KEY POINTS:

- Sterling sinks as Johnson warns of no deal into negotiations

- BoC again distances itself from October MPR...

- ...and speaks to two-tailed policy options

- US UofM, producer prices due out

- Light overnight

TODAY’S NORTH AMERICAN MARKETS

Off-calendar risk (US stimulus talks, Brexit headlines etc) will dominate market drivers if anything does through the overnight session into the end of the week.

Nothing by way of global calendar-based risks will matter. The EU Summit into tomorrow took on less significance with the punting of final, final, really, this time it’s final Brexit talks to Sunday and how this time they really, really, absolutely, no kidding this time, absolutely must arrive at a decision. Or not. Or maybe. Or maybe the deadline gets gamed, or maybe the translators and lawyers crafting the legal text have to do their best Bob Cratchit impressions and work through Christmas and New Year's. Or it may be that we’ve simply arrive at a point of irreconcilable differences with the EU perhaps not as sensitive to UK sovereignty matters while the UK may not quite get that the EU needs to make the divorce terms difficult enough to set an example for all other members.

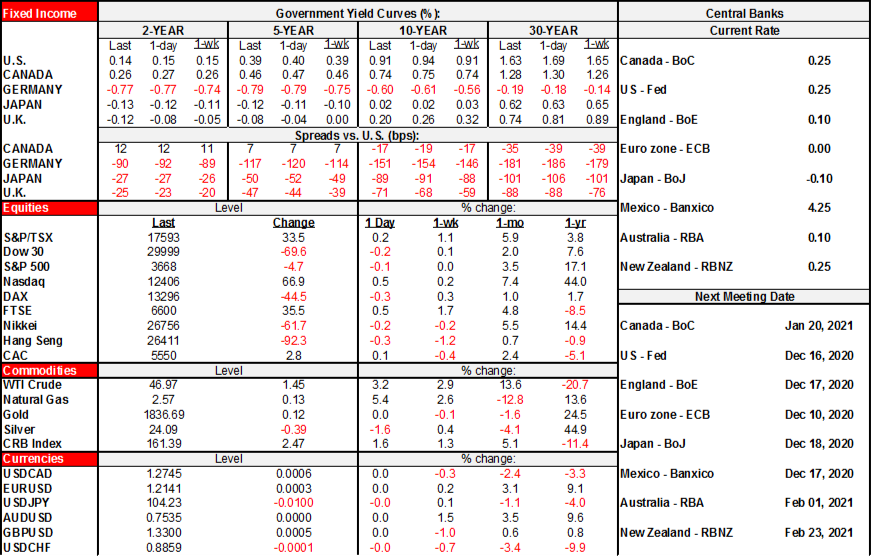

- The gilts curve outperformed everyone’s today as 2s richened by 3–4bps and the longer end rallied by about 6bps. US Ts were in second place as the long end rallied 6bps and the front-end rallied 1bp. Canada’s curve underperformed the US at 10s and 30s and matched the US front-end’s performance.

- Oil prices rallied 3% in terms of both WTI and Brent.

- Equities were mixed as US tech stocks drove the Nasdaq up ½% while the S&P slipped a tenth. Toronto was up about ¼%. European bourses ranged from a drop of just over ½% in Spain to a rise of about ½% in London on sterling’s drop.

- Speaking of sterling, it fell another ¾% today. Since the intra-day peak of about one week ago, sterling has dropped by 1.8% to the dollar and it led the weakest crosses today. CAD was among the stronger currencies on the back of oil prices and straight through Beaudry’s talk.

I found BoC Deputy Governor Paul Beaudry’s speech and press conference to be insightful and worth reviewing by clients (here). Parts of it can be skipped right over by an audience that is comprised of experienced BoC watchers, but there were several parts of his written and spoken comments that yielded further insight into what the BoC is thinking at this juncture. His performance today makes him a fine candidate among others for Senior Deputy Governor in my view.

For starters, Beaudry further hinted at how the October MPR forecasts are likely stale in the following paragraph with emphasis added. This builds upon my interpretation of how yesterday’s statement placed emphasis upon “In our October projection” rather than reaffirming those forecasts to be a present view.

"What we do know today is that Canada’s economic recovery will continue to require extraordinary monetary policy support. We have been clear that we will hold our policy rate at its effective lower bound until economic slack is absorbed, so that the 2 percent inflation target is sustainably achieved. As of our October MPR, that doesn’t happen until into 2023. We have not yet done a full analysis of all new information to shift that assessment." [emphasis added.]

Beaudry spoke in balanced fashion to what the BoC could do if it either encountered upside or downside risks and deliberately noted that the Bank is “prepared to respond in either direction.” They are speaking more candidly toward bidirectional risks which is an indication the BoC feels it is largely done and in observing mode now while waiting for clearer evidence of the direction of major risks.

Here is what Beaudry said they could do if things really deteriorated further and note that he downplayed negative rates:

"Should things take a more persistent turn for the worse, we have a range of options at our disposal to provide additional monetary stimulus. This could include increasing the stimulus power of our QE program, or it could involve targeting specific points in the yield curve, otherwise known as yield-curve control. It could also include reassessing the effective lower bound, which would allow for the possibility of a lower—but still positive—policy rate. In theory, negative interest rates remain in the Bank’s tool kit. But we’ve been clear that, barring a dramatically different set of circumstances, we don’t think negative rates would be productive in a Canadian context."

Beaudry’s press conference indicated that further maturity extension of purchases in a downside risk scenario would be more likely than raising purchase targets in aggregate. Beaudry’s press conference remarks added further colour to his comments on evaluating the effective lower bound. He said “We are trying just to reassess, maybe it still is the right level to keep markets functioning” after describing 0.25% back in March/April as necessary to keep markets functioning and “it’s not something that’s at the forefront yet. It’s just a possibility among the different tools that we have.” As a caution to those who draw an RBA parallel, not that the A$ has continued to appreciate by about 4% to the USD since the RBA cut by 15bps to 0.1% such that any clear influence on currency strength is at best de minimis relative to far more dominant drivers. The reflation trade’s lifting of commodities has perhaps led to generally sensible CAD and A$ appreciation that shouldn’t be counter-acted by modest sized central banks with very limited ability to affect their currencies.

Nevertheless, what the BoC has not been clear about over time is where they view the effective lower bound. Recall that in December 2015 the review of policy options defined the ELB to be -0.5% with negative rates in the toolkit. That lasted until March of this year when former Governor Poloz ruled out negative rates and then in the April statement redefined the ELB to be +0.25%. Governor Macklem’s May 1st press conference said negative rates were in the toolkit but yes the ELB was +0.25% and has signed off on statements saying +0.25% ever since. Negative rates cannot theoretically be in the toolkit as long as the BoC views the ELB to be positive. The ELB is supposed to be the theoretical lower limit below which the risks to pushing rates lower outweigh the benefits. At +0.25% or even if it’s 0.1% but still positive, the BoC is saying anything lower would risk greater risk than reward. It makes no sense to say negative rates are a theoretical option if the ELB is positive; at a minimum, the BoC should be asked to explain how the two notions can co-exist. I wouldn’t reassess this again at this juncture if I were them unless they are prepared to risk being pushed into negative territory by market pricing given that market participants probably view anything further that they’d say on the topic with skepticism. Unless they really truly think it’s worth it, then let sleeping dogs lie.

He also said this about what they could do in an upside risk scenario which is the one I’m leaning toward over the 6–24 month horizon that overlaps with the traditional monetary policy horizon:

“What about options for responding to the upside? The faster people get vaccinated and more people get back to work in contact-sensitive sectors, the more quickly the recovery could unfold. Such an outcome would be welcome news. In that context, we may need to re-examine the amount of stimulus needed to achieve our inflation target. Earlier in my speech, I illustrated how we could withdraw stimulus from our QE program when the time comes.”

Beaudry also poured cold water on using the QE program to overshoot the target inflation range (but not on working the range…). The BoC’s strategic review of its framework is ongoing.

“But rest assured we will not overuse QE and overshoot our 1 to 3 percent target range for inflation. The exit strategy for our QE program is tied to our inflation goals.”

In discussing with clients, I have expressed the view that the order of operations and timing for BoC actions going forward when judged with information regarding the outlook that we presently have available is as follows:

- First, stand pat with stimulus measures;

- Start further tapering of GoC bond purchases — 2021H1;

- End GoC bond purchases — 2020Q4/2021Q1;

- Output gap shuts — mid-2022;

- Headline and core inflation back on target — 2022H2;

- Hike — mid- to late-2022.

All of that timing winds up being earlier than they guided at the October MPR which they are indicating to be a stale assessment now anyway. It is all consistent with the loose order of ops the BoC has guided which is to keep buying until “the recovery is well underway” but stop well before the gap shuts and then hike when they think inflation is durably on target. When they stop buying, it likely won't be cold turkey, rather than gradually backing away through further reductions and communication well in advance. I view the output gap framework as dominant to the BoC in determining the timing of steps over issues like shares of the bond market. The closure of the output gap is probably going to happen earlier than the BoC anticipates with chart 1 showing this around mid-2022.

OVERNIGHT MARKETS

Overnight releases will be very light. Peru’s central bank is expected to stand pat at 0.25% (6pmET) and Italian industrial production for way back in October is unlikely to cause any tectonic plates to shift (4amET).

TOMORROW’S NORTH AMERICAN MARKETS

Nothing on tomorrow’s calendar is likely to be impactful to the broad market tone. US markets will consider consumer confidence and producer prices.

US producer prices in November (8:30amET) probably continued to crawl along little changed in year-ago terms and weighted down by commodities, while prices ex-food and energy may have accelerated somewhat.

US UofM sentiment for December (10amET) will be a bit of a warm up for the Conference Board’s consumer confidence measure on December 22nd. Confidence had fallen the prior month as the second wave of COVID-19 cases increased, but it’s uncertain whether ir keeps falling on rising COVID-19 cases or whether vaccines buoy confidence or at least help to set a floor.

Mexico updates industrial production for October (7amET) which should have about the same impact as Italy’s overnight update.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.