KEY POINTS:

- NYC shutdown talk sinks stocks

- What to watch for in BoC Gov Macklem’s talk

- Why BoC parallels to the RBA’s token cut are off base

- Canadians are highly receptive to vaccines

- Canadian housing, manufacturing readings due out

- US industrial readings, UK jobs, China readings on tap

- Weekly global COVID-19 charts

TODAY’S NORTH AMERICAN MARKETS

After getting off to a solid start on Brexit and US stimulus speculation, US stocks began to turn south the minute NYC Mayor Bill De Blasio said that “If we do not change the trajectory, we could very well be headed to shut down” and that “The likelihood of more restrictions soon is high.” What may have also contributed to the soured market tone was growing realization of the magnitude of a cyber attack on US government agencies and companies with speculation that Russian hackers were involved. Outgoing President Trump spent the day tweeting about election conspiracies which may indicate that the hostile act will confront incoming President Biden.

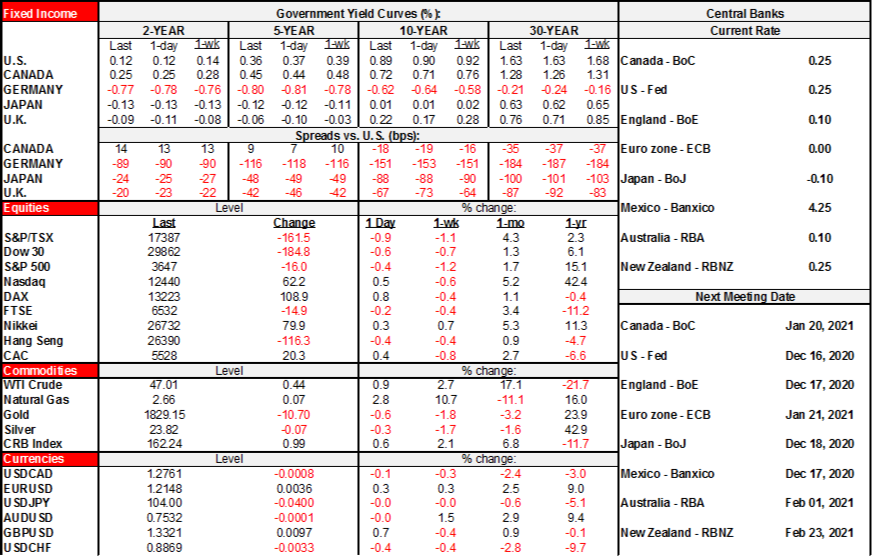

- The S&P500 ended about ½% lower on the day after early gains reversed with the index falling 1.4% from the morning peak. The TSX also shed about 1%. European cash markets closed mixed with London down ¼% but most of the rest of Europe’s main exchanges ending up by between ¼% and 1%.

- Gilts led cheapening across major bond markets with yields up 3–5bps in a mild steepener move on continued optimism that Brexit talks remain alive. US Treasuries ended little changed along with Canada’s curve except for small cheapening at the long end.

- Oil prices ended up about three dimes across WTI and Brent.

- The USD slipped and did so primarily versus European crosses. CAD and the A$ were little changed and the Mexican peso depreciated.

OVERNIGHT MARKETS

Overnight releases are not expected to be terribly impactful.

UK jobs and wages during October and jobless claims during November arrive at 2amET. The government furlough scheme was only extended at the end of October—which was originally set to expire at the end of the month. With firms anticipating the end of the subsidy at the end of the month, the 3-month unemployment rate is expected to rise from 4.8% to 5.1% and employment to fall by 250k over the same period.

Chinese releases for industrial production and retail sales will be released tonight (9pmET). These indicators are expected to show the Chinese economy continuing to gain traction. Retail sales were hit harder by the original shutdown measures relative to the manufacturing sectors. Compared to last year between January and October, retail sales are down -5.9% while industrial production sits 2.3% higher. Due to relatively quick containment and a robust economic recovery, China is the one of the few countries that is expected to register growth in 2020.

TOMORROW’S NORTH AMERICAN MARKETS

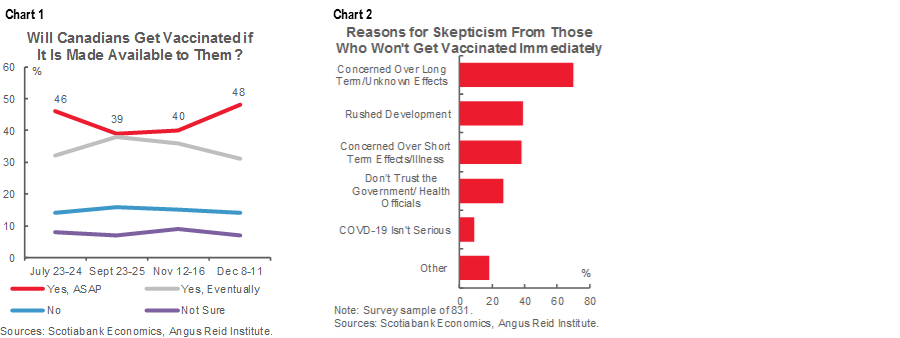

The main focus into tomorrow’s North American session may be BoC Governor Macklem’s traditional pre-holiday Governor’s speech. He might find reason for optimism in survey results that were released today that show just shy of 80% of Canadians expect to go for COVID-19 vaccinations, though the minority who say they won’t might take a long time to possibly change their views (charts 1–2). Macklem’s topic will be “Trading for a sustainable recovery.” The speech will be released at 2:30pmET and a virtual press conference will be held at 3:45pmET.

The addition of a press conference leaves the field wide open for potential considerations, but here are four suggestions for things to watch out for in the Governor’s speech:

- comments on the effective lower bound and cut risk. See below for elaboration of my thoughts on the topic.

- Possible hints at the direction of forecast risks being considered. Beaudry’s recent speech appeared to indicate a fairly neutral bias with upside and downside risks being evaluated while distancing the BoC from the October MPR projections. Recall Beaudry said “We have not yet done a full analysis of all new information to shift that assessment.” I would expect Macklem to say the usual thing about not pre-judging outcomes, but any straying from that tendency could be informative.

- Comments on the global trade picture going forward. I would expect a cautious tone and one that perhaps notes that a global rebound in trade is feasible going forward but that a sustained rise in global trade will be more challenging to accomplish given damage to globalization.

- Remarks on Canada’s competitiveness. Expect the Governor to probably emphasize how firm destruction could damage the export cycle going forward while magnifying competitiveness challenges that existed before the pandemic.

- Related to the prior bullet, what does the Governor think of CAD’s appreciation in terms of its drivers, merits and risks posed to the outlook?

The BoC raised market interest in the possibility of a token cut to its overnight rate following comments that Governor Macklem made in his parliamentary testimony on November 26th and comments made last Thursday by Deputy Governor Beaudry. Overall, I’m unconvinced that the BoC is preparing the way ahead for such a move and even less convinced of the merits to doing so.

- First, nothing sounds imminent and it appears as though much harsher downside risks would be required to go there. Recall that Beaudry said “it’s not something that’s at the forefront yet. It’s just a possibility among the different tools that we have” and that it is among the options “Should things take a more persistent turn for the worse” versus the other upside scenario.

- Parallels to the RBA’s move to cut by 25bps on November 2nd are likely off-base for a few reasons.

- For one, average Australian core inflation (1¼% y/y) is further beneath the RBA’s higher headline inflation target of 2–3% (chart 3) than is the case for the BoC where average core inflation sits at 1.8% and just tenths from the headline inflation target of 2%.

- The RBA’s cut pre-dated vaccine optimism that represents a material positive development.

- If a side goal of the RBA cut was to weaken the A$ then it didn’t work. The A$ has continued to appreciate by almost 7% to the USD since the cut. That’s a caution against the BoC doing likewise.

- The BoC may be under rising pressure to further taper bond purchases as 2021 unfolds.

- The BoC has been challenged enough when it comes to communicating what it thinks the effective lower bound is. The signal sent to markets is that the ELB is totally arbitrary. They were fine with the ELB being defined at -0.5% from late 2015 until the pandemic struck and then all of a sudden switched to 0.25%. I’ve written previously that this may have been because back in March they were not prepared to be pushed toward going negative, but its framework on the ELB and negative rates has been deeply inconsistent.

- Canada is likely to witness greater fiscal stimulus when the Federal winter budget is delivered and has already extended pandemic stimulus measures well into next year.

Canada will also release housing and manufacturing updates. Housing starts for November and existing home sales for the same month will arrive at 8:15amET and 9amET respectively. Manufacturing shipments are expected to post a modest additional gain previously guided by StatsCan to be in the vicinity of a 0.6% m/m lift (8:30amET).

US releases are unlikely to be terribly influential upon broad risk appetite with the focus mostly upon industrial readings. The Empire manufacturing gauge for December (8:30amET) will kick off tracking provided by regional surveys on the path to the next ISM-manufacturing report in early January. Industrial output during November probably faced little to no growth (9:15amET).

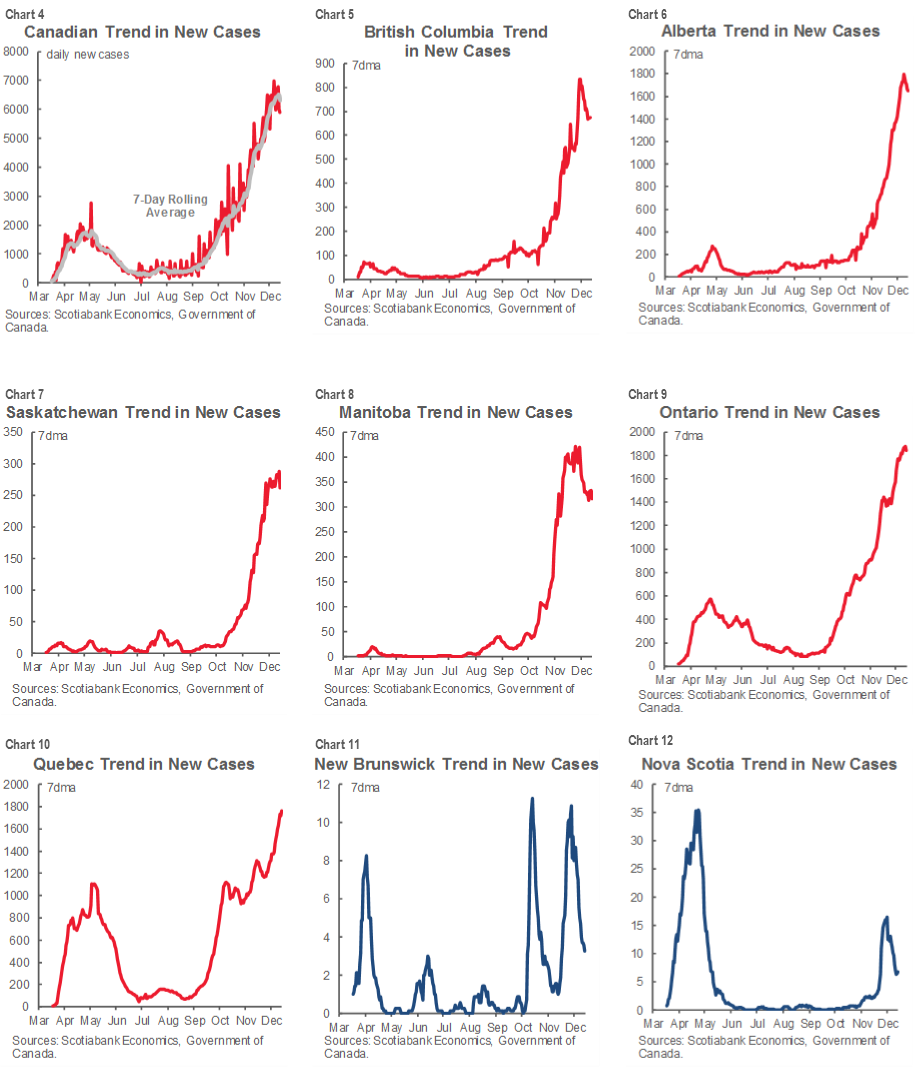

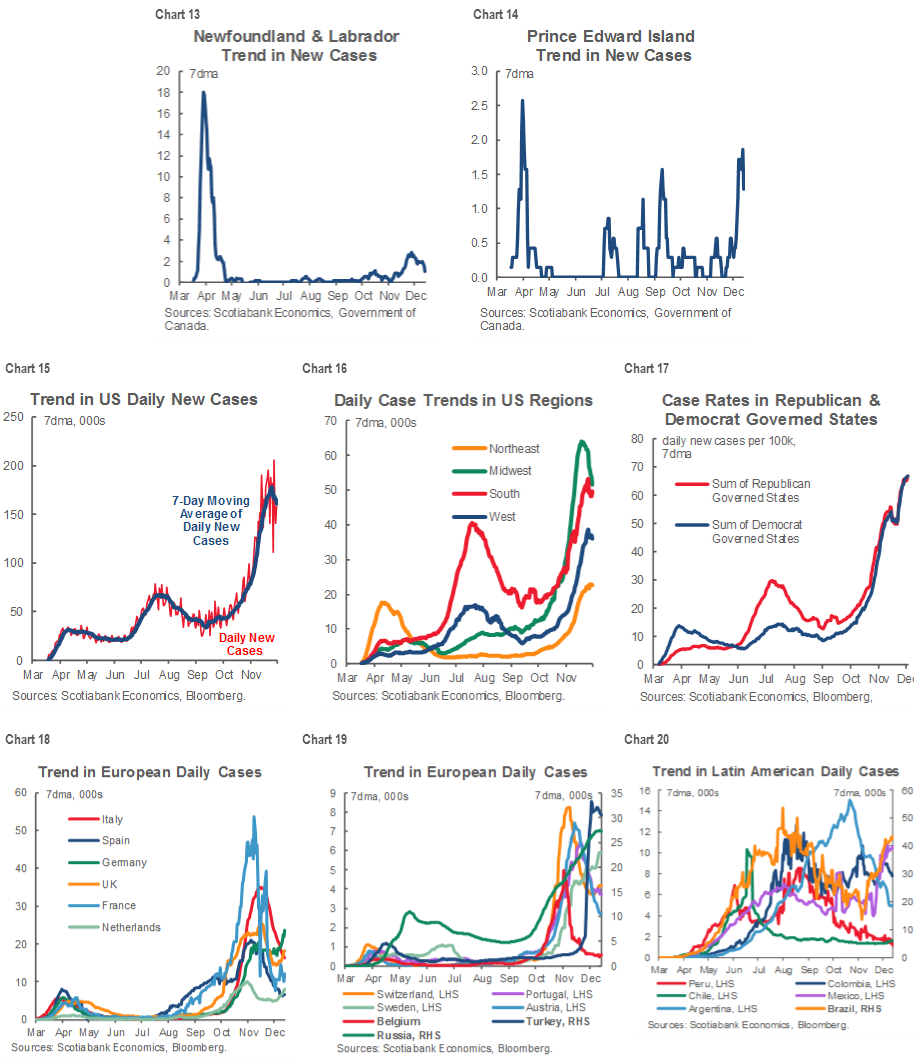

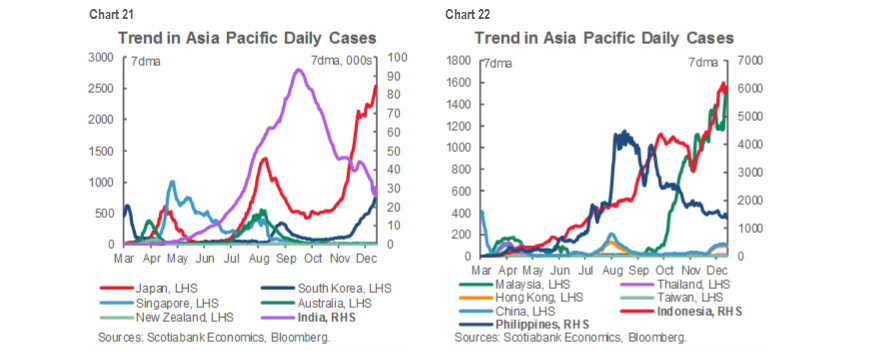

Also see the accompanying charts depicting global COVID-19 case trends as the usual Monday update.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.