarm & Canadian jobs on Friday. There may be random headline risk on Brexit and US stimulus talks. Nothing on overnight calendars will impact global market sentiment but may influence local markets.

November South Korean CPI is released at 6pmET. November inflation could improve from the 0.1% y/y print in October due to transitory effects. However, spare capacity and low energy prices should keep inflation from reaching the Bank of Korea’s 2% inflation target for the foreseeable future.

Q3 Australian GDP will be released at 7:30pmET this evening. Australia won’t see quite the same rebound in Q3 as some other developed economies as the lockdown in Melbourne weighted on the recovery. However, the modest quarterly growth is expected to be driven by a return to more normal consumption activity. Our Asia-Pacific economist estimates growth to register -5.3% y/y, compared to -6.3% y/y during the previous quarter. During yesterday’s monetary policy meeting, the RBA stated that recent data has come in better than expected and that the recovery should continue in Q4.

October German retail sales arrives at 2amET. While restrictions were reintroduced in the second half of the month, their more targeted nature should weigh less on economic activity than the restrictions during the first wave. The 1.2% m/m consensus expectation could reflect consumers front loading purchases prior to the restrictions being implemented.

TOMORROW’S NORTH AMERICAN MARKETS

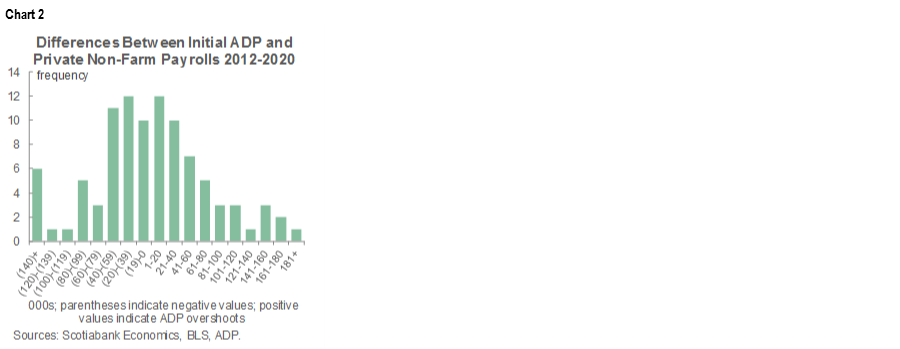

US ADP (8:15amET) will be the main event which speaks more to how the rest of the calendar will be pretty quiet. In order to influence nonfarm expectations, it takes a big miss in either direction for ADP to matter. Chart 2 demonstrates this point by noting the rarity of massive outsized changes in private nonfarm payrolls in relation to changes in ADP payrolls. Consensus guesstimates 430k with Scotia at 350k.

Canadian Q4 bank earnings releases will continue with RBC (6amET) and National (6:30amET) due out. This morning’s BNS and BMO earnings helped pop banks 1.9% higher as a group.

Fed Chair Powell delivers round two of CARES Act testimony tomorrow before the House (10amET). The Fed’s Beige Book of regional conditions will arrive at 2pmET.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.